• Weaker JPY. Quiet markets, except for the JPY. Reports indicating the BoJ may not be in a rush to change policy has weighed on the JPY.

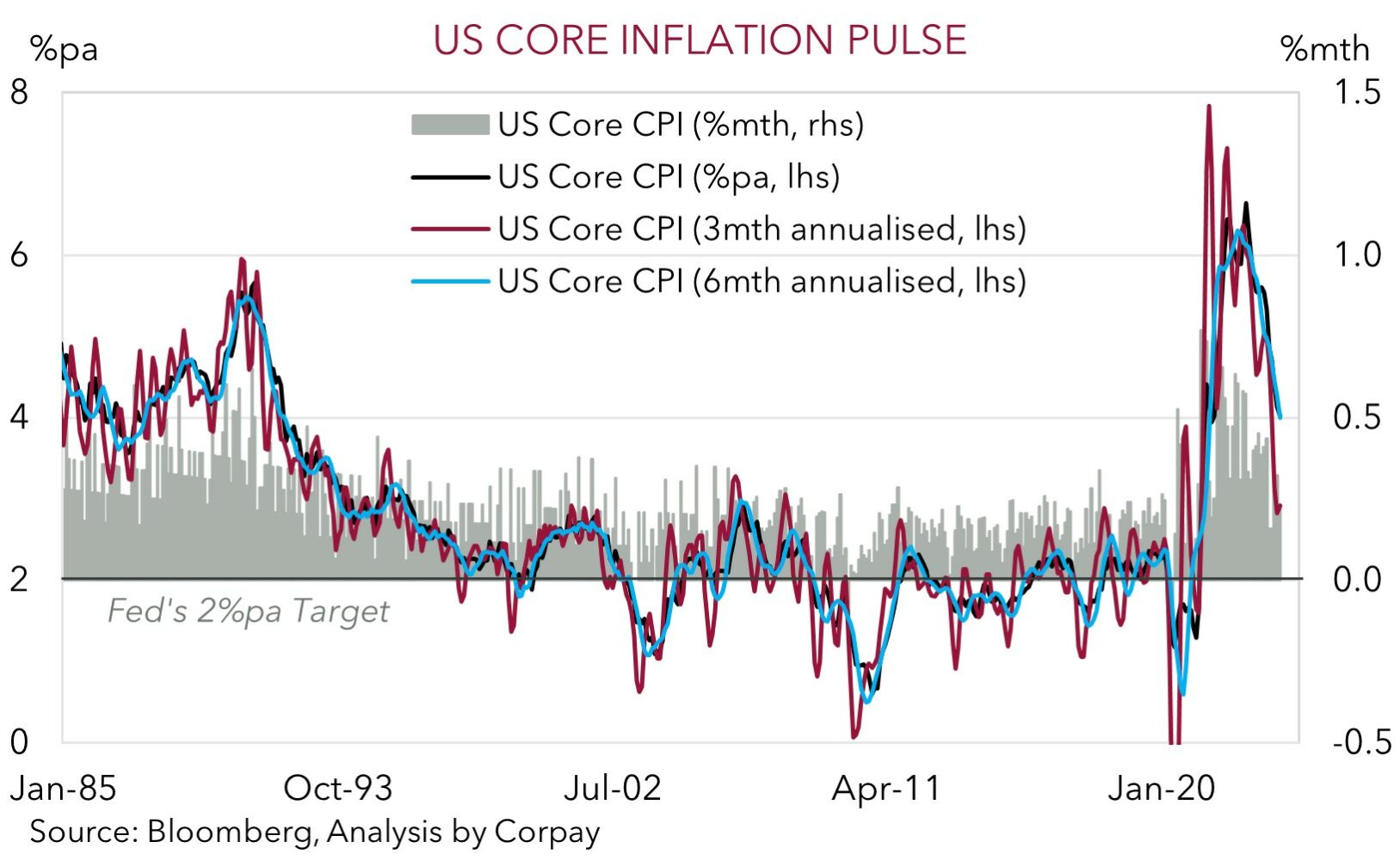

• US CPI. US inflation tonight, ahead of this weeks Fed meeting. Signs inflation is easing should support views the next move will be to cut rates, albeit in 2024.

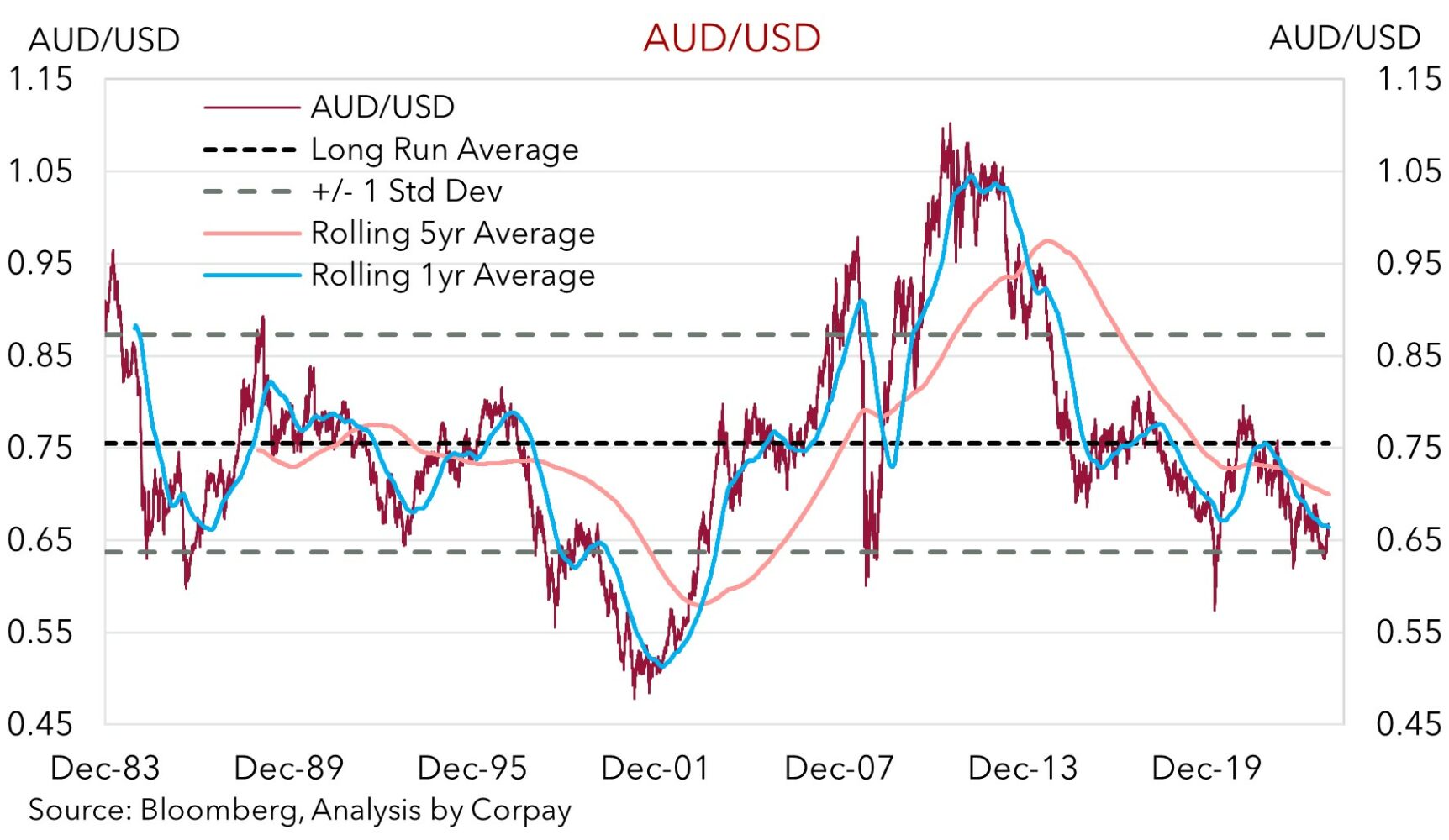

• AUD anniversary. 40yrs since the float. Over this time AUD avg. $0.7550. But it is volatile. On avg. AUD has traded in a ~14cent range each year.

It has been a quiet start to the week across most markets as participants marked time ahead of the key upcoming global events. As a reminder US CPI inflation is due tonight (12:30am AEDT), the US Fed (Thurs morning AEDT), Bank of England (Thurs AEDT) and European Central Bank (Fri AEDT) meet later in the week, and this is followed by the release of US retail sales (Fri AEDT) and the China activity data batch (Fri AEDT). In terms of the numbers US equities ticked up (S&P500 +0.4%), US and German bond yields consolidated with the 10yr rates at 4.23% and 2.27% respectively, oil prices were flat (WTI crude is at ~US$71.40/brl), and iron ore remains elevated (~US$134/tonne, just shy of its highest level since April 2022).

Across FX, EUR is hovering around ~$1.0760, GBP is near ~$1.2560 ahead of the release of the latest UK labour stats (6pm AEDT), USD/SGD has edged up a bit to now be at ~1.3440 (highest since 20 November), and the AUD is sitting under its 200-day moving average (~$0.6576). A weaker JPY has been a notable exception to the otherwise limited market moves. USD/JPY has continued to claw back lost ground with the pair moving above ~146 to now be less than 1% below where it was prior to last Friday’s plunge. BoJ officials pushed back on the ramp up in thoughts that a policy change could be forthcoming as soon as next week with media reports indicating they “see little need to rush into scrapping” negative interest rates this month, though it will apparently make its final decision after reviewing all available data up to the 19 December meeting. The twists and turns are no surprise to us. Following last week’s jump up in expectations we noted that we believed a move this month was probably too soon. That said, we think it remains a matter of when, not if, the BoJ takes large steps along the policy normalisation path with adjustments in Q1 anticipated.

Leading into this week’s US Fed meeting tonight’s US print will be in focus. The fall in energy prices should continue to suppress headline inflation, with the annual pace forecast to slow to 3.1%pa. And while a few temporary factors may see US core CPI quicken slightly over the month, we don’t expect it to change the outlook for no further rate rises by the US Fed this cycle. Policymakers tend to look at the 6-month annualised and annual run-rates to assess disinflation progress. On these metrics we believe US inflation is moving in the right direction. In our opinion, more signs US inflation pressures are receding should reinforce views the next move by the US Fed will be to cut rates, albeit over H2 2024, which in turn could see the USD lose ground.

AUD corner

The AUD has oscillated near ~$0.6565 over the past 24hrs with limited moves coming through across most markets at the start of what is a busy week full of global macro events (see above). On the crosses, the AUD has generally drifted back a little falling by ~0.2-0.3% against the EUR, GBP, NZD, and CAD compared to this time yesterday. AUD/JPY has been an exception. As mentioned, media reports have watered down expectations the BoJ might make a meaningful change at next week’s meeting and this has taken the heat out of the JPY. At ~96 AUD/JPY is tracking just below its 50-day moving average and near the middle of the wide range it has occupied over recent weeks.

Today’s marks 40-years the AUD was floated. As our chart below shows, it has often been a wild ride over the past 4 decades with the AUD trading in a $0.4775 (touched on 2 April 2001) to $1.1081 (reached on 27 July 2011) range over this period. Since floating the AUD has averaged ~$0.7550, with the currency spending the bulk of its time between $0.65-0.80 (~62% on our figuring). What also shouldn’t be forgotten, particularly when it comes to hedging decisions and thinking about the future, is that the AUD can be a volatile currency that is impacted by not just the state of play in the local economy but also what is happening offshore. The swings seen recently may seem large but the moves so far over 2023 have been a little tamer than what has occurred in other years. Since 1984 the AUD has, on average, traded in a ~14cent/~21% range over a calendar year. In 2023 the range has only been ~9cents/~14%.

In terms of today, RBA Governor Bullock is giving a speech (9:20am AEDT), and while the forum suggests it may not be monetary policy related, there is a Q&A session that could generate some intra-day headlines. A per the recent trend, if policy is mentioned, the risks are that the Governor sounds a bit more ‘hawkish’ given the lingering services inflation issues, which if realised may give the AUD some support ahead of the latest read on consumer sentiment (10:30am AEDT) and business conditions (11:30am AEDT). Beyond that, as flagged above, market attention will be on tonight’s US inflation data (12:30am AEDT) with the US Fed meeting also approaching (Thurs morning AEDT). Indications the US inflation pulse is continuing to soften should, in our view, reinforce thoughts the US Fed’s updated economic and interest rate projections might take a more ‘dovish’ turn with rate cuts penciled in to be the next policy move. In our opinion, if this was to occur we would expect the USD to weaken and for growth linked currencies such as the AUD to outperform.

AUD levels to watch (support / resistance): 0.6510, 0.6540 / 0.6620, 0.6680