• Middle East. Developments look set to hang over markets at the start of the new week. The USD, JPY & oil are typically supported by this type of unrest.

• US jobs. Payrolls exceeded forecasts, but the underlying detail wasn’t as rosy. Markets were volatile around the data. US CPI released on Thursday.

• AUD cross-currents. More negative risk sentiment can exert a bit of pressure on the AUD. But softer US inflation can offset this later in the week.

The tragic weekend developments in the Middle East look set to hang over markets at the start of the new week. Rising risks across the region following Israel’s declaration of war in response to the incursion and attacks by Hamas are likely to dampen risk sentiment. Stock markets across the Middle East that were trading over the weekend lost some ground, while the USD and JPY have ticked up modestly in this morning’s early trade compared to Friday’s closing levels (USD/JPY -0.2% to ~149, EUR -0.3% to ~1.0555, AUD -0.4% to ~$0.6360). This is inline with the reaction to this type of geopolitical unrest with the USD, JPY, and oil prices typically supported, and growth linked assets like the AUD and equity markets on the backfoot for a time.

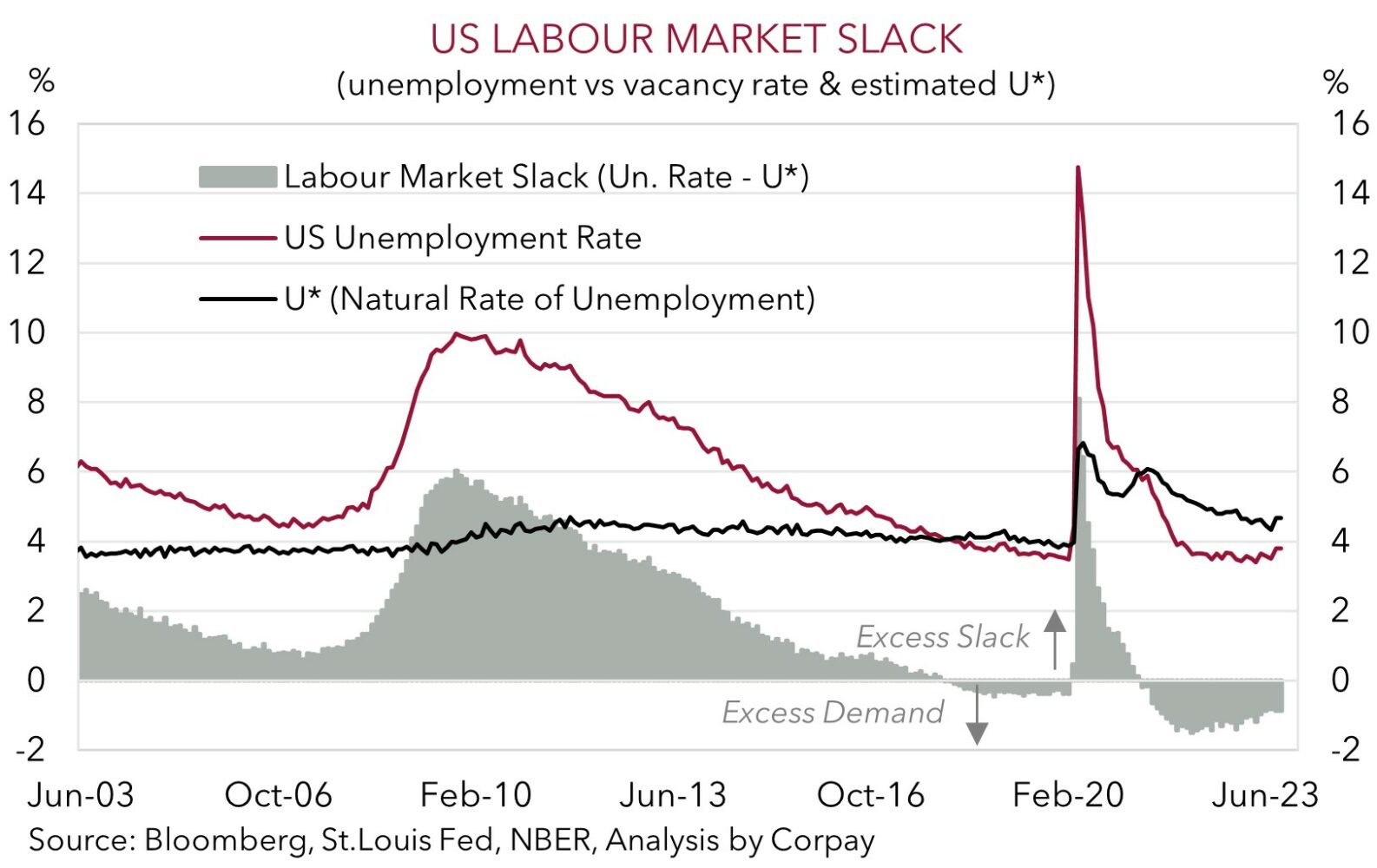

Stepping back from the weekend news, markets also endured some volatility on Friday following the release of the latest US jobs report. Non-farm payrolls blitzed through analyst forecasts, rising by 336,000 in September, the best result since January. That said, the initial knee-jerk rise in US bond yields and the USD, and negative start to the session in US equities wasn’t sustained as participants digested the other parts of the data set. Household employment was subdued (up just 86,000 in the month), unemployment held steady at 3.8% (the highest rate since early-2022), and average hourly earnings (a wages gauge) decelerated to 4.2%pa (the slowest pace since mid-2021). The broader signs that the heat is coming out of the US labour market and that it is rebalancing tempered Fed rate hike bets, which in turn boosted risk sentiment. US bond yields ended the day higher, but below their intra-day peak (US 2yr and 10yr now 5.08% and 4.80% respectively), as did the USD. The turn around saw US equity markets (S&P500 +1.2%), base metal prices (copper +2.1%), and the AUD rebound, though as mentioned the weekend news has knocked things on its head.

In addition to Middle East developments, the global macro focus this week will be on the US CPI inflation report (Thurs night AEDT), the China trade data (Fri AEDT), speakers from the US Fed, and the minutes of the last Fed meeting (Thurs morning AEST. The push-pull dynamics point to market volatility continuing. But barring a sharp escalation in the conflict and large deterioration in risk sentiment, we think the USD could give back any early week gains given our thinking core US inflation might slow a little more than predicted (mkt 4.1%pa from 4.3%pa) due to the softening wage pulse, cooling rents, and drop in airfares in September. If realised, this could see markets pare back still lofty US rate expectations, dragging on the USD.

AUD corner

Looking at the level of the AUD it would be easy to think that nothing much has happened. Compared to this time Friday the AUD is little changed (now ~$0.6360). But this masks a decent amount of volatility that has come through. The AUD traded in a ~1.4% range in the wake of Friday’s US jobs report. As discussed above, the initial positive USD reaction to the topline result wasn’t sustained, and the reversal in markets propelled the AUD higher. However, AUD/USD has started the new week on a softer footing due to the escalating tensions in the Middle East. The AUD is also a bit weaker on the crosses.

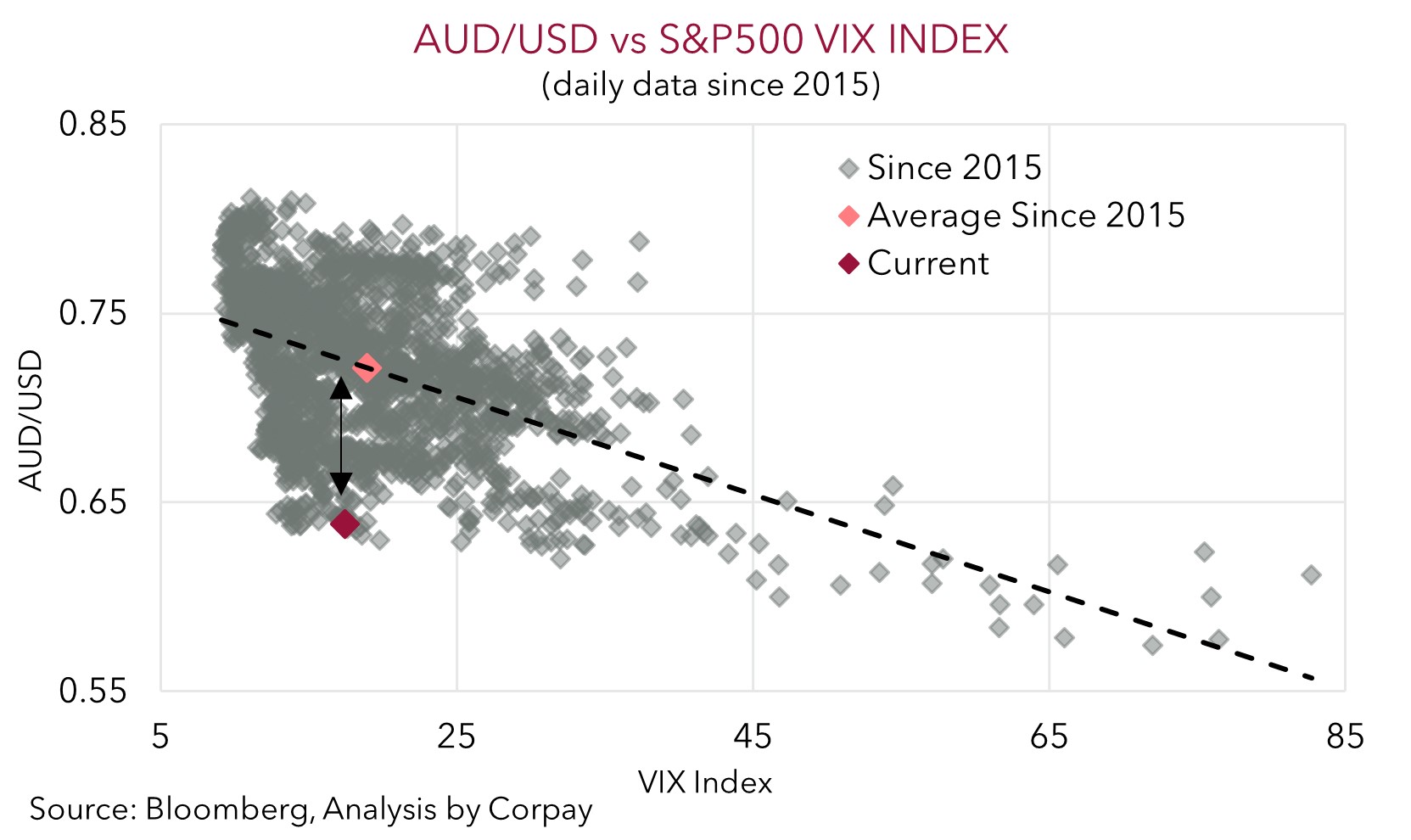

Risk sentiment is set to be a market driver in the early part of this week as developments in the Middle East continue to unfold. China is also back online after its Golden Week break. As is normally the case, based on its positive correlation to risk assets like equities and base metal prices, this may exert some downward pressure on the AUD. However, given already stretched negative AUD positioning (as measured by CFTC futures), the flow support generated by Australia’s current account surplus (now ~1.2% of GDP), and our assessment that the AUD is already trading below levels implied by broader risk appetite (see scatter chart below), unless there is a sharp escalation in the conflict, we don’t foresee AUD weakness being overly pronounced and/or sustained.

As outlined, from a macro perspective, we believe the USD could come under some pressure later this week, with the latest US CPI inflation data (Thurs night AEDT) at risk of underwhelming, in our view. If realised, this could support growth-linked currencies like the AUD as it relieves the pressure on the US Fed to raise rates further. With a ‘higher for longer’ US Fed view looking well discounted, we believe this could see the USD ease back. This is inline with our broader thoughts that down near current low levels a lot of negatives are priced into the AUD, and that relative to its starting point there is more upside than downside potential over the medium-term (see Market Musings: AUD: Always darkest before the dawn). Indeed, we think markets may also be underpricing the odds of another near-term RBA rate hike based on our judgement that the bank may need to upgrade its near-term growth and inflation assessment. Interest rate markets are assigning a ~25% chance of a change at the November meeting. We think there is scope for this to lift given lingering domestic inflation and wage pressures. The RBA’s rather sanguine assessment of the financial position of Australian households and businesses in its latest Financial Stability Review suggests it can be comfortable raising rates further should inflation warrant it. According to the RBA “most Australian households and businesses remain well placed to manage the impact of high inflation and higher interest rates”. Q3 CPI is released on 25 October.

AUD levels to watch (support / resistance): 0.6170, 0.6280 / 0.6441, 0.6547

SGD corner

USD/SGD drifted back over the latter part of last week, with the pair (now ~$1.3670) ~0.7% below the multi-month high touched on 3 October. As discussed, the USD exhibited some volatility around last Friday’s US jobs report as a closer look at the detail showed the underlying backdrop wasn’t as rosy as the headline result suggests (see above). On the crosses, EUR/SGD (now ~1.4423) has consolidated near the bottom-end of its ~4-month range, while SGD/JPY (now ~109.15) remains historically high.

Middle East developments look set to be a market focus over the early part of this week with the tensions normally favoring currencies like the USD and JPY over cyclical growth-linked ones such as the SGD. However, as outlined, barring a significant deterioration in risk sentiment, we don’t think the USD is likely to strengthen that much, given the downside risks we see to the upcoming US CPI inflation data (released Thursday). A softer US inflation pulse could weigh on US interest rate expectations, and in turn the USD (and USD/SGD), in our opinion. On top of that, the SGD will also have to contend with (and could garner some support from) the Monetary Authority of Singapore’s semi-annual policy meeting (Friday). We expect the MAS to deliver a ‘hawkish hold’. Inflation is cooling, but we think it is too high for the MAS to move away from its ‘hawkish’ bias even though downside growth risks remain. Continued tightening via the current 1.5%pa appreciation slope appears the most likely course of action, in our judgement.

SGD levels to watch (support / resistance): 1.3560, 1.3585 / 1.3723, 1.3767