• Mixed signals. Markets brushed off the hotter than expected headline US PPI, with the minutes of the last policy meeting reinforcing the Fed’s cautious stance.

• USD volatility. Long-end US bond yields continue to fall as markets pare back further US Fed rate hike bets. The USD is near the bottom of its October range.

• AUD holding. AUD whipped around a little overnight, but on net it is still tracking above ~$0.64 (~2% above recent lows). US inflation data released tonight.

Markets were generally subdued overnight. The modest knee-jerk strength in the USD, lift in bond yields, and softness in equity markets following the higher-than-expected headline US Producer Price Inflation data reversed following the release of the minutes of the last Fed meeting. While the late-September meeting outcome included a hawkish upward revision to Fed’s interest rate projections, the minutes tempered that by emphasising the current stance of policy was “restrictive”, settings appeared to be restraining the economy, the risks to the outlook had become “more balanced”, and “all members” agreed the committee was able to “proceed carefully” from here. In our mind, the tone of the minutes, coupled with other recent comments by Fed officials indicates the focus has shifted from how high rates may go to how long they need to remain ‘restrictive’. Rate cuts could be some time away, but the bar to further rate rises looks to have increased, and without large upside surprises in the US data another Fed hike is becoming unlikely, in our view. The odds of a Fed rate hike at the early November meeting has fallen to below 10%.

On net, the S&P500 ended the day higher (+0.4%) with the index now ~3.7% above last Friday’s low. On the back of the shift in the Fed’s tone the pull-back in long end bond yields has continued and this is helping boost sentiment. The US 10yr rate fell another ~10bps (now 4.56%), taking its cumulative falls in the past week to ~33bps. Elsewhere, oil prices have continued to ease despite the unfolding Middle East developments. WTI crude declined ~2.6%, with Monday’s lift now largely unwound. In FX, the USD failed to hold onto its intra-day gains, with the Index near the bottom of its October range. EUR has edged up towards ~$1.0620 and GBP has risen back over ~$1.23 for the first time in ~3-weeks. USD/JPY bucked the trend with the positive risk vibes weighing on the JPY (now ~149.20). After dipping under $0.64 in the wake of the US PPI data the AUD has recovered lost ground (now ~$0.6414). USD/SGD has followed the broader USD patterns with the pair hovering just below its 1-month average (now ~1.3630) ahead of Friday’s Monetary Authority of Singapore meeting.

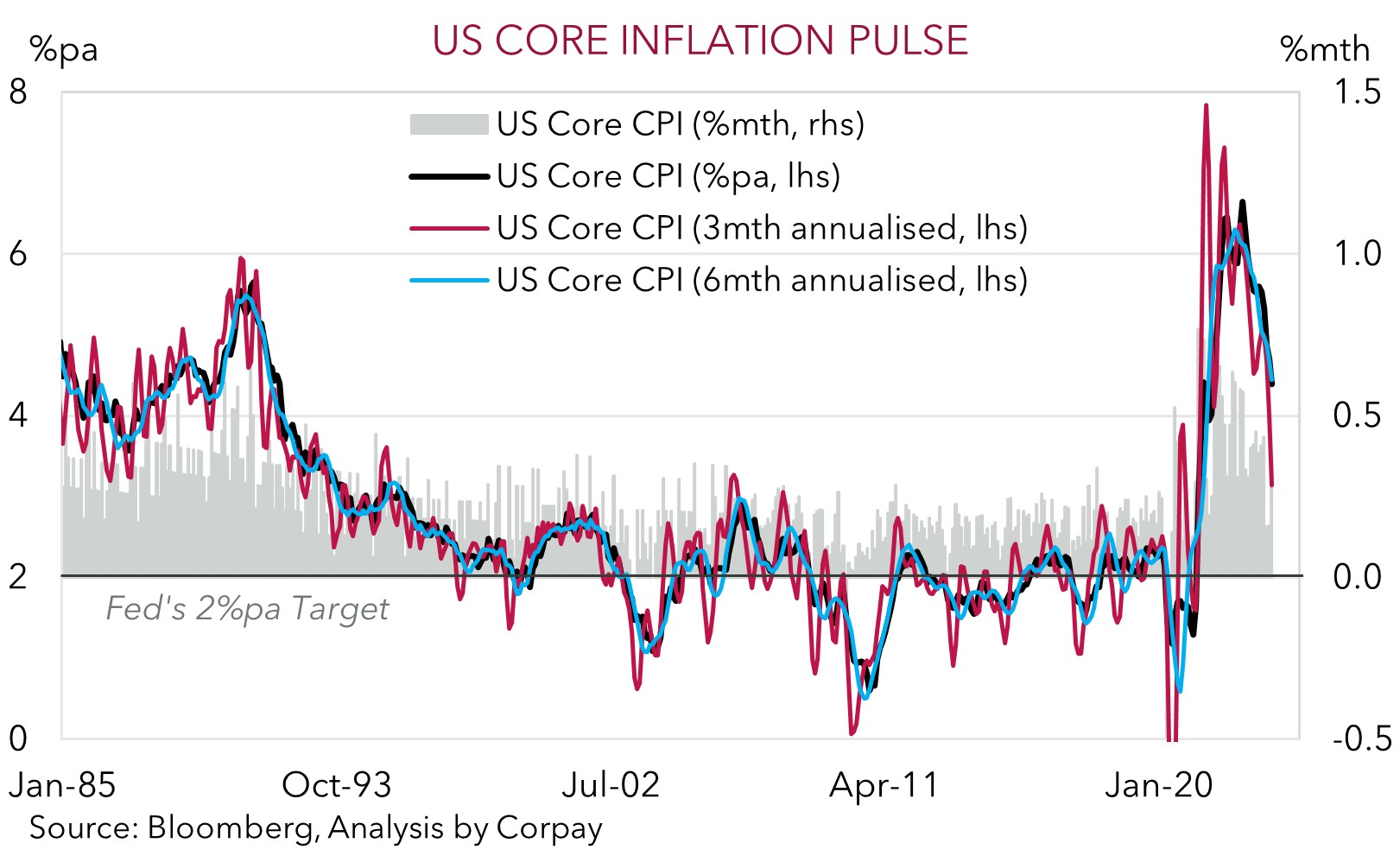

Focus for markets will be on tonight’s US Consumer Price Inflation data (11:30pm AEDT). While the headline PPI exceeded forecasts (+2.2%pa vs mkt 1.6%pa) this was largely a reflection of higher energy prices. Core producer prices (i.e. ex food, energy, trade) decelerated slightly. This supports our thinking that US core inflation risks slowing a little more than projected (mkt 4.1%pa from 4.3%pa) due to the softening wages and cooling rents. As per the recent trend, if realised, we believe a softer US inflation pulse may weigh on still elevated US rate expectations and the USD.

AUD corner

The AUD was whipped around a bit overnight, mirroring the modest USD volatility and swings in risk sentiment stemming from the hotter than forecast headline US PPI data and ‘cautious tone’ from the US Fed minutes (see above). AUD traded in a ~0.9% range over the past 24hrs, but on net, at ~$0.6414 it is only slightly below where it was this time yesterday. On the crosses, AUD has given back some ground against the EUR (-0.4% to ~0.6040) and GBP (-0.5% to ~0.5208) but has nudged up versus the JPY (+0.1% to ~95.69) and NZD (+0.2% to ~1.0654).

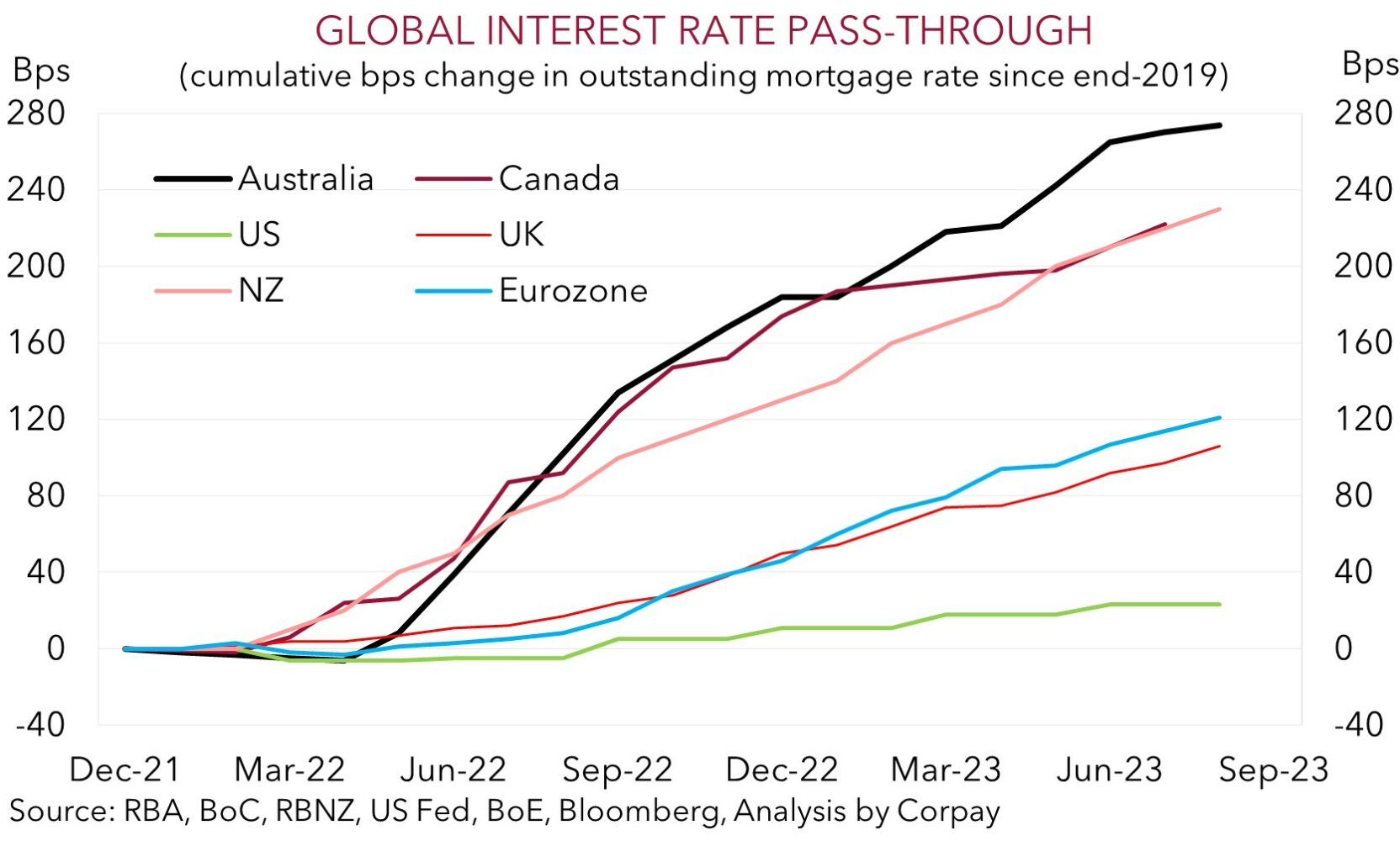

Locally, Assistant RBA Governor Kent gave a speech on the “Channels of Transmission”. Increases in the cash rate are flowing through to rebalance demand and supply. The ‘cash-flow channel’ (i.e. the hit to indebted household incomes from higher rates) is the most well-known and quickest pass through, but tighter policy also has an impact via reduced credit flows, asset price, exchange rate and substitution impacts, down the track. According to Kent the RBA is now in the 3rd phase of policy and is looking at how the data is evolving. As such the door to “some further tightening” is still open if needed. The Q3 CPI report (released 25 October) will be an important signpost. Notably, despite the RBA lagging its peers by raising rates by only ~400bps so far this cycle, given Australia’s higher share of variable rate debt, the flow through to the real economy has (so far) been more pronounced. As our chart shows, Australia’s ‘effective mortgage rate’ (i.e. the average rate across existing mortgages) has gone up by more, but this gap should close over time as borrowers elsewhere refinance at much higher rates. FX is a relative price. In our view, the RBA’s more pragmatic approach, which has been a AUD headwind, could turn into a medium-term tailwind as yield spreads move in Australia’s favour should growth slow more sharply offshore as the lagged drag from higher rates bites, and central banks that have been more aggressive than the RBA pivot to an easing stance (see Market Musings: AUD: Always darkest before the dawn).

Near-term, the AUD and market focus will be on tonight’s US CPI data (11:30pm AEDT). As mentioned, we think the still elevated USD can deflate further if US core inflation underwhelms. This is where we think the risks reside. We believe signs underlying US inflation is moderating would reinforce the Fed’s more watchful tone, exerting more downward pressure on US yields and the USD, and supporting growth-linked currencies like the AUD.

AUD levels to watch (support / resistance): 0.6280, 0.6350 / 0.6435, 0.6547