No shock and awe from the RBA today, but its underlying tone did lean a little more ‘hawkish’. The cash rate was held steady at 4.35%, where it has been since last November, with the Board also reiterating it needs to “remain vigilant to upside risks to inflation” and that it “is not ruling anything in or out” when it comes to future moves. This is now a somewhat familiar mantra, and although the hurdle for another hike looks high the chances aren’t zero with the start of the RBA’s easing cycle appearing some time away. Getting consumer prices down to target within a “reasonable timeframe” is the RBA’s “highest priority”, and in something it hasn’t said since February the Board also stressed it “will do what is necessary” to achieve this. Indeed, according to RBA Governor Bullock the Board considered the case for another hike at today’s meeting.

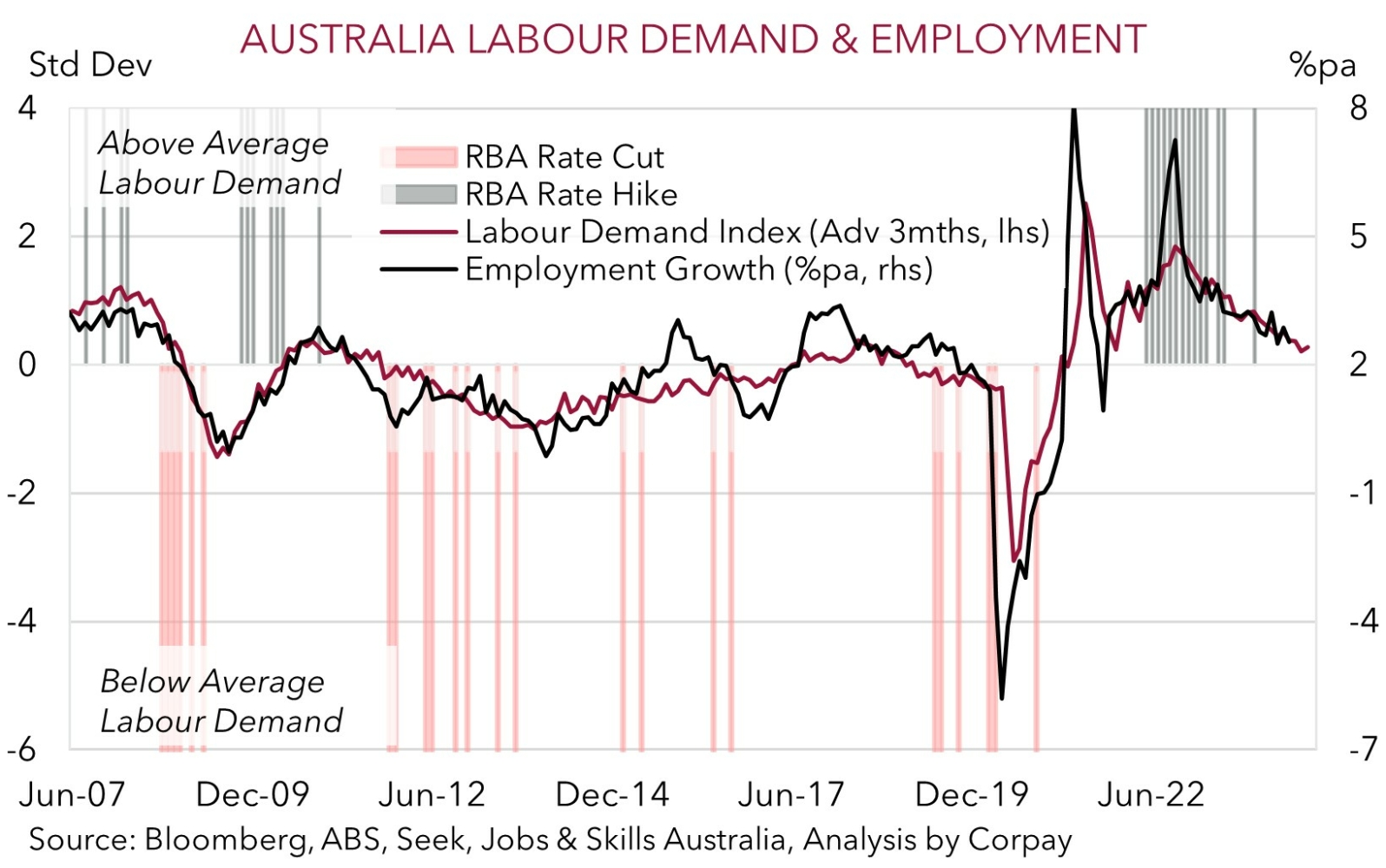

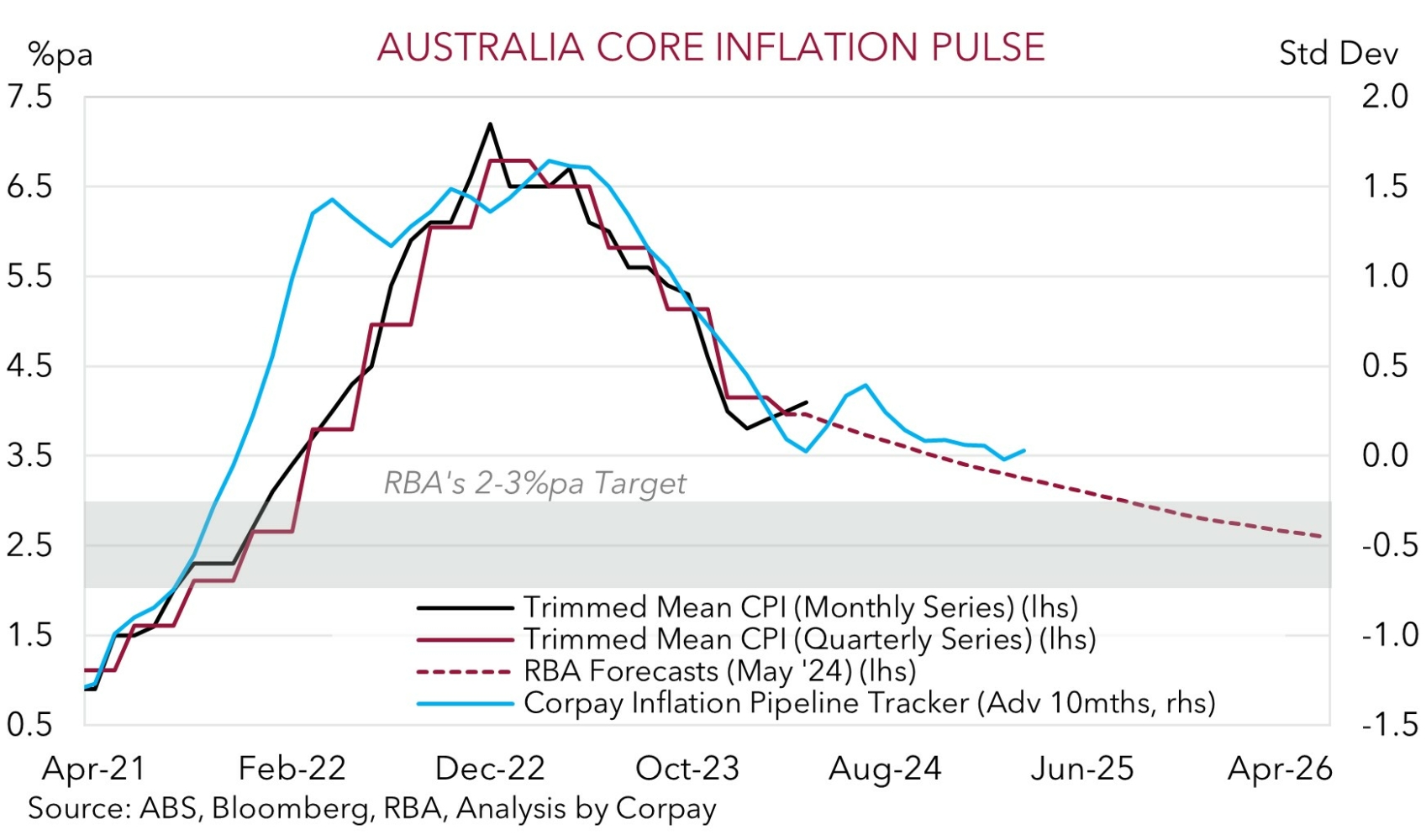

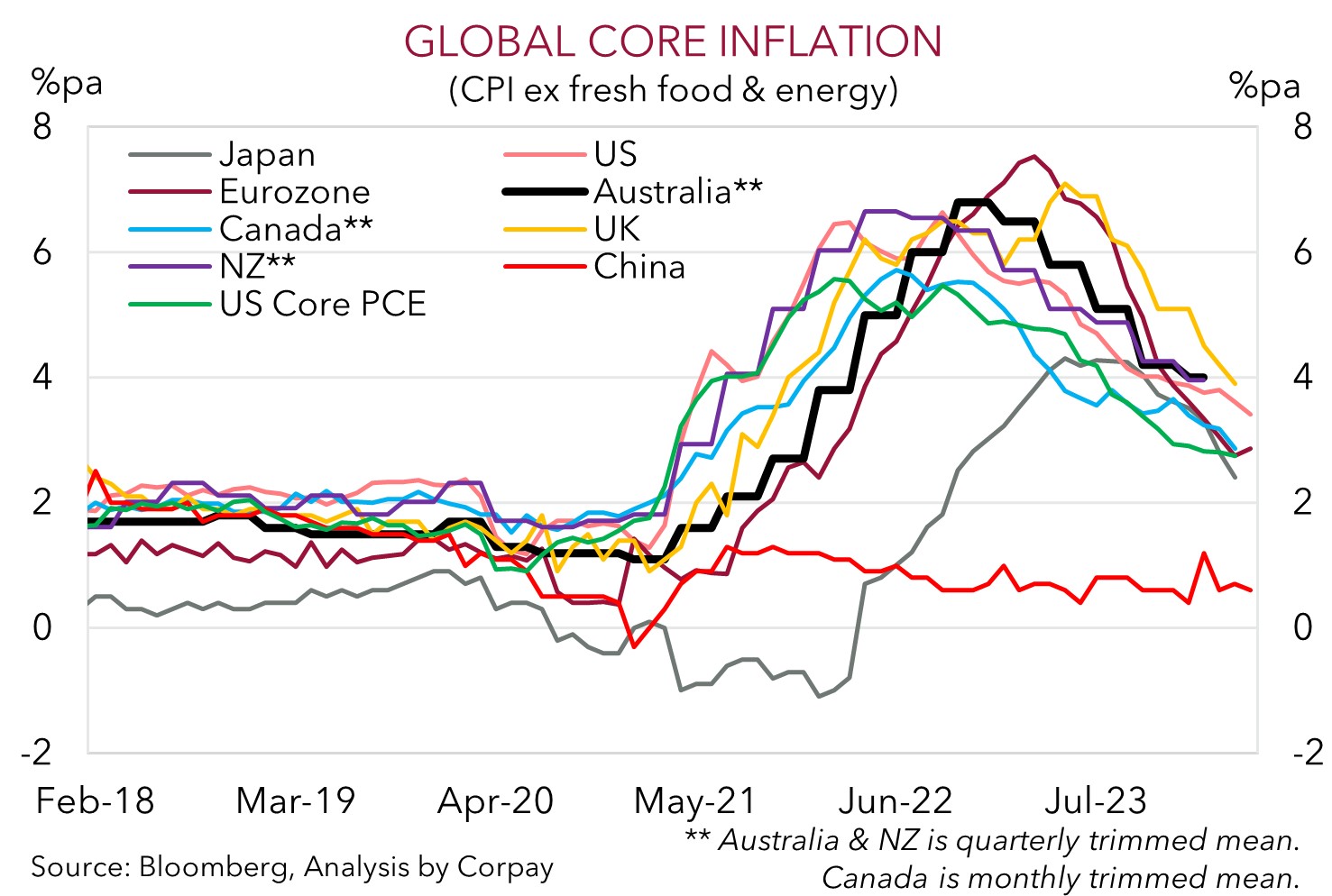

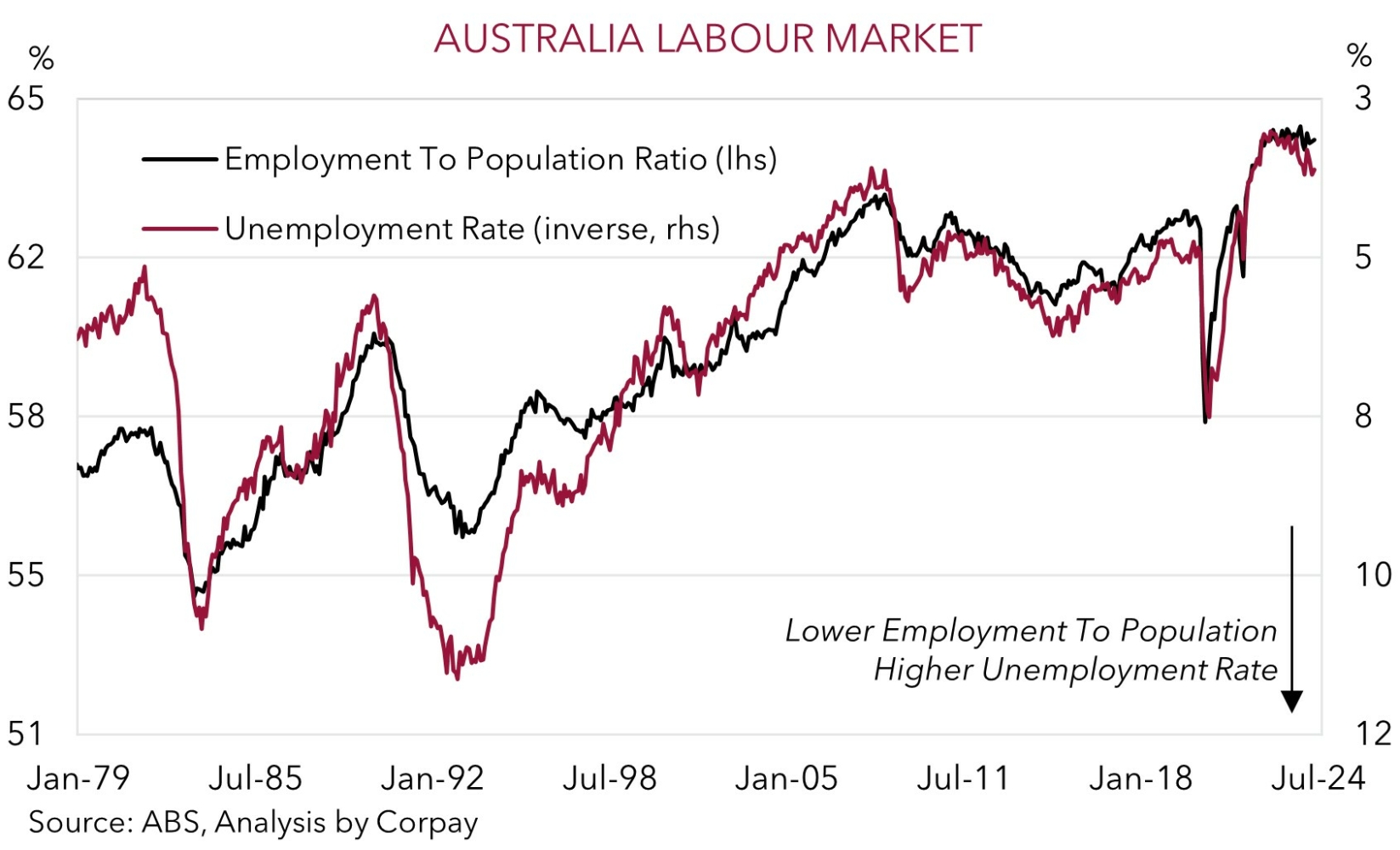

We are at a tricky point of the business cycle with several complex push-pull forces buffeting the Australian economy. Unlike a few other developed economies, particularly the Eurozone and Canada where their respective central banks have already cut interest rates, the improvement in Australian core inflation is beginning to slow (chart 1). The relative persistence isn’t that surprising based on the still tight labour market conditions, upturn in wages, and Australia’s lackluster productivity. Australia’s unemployment rate has nudged up over the past year, but at ~4% it remains below estimates of ‘full-employment’. Moreover, Australia’s employment to population ratio is still elevated with few signs large scale job losses are (yet) on the horizon (chart 2).

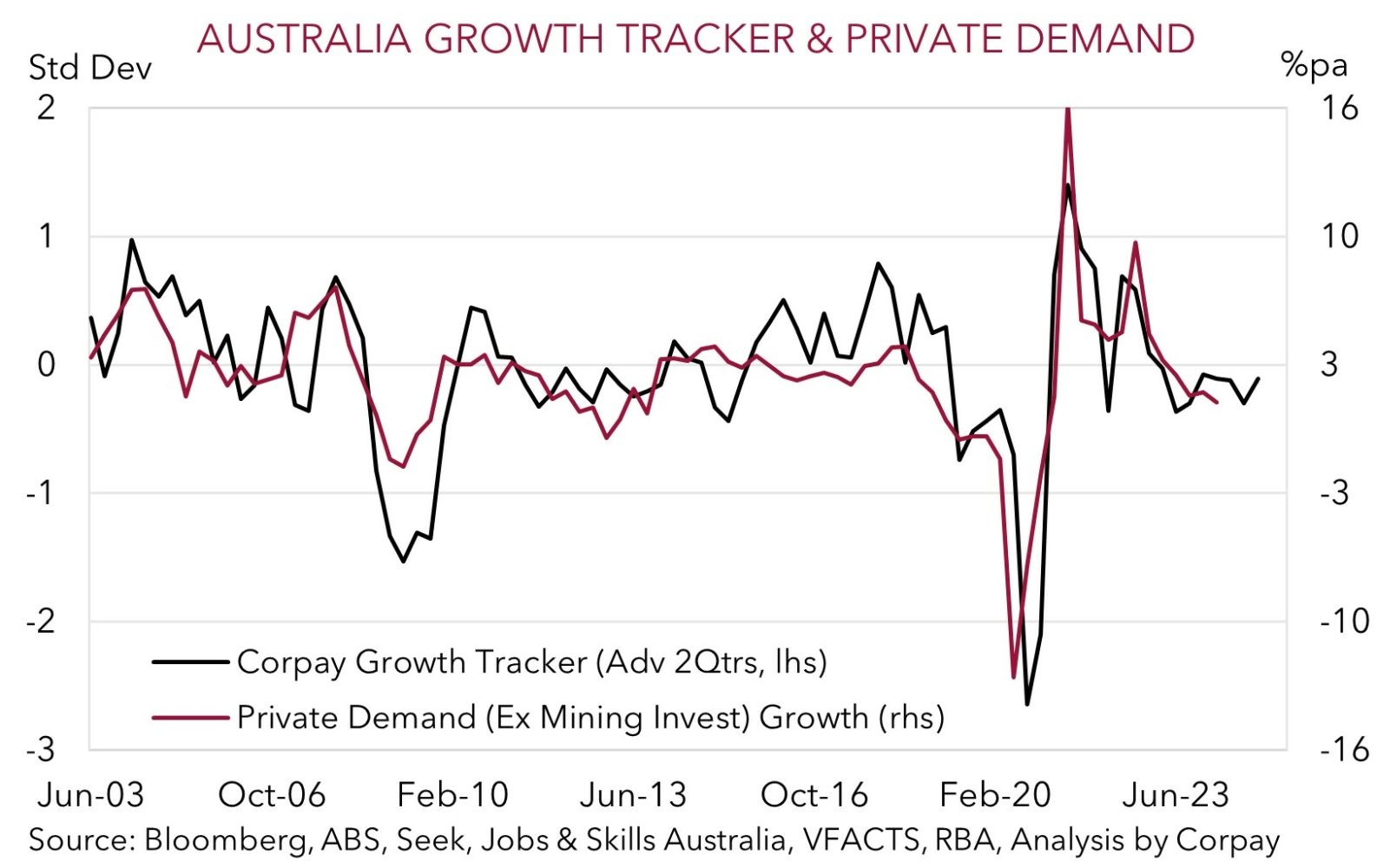

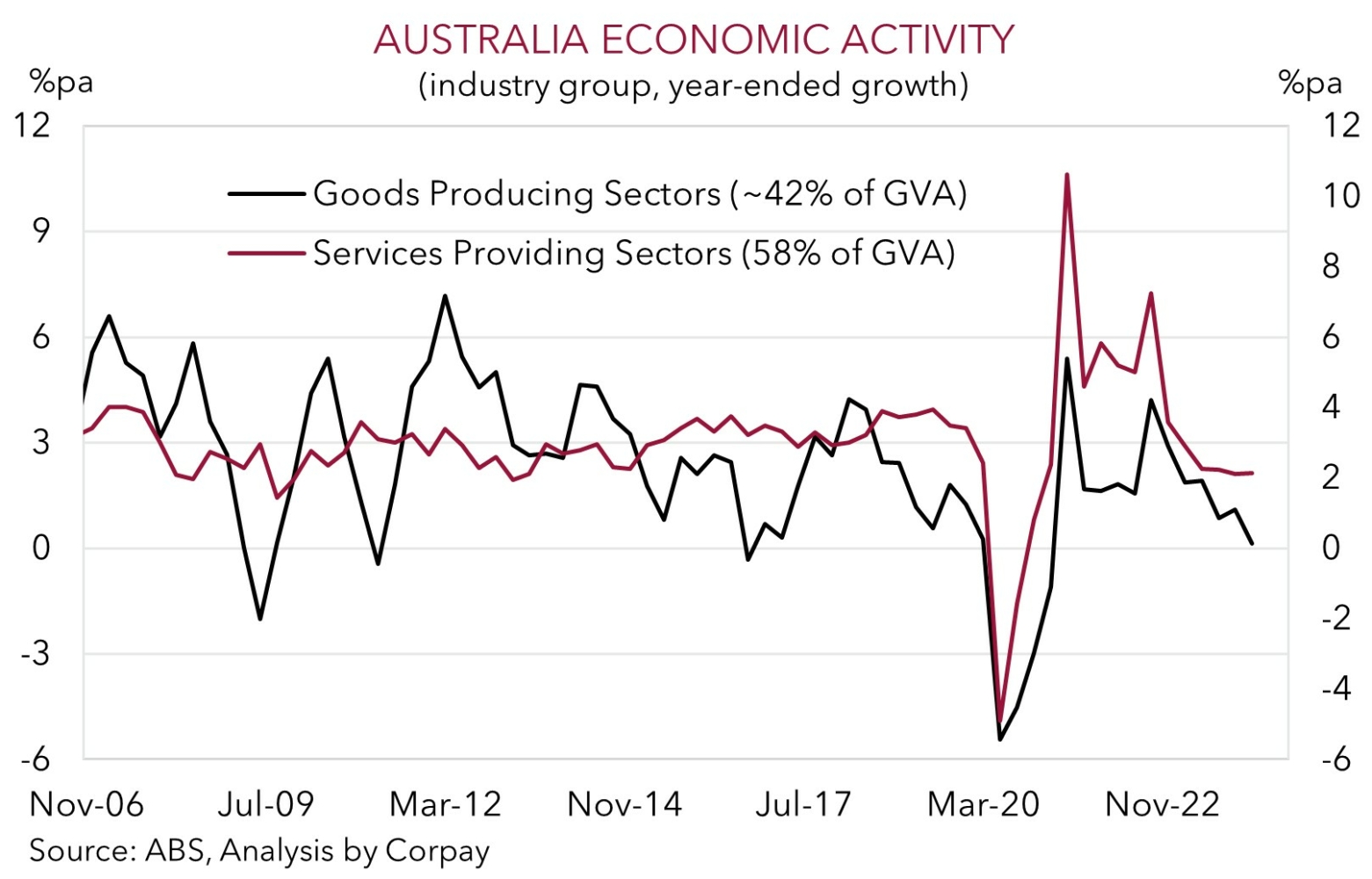

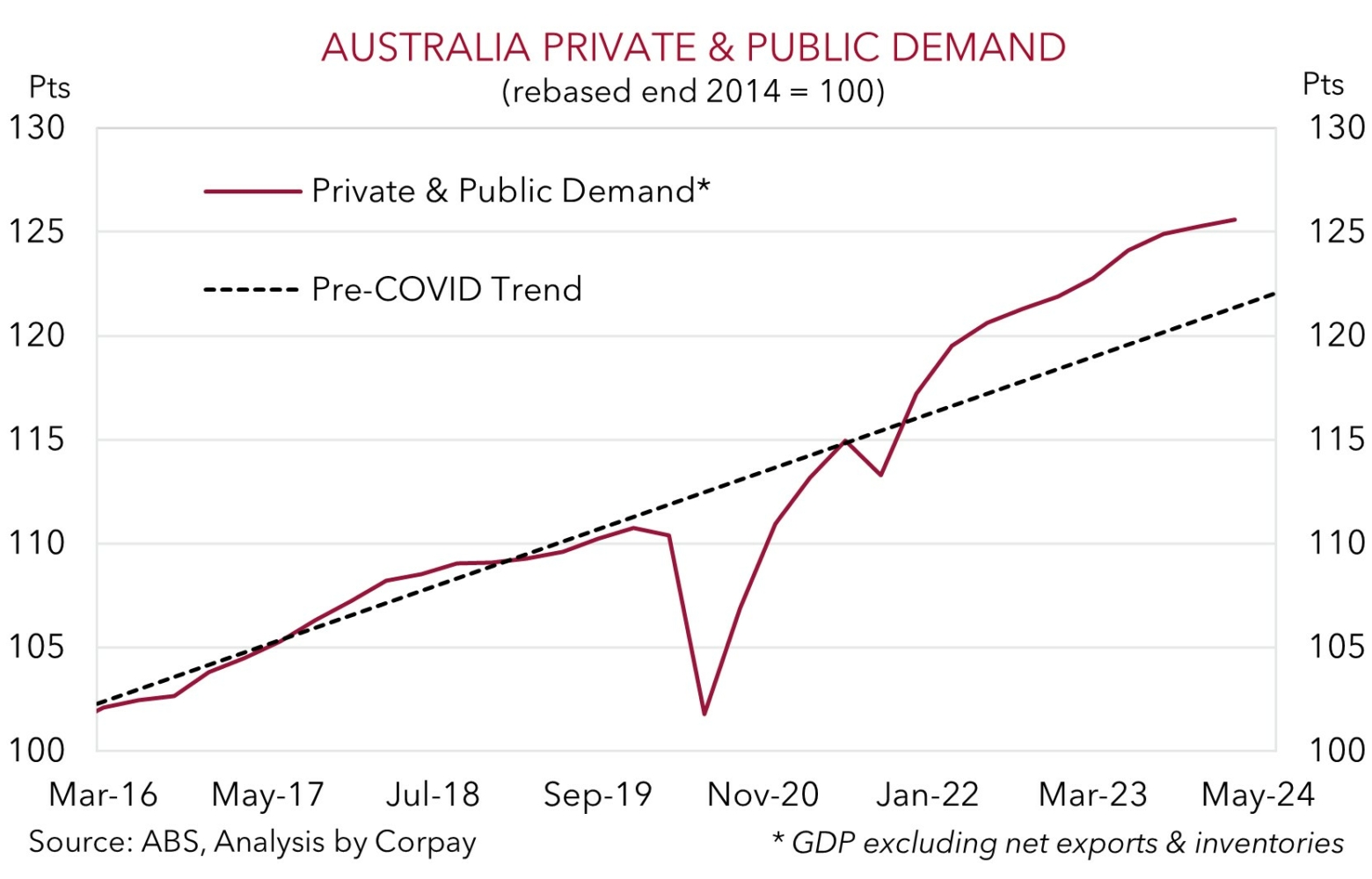

All up this illustrates that Australia’s economy is still in running in a state of ‘excess demand’. While growth rates and momentum have slowed, particularly on a per capita basis and across ‘goods producing sectors’ on the back of the cost-of-living squeeze and higher mortgage costs (chart 3), the level of aggregate activity across the private and public sectors (and services providing industries) is north of its pre-COVID trend (chart 4).

The level of demand compared to supply drives inflation. We think a further rebalancing may take time to play out. Upward revisions in the recent national accounts indicates household consumption has held up better than previously thought. And with stage 3 tax cuts kicking off on 1 July, real wages set to turn course due to moderating inflation and higher wages, State and Federal Government relief measures flowing, ‘excess savings’ across the household sector still lofty, the population expanding, and positive wealth effects stemming from rising asset prices coming through aggregate consumption may not be as weak as what is needed to definitively break the back of domestic inflation.

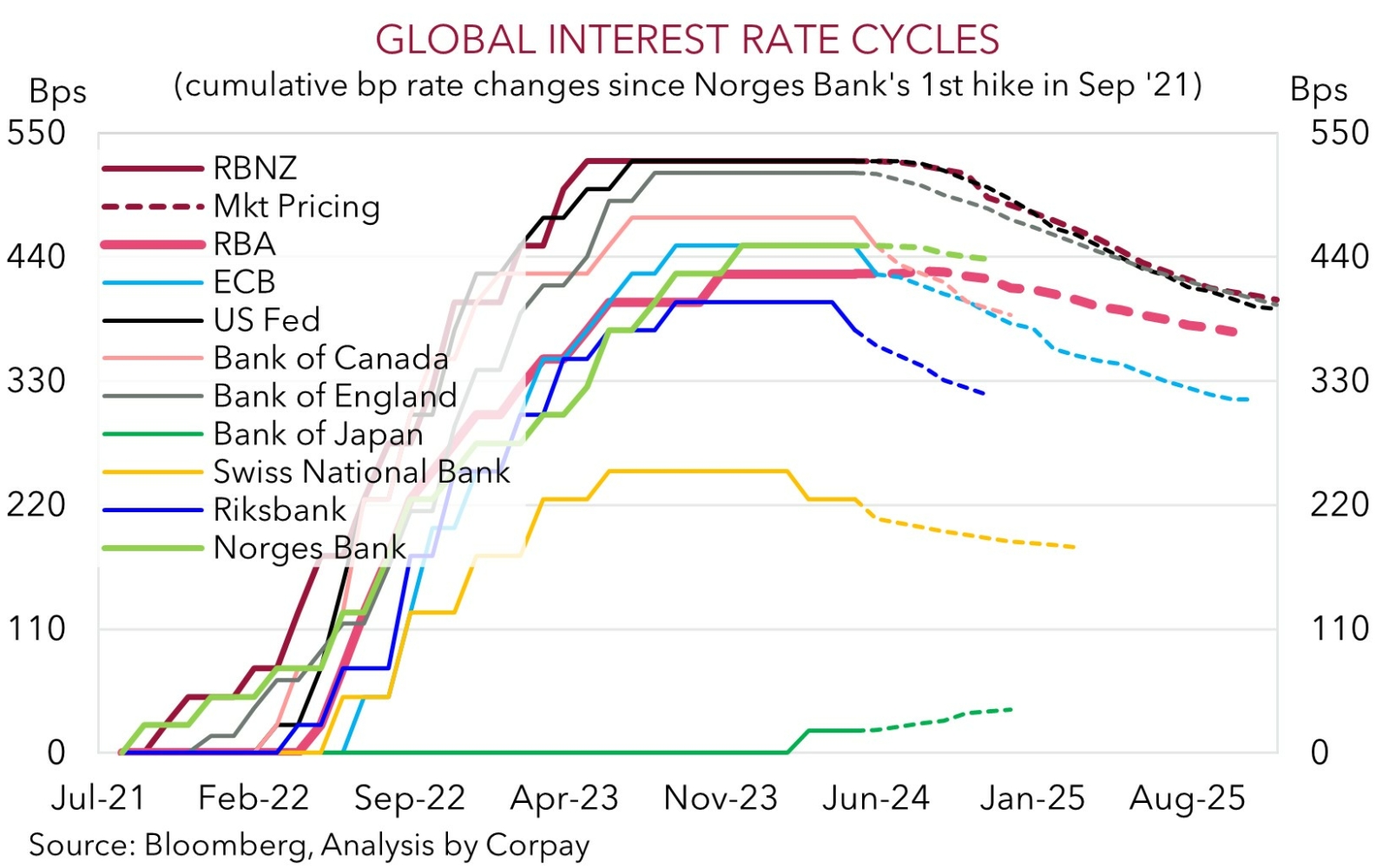

Our private demand growth tracker (chart 5) and labour demand gauge (chart 6) are signaling things are set to cool a bit further, however they aren’t pointing to activity falling off a cliff. Australia’s economy continues to travel along the ‘narrow path’ the RBA is aiming for, but this strategy also underpins our view that its policy trajectory is different and it should lag its peers in terms of when it starts and how far it goes during the next easing cycle (chart 7). As our pipeline CPI tracker also illustrates, based on current RBA policy settings which are calibrated to try and limit possible labour market damage, improvement in core inflation might be drawn out from here (chart 8).

In our judgement, when we throw this all into the mix, the potential start of a modest RBA rate cutting cycle looks to be a story for 2025. Interest rate markets agree with the first RBA rate cut not fully priced in until April 2025. Medium-term, we continue to believe that relative macro fundamental trends, especially the turn in yield spreads to an incremental tailwind, should be AUD supportive. Not just against the USD, but also on crosses like AUD/EUR, AUD/GBP, AUD/CAD, and AUD/NZD where other central banks have started or could soon begin to lower interest rates.