• Risk-off/risk-on. Oil rose ~4%, but the firmer USD & dip in equities unwound overnight. Developments & Fed comments weighed on US rates.

• AUD rebound. A weaker USD & improved risk sentiment boosted the AUD. Australia’s position as a net energy exporter is also AUD supportive.

• AU data. Cons. confidence & bus. conditions due today. Population growth is somewhat offsetting the impact on the economy from higher rates.

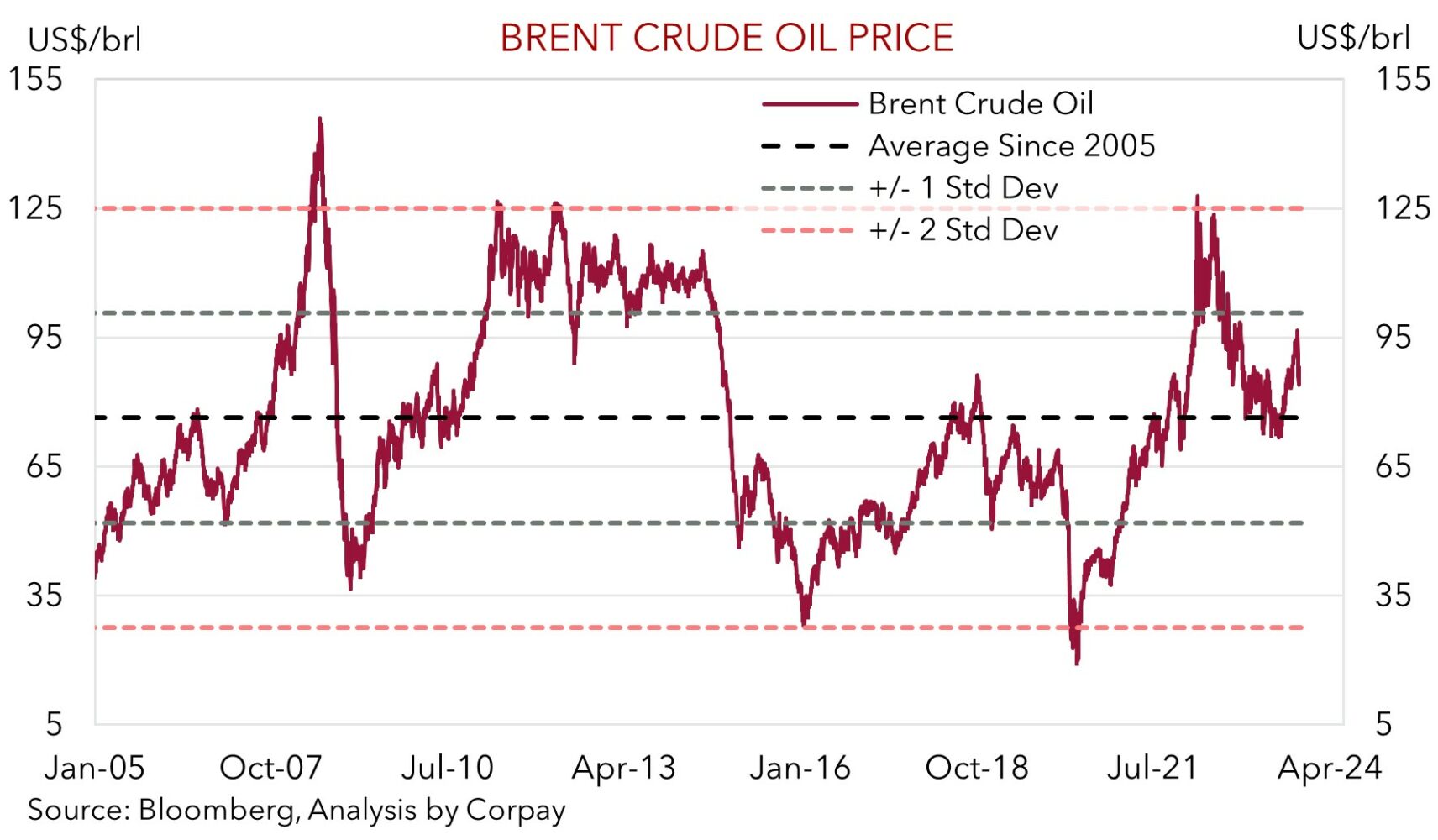

Events in the Middle East continue to dominate the headlines with the conflict still raging and the implications of the increased geopolitical risks across the region still being worked out. However, in terms of markets after initially moving in their usual geopolitical event drive direction during yesterday’s Asian session (i.e. equities weaker, oil prices higher, USD firmer, and bond yields lower) not all the moves were sustained. Oil prices rose ~4%, with Brent Crude now up at ~US$88.10/brl. But this is a somewhat muted response. As our chart shows, Brent Crude is only back where it was trading mid last week, and it remains well below its cyclical peak.

Elsewhere, after opening down ~0.5%, the US S&P500 rallied back into positive territory, ending the session up +0.6%. The decline in bond yields provided some support, particularly as the moves reflected more than just Middle East developments. Speakers from the US Fed sounded more cautious about the need to raise rates further. Specifically, Dallas Fed President Logan said that the recent surge in long-term US bond rates (which feeds through to tighter monetary conditions) may mean there is less need for the central bank to move again. This an eye-catching comment from a Fed member that has normally been at the more ‘hawkish’ end of the spectrum. Vice Chair Jefferson added that the Fed is “in a position to proceed carefully” and that he “will remain cognisant of the tightening in financial conditions through higher bond yields and will keep that in mind”. There are more Fed members speaking over the next 24hrs (Perli, Bostic, Waller, Kashkari, Daly).

US bond markets were closed for a public holiday, but Treasury futures rallied on the combination of risk aversion and Fed comments, with the moves implying a ~12bp drop in the US 10yr yield. European 10yr rates declined by ~10-11bps. The decline in yields exerted a bit of downward pressure on the USD which unwound yesterday’s knee-jerk lift. EUR has ticked up to ~$1.0570, USD/JPY has slipped down to ~148.50, GBP is up around ~$1.2240, while AUD and NZD have outperformed with the reversal in equity markets supportive. The NZD has risen above ~$0.60 and the AUD is near a ~1-week high (now ~$0.6410, ~1% above Monday’s low).

As noted yesterday, in addition to the unfolding Middle East events, the global macro attention will be on the US CPI inflation report (Thurs night AEDT). Barring a sharp escalation in the conflict we believe the USD may give back more ground based on our assessment that US core inflation risks slowing a bit more than predicted (mkt 4.1%pa from 4.3%pa) due to the softening wage pulse, cooling rents, and drop in airfares in September. As per the moves overnight a further paring back of still lofty US interest rate expectations can drag on the USD.

AUD corner

The AUD bounced back overnight, more than unwinding yesterday’s ‘risk-off’ dip following the weekend developments in the Middle East. The decline in bond yields, which was partly a function of slightly more ‘dovish’ rhetoric from a few US Fed members, supported risk sentiment and exerted some pressure on the USD (see above). The higher oil price is also somewhat positive for the AUD, particularly on the crosses, given Australia’s position as a net energy exporter. AUD/USD has pushed back up to ~$0.6410, a ~1-week high and ~1% above yesterday’s low point, with the AUD also appreciating by 0.4-0.6% against the EUR, JPY, GBP, and CNH compared to this time yesterday. At ~0.6065 AUD/EUR has poked its head back above its 100-day moving average.

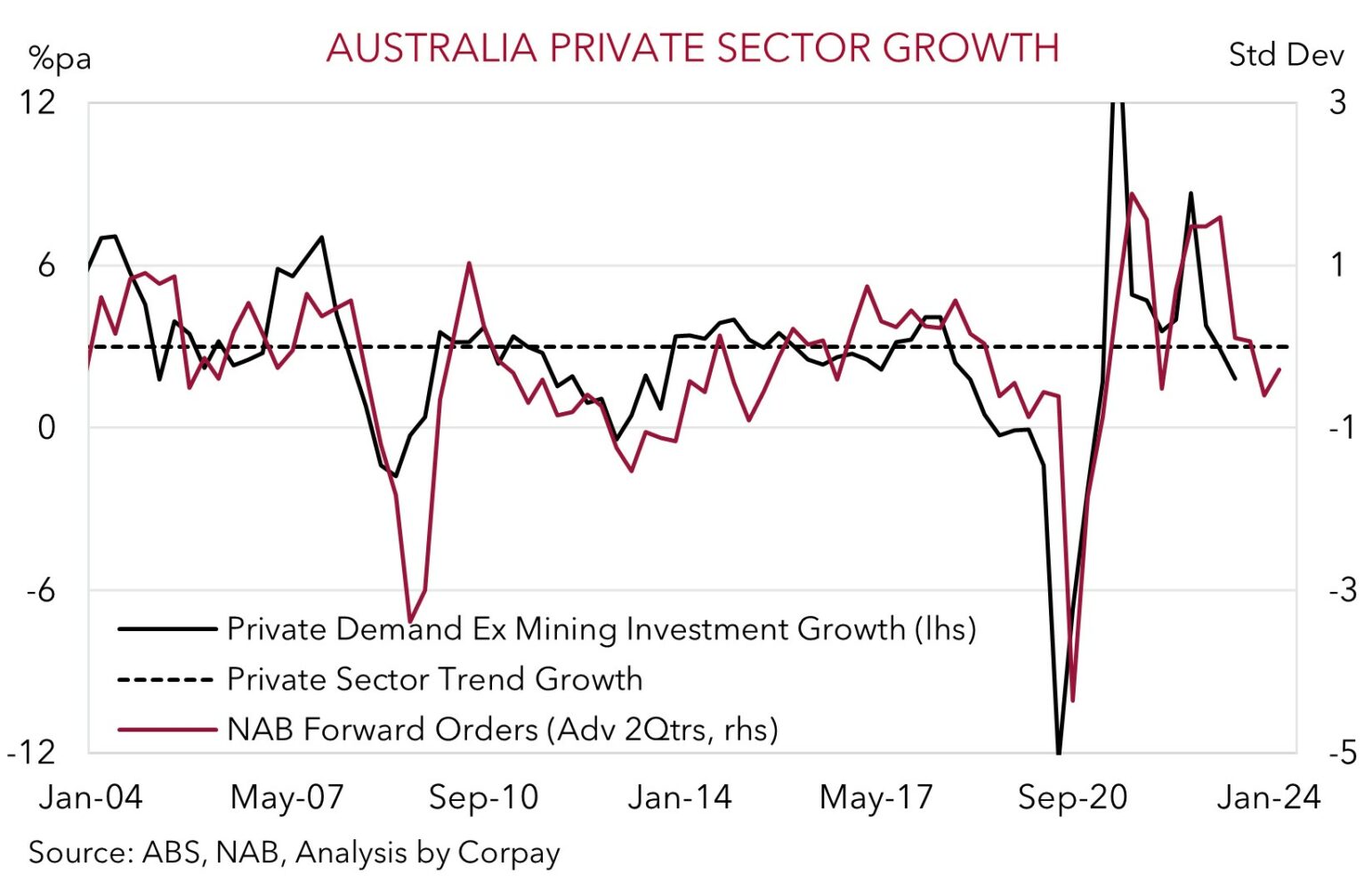

Locally, the latest readings on consumer confidence (10:30am AEST) and business conditions (11:30am AEDT) are released today. Given the high petrol price and other cost of living pressures, consumer sentiment is likely to remain in the doldrums, consistent with slowing discretionary spending. That said, we place more weight on the business survey. Conditions ticked up last month, with forward orders (a guide to future private sector activity) showing signs of bottoming out. The resilience in the broader economy in the face of rising mortgage rates, thanks in part to the burgeoning population, should be a relative positive for the AUD over time, in our opinion. Indeed, we think markets may be underpricing the odds of another RBA rate hike by year-end based on our judgement that the bank may need to upgrade its near-term growth and inflation views. Q3 CPI is released on 25 October.

As discussed, from a macro perspective, assuming Middle East geopolitical risks don’t escalate, we think the USD can give back more ground over the period ahead if the upcoming US CPI inflation data undershoots expectations (Thurs night AEDT). Signs underlying US inflation is moderating could compound the more cautious tone coming from US Fed members about the need to hike interest rates further. In our opinion, with a ‘higher for longer’ US Fed outlook well priced, we believe this could weigh on the USD and support growth-linked currencies like the AUD. This is in line with our broader thoughts that down near current levels a lot of negatives are factored into the AUD, and that compared to its starting point there is more upside than downside potential over the medium-term (see Market Musings: AUD: Always darkest before the dawn).

AUD levels to watch (support / resistance): 0.6280, 0.6350 / 0.6442, 0.6547

SGD corner

USD/SGD has swung around inline with the USD gyrations over the past 24hrs (see above). At ~$1.3650, USD/SGD is little changed from where it closed last week and is ~0.8% below the multi-month peak reached on 3 October. On the crosses, EUR/SGD (now ~1.4434) has consolidated near the bottom-end of its ~4-month range, while SGD/JPY (now ~108.72) has eased back, though it remains historically high.

As outlined, barring a significant escalation and broadening out in the Middle East conflict, we think that on purely macroeconomic grounds the USD may continue to lose steam over the near-term. We see downside risks to the upcoming US CPI data (released Thursday). A softer US inflation pulse could weigh on US interest rate expectations, and in turn the USD (and USD/SGD), in our view. Added to that, the SGD could garner support from the Monetary Authority of Singapore’s semi-annual policy meeting (Friday). We think the MAS is likely to deliver a ‘hawkish hold’ by maintaining its current SGD NEER 1.5%pa appreciation slope. Inflation is cooling, but we believe it is still too high for the MAS to shift from its ‘hawkish’ bias.

SGD levels to watch (support / resistance): 1.3560, 1.3585 / 1.3723, 1.3767