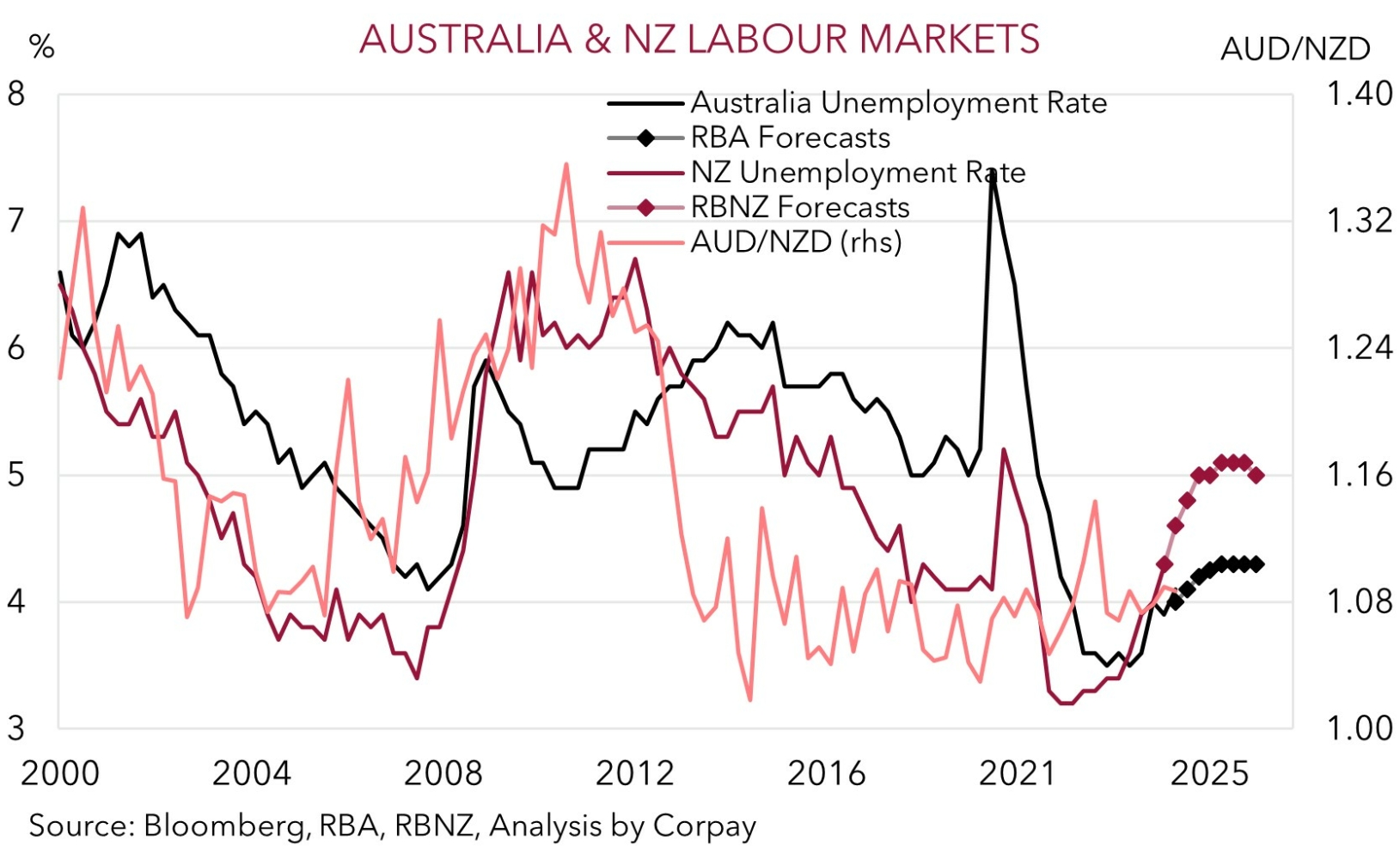

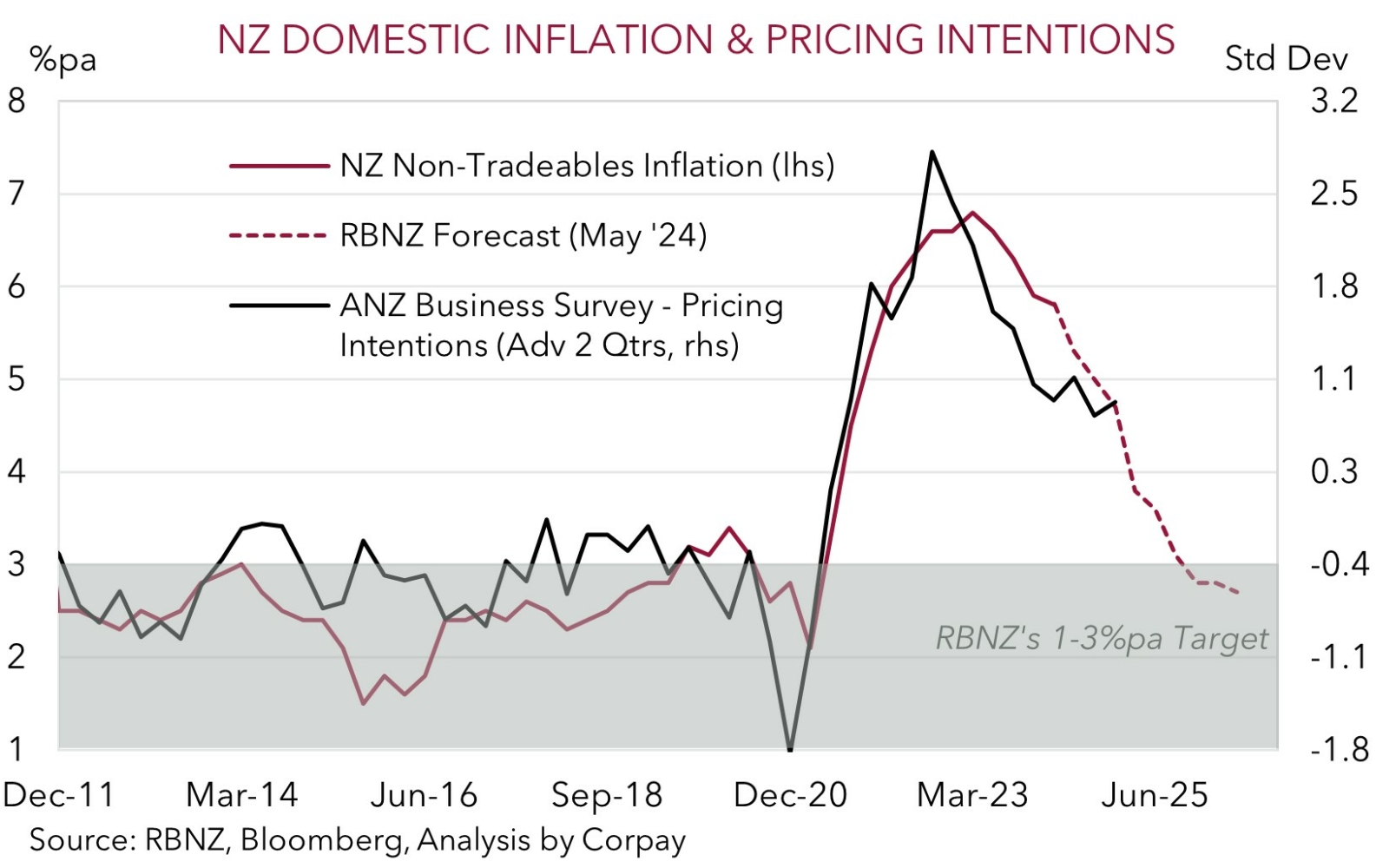

The RBNZ kept interest rates steady at 5.5% at today’s meeting. No surprises. But in a shock to market analysts and the NZD, the RBNZ’s tone and updated projections were more ‘hawkish’. The RBNZ is still grappling with a growth/inflation trade-off, and the latter continues to win out, for the time being at least. Despite the increasingly apparent weakness in the NZ economy (GDP has contracted in 4 of the past 5 quarters even with robust population growth) and widening cracks in the labour market (NZ’s unemployment rate has risen by ~1%pt the past year) concerns about inflation are (still) front-of-mind for the RBNZ. The RBNZ nudged up its inflation forecasts with a more gradual pull-back down to target over coming years anticipated. Governor Orr stressed that “more work needs to be done to reduce” domestic inflation and that there is “limited room” for upside surprises (chart 1).

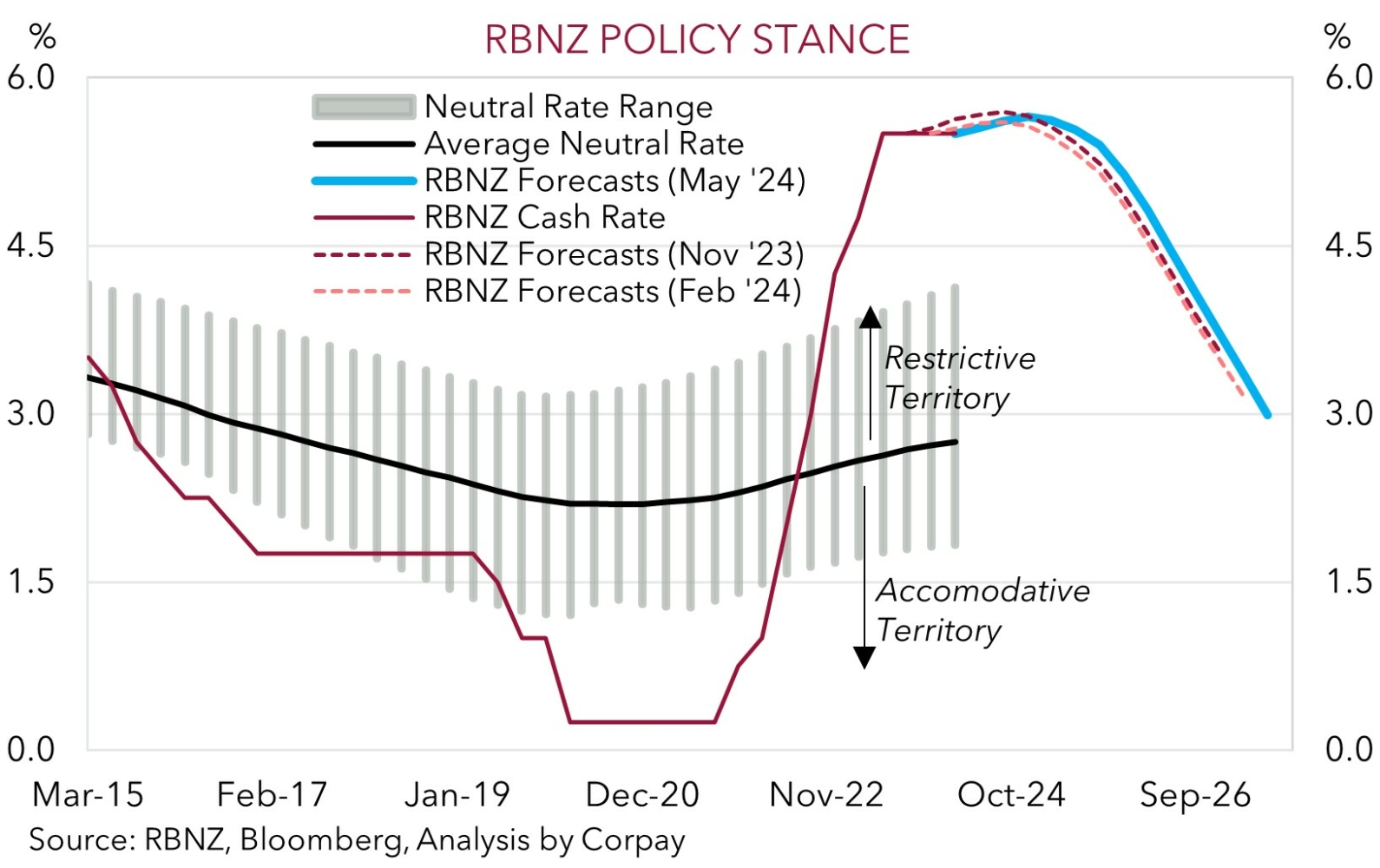

This, and an upward adjustment to the RBNZ’s views around the ‘neutral’ interest rate (i.e. the theoretical equilibrium level which the stance of monetary policy is benchmarked against) flowed through to its interest rate assessment. The RBNZ’s latest projections show greater odds of another rate hike by end-2024 (now ~60% from ~40%), with eventual rate cuts pushed further into 2025 (now starting in Q3 2025) (chart 2). Indeed, RBNZ Governor Orr rattled the rate hike sabre by noting a hike today was a “real consideration” due to the near-term inflation challenges.

The RBNZ was at the front of the central bank pack during the global rate hiking cycle over the past few years having kicked things off earlier than most in October 2021 and been more aggressive. The RBNZ last moved rates up a year-ago. Although it amped up its hawkish rhetoric, we believe it is more of a ‘risk management’ shot across the bow of markets and NZ consumers/businesses. In our view, the sluggish performance of the NZ economy could negatively surprise the RBNZ’s thinking given the outlook for slower population growth, sub-par business and consumer sentiment, negative real wages, ‘restrictive’ policy settings, and as amplifiers like high household debt and rising unemployment continue to kick in. Overtime, the greater slack in the NZ economy should help cool domestic inflation. In our opinion, the next move in the RBNZ Official Cash Rate is still more likely to be down not up, but due to the RBNZ’s leanings this could be more of an early 2025 story rather than later this year.

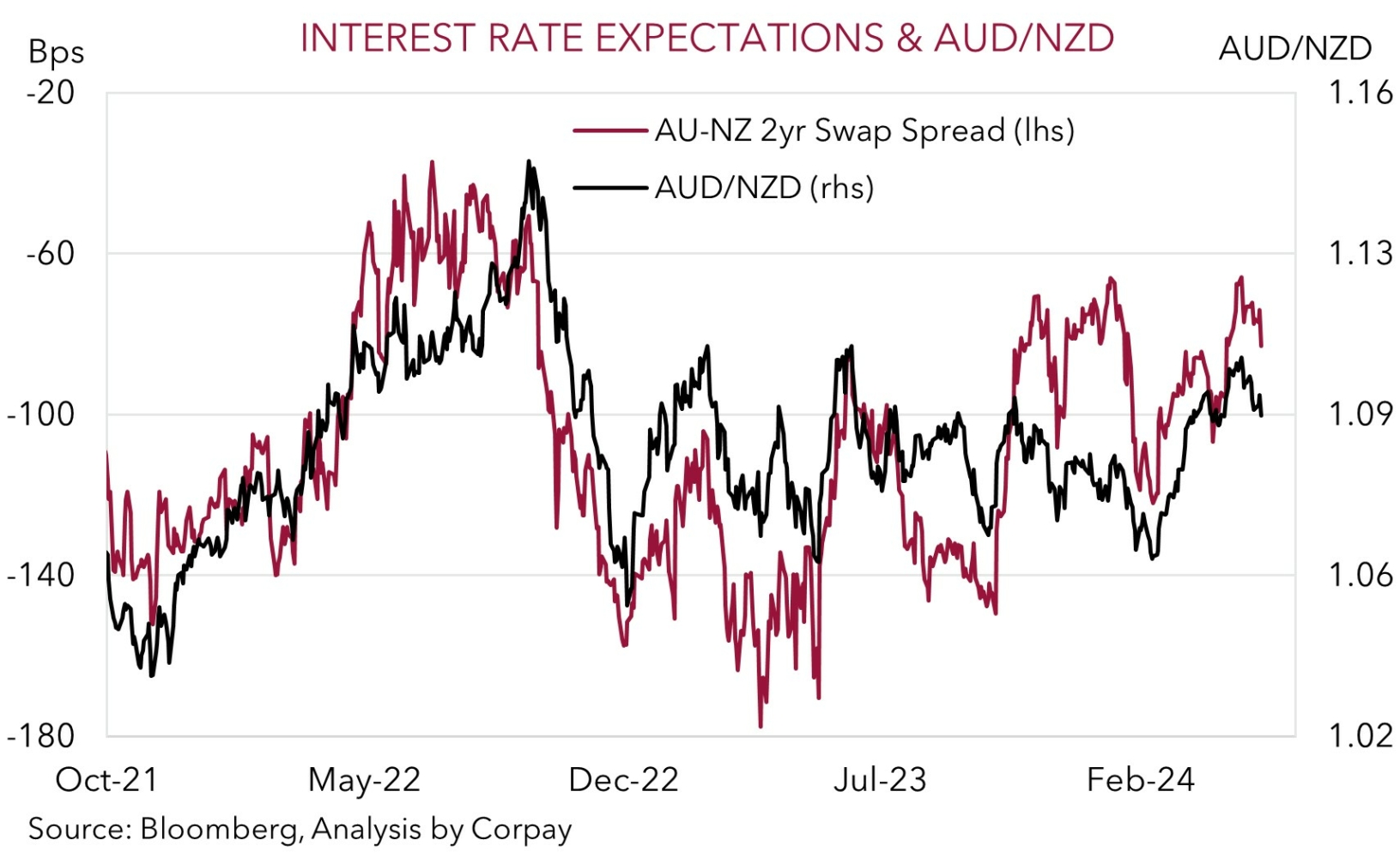

In response to the RBNZ’s ‘hawkish’ hold, the NZD jumped up and AUD/NZD dipped to now be sitting just below ~1.09. In our view, this is more of a knee-jerk response to the ‘sticker shock’ of the RBNZ’s surprising tone. While this reaction and positioning adjustment may continue to wash through in the short term, generating a bit more support for the NZD and pressure on AUD/NZD, our medium-term views remain unchanged. We believe the combination of NZ’s weaker economic and labour market foundations, coupled with NZ’s large external imbalance (NZ’s current account deficit is still a lofty ~7% of GDP) and the potential funding challenges associated with this should be NZD headwinds over coming quarters. Relative growth and labour market trends should remain in Australia’s favour (chart 3). We feel these types of relative trends should see AUD/NZD, which already looks too low compared to the AU-NZ two-year swap spread even after today’s swings, lift up towards ~1.12 by Q4 (chart 4).