• US jobs. Payrolls were a bit higher than forecast & US unemployment dipped. US equities & yields rose giving the USD some support.

• FX moves. The USD rebound was modest. Most of the major pairs, including the AUD, only slipped back to where they were tracking the day earlier.

• Event radar. Locally, jobs data is due. Offshore, the US Fed, ECB & BoE meet. On top of that US CPI & retail sales are released, as is the China data batch.

Positive sentiment across financial markets continued into the end of last week. A better-than-expected US labour market report supported views that the path to a ‘soft landing’ across the economy may be widening. US equities ticked up (S&P500 +0.4%), and bond yields rose as near-term US Fed policy easing expectations were pared back. The probability of a rate cut at the March Fed meeting has fallen below 50%, though a full 25bp reduction is still discounted by May with a little over 3 additional moves factored after that in 2024. The US 2yr bond yield increased ~12bps to 4.73%, while the benchmark 10yr rate ended the day ~7bps higher (now 4.23%). The rebound in US yields gave the USD a bit of a boost, but in the grand scheme of things the reaction looked relatively modest with most of the major currency pairs only slipping back to where they were tracking the day earlier. EUR/USD is down near ~$1.0760, GBP/USD eased towards ~$1.2535, and the interest rate sensitive USD/JPY nudged up to ~144.85 with Bank of Japan policy normalisation predictions an offsetting force. The AUD lost some ground (now ~$0.6572) to be just above its ~4-week average.

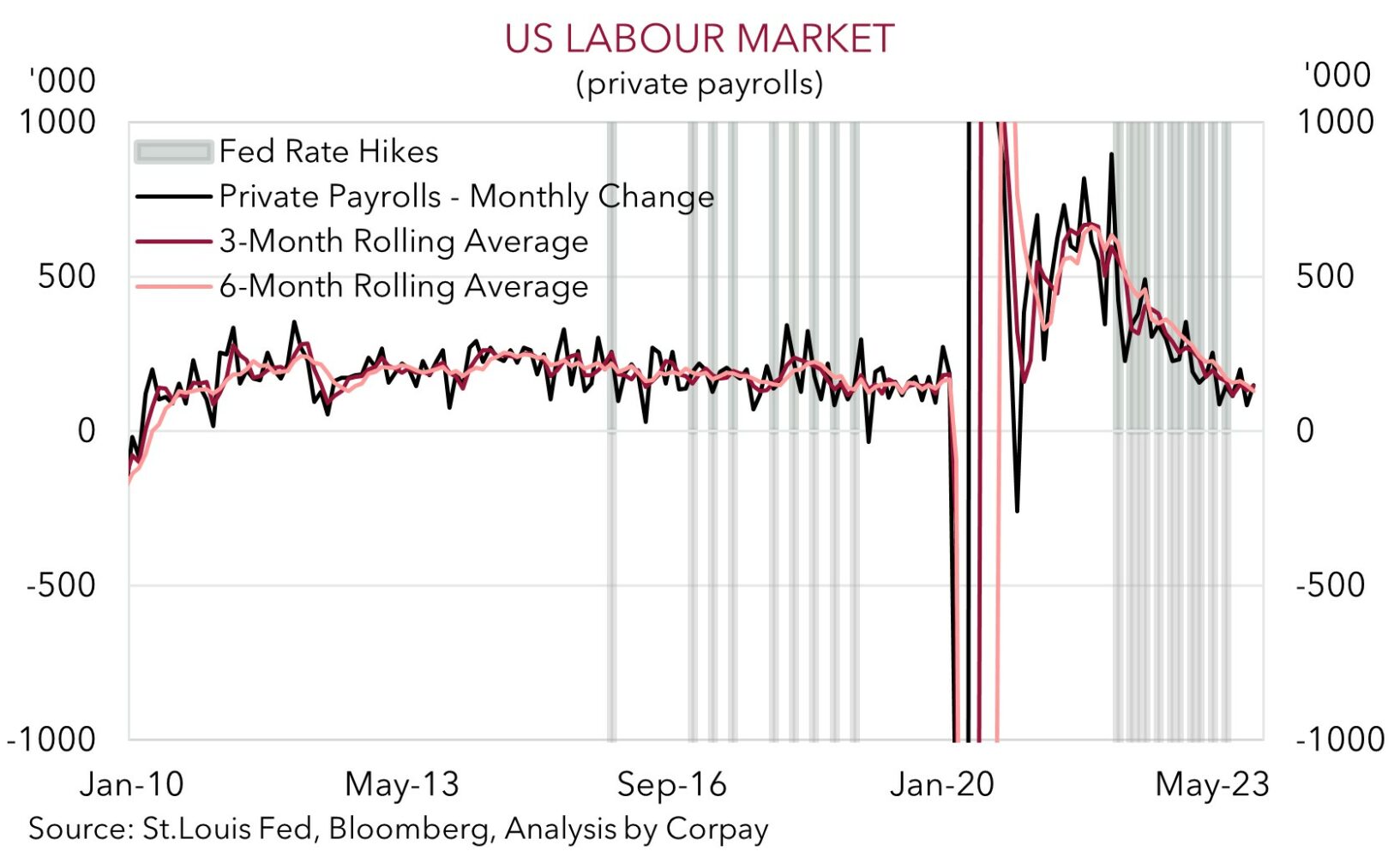

In terms of the US jobs data, unemployment dipped to 3.7% and headline non-farm payrolls were higher than forecast in November (+199,000). That said, a jump in government hiring (+49,000) and a temporary jolt of close to ~50,000 from the end of the autoworkers and actors strikes propped up the result. Stripping things back momentum has softened with the 6-month average private payrolls run-rate stepping down to ~130,000/mth (the lowest since COVID struck). Moreover, with supply improving and demand weakening (as illustrated by the lift in the US labour force participation rate and decline in job openings) conditions continue to move into better balance, and this is slowing wage growth which in turn is cooling inflation. This is the ‘goldilocks’ type outcome the US Fed has been striving for.

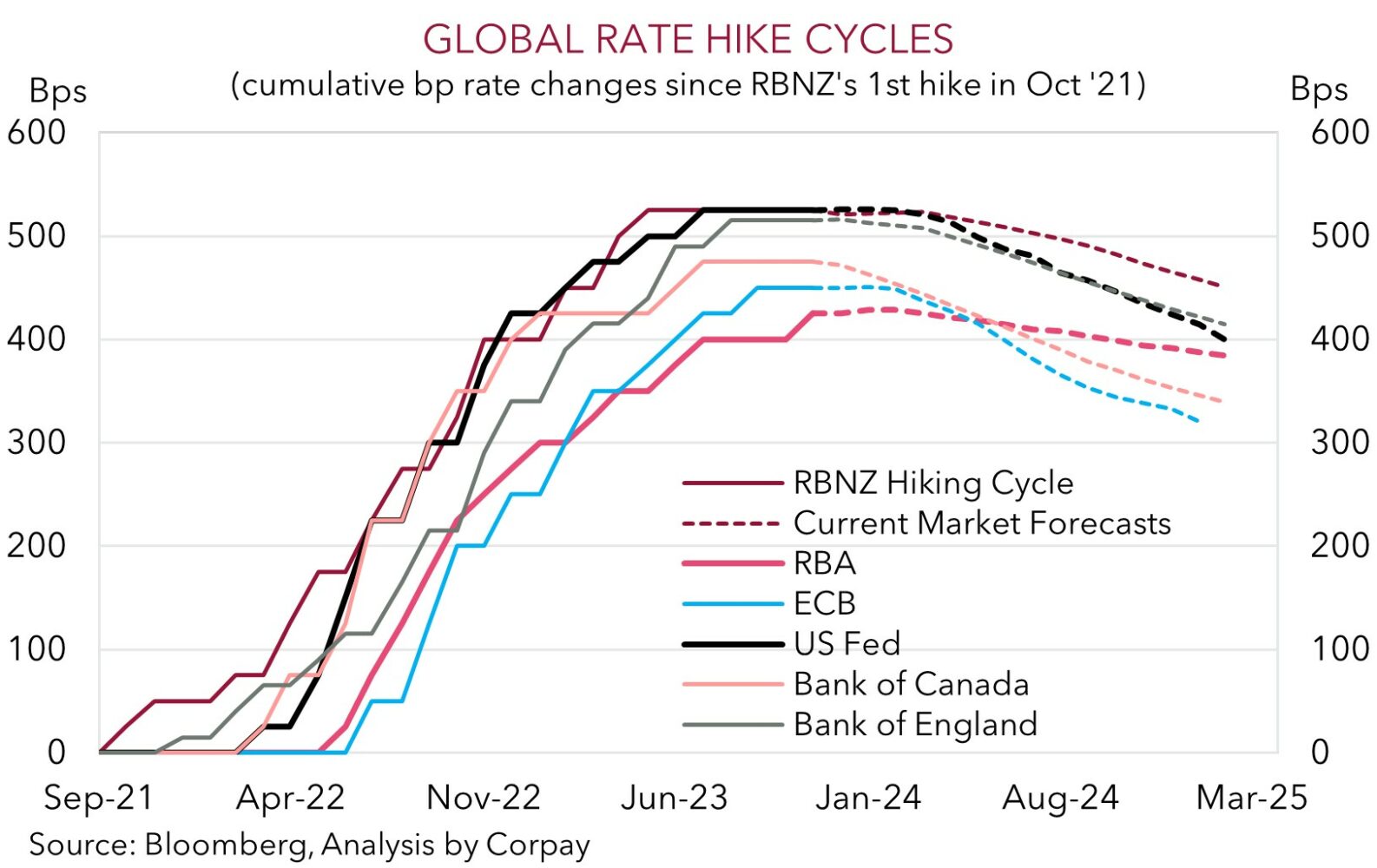

There are several offshore events this week that may generate further bursts of volatility. In the US, CPI inflation (Weds AEDT), the US Fed meeting (Thurs morning AEDT), and retail sales (Fri AEDT) are in focus. Elsewhere, the ECB (Fri morning AEDT) and the BoE (Thurs AEDT) also meet with the China data batch due Friday. No policy change is anticipated from the central banks. While we think the US Fed (as well as the ECB and BoE) will keep the door open to further tightening, if needed, we believe the underlying tone and the Fed’s updated economic projections should reinforce views the next move will probably be a cut with the interest rate ‘dot plot’ potentially revised lower. In our opinion, this type of ‘dovish’ tilt coupled with a softening US inflation and retail spending pulse could exert downward pressure on the USD. Moreso if data also shows growth in China is picking up.

AUD corner

The tick up in the USD following the slightly better than anticipated US labour market report and rebound in US bond yields exerted a bit of downward pressure on the AUD on Friday (see above). But at ~$0.6572 the AUD is only back where it has trading on Thursday and is sitting slightly above its ~1-month average. On the crosses, the AUD consolidated versus the EUR, GBP, and CNH, though it has recouped a little ground against the JPY following the steep drop earlier last week. At ~95.35 AUD/JPY is just below its 100-day moving average. And ahead of this week’s Q3 NZ GDP report (Thurs AEDT) where growth is forecast to have slowed, AUD/NZD has picked itself up to be back near ~1.0750.

AUD volatility looks set to continue this week given the macro events on the schedule. Locally, RBA Governor Bullock is giving a speech (Tues AEDT), however the forum (the AusPayNet summit) suggests it may not be monetary policy related. Thursday’s labour force report is the last notable local data release of the year. Australian employment has been more volatile than usual recently. Following a strong October employment is predicted to slow in November (mkt +10,000) with unemployment edging a touch higher (mkt 3.8%). For the RBA this type of result would show that conditions are moderating, but they are still a long way from where they need to be to be confident services inflation is on a sustainable path back to target.

That said, the local releases should play second fiddle to offshore developments. As discussed above, in the US CPI inflation (Weds AEDT), the Fed meeting (Thurs morning AEDT), and retail sales (Fri AEDT) are due, while in China the latest activity data batch is released (Fri AEDT). We believe that while the US Fed may continue to talk tough and flag it is still open to more tightening if required, its updated economic forecasts are more likely to support the case that the next move will probably be to lower interest rates. If realised, we think this, combined with signs momentum in China’s economy is improving, should be a positive for risk sentiment and growth linked currencies such as the AUD.

There will be bumps along the way. But based on our fundamental outlook which assumes growth in China improves; the USD trends lower as the US Fed pivots to an easing stance and the JPY rebounds on the back of BoJ policy normalisation steps (see Market Musings: USD losing its shine); and short-dated interest differentials narrow in Australia’s favour due to the likelihood the RBA lags its peers in the next global easing cycle, we continue to forecast the AUD to rise to ~$0.68 by Q1 and then onto ~$0.70 by this time next year.

AUD levels to watch (support / resistance): 0.6510, 0.6540 / 0.6620, 0.6680