• Relief continues. Bond yields, oil prices & the USD lost a bit more ground overnight. BoE & US Fed comments raise doubts about the extent of further hikes.

• AUD recovery. The AUD has edged up a little against the USD & on most crosses. In addition to tonight’s US labour report, US CPI is released next week.

• US payrolls. Based on where things are tracking we think a larger (more negative) USD reaction could occur if the US data underwhelms.

Yesterday’s moves extended a bit further overnight with markets marking time ahead of tonight’s US jobs report (11:30pm AEDT). US equities slipped back marginally (S&P500 -0.1%), and the pull-back in bond yields, oil prices, and the USD continued. The US 2yr yield declined ~3bps (now 5.02%), while the 10yr rate eased another ~2bps (now 4.72%). There were slightly bigger moves in UK bonds (2yr -6bps) as markets tempered their BoE rate hike bets after Deputy Governor Broadbent warned there are ‘clear signs’ the economy is weakening. Elsewhere, concerns about the demand outlook have continued to pressure oil, with WTI crude down another 2%. At ~US$82.40/brl WTI is back where it was tracking a month ago with the ~14% drop from its September peak a renewed drag on headline inflation down the track. This is likely to be a factor weighing on global bond yields. Added to that doubts about the extent of future US Fed rate hikes continue to creep in. Overnight the Fed’s Daly (a FOMC voter in 2024) noted that rates could be held steady if the US labour market and inflation continue to cool and/or financial conditions remain tight.

The USD Index drifted lower. In addition to the dip in yields, the falling oil price is likely to be dragging on the USD. The sharp turnaround in the US’ energy trade balance over recent years given its increased domestic production has meant that the correlation between the USD and commodity/oil prices is more aligned than it used to be. EUR has edged up towards ~$1.0550 and lower bond yields have exerted pressure on USD/JPY (now ~148.50). GBP shrugged off the BoE comments and rose modestly (now ~$1.2190), while the NZD and AUD have nudged up a little more (now ~$0.5965 and ~$0.6369 respectively). USD/SGD has tracked the moves in the broader USD, and at ~1.3673 the pair is ~0.7% below Monday’s multi-month peak.

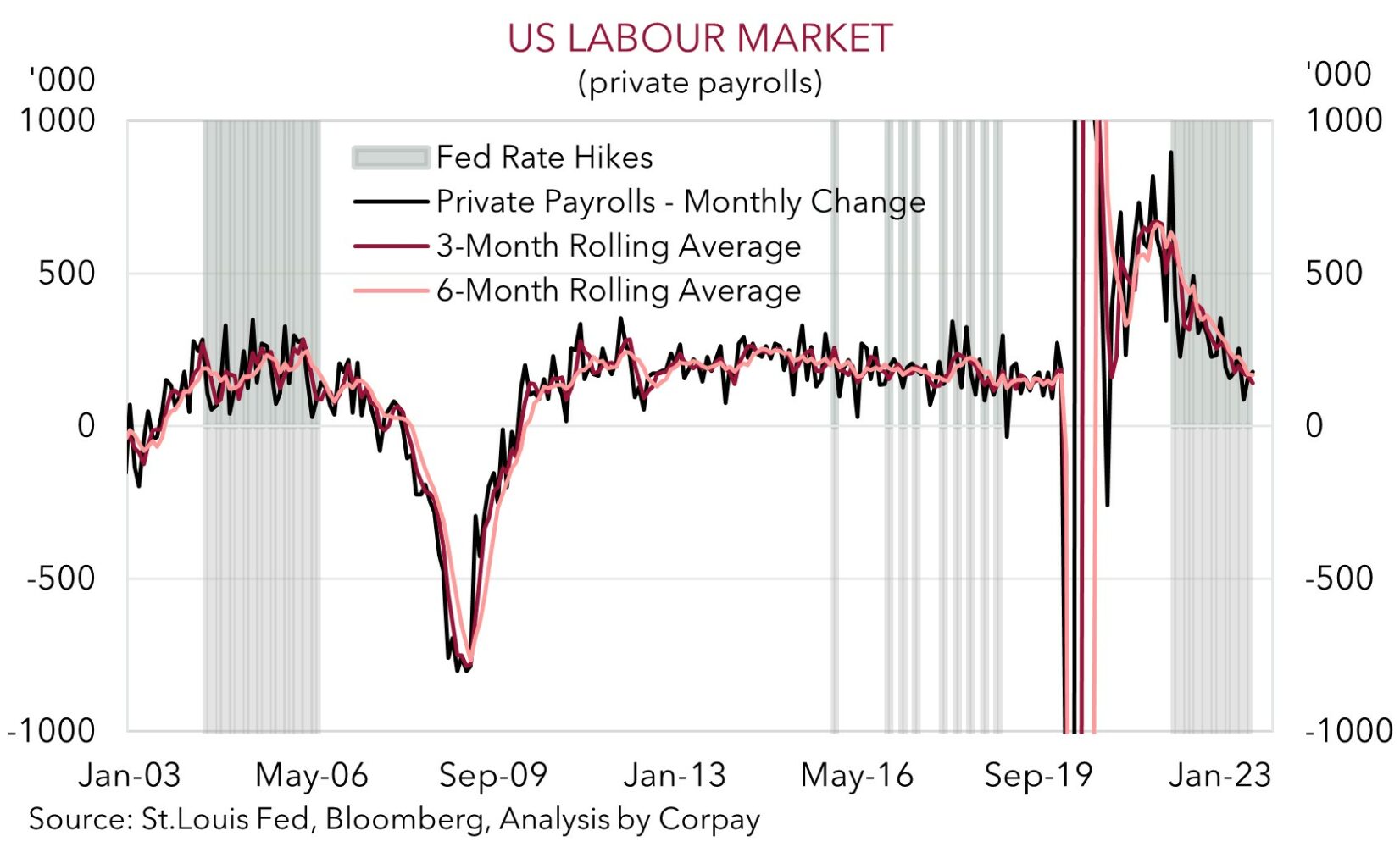

As discussed recently, we think a lot of positives look to be factored into the USD, with a ‘higher for longer’ Fed rates outlook well priced. Based on the still elevated levels we think there could be a larger and more negative reaction in US yields and the USD if tonight’s US jobs report underwhelms. There are a few moving parts. Market consensus is looking for non-farm payrolls to slow to 170,000 in September (which would lower the 6-month moving average to around its pre-COVID pace), for the unemployment rate to tick down to 3.7%, and for average hourly earnings to hold steady at 4.3%pa.

AUD corner

The AUD has continued to claw back ground, rising by ~0.7% against the softer USD over the past 24hrs (now ~$0.6369). The pull-back in bond yields and lower oil prices have exerted a bit of downward pressure on the USD ahead of the US jobs report (see above). The AUD has also ticked up on most of the major crosses, rising by 0.3-0.5% against the EUR, JPY, GBP, CAD, and CNH compared to this time yesterday.

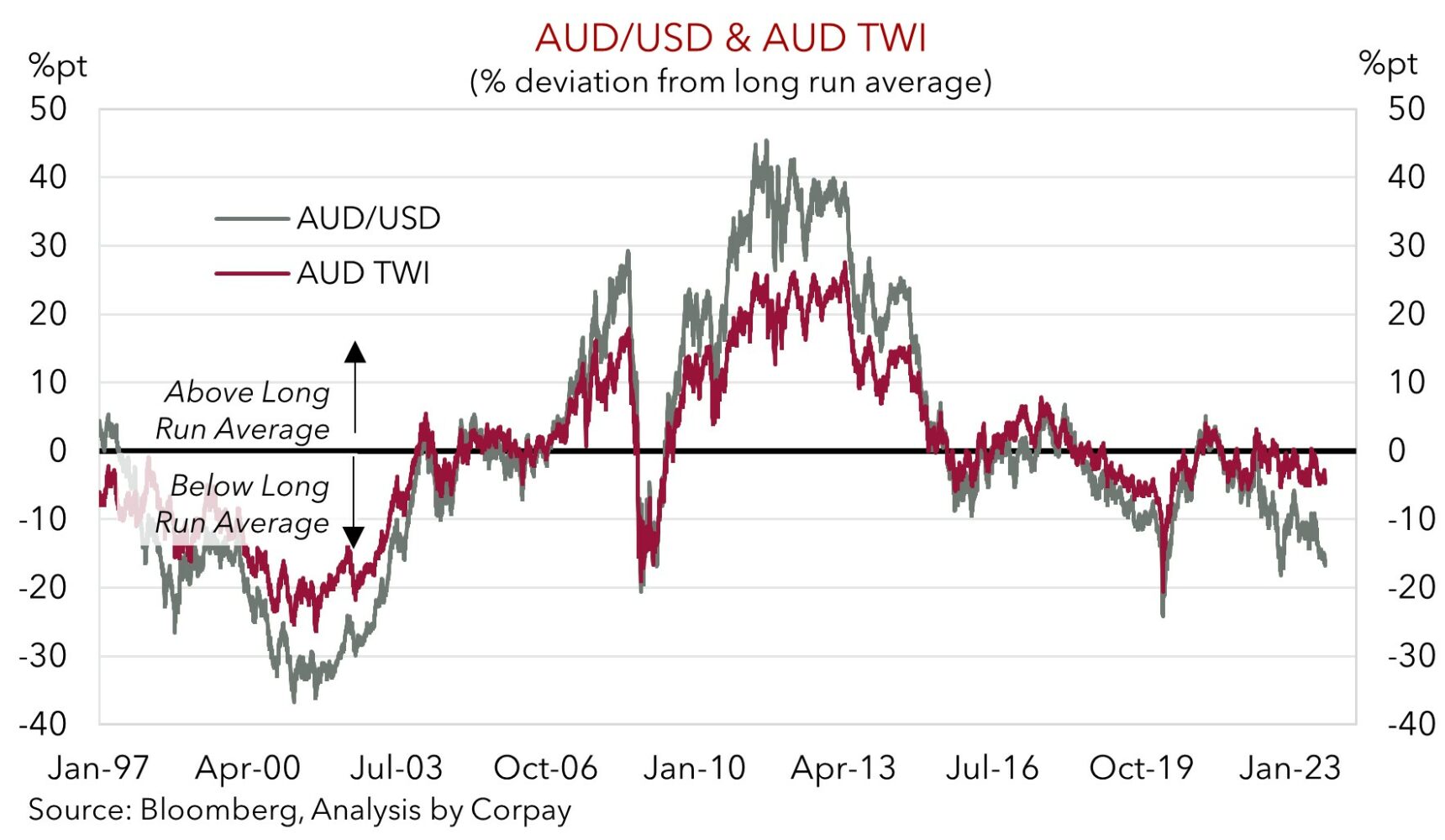

Taking a step back we continue to note that the AUD’s falls over the past few months has been more of a positive USD rather than a negative AUD story. Illustrating this AUD/EUR and AUD/GBP are 3-4% above their respective mid-August lows, and AUD/JPY is still hovering above its 1-year average. As our chart shows, while AUD/USD is well below its long-run average, the AUD trade-weighted index has been range-bound for some time.

Market attention will be on tonight’s US labour market data (11:30pm AEDT). As mentioned above and over the past few days, although there is likely to be a binary response to the US data, we think the size of the reaction in the USD (and in turn the AUD) may not be even. With a ‘higher for longer’ US interest rate outlook now looking well priced in, and bond yields still high even after the pull-back over recent days, we believe a bigger and more negative USD (positive AUD) reaction could stem from a softer US employment report. Signs the US labour market is cooling would take the pressure off the US Fed to raise interest rates again, in our view, and if realised this shift in expectations could have a cascading impact across risk sentiment and other asset markets.

This is inline with our broader thoughts that down near current low levels a lot of ‘bad news’ looks factored into the AUD, and that relative to its starting point there is more upside than downside potential over the medium-term (see Market Musings: AUD: Always darkest before the dawn). In addition to the USD looking susceptible to weaker US data, as discussed over the past week, AUD positioning indicators are starting to look stretched, and after a negative period between August-early October, seasonal forces are typically more AUD supportive later in the year (see Market Musings: History doesn’t repeat, but…).

AUD levels to watch (support / resistance): 0.6170, 0.6280 / 0.6453, 0.6547