• Positive tone. Cautious rhetoric from Fed officials is weighing on bond yields & the USD, & boosting risk sentiment despite the Middle East conflict.

• AUD ticking up. The downshift in the USD & reports China is considering a new round of stimulus is helping the AUD. The RBA’s Kent speaks today.

• US data. US PPI inflation released tonight, as are the minutes of the last Fed policy meeting. The important US CPI report is due tomorrow night.

Risk sentiment has remained positive with markets taking a somewhat sanguine view about the implications of the Middle East events. Oil prices eased slightly (Brent Crude -0.8%), while equities have continued to rebound with European markets outperforming (EuroStoxx50 +2.3%, US S&P500 +0.6%). The slide in bond yields stemming from the geopolitical risks and more cautious rhetoric from US Fed officials has been more of an underlying driver. Adding to comments from the past few days the Fed’s Bostic noted that he thought the US economy was on track for a ‘soft landing’, and that in his view there was no need for further rate hikes as inflation is on track to get back down to 2%pa given policy is already at a “sufficiently restrictive position”. The Fed’s Kashkari also stated that it is “possible” higher bond yields, which have tightened financial conditions, “could leave less for the Fed to do”.

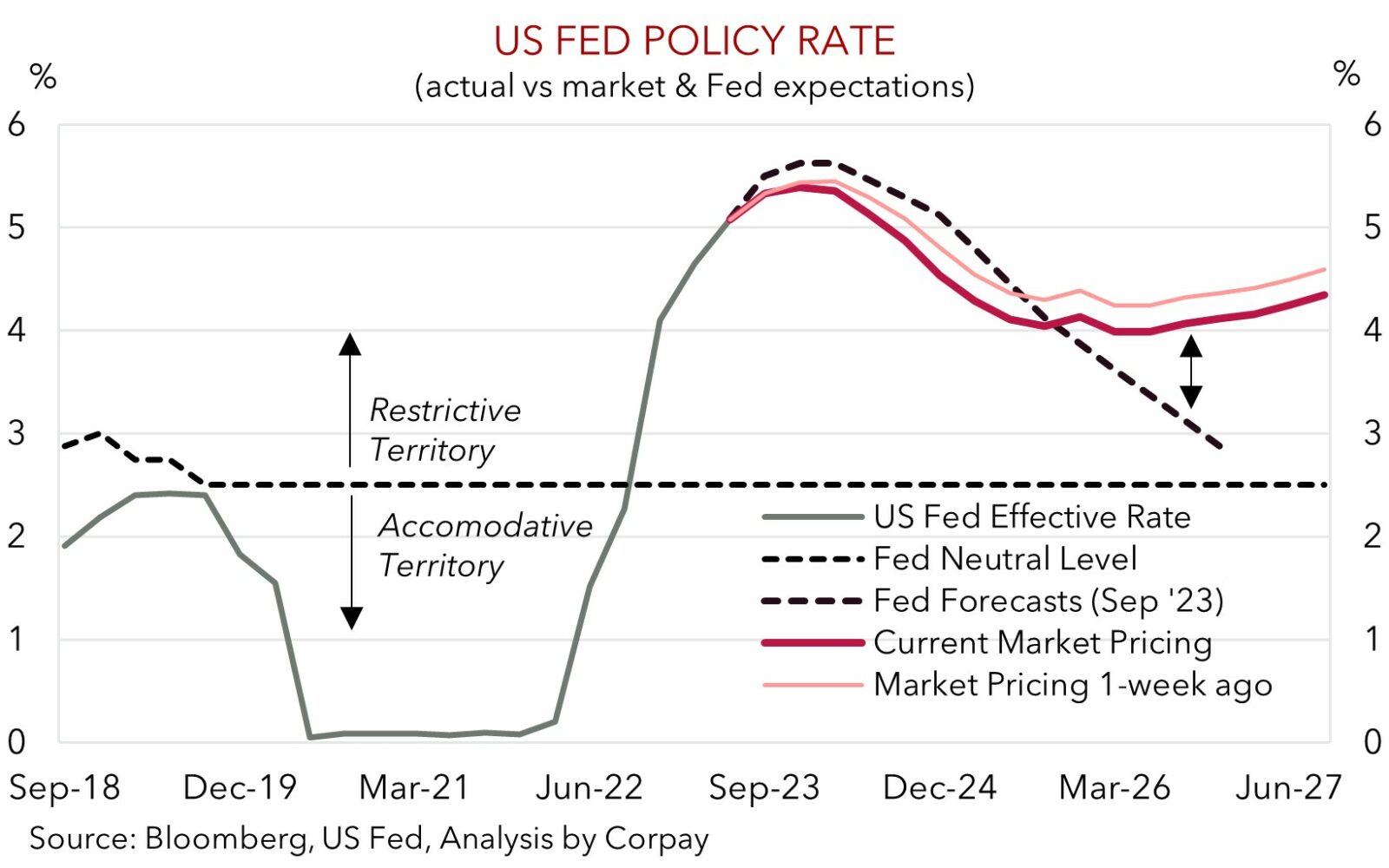

As our chart shows, US interest rate expectations have shifted down slightly over the past week. Markets are now only assigning a ~30% chance of another Fed hike by year-end with a modest rate cutting cycle penciled in from mid-2024. The minutes of the last Fed meeting are released tomorrow (5am AEDT). A ‘higher for longer’ message is likely to be repeated in the now dated minutes, however, even after the recent repricing, we would note that longer-term market assumptions are still above the Fed’s base case.

The backdrop has exerted downward pressure on US bond yields with the 10yr rate falling by ~15bps to 4.65% in the first day back after the long weekend. The US 2yr yield declined ~12bps (now 4.96%). In FX, the USD Index has continued to give back ground, with EUR edging above ~$1.06 for the first time this month. USD/JPY has consolidated (now ~148.67), GBP has pushed up towards ~$1.23, NZD (now ~$0.6048) is near its late-September high, while the AUD has drifted a touch higher (now ~$0.6431) despite Country Garden, China’s largest private developer, warning it may not be able to meet all its future offshore obligations. Reports that China is considering raising its 2023 budget deficit as it mulls a new round of stimulus to help the economy achieve its growth target has been more of a focus.

In addition to the Fed minutes, US PPI inflation (11:30pm AEDT) could generate some USD volatility tonight given it can provide a read on tomorrow nights CPI inflation report. As things stand, we think US core inflation risks slowing a little more than projected (mkt 4.1%pa from 4.3%pa) due to the softening wage pulse and cooling rents. As per the moves over recent days, if realised, we believe a softer US inflation pulse may weigh on still lofty US interest rate expectations and in turn the USD.

AUD corner

The AUD has edged a little higher over the past 24hrs to be back near ~$0.6430, the top of its October range. The softer USD and positive risk sentiment generated by the pull-back in US bond yields as markets re-evaluate the Fed policy outlook and reports China could inject more fiscal stimulus are supporting the AUD (see above). On the crosses the AUD has held steady against the EUR, GBP, and NZD, though it has appreciated by ~0.4% versus the JPY and ~0.3% relative to the CAD and CNH.

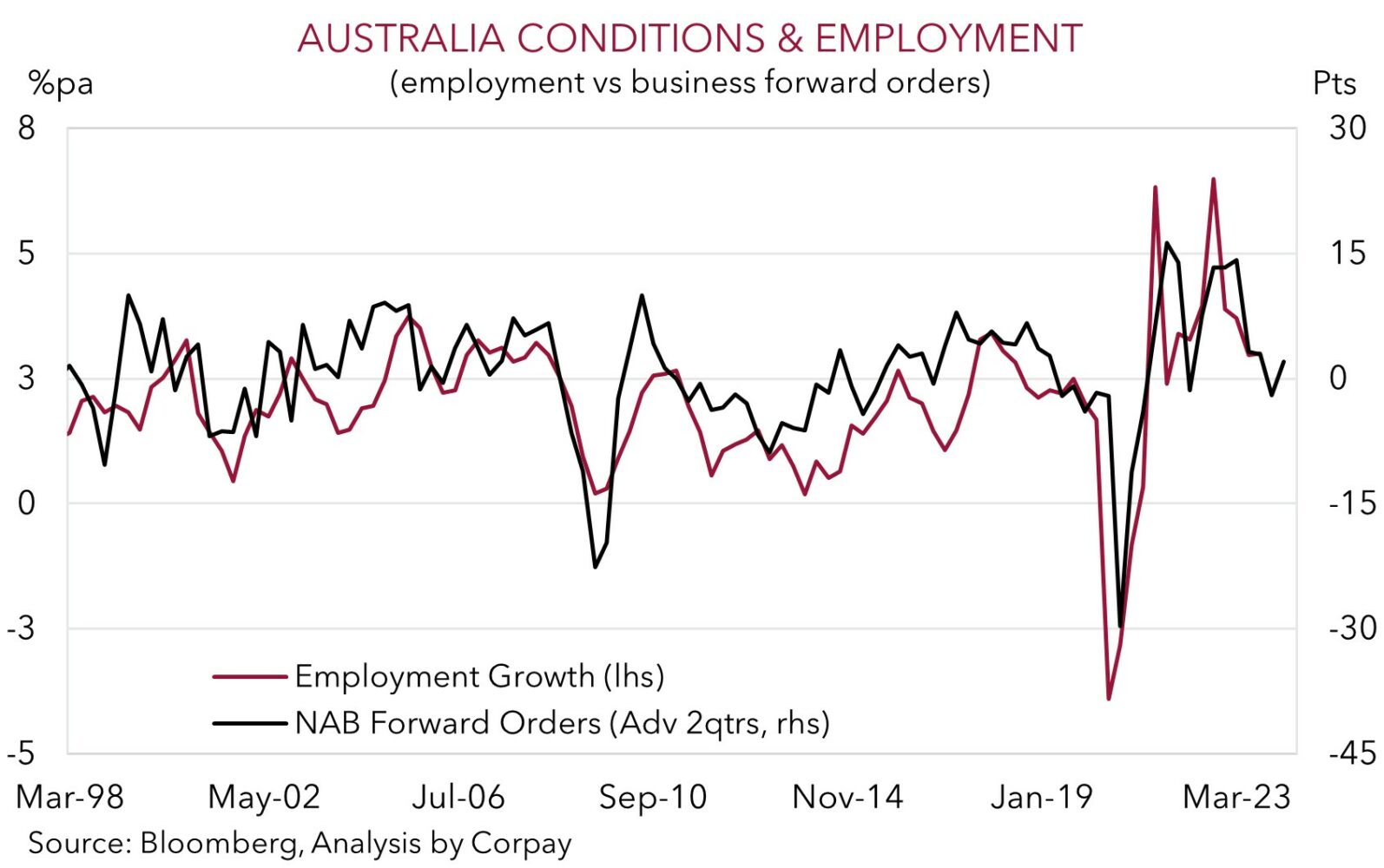

Locally, consumer sentiment rose in October with the extended RBA ‘pause’ helpful, however the index remains below average. By contrast, while business conditions eased, they remain elevated, suggesting ongoing resilience in domestic activity with the growing population an offset to the cashflow hit on indebted households. Indeed, as our chart illustrates, forward orders (which are a guide to future private demand and employment) have ticked up. And although the survey suggests inflation pressures are easing, they haven’t been extinguished. Labour costs are still double the long run average. This poses ongoing upside risks to wages and services inflation, in our view. We expect the RBA to maintain its hawkish bias for a time, and when contrasted to the downward repricing in the US, relative yield differentials could be bottoming out and may begin to shift in a more AUD supportive direction. Today RBA Assistant Governor Kent speaks (12pm AEDT) on the “Channels of Transmission”. Any update on the RBA’s Quantitative Tightening plans (i.e. how it will shrink its bloated post-COVID balance sheet) could be an intra-day AUD positive surprise.

As mentioned, we think the elevated USD can deflate further over the period ahead if the incoming US PPI (11:30pm AEDT) and CPI inflation data (Thurs night AEDT) underwhelms. Signs underlying US inflation is moderating could reinforce the more watchful tone from US Fed members about future policy, exerting more pressure on the USD and supporting growth-linked currencies like the AUD. This is in line with our thoughts that compared to current low levels there are more upside than downside risks for the AUD over the medium-term (see Market Musings: AUD: Always darkest before the dawn).

AUD levels to watch (support / resistance): 0.6280, 0.6350 / 0.6438, 0.6547

SGD corner

USD/SGD has drifted back (now ~1.3628), tracking the moves in the broader USD as markets downwardly adjust their US interest rate expectations (see above). USD/SGD is now ~1% below its early-October peak. As discussed over recent days and above, barring an escalation and broadening out in the Middle East conflict, we believe the USD can continue to ease back over the near-term. US PPI inflation is released tonight, and we see downside risks to the US CPI report (released Thursday). In our opinion, softer US inflation could exert further pressure on still high US interest rate pricing, and in turn the USD (and USD/SGD). Furthermore, the SGD may garner support from the upcoming Monetary Authority of Singapore meeting (Friday). We think the MAS could deliver a ‘hawkish hold’ by maintaining its current SGD NEER 1.5%pa appreciation slope. Inflation is coming down, but we believe it is still too high for the MAS to shift from its ‘hawkish’ leanings.

SGD levels to watch (support / resistance): 1.3560, 1.3590 / 1.3723, 1.3767