• US CPI. The data caused a bit of a market conniption with US bond yields & the USD jumping up. This & negative risk sentiment weighed on the AUD.

• Over-reaction? We think markets may have over-reacted. Rents boosted services prices, but more broadly there are signs progress is (slowly) being made.

• Event radar. Since 2015 the AUD has only traded below current levels ~1% of the time. China trade & CPI, & the MAS meeting are in focus today.

US CPI inflation was in focus overnight, and the result, even though it was very close to expectations, caused a bit of a market conniption. Indeed, in our mind, jittery markets look have over-reacted to some parts of the data, and we think the knee-jerk moves are at risk of unwinding over the period ahead. After falling over recent days US bond yields and the USD rebounded, which in turn dampened risk sentiment and weighed on growth-linked assets like equities and the AUD. The US 10yr rate rose ~14bps to 4.7%, which in effect only put things back where they were during Tuesday’s trading session, while the 2yr yield increased ~8bps (now 5.06%) as odds of another rate hike by the US Fed by year-end nudged up to ~38% (from ~30% yesterday).

Elsewhere, the S&P500 ended the day 0.6% lower, crude oil was flat (WTI is near ~US$83.50/brl) and base metals like copper (-0.8%) were weaker. In FX, the USD index bounced back with EUR slipping down to ~$1.0530, GBP dipping sub ~$1.22, and the yield sensitive USD/JPY pushing up towards ~150, the region that tends to generate increased verbal rhetoric from Japanese authorities about excess JPY weakness. Ahead of today’s semi-annual Monetary Authority of Singapore meeting (11am AEDT), where we expect policymakers to deliver a ‘hawkish hold’ by maintaining its SGD NEER 1.5%pa appreciation slope, USD/SGD has jumped up to ~1.37. AUD (-1.6%) and NZD (-1.5%) slumped with the latter’s foray above ~$0.60 not lasting and the former tumbling towards its early October lows (now ~$0.6314).

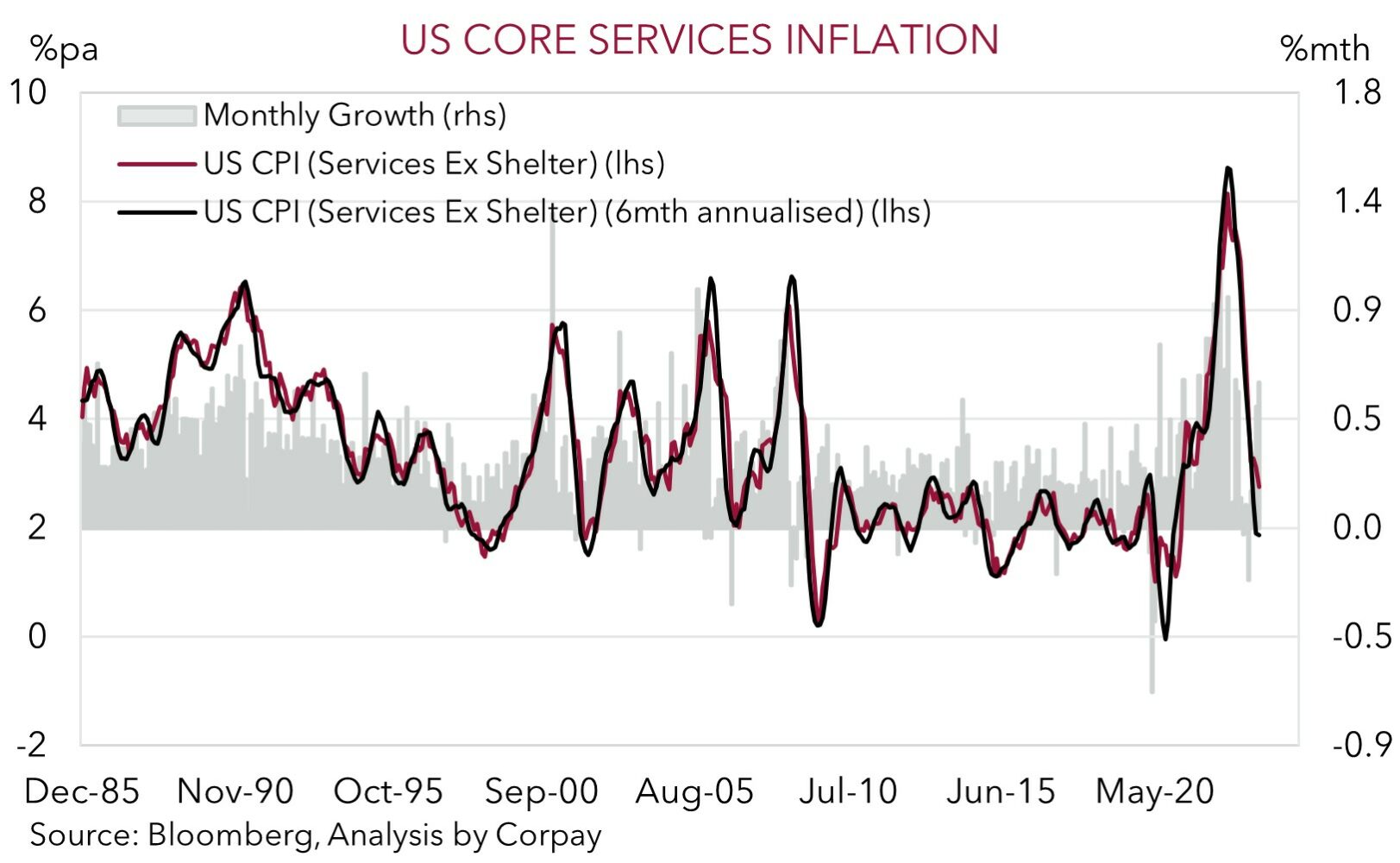

In terms of the data US headline rose 0.3% in September (matching analysts’ forecasts), but the annual run rate rounded up to 3.7%pa (mkt 3.6%). Core inflation (i.e. ex food and energy) came in as forecast, with annual growth ticking down to 4.1%pa (the slowest pace in ~2-years). Higher petrol prices were a factor boosting headline CPI, with a larger than anticipated lift in rents driving a lot of the monthly gains, particularly in services prices. A pick up here is what spooked investors. But as mentioned, we think markets may be too short-sighted. Stepping back, we would note that the broader suite of core inflation measures continue to show progress towards the Fed’s 2%pa target, the pulse across core services inflation (excluding rents) is moderating (on a 6-month annualised basis this measure is running sub 1.9% for the first time since COVID struck), and forward looking indicators of wages like the ‘quits rate’ point to a further slowdown over time. While the door to another move is still open, we don’t believe the Fed will walk through it given the tightening in financial conditions and signs growth is set to slow on the back of already ‘restrictive’ policy settings. The USD may remain firm near-term, but we think it could once again lose ground if next week’s US retail sales disappoints and/or the China activity data shows signs momentum is turning more positive.

AUD corner

The AUD is battered and bruised. The USD rebound on the back of higher US bond yields in response to the slight upside surprise in the US CPI data, and modest bout of risk aversion has weighed on the AUD (see above). At ~$0.6314 has given back most of its recent gains to be just above its early-October lows. The AUD has also (disproportionately in our opinion) underperformed on the crosses. AUD/EUR has fallen back under ~0.60 for the first time in ~1-month, AUD/GBP (now ~0.5186) is near a ~4-week low, AUD/JPY (now ~94.58) is just below its 100-day moving average, and AUD/CNH is at the bottom of its multi-month range. Ahead of tomorrow’s NZ General Election AUD/NZD (now ~1.0650) is tracking near levels last traded in late-May.

As outlined above, we think the USD reaction (and in turn the size of the AUD’s falls) to the US inflation report looks a bit excessive given the bigger picture signs price pressures are still heading in the right direction. Based on the balance of probabilities we doubt the US Fed will need to hike interest rates again, and following the overnight recovery, a lot of positives look to be factored into the USD once again. With this in mind, we believe the USD could be vulnerable to a softer US retail sales print (released 17 October), and a repeat of the cautious tone from Fed officials (Chair Powell speaks on 20 October).

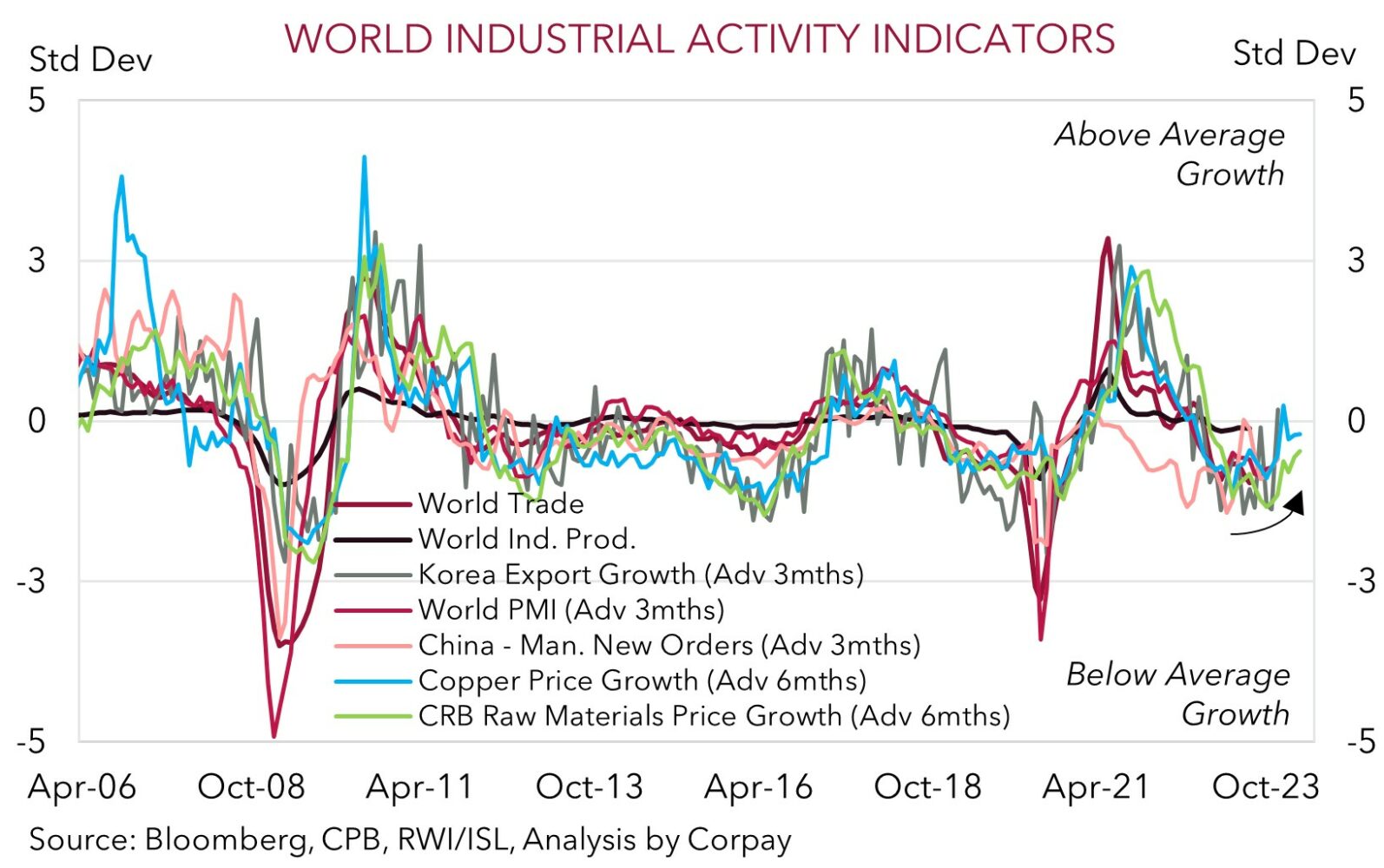

At the same time, we continue to believe markets may be underpricing the odds of another move by the RBA over upcoming meetings based on our assessment the bank may need to upgrade its near-term growth and inflation views. Q3 CPI is released on 25 October. Markets are assigning a ~18% chance of a hike by the RBA in November. And more broadly, there are indications momentum in global industrial activity is bottoming out and could improve over future months. As our chart shows, several leading indicators that we track have picked up and a further turnover could be on the cards with authorities in China likely to inject fresh stimulus to boost confidence, growth and job creation. This normally bodes well for the AUD. China trade data is released today, while Q3 GDP is due on 18 October.

All up, despite the hiccup over the past 24hrs, we don’t want to be bearish the AUD down at current low levels given the underlying supports stemming from Australia’s high terms of trade and current account surplus (now ~1.2% of GDP). Since 2015 the AUD has only traded below current levels ~1% of the time. We remain of the view that fundamental and seasonal forces continue to point to a gradual lift in the AUD into year-end, especially with the USD’s revival looking to be on shaky foundations (see Market Musings: AUD: Always darkest before the dawn and Market Musings: History doesn’t repeat, but…).

AUD levels to watch (support / resistance): 0.6170, 0.6280 / 0.6431, 0.6547