• Bond yields. Weaker than expected data & drop in oil has bolstered rate cut bets, pushing long-end bond yields lower once again.

• Shaky sentiment. Negative sentiment gave the USD a bit of a boost. After clawing back ground earlier on, the AUD is back down where it was 24hrs ago.

• AU GDP. Economic momentum has stepped down. While the growth outlook supports the case for no more hikes, RBA cuts could still be some time away.

Global bonds have continued to power ahead. Weaker than expected data and an oil price slump has eased inflation worries, bolstered rate cut expectations, and pushed long-end bond yields lower. In Europe, the UK 10yr rate fell another 8bps (now ~3.94%), with the German 10yr 5bps lower (now 2.19%) and the US equivalent falling 6bps. At ~4.11% the US 10yr is at a 3-month low, ~90bps below its October peak. Markets are discounting the start of the US Fed easing cycle from May, while the ECB is projected to kick things off in April. The Bank of England is priced to deliver its first rate cut in June. Despite the Bank of Canada flagging that it “is still concerned” about inflation and “remains prepared to raise the policy rate further if needed” markets think a steady stream of rate reductions could flow from April.

Equities were mixed. In contrast to the positive day in Europe (EuroStoxx50 +0.7%) US markets slipped late in the session (S&P500 -0.4%). This helped generate intra-day support for the USD, with the EUR (now ~$1.0762) and GBP (now ~$1.2556) losing ground as risk sentiment soured. USD/JPY consolidated, while USD/SGD edged a touch higher (now ~1.3420). After it had staged a bit of a recovery earlier on, the backdrop pushed the AUD down towards yesterday’s lows (now ~$0.6550).

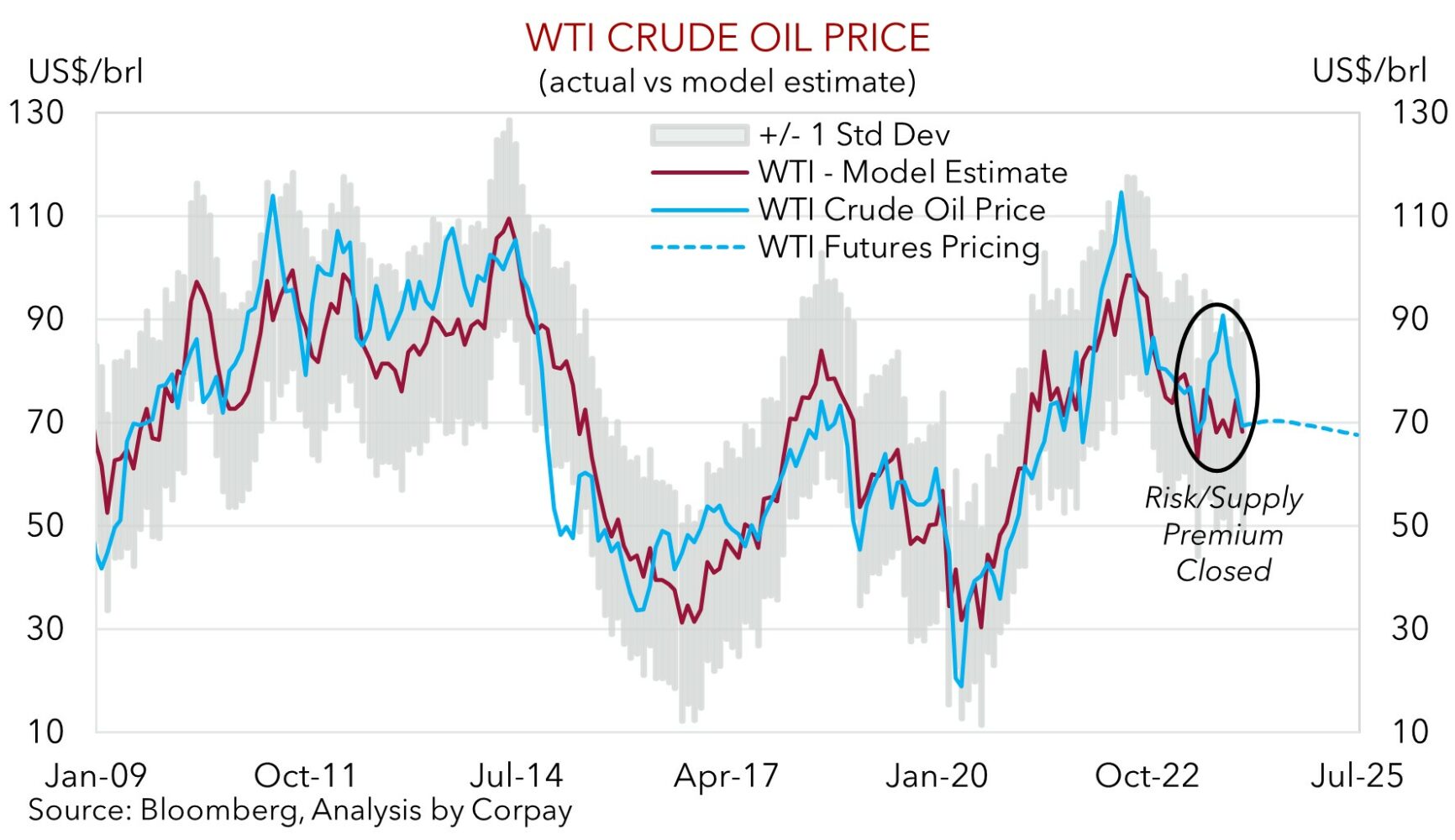

Data wise, German factory orders (a forward-looking indicator for global industrial activity) declined by 3.7% in October, Eurozone retail sales undershot forecasts by rising just 0.1%, and US ADP employment was weaker than predicted. According to ADP US companies scaled back their hiring in November with only 103,000 jobs added. Notably, service-providing sectors, which underpinned the robust employment during the economic recovery cut jobs for the first time since early-2021. The unfolding growth slowdown coupled with doubts OPEC+ will be able to stick to the agreed curb in production saw WTI crude shed another 4.2%. At US$69.30/brl WTI is ~27% below its September highs and where it was trading in July. The oil price tumble over the past few months should be a mechanical drag on headline inflation over coming months. But as our chart shows, further falls may be hard to come by. Prices are back tracking broadly inline with our ‘fair value’ estimate, with the prior risk premium unwinding.

Trade figures out of China are released today (no set time), and they should give another read on the pulse of the global economy. Expectations are centered on some improvement, which if realised, we think could support fragile risk sentiment. Beyond that, US labour market trends will continue to be watched. US jobless claims are due tonight (12:30am AEDT) with non-farm payrolls rounding out the week (Sat 12:30am AEDT). We believe more signs US labour conditions are cooling (but not falling off a cliff) may see the USD give up recently recouped ground.

AUD corner

After grinding higher yesterday, the AUD slipped back overnight as risk sentiment soured. A run of weaker global data and a lower oil price fanned fears about global growth momentum (see above). That said, while there was some intra-day volatility, at ~$0.6550 the AUD is little different to where it was 24hrs ago. It is a similar story on the crosses. On net, AUD/EUR is a bit firmer (+0.2% to ~0.6085), as is AUD/GBP (+0.2% to ~0.5216), while AUD/NZD has remained on the backfoot (now ~1.0675, around its lowest since mid-October).

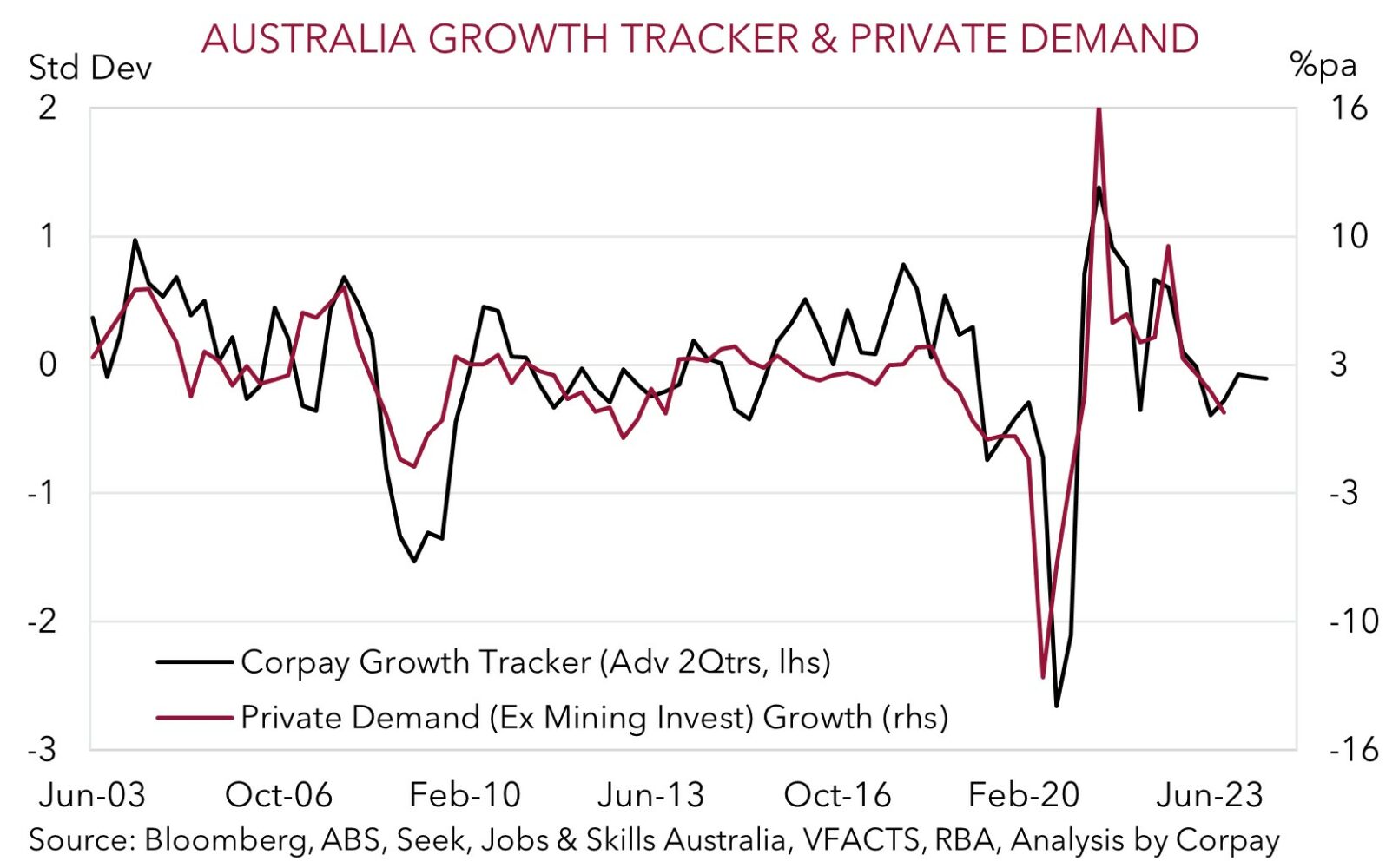

Locally, Q3 GDP was released yesterday. Momentum across the economy has stepped down, unsurprising given the 425bps worth of rate hikes delivered by the RBA and other cost of living pressures that are hitting the private sector. The economy expanded by just 0.2% in Q3, down from an average of 0.5%qoq in H1 2023 and H2 2022. Within that a fair amount of support to aggregate demand continues to come via Australia’s rapidly expanding population. In contrast to the modest overall expansion, in per capita terms GDP fell again in Q3. In our opinion, the outlook for slower economic activity over the period ahead remains intact as the RBA’s ‘restrictive’ settings continue to gain traction. As shown, our Private Demand Tracker is pointing to sub-trend growth continuing over H1 2024. That said, sub-trend doesn’t mean things are about to nosedive. The burgeoning population remains demand supportive, as is the pipeline of infrastructure investment, CAPEX spending trends, and a re-acceleration in China on the back of its stimulus push. Added to that firmer wages and moderating inflation should, over time, help lessen some of the pressures currently buffeting households. And while many are feeling the pinch from higher interest rates and have limited buffers, it isn’t all one-way. Net savers benefit from the added income and a sizeable pool of ‘excess savings’ still exists (now ~$215bn on our figuring). For more see Market Musings: Australia’s growth pulse: down but not out).

While the growth trajectory supports a view that the RBA might have reached the top of its interest rate mountain, we think it is unlikely it will ease policy for some time. As outlined before, we believe factors such as the RBA’s pragmatic tightening cycle, lags in Australia’s wage dynamics due to the prevalence of multi-year enterprise bargaining agreements, and incoming income tax cuts are likely to see the RBA lag its peers when the next global easing cycle kicks in. With the RBA set to remain on a slightly different/delayed path, we are looking for relative yield spreads to continue to trend in a more AUD supportive direction over coming quarters. There will continue to be volatility along the way, but based on our outlook we continue to see the AUD edging up to ~$0.68 by Q1 and then onto ~$0.70 by this time next year.

AUD levels to watch (support / resistance): 0.6510, 0.6540 / 0.6600, 0.6620