• JPY surge. Comments by BoJ officials has bolstered expectations a change could be coming. The jump in the JPY has cascaded across FX markets.

• USD weaker. The 2.6% drop in USD/JPY (the 2nd most traded currency pair) has given other currencies a boost. AUD is back over ~$0.66.

• US jobs. US labour market report released tonight. The end of the auto strike can give employment a temporary boost. But broader conditions should loosen.

The tone across markets was a bit more positive overnight. US equities rebounded (S&P500 +0.8), with the tech-focused NASDAQ outperforming (+1.3%). Optimism about Artificial Intelligence re-emerged after Google released ‘Gemini’, the “largest and most capable AI model” it has built. Elsewhere, US long-end bond yields ended the day a little higher (10yr +4bps to 4.14%), oil consolidated, and the USD lost ground. The USD weakness was driven by a sharp rebound in the JPY. USD/JPY is the 2nd most traded pair, and the ~2.6% decline over the past 24hrs to ~143.55, its lowest since early-August, cascaded across FX markets. EUR edged up to ~1.08, GBP ticked higher (now ~$1.2597), USD/SGD slipped to ~1.3380, and the AUD has risen above ~$0.66 (~1.2% from yesterday’s low).

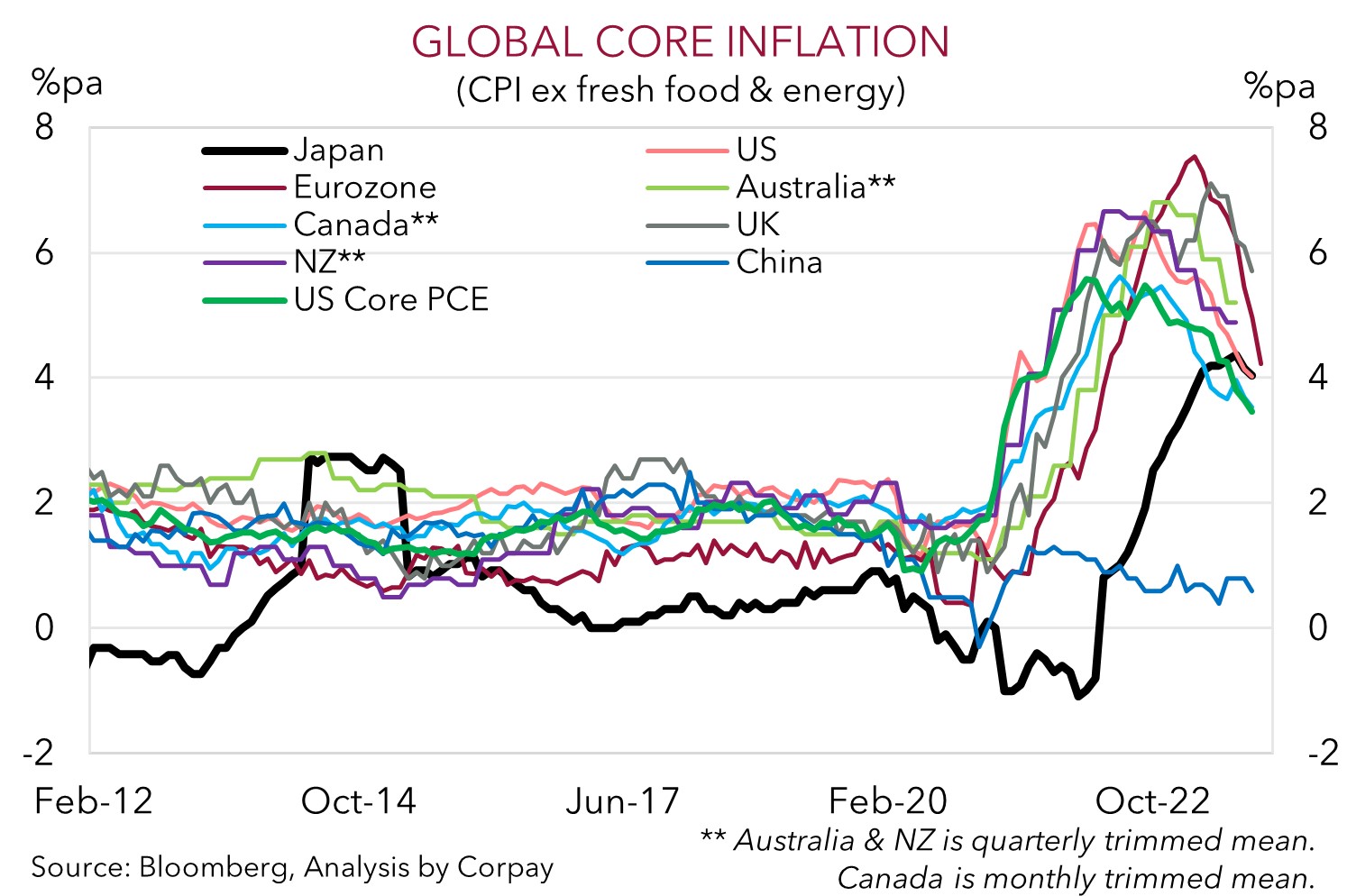

JPY appreciation has stemmed from expectations the Bank of Japan could soon take meaningful steps along the policy normalisation path. In contrast to its peers which have put through aggressive rate hikes over the past few years and have been unwinding other measures the BoJ has maintained its ultra-accommodative stance. This is despite relatively robust nominal GDP growth, a tight labour market, and elevated inflation. Core inflation in Japan (i.e. excluding fresh food and energy) is running at 4%pa, near its fastest pace in ~40yrs, and as our chart shows it is on par with other economies.

Over recent days comments by BoJ officials have sparked thoughts a sea change mayoccur. During parliamentary testimony BoJ Governor Ueda noted his job “will become even more challenging from the year-end and heading into next year”. This compounded comments by Deputy Himino a day earlier where he outlined the potential impacts that could follow an exit from large-scale stimulus. In our mind, you probably would only be considering the possible effects of a change if one was going to be on the table. The BoJ next meets on 19 December. This may prove to be too soon for large steps to be unveiled, but as we have flagged previously, we believe it is a matter of when, not if, the BoJ jettisons its negative interest rate regime. This eventual turn and the capital flow implications as it might see Japanese investors allocate less offshore and/or repatriate capital back home, coupled with lower bond yields elsewhere as other central banks begin to loosen policy, underpins our forecasts looking for the ‘undervalued’ JPY to strengthen over the next year. This is also one of the pillars behind our outlook for the USD to weaken (see Market Musings: USD losing its shine).

Tonight, attention will be on the US labour report (12:30am AEDT). A one-off return of striking autoworkers and actors could prop up employment in November, but this should be looked through (mkt 185,000). We think the broader set of figures is likely to show conditions are loosening. If realised, we think this should reinforce views the next move by the US Fed will be to lower rates, weighing on the USD.

AUD corner

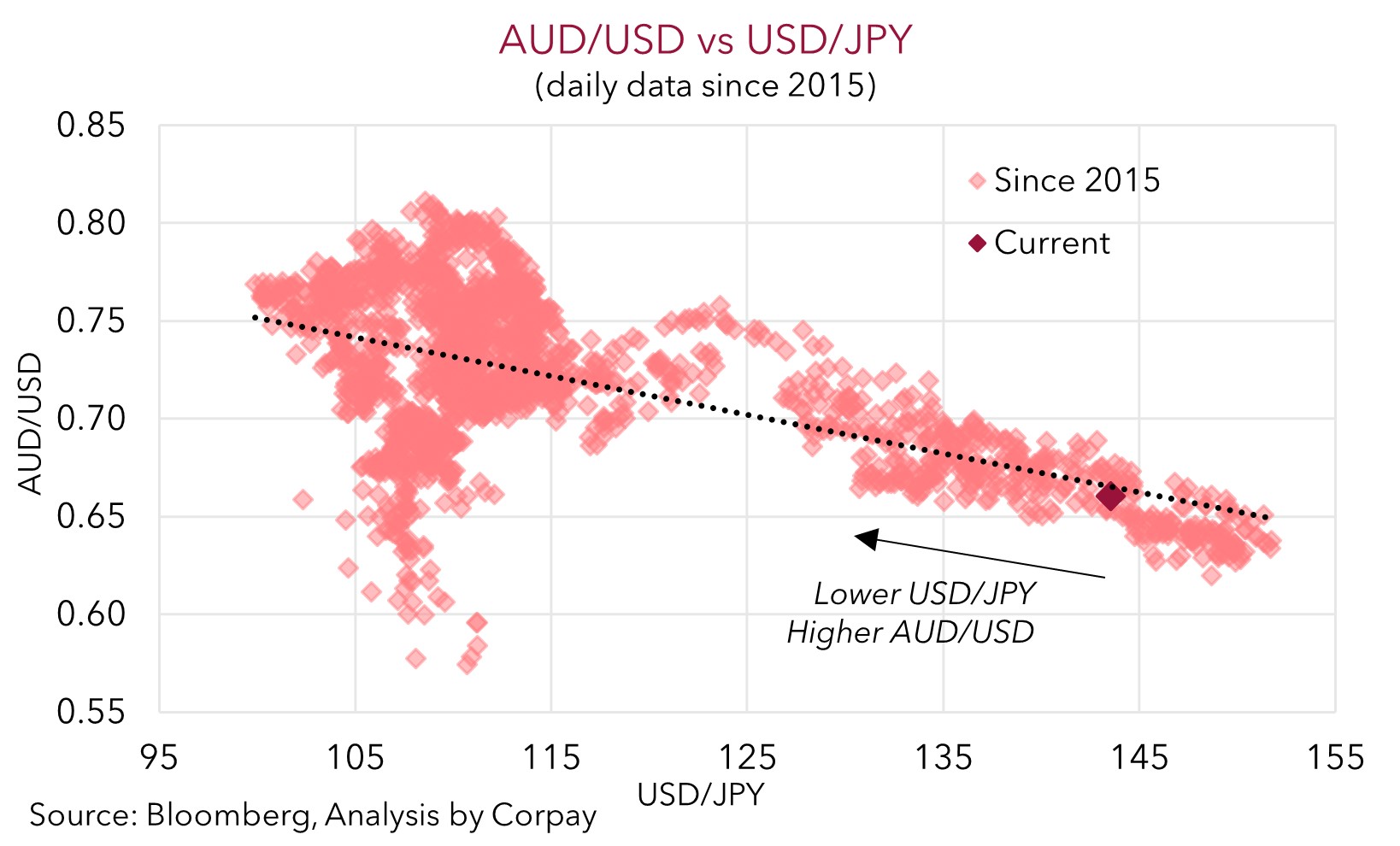

The AUD has perked up over the past 24hrs rising back over $0.66. The AUD recovery has been a function of the improved risk sentiment (as illustrated by the lift in US equities) and the JPY-led weakening in the USD (see above). Given it is the 2nd most traded currency pair, as our chart shows, there is an solid inverse relationship between swings in USD/JPY and the AUD/USD.

On the crosses, the AUD has also generally outperformed, with AUD/JPY an exception. At ~94.83 AUD/JPY is ~1.7% below where it was tracking this time yesterday. That said, while AUD/JPY has fallen back it remains historically elevated having only traded above current levels ~10% of the time going back to 1995. We remain of the view that there are there are uneven medium-term risks in AUD/JPY, with more downside than upside potential. Elsewhere, AUD/EUR (now ~0.6115) has pushed back towards the upper end of its multi-month range as Eurozone growth concerns remain front-of-mind and an aggressive ECB rate cutting cycle is factored in.

As mentioned, tonight market focus will be on the US jobs report (12:30am AEDT). Consensus is looking for US non-farm payrolls to lift by 185,000, the unemployment rate to hold steady at 3.9%, and for wages to ease to 4%pa. As flagged, the end of the auto workers and actors strikes may give payrolls a temporary boost. But in the main we think broader labour market conditions should cool. US labour supply has increased, and it is harder for job seekers to find work given demand is moderating. More signs heat is coming out of the US labour market, should in our opinion, support views the next move by the US Fed will be to cut rates, albeit in mid-2024. If realised, this, in combination with the reinvigorated JPY, may exert more pressure on the USD and give the AUD further support.

Beyond short-term data driven gyrations, we continue to believe the drivers for the AUD to edge higher over coming quarters are moving into place. On top of our expectations for China’s economy to re-accelerate (which would be a positive for regional growth and commodity demand), and the JPY to recapture lost ground, we are looking for bond yield spreads to narrow in the AUD’s favour as the RBA diverges from its peers. In our judgement, factors such as the RBA’s pragmatic tightening cycle, Australia’s slower moving wage dynamics due to multi-year enterprise bargaining agreements, and incoming income tax cuts could see the RBA lag others when the next global easing cycle comes through. There will be bumps along the way, but based on our fundamental outlook we see the AUD ticking up to ~$0.68 by Q1 and then onto ~$0.70 by this time next year.

AUD levels to watch (support / resistance): 0.6510, 0.6540 / 0.6620, 0.6680