• Mixed markets. Equities in China continue to power ahead, while lower inflation weighed on European/US bond yields. USD near 2024 lows.

• AUD holding. AUD remains near the top of the range it has occupied since early-2023. Diverging policy expectations & China stimulus are supportive.

• Event radar. China PMIs released today. EZ CPI is out (Tues), while in the US non-farm payrolls rounds out the week. US Fed Chair Powell also speaks.

Mixed fortunes across markets at the end of last week with geopolitical and economic forces push and pulling on different asset classes. China’s equity market continued to power ahead with another 4.5% rise taking its weekly gain to 15.7%, the strongest performance since 2008, on the back of stimulus measures and pledges of more to come. On Friday China’s National Development and Reform Commission stressed that to help overcome difficulties private firms have their ‘full support’. The tailwinds from China helped European equities rise again (EuroStoxx50 +0.7%), while US indices consolidated. The S&P500 eased 0.1% after hitting yet another record.

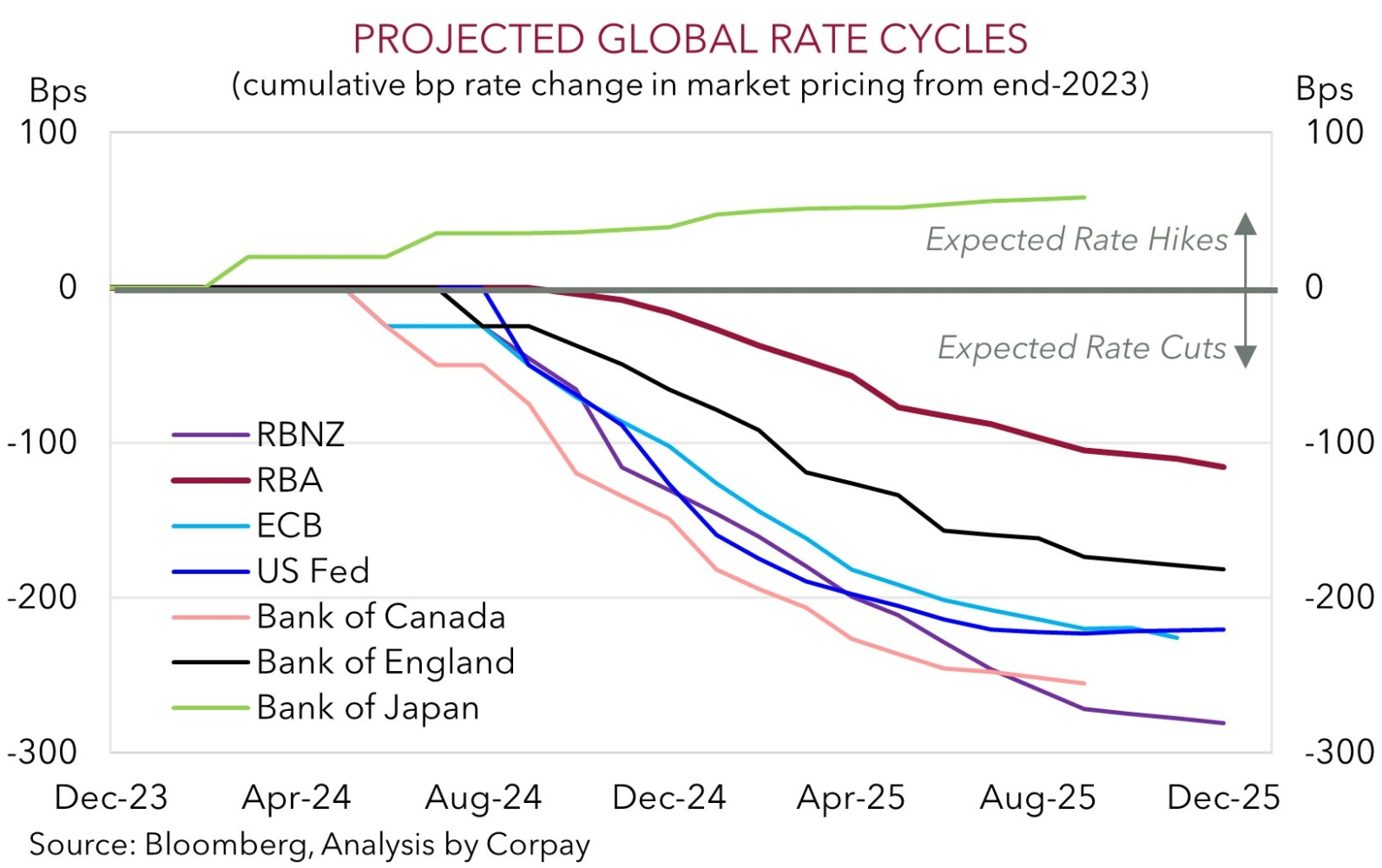

Elsewhere, escalating tensions in the Middle East have had limited direct market impact. Brent crude oil prices have ticked up modestly, but at ~US$72/brl they remain near the lower end of their 1-year range. Macrowise, CPI inflation in France (1.5%pa) and Spain (1.7%pa) was weaker than predicted ahead of tonight’s German figures (10pm AEST) and tomorrow’s Eurozone reading. The softer inflation pulse across the Eurozone added to the recent run of weaker activity data, increasing the odds of another ECB rate cut in mid-October. This dragged on European bond yields (2yr and 10yr rates in Germany fell ~5-6bps). In the US, the PCE deflator (the Fed’s preferred inflation gauge) also confirmed price pressures are cooling with the annual headline run-rate slowing to 2.2%pa, the slowest since early-2021. US bond yields also lost altitude (US 10yr -5bps to 3.75%) as chances of another outsized rate cut by the US Fed in early-November nudged up.

In FX, the USD index tread water with a drift lower in EUR (now ~$1.1160) and GBP (now ~$1.3374) offsetting a firmer JPY. USD/JPY has dropped down to ~142.50 as lower global bond yields compounded Shigeru Ishiba’s surprise win in the LDP leadership ballot. Ishiba (who will become Japan’s latest Prime Minister) has been a vocal critic about the Bank of Japan’s aggressive policy easing. The crosscurrents have seen saw NZD (now ~$0.6340) and AUD (now ~$0.69) track sideways near the upper end of their respective ranges.

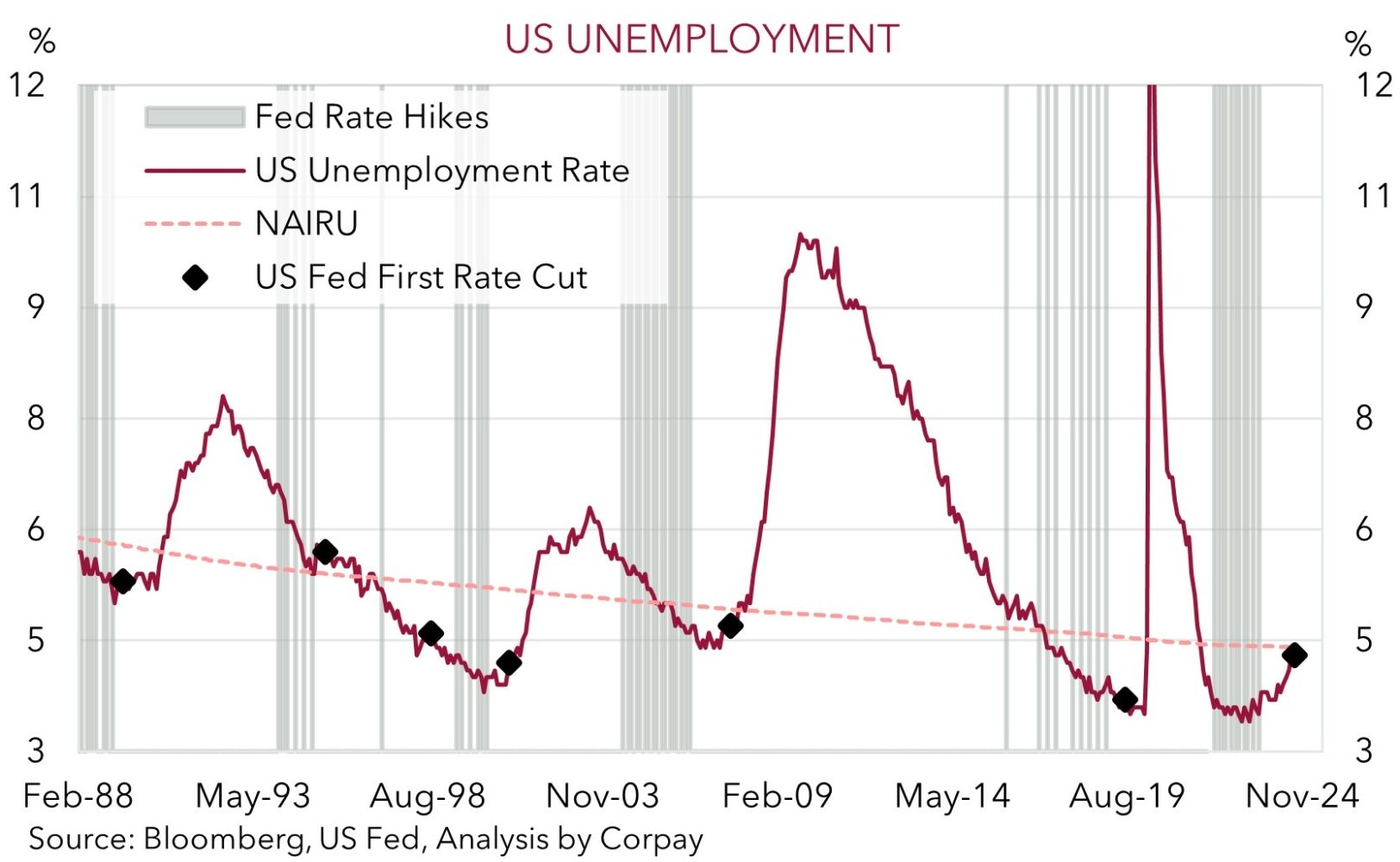

There are several important economic releases on the schedule this week including the China PMIs (11:30am AEST), Eurozone CPI (Tues), and a range of US employment indicators that will be rounded off by the monthly non-farm payrolls report (Fri night AEST). On top of that several US Fed policymakers are speaking, including Chair Powell (Tues 3am AEST). The US Fed has become very focused on the downside risks in the US labour market. Based on various leading indicators we think another soft jobs print is possible with risks tilted to the US unemployment rate (now 4.2%) edging up further. Given its reaction function, if realised, we think this could bolster bets looking for another 50bp rate cut by the US Fed at its next meeting which in turn could exert more downward pressure on the USD.

AUD Corner

The AUD consolidated at the end of last week with the various market and geopolitical dynamics mentioned above offsetting each other. At ~$0.69 the AUD is tracking near the top of the range it has occupied since early-2023. The AUD was a bit more mixed on the crosses with some various relative trends coming through. Softer inflation data in France and Spain and the drop in Eurozone bond yields helped AUD/EUR edge higher (now ~0.6190, a high since mid-July). AUD/GBP (now ~0.5160) also ticked up, as did AUD/CAD (now ~0.9325, levels last traded in Q1 2023) and AUD/CNH (now ~4.8155). By contrast, the jump up in the JPY stemming from the support garnered by lower global bond yields and political change in Japan has seen AUD/JPY fall back below its 1-year average (now ~98.65).

Locally, it is a quiet week on the economics front with retail sales (Tues) the main data point. We think spending related to the earlier timing of Father’s Day and income support from the stage 3 tax cuts could see retail turnover improve in August. Signs of life in consumer spending could reinforce expectations that the RBA is on a different path to its global peers with rate cuts set to start later and be more limited in Australia than in many other countries. We believe the resilient Australian labour market, core inflation trends, and lower interest rate starting point means the start of a measured and modest RBA rate cutting cycle remains a story for H1 2025.

The ongoing adjustment in interest rate differentials in Australia’s favour, coupled with upbeat risk sentiment stemming from China’s policy push and positive spillovers on emerging market equities and base metal prices should be AUD supportive not just against the USD but also against currencies like the EUR, CAD, NZD, and GBP over the medium-term, in our opinion. Some of these undercurrents could get a kick along this week via a relative improvement in the China PMIs (released today 11:30am AEST), a deceleration in Eurozone CPI inflation (released Tues night AEST), and/or more signs the US labour market is losing steam. There are several US jobs and leading activity indicators released this week including the ISM surveys, JOLTS job openings, ADP employment, and non-farm payrolls. We believe the risks are tilted to US employment growth remaining sluggish and/or the US unemployment rate ticking higher. If realised, this could bolster expectations the US Fed may continue to cut interest rates aggressively over upcoming meetings to support growth, which in turn might drag on the USD and boost cyclical currencies such as the AUD.