The wild ride in the JPY over the past few trading sessions has got the markets attention, and raised the question of whether Japanese authorities have (finally) intervened after firing several verbal warning shots? USD/JPY traded in a 3.6% range on Monday, around 4 times its historical norm, as it quickly plunged from a fresh multi-decade peak just above 160 before settling down (now ~156.70). Officials from Japan have kept markets guessing by not confirming or denying whether any action took place. But as the saying goes “if it walks like a duck and quacks like a duck then it probably is one”.

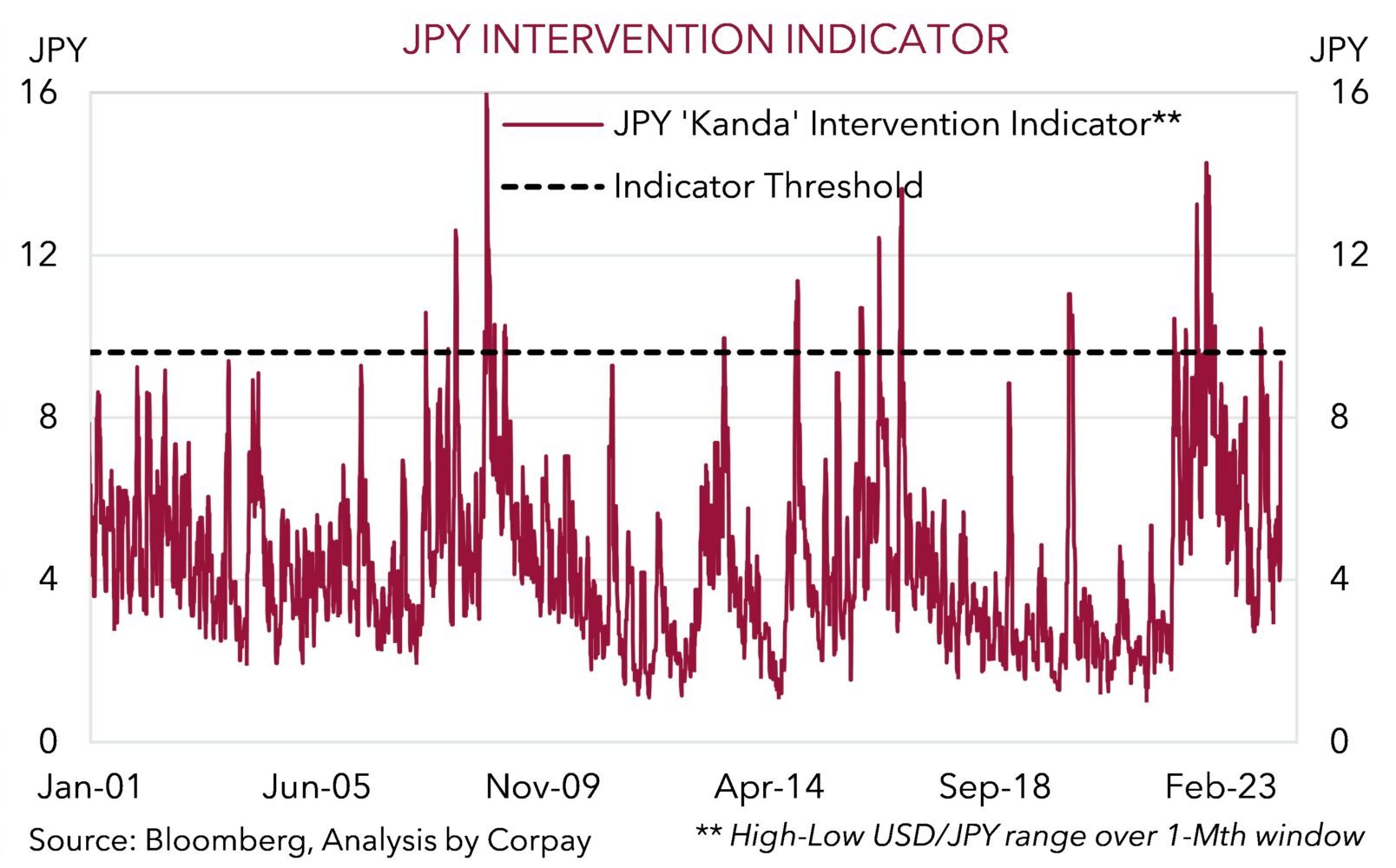

In our view, after taking a close look at some factors, we think intervention occurred. The sharp swing in the JPY coincided with: (a) USD/JPY rising to within a whisker of its 1990 highs; (b) the 10 yen low to high monthly range threshold flagged by Vice Finance Minister Kanda almost being reached (chart 1); and (c) liquidity being lower than usual as Japan was observing its Showa Day public holiday. Looking back the Japanese have intervened a few times on public holidays (i.e. May ‘93, April ‘94, May ‘94, and January ‘04), as the reduced market activity can generate a ‘bigger bang for its buck’.

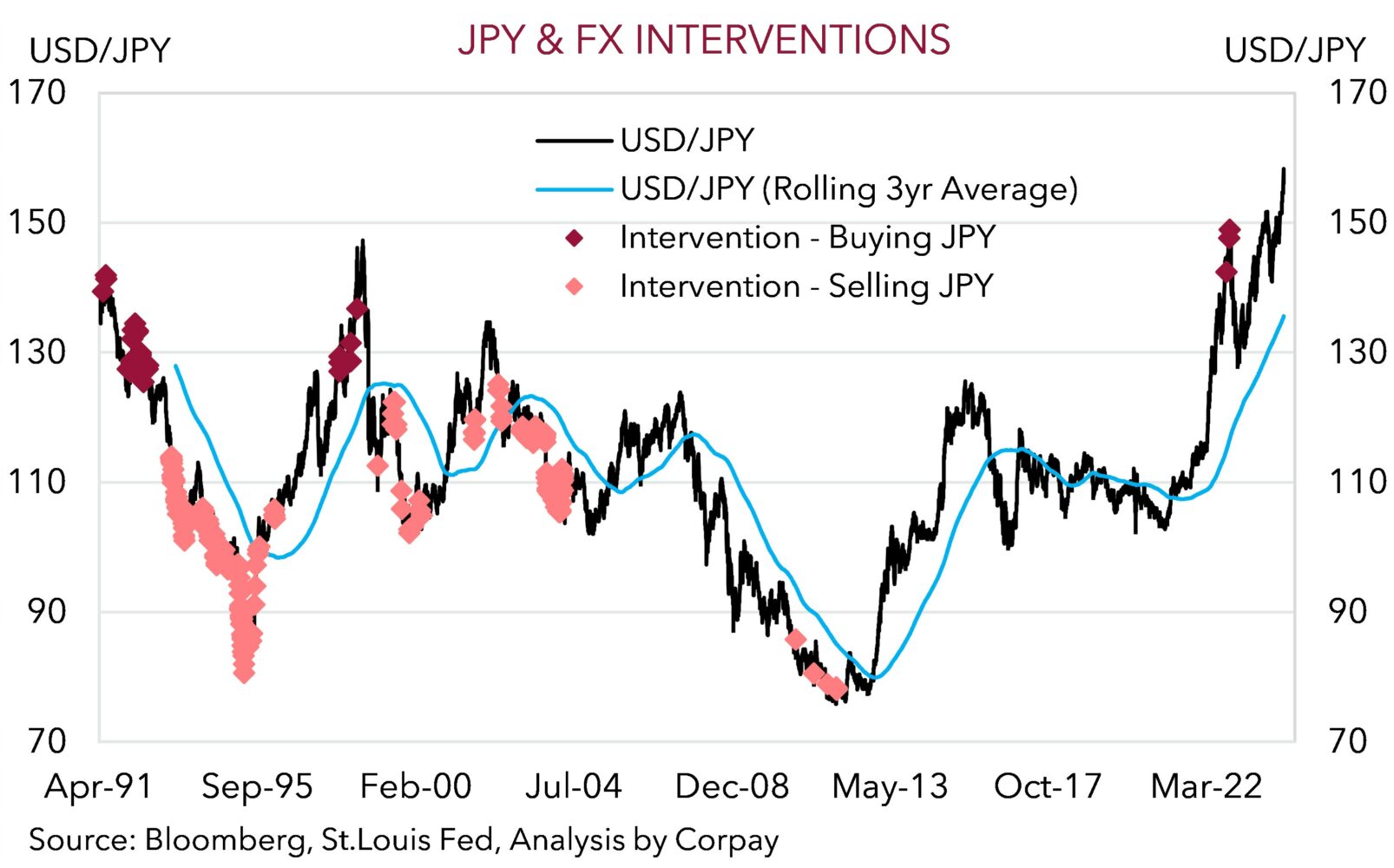

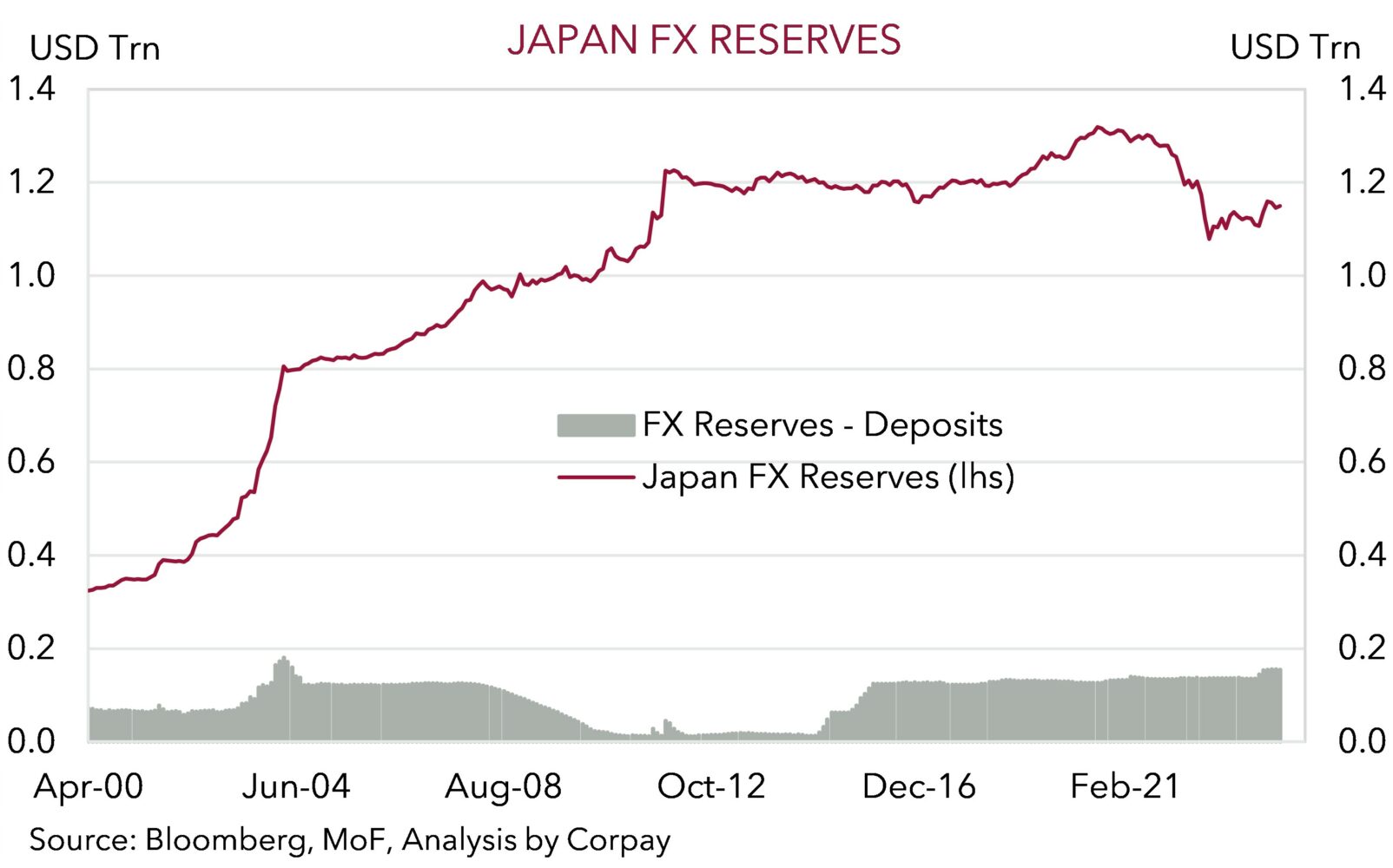

Going forward we believe further bouts of intervention to support the undervalued JPY are more likely than not. History shows that the Japanese don’t typically just wade into markets once (chart 2). And the Japanese do have the ability to intermittently step in. While it is theoretically unlimited when intervention is undertaken to weaken a currency, Japan’s FX reserves (which are deployed to strengthen the JPY) are quite substantial. As at the end of March the amount of total FX reserve ‘firepower’ sat at US$1.15 trillion with ~US$155bn in readily available currency deposits (chart 3).

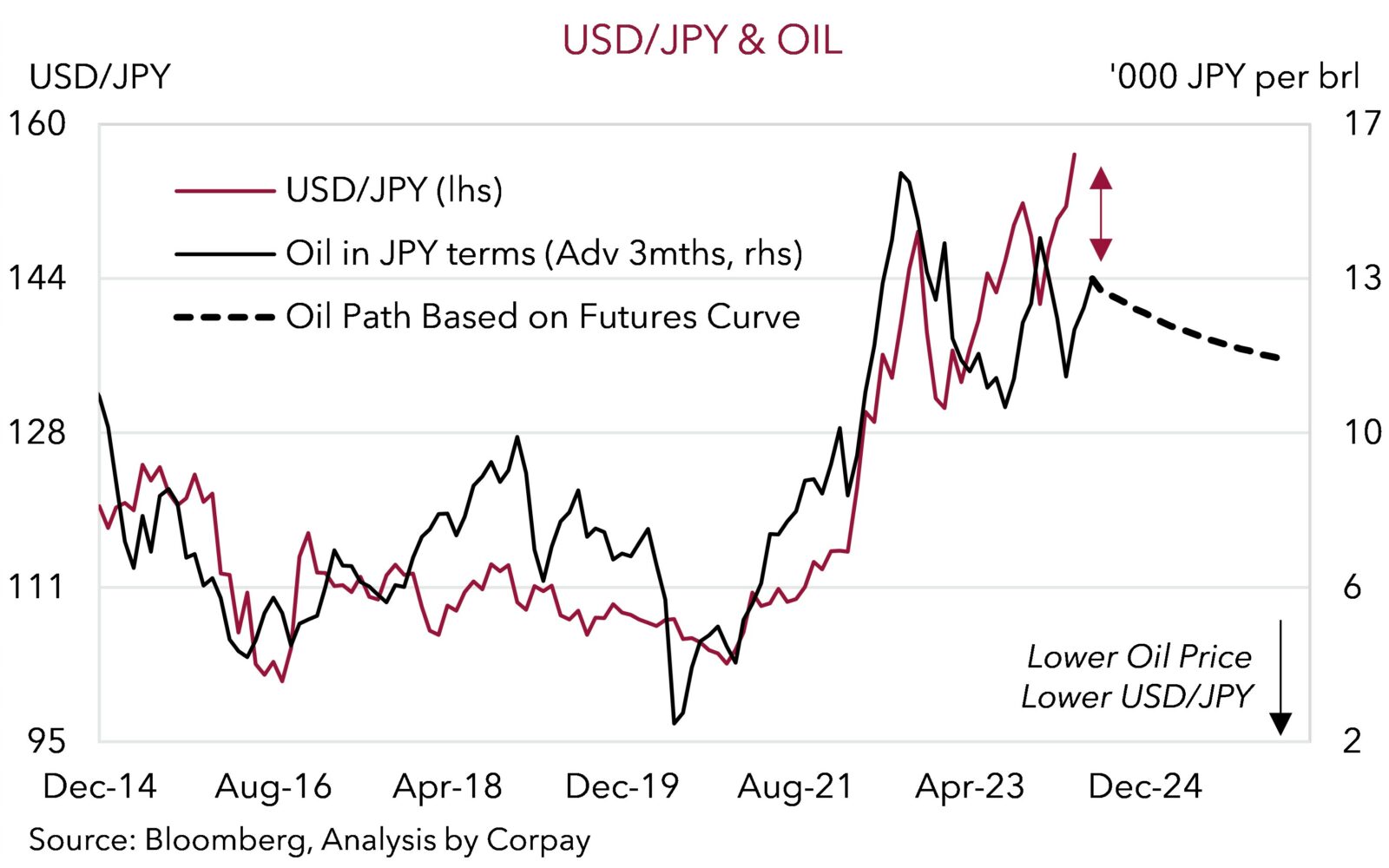

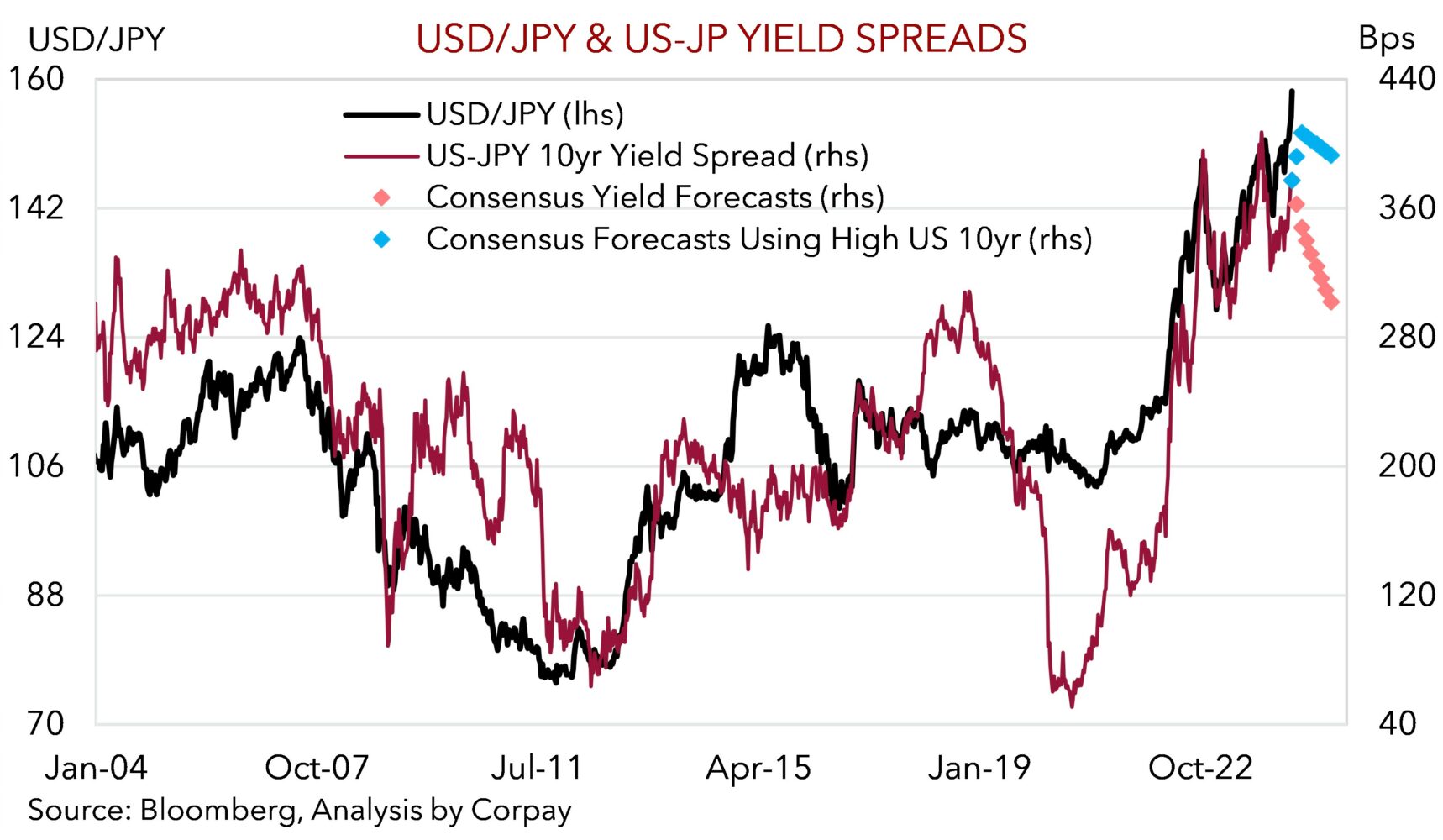

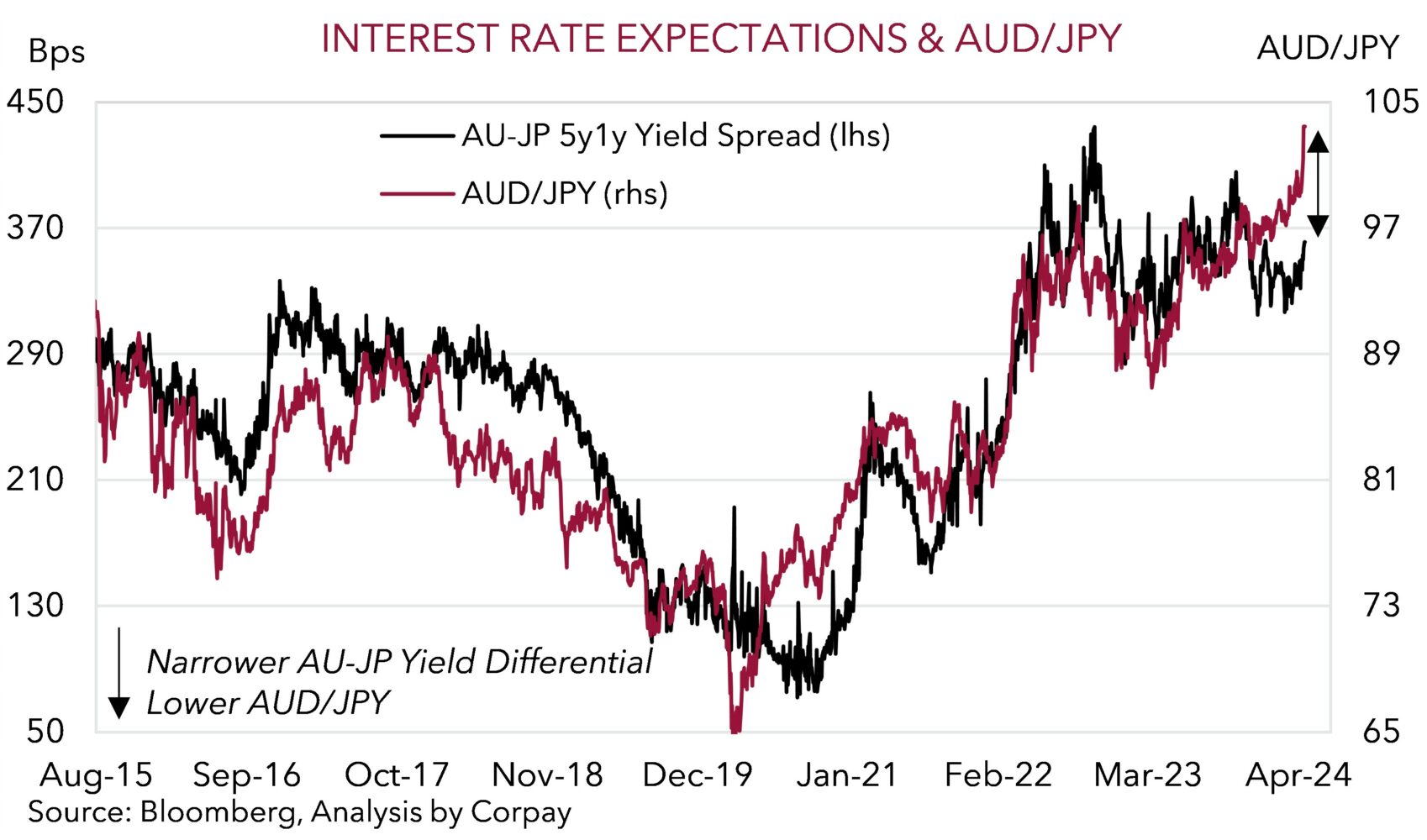

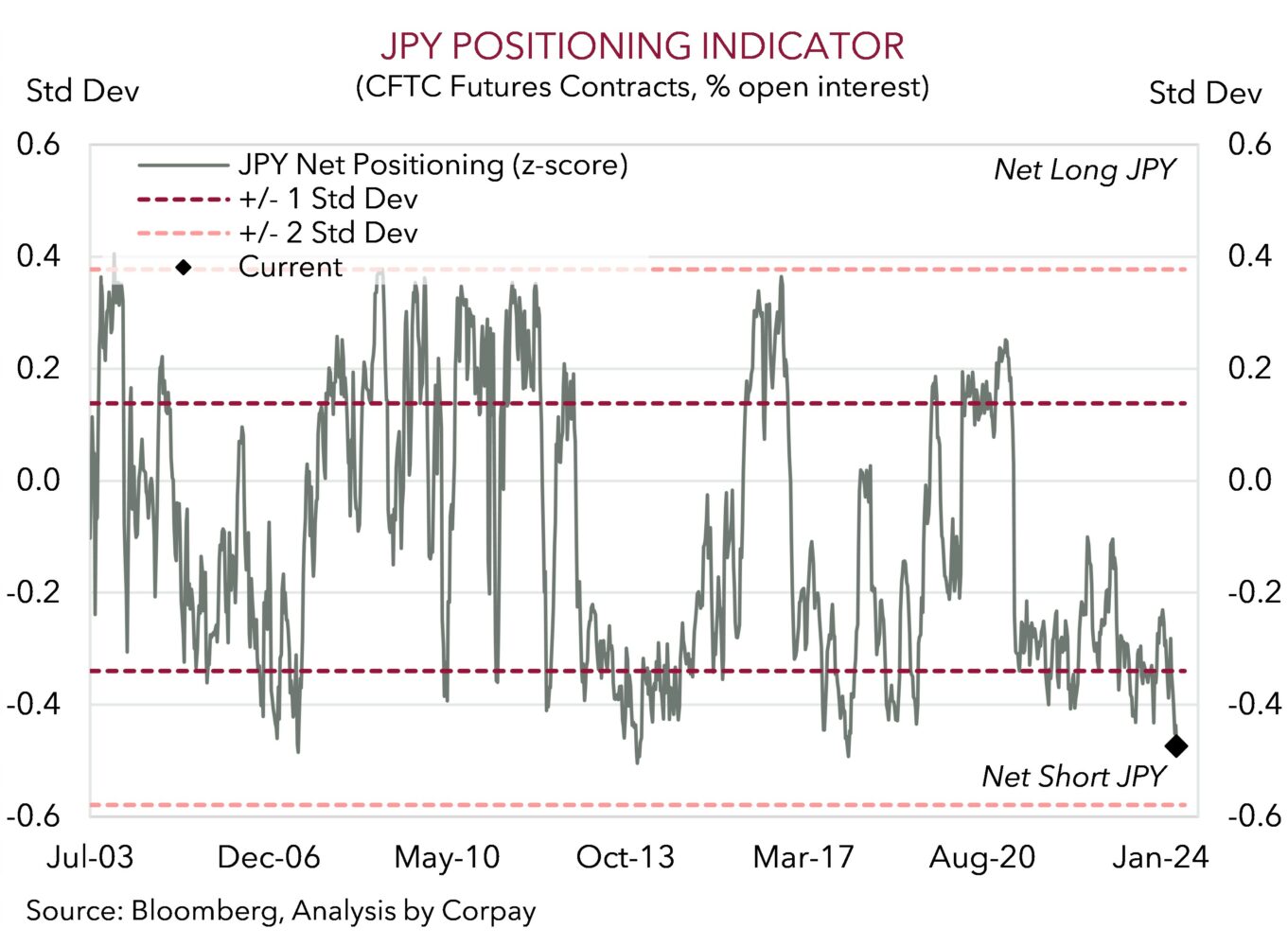

FX intervention doesn’t usually alter an underlying trend, especially when it is constrained by the level of reserves a country has at its disposal. However, we feel that if it isn’t a one-off, it can create more two-way risk in the JPY which has been on a relentless depreciation path over the past few months as speculative momentum ramped up. ‘Net short’ JPY positioning (as measured by CFTC futures) is at extremes (chart 4). A paring back of ultra-bearish JPY positioning can help the JPY realign with its fundamentals. In our judgement, the JPY’s 2024 year-to-date weakness (and rise in USD/JPY and other pairs like AUD/JPY) has outstripped moves in various drivers such as bond yield differentials, even after accounting for the upward repricing in US and Australian interest rate expectations, and other normally JPY negatives like a higher oil price (chart 5). Indeed, we would point out that while bond yield differentials have widened and the oil price has risen since the turn of the year, they are still a fair way from their respective Q4 2023 peaks, and back then USD/JPY topped out ~3% below where it now is.

Based on its current starting point, and disconnect with relative fundamentals, we think there are asymmetric risks in USD/JPY and AUD/JPY from here (i.e. there is more downside than upside potential). As our chart illustrates, even after incorporating the most bullish analyst forecast for US 10yr bond yields USD/JPY is still projected to gradually move lower over the next year (chart 6).

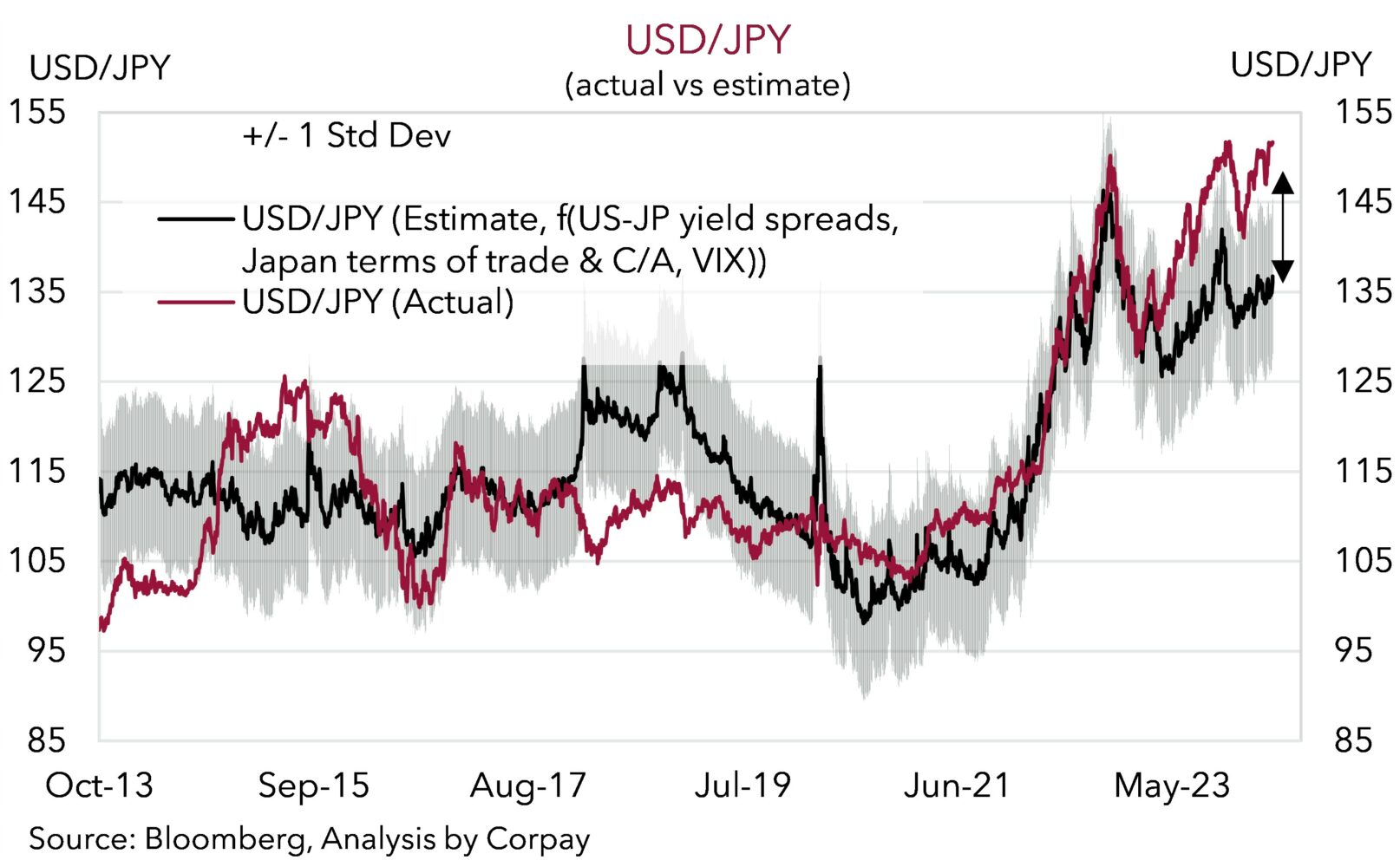

We are more optimistic than that given: our ‘fair-value’ model suggests USD/JPY should currently be trading closer to ~140 than ~160 (chart 7); our assessment US interest rate expectations have swung too far and may now not be discounting enough policy easing by the US Fed over the next ~2-years; the prospect for further bouts of JPY supportive market volatility as macro and geopolitical issues play out; and with the BoJ likely to normalise its policy stance a bit further to quell inflation pressures. A rebound in the JPY should also drag on AUD/JPY over time, in our view. Even after accounting for our bullish medium-term AUD bias we are forecasting the stretched AUD/JPY to drop back to ~97 by Q3 2024 (chart 8). Statistically AUD/JPY is now in somewhat rarefied air given it has only traded above current levels (now ~102.28) ~1% of the time since 1995.