No change in policy from the RBNZ at today’s meeting, as widely expected. And given this was an interim review meeting, not a full forecast update, there was another fairly short post meeting statement. That said, we think were noteworthy tweaks in the RBNZ’s tone and guidance. After leading the central bank charge during the global tightening phase and maintaining a ‘hawkish’ bias for some time, the RBNZ has started to soften its message as the harsher NZ economic reality appears to be hitting home. This is no surprise to us as we never bought into the RBNZ’s surprisingly ‘hawkish’ turn at its last meeting in late-May (see Market Musings: AUD/NZD – Another round of RBNZ Shock & Orr).

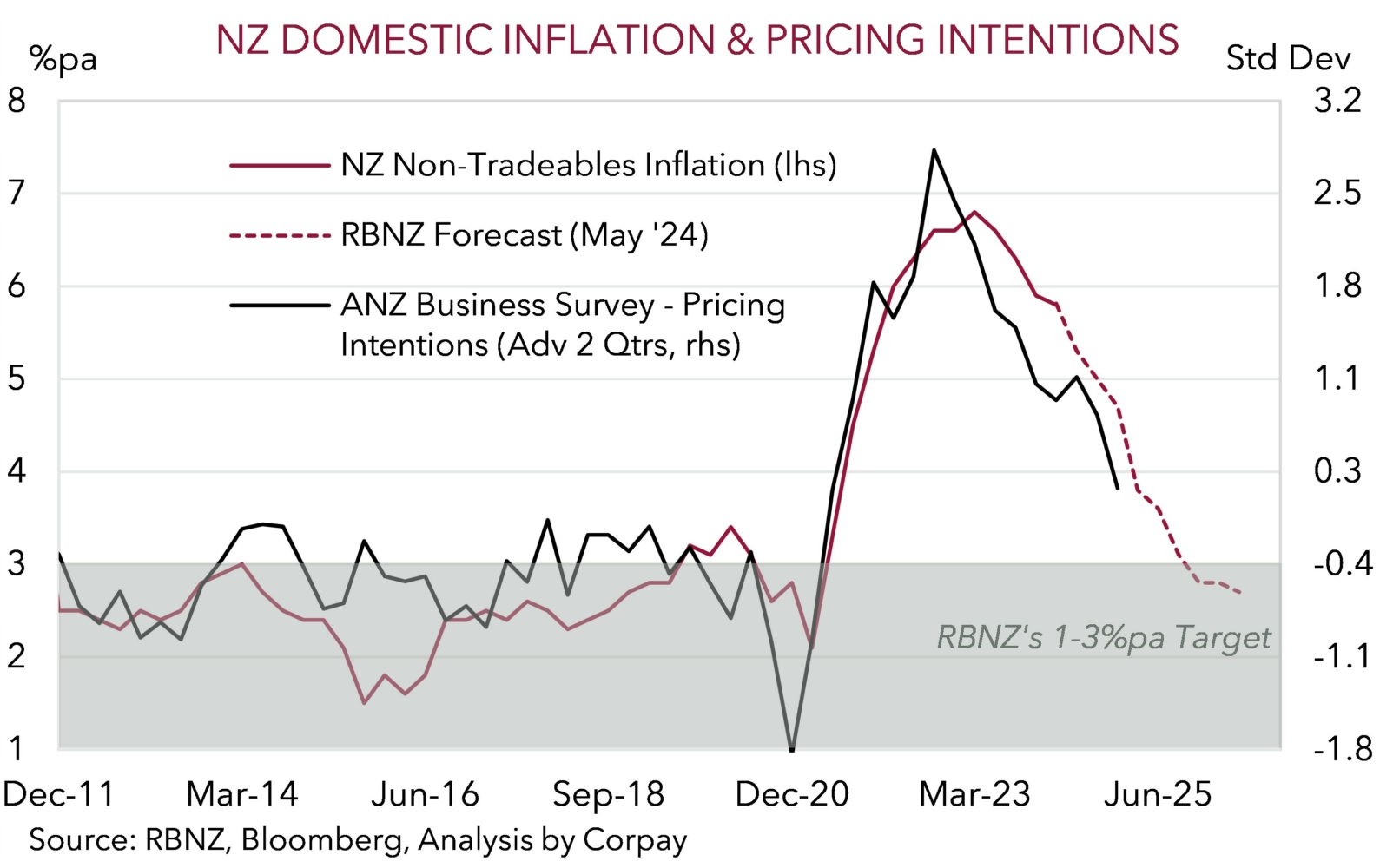

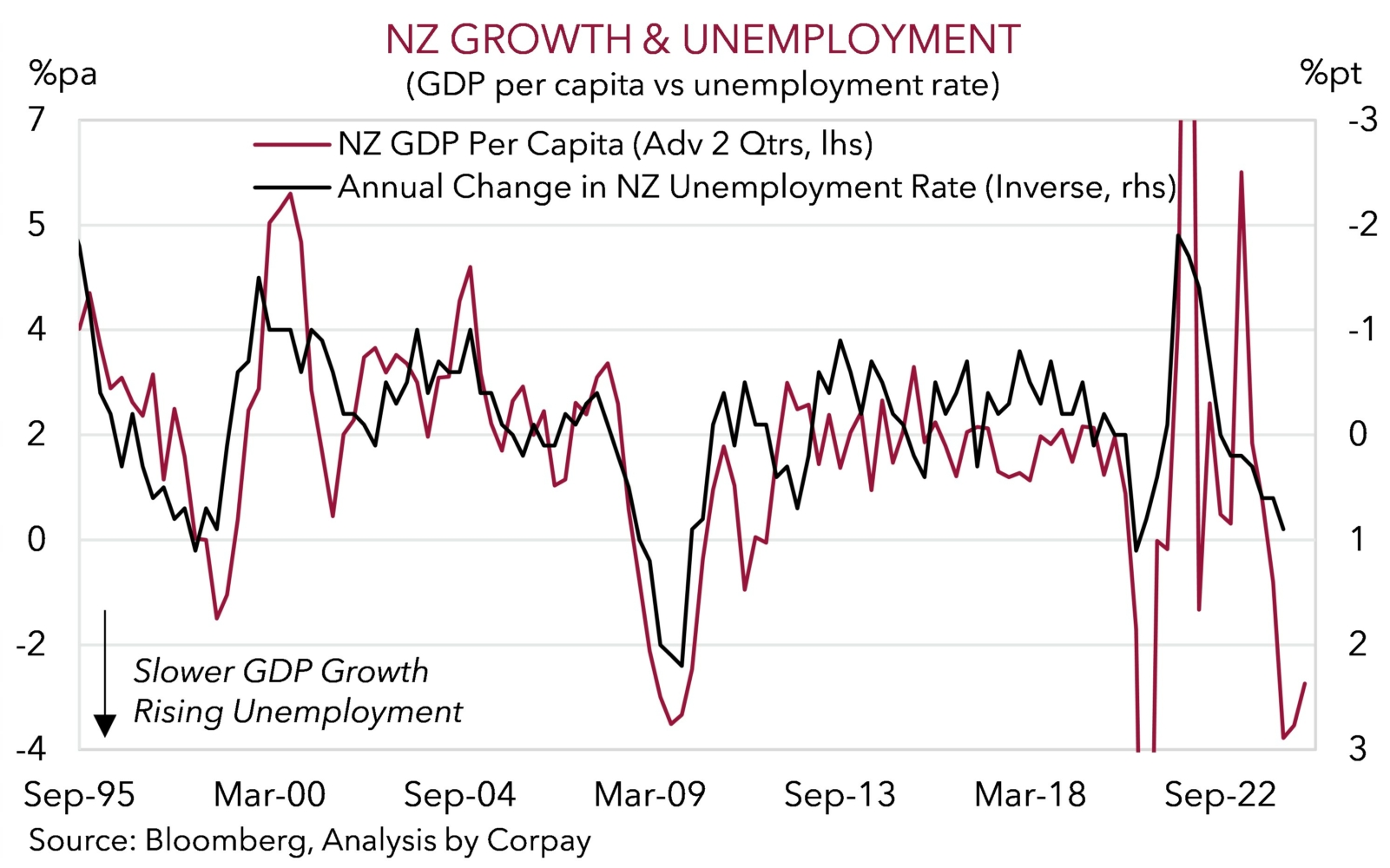

This time around the RBNZ noted that “restrictive monetary policy has significantly reduced consumer price inflation” and added that while “some domestically generated price pressures remain strong” there are “signs inflation persistence will ease”. As our chart shows, this is the signal coming from pricing intentions within NZ business surveys (chart 1). The step down in NZ economic growth (on a per capita basis NZ GDP has contracted for 6 straight quarters) is likely to push up unemployment (now 4.3%, more than 1%pt above where it was a year ago) (chart 2). This in turn should dampen NZ wages and inflation over the period ahead .

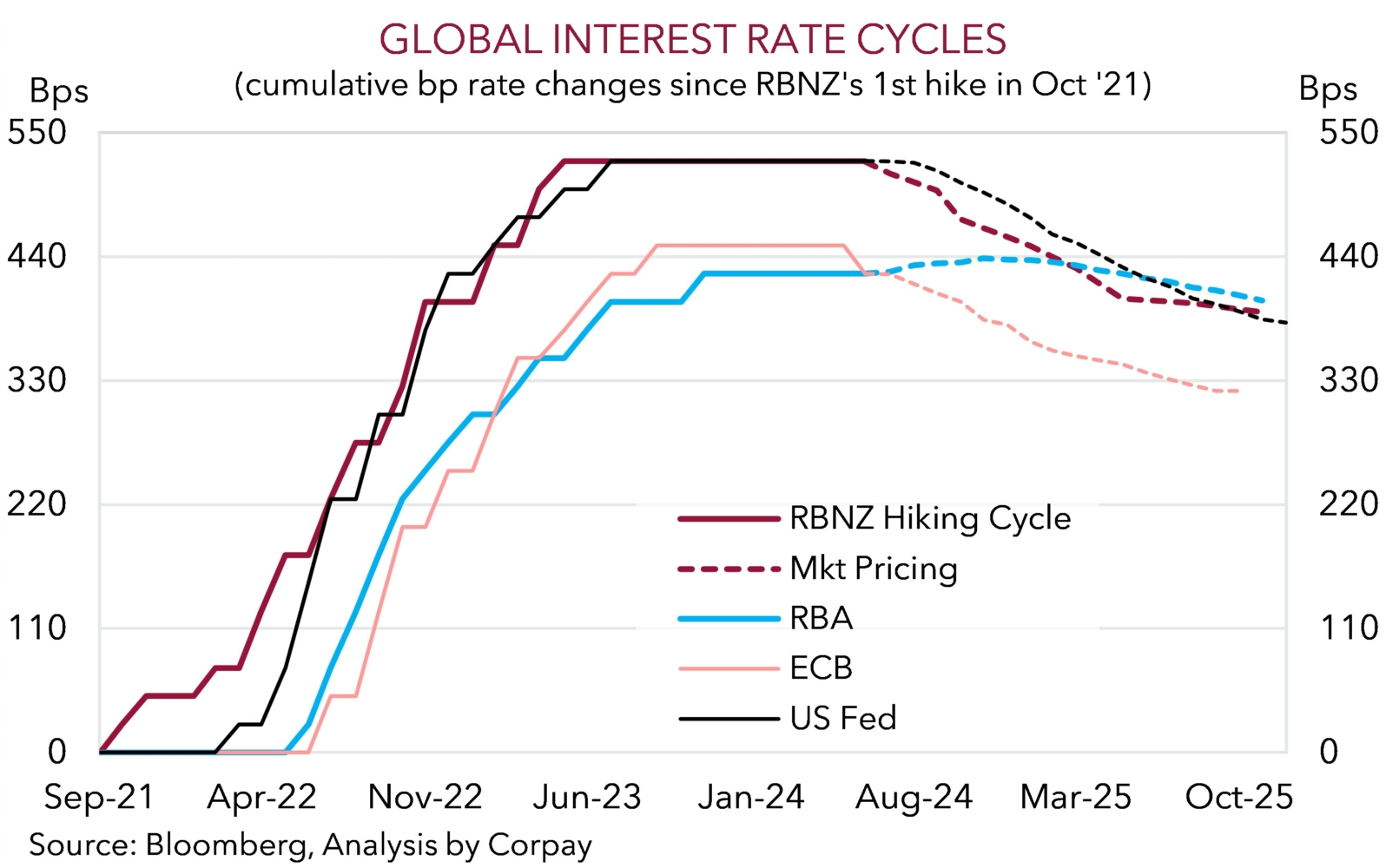

As such, while the RBNZ thinks policy will need to remain “restrictive” the door to tinkering down the track looks to be opening with the committee flagging that the “extent of this restraint will be tempered over time” if NZ inflation declines as anticipated. This is in line with our thinking that it was a matter of when, not if, the RBNZ starts to shift course due to the slack emerging across the NZ economy on the back of the very constrictive monetary policy settings that have been put in place. The start of an extended RBNZ easing cycle in late-2024 looks probable, in our opinion (chart 3).

The ‘dovish’ tilt in the RBNZ’s tone has given AUD/NZD, which rebounded sharply over June, another boost (now ~1.1080). We believe that there is more room to run with our long-held forecast being for AUD/NZD to edge up towards ~1.13 by Q4. From our perspective, the relative macro and monetary policy impulses between Australia and NZ should continue to be AUD/NZD supportive over the medium-term.

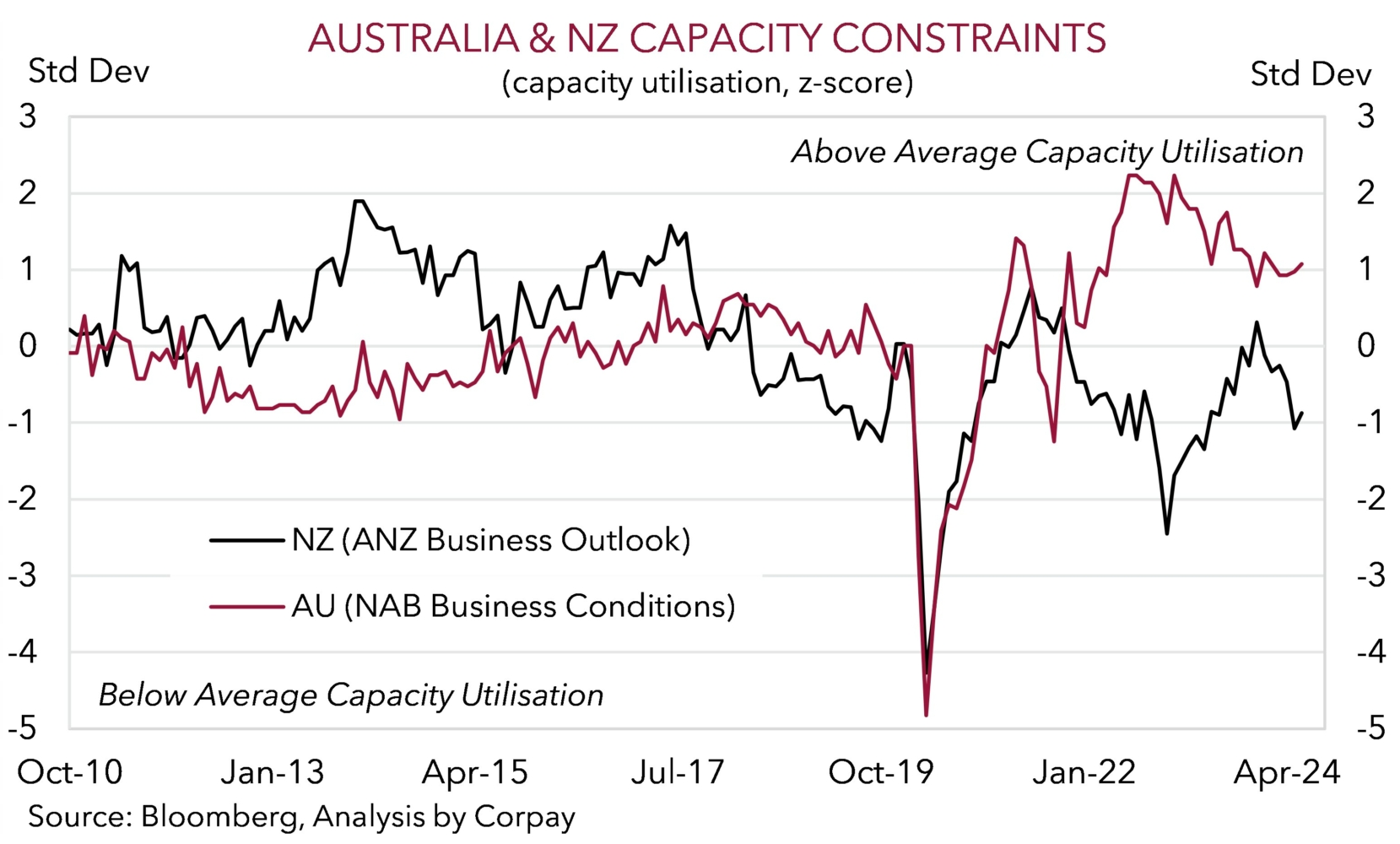

As we often stressed, the RBNZ went hard and early during the hiking phase, especially compared to the RBA. However, this is now creating larger negative economic impacts in NZ with growth weaker, unemployment high, and capacity constraints less pronounced than in Australia (chart 4).

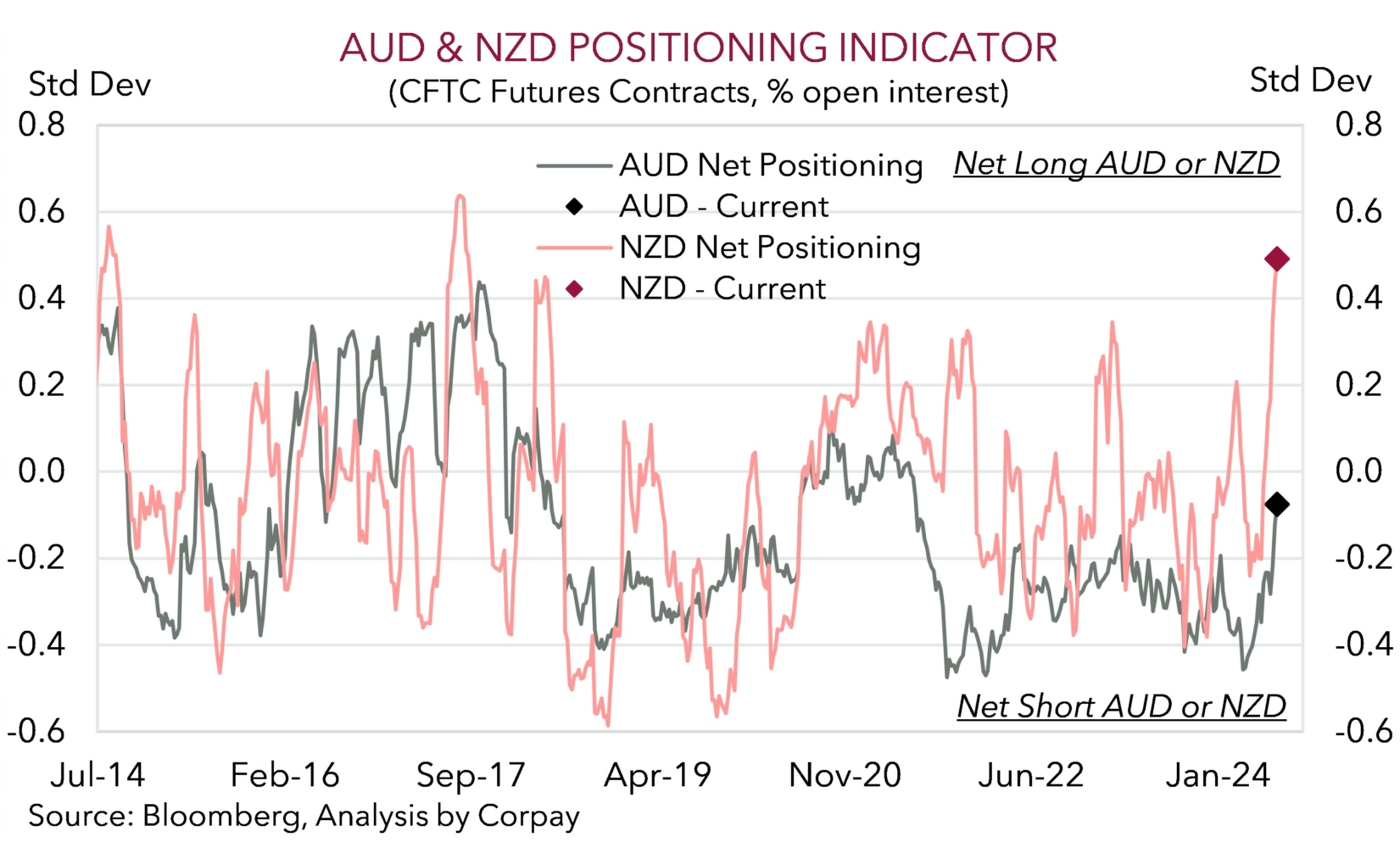

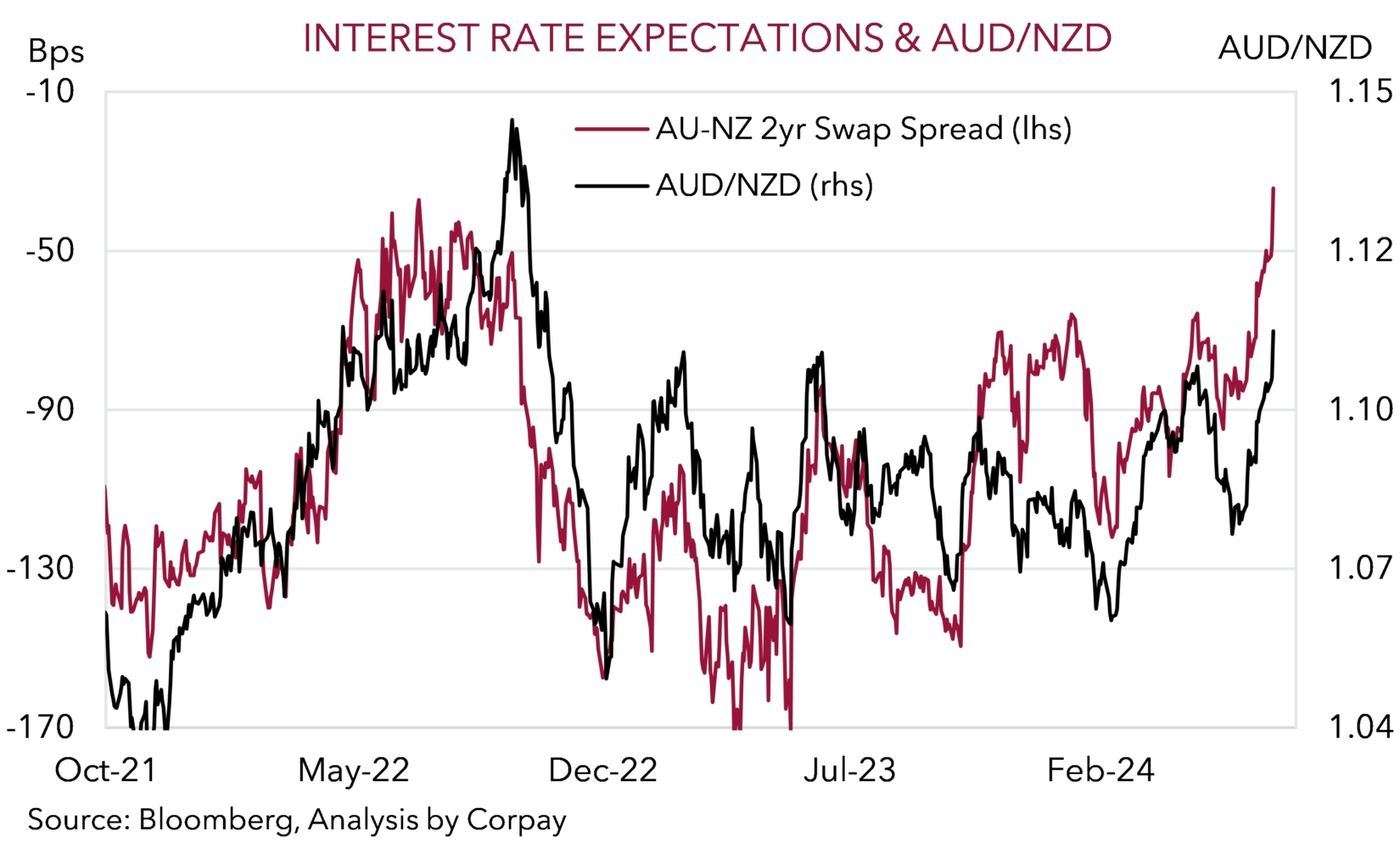

A paring back of recently accumulated ‘bullish’ net long-positioning (as measured by CFTC futures) could exert downward pressure on the NZD (chart 5), giving AUD/NZD a further lift particularly with lingering/sticky inflation in Australia, a resilient jobs market, and still high level of activity across the labor-intensive services sectors raising the odds of another RBA interest rate rise over coming months (see Market Musings: RBA: No retreat, No surrender). Indeed, the current level of the Australia-NZ two-year swap spread already implies that AUD/NZD may currently be a few cents too low (chart 6).