• Market relief. Softer US ADP employment data & a lower oil price weighed on bond yields. US equities rose & the USD drifted back slightly.

• AUD consolidates. The AUD has clawed back a little ground. But it remains at low levels. Since 2015 the AUD has only traded sub ~$0.63 ~1% of the time.

• US data. US payrolls is the next major event (Friday AEDT). Given where things are tracking a larger (more negative) USD reaction could occur if the data disappoints.

A break from the recent trend overnight with bond yields lower, equities higher, and the USD a touch softer. The US 10yr yield declined ~7bps (now 4.73%), while the 2yr rate fell ~10bps (now 5.05%) after an underwhelming US ADP employment report raised some doubts about the extent of future US Fed rate hikes. The probability of another Fed rate rise by year-end has eased to ~43% (from ~53%). According to ADP firms added just 89,000 jobs in August. This was the lowest since early-2021. There are differences between how the ADP and non-farm payrolls figures (which are released on Friday) are calculated, and so the ADP report can give a false read on how payrolls may pan out. But the step down does support our thinking outlined yesterday that markets look to have over-reacted to the JOLTS job openings data a few days ago given various underlying components didn’t match the improvement in the headline result. Elsewhere, the US ISM services index also dipped back in September. Although the gauge remains in ‘expansionary territory’, at 53.6 it is below average and the steep drop in ‘new orders’ points to a loss of momentum over coming months.

The pull-back in yields gave equity markets a boost. The S&P500 increased 0.8%, with the tech-focused NASDAQ outperforming (+1.4%). A large fall in the oil price also helped sentiment and weighed a bit on bond yields given the reduced pressure on headline inflation this can generate. WTI crude oil fell ~5% to ~US$84.70/brl, a 1-month low. Concerns about the demand outlook and reports Russia may end its ban on diesel exports look to be behind the moves. In FX, the USD index drifted back slightly with EUR ticking back above ~$1.05, GBP rising towards ~$1.2150, and USD/JPY hovering near ~149. AUD has edged up modestly (+0.4% to ~$0.6327), while USD/SGD has consolidated near multi-month highs (now ~1.3716).

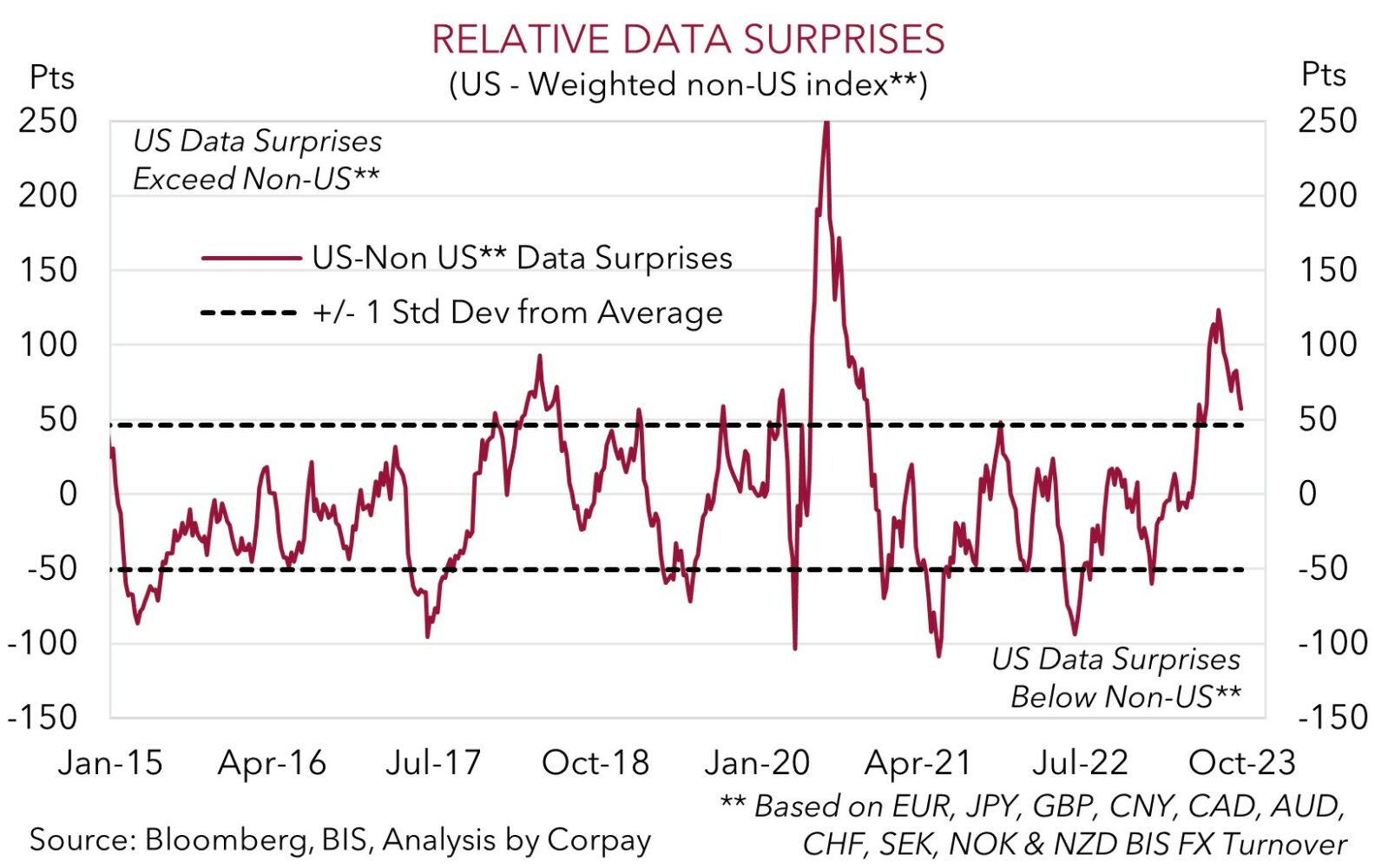

Outcomes compared to expectations drive markets, and the run of better-than-anticipated US data over the past couple of months at a time the growth pulse in the other major economies was weakening, helped propel the USD higher. However, as our chart shows, US data has started to undershoot more optimistic predictions with the spread between US and non-US ‘data surprises’ narrowing. We believe this can continue over the period ahead. In our opinion, a lot of positives now look to be baked into the USD. And based on current elevated levels and market positioning we think there could be a larger and more negative reaction in US yields and the USD if Friday’s non-farm payrolls data disappoints.

AUD corner

The AUD has clawed back a little ground over the past 24hrs, rising by ~0.4% to ~$0.6327. The slightly softer USD on the back of lower bond yields following the drop in the oil price and weaker US ADP employment data, and rebound in equities has given the AUD a bit of support (see above). The AUD has also nudged up on some of the crosses rising by 0.6% against the JPY and CAD, and 0.4% relative to CNH.

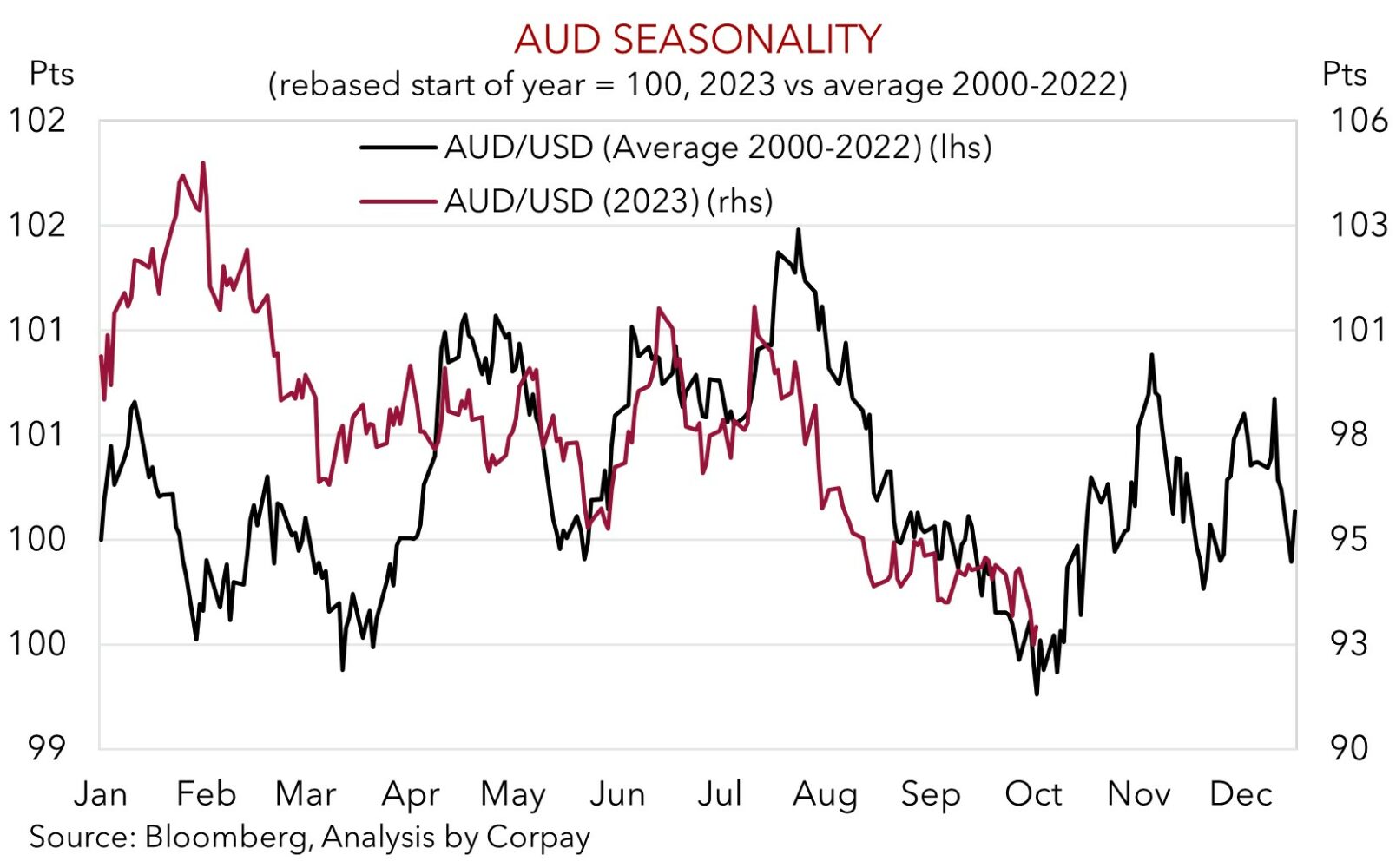

US initial jobless claims are released tonight (11:30pm AEDT), but the next scheduled major event for markets and the AUD will be the US non-farm payrolls report (Friday 11:30pm AEDT). As outlined above, we believe there are asymmetric risks around the USD (and in turn the AUD) to the incoming US data. With a ‘higher for longer’ US interest rate outlook now looking well priced in and bond yields very high, we believe a bigger and more negative USD (positive AUD) reaction could stem from weaker US employment data. This is inline with our underlying thoughts that down near current low levels a lot of ‘bad news’ looks to be factored into the AUD and that there are uneven medium-term risks from here (Market Musings: AUD: Always darkest before the dawn). Indeed, since 2015, the AUD has only traded sub ~$0.63 around ~1% of the time. In addition to the USD looking vulnerable to weaker US data, as flagged over the past week, AUD positioning indicators are starting to look stretched, and after a negative period between August-early October, seasonal forces are typically more AUD supportive in the later part of the year (see Market Musings: History doesn’t repeat, but…). As our chart shows, while the levels are slightly different, the AUD has been following a similar pattern to its average movements from the past ~20-years.

AUD/NZD endured some volatility in the wake of yesterday’s RBNZ announcement. On net, the AUD is tracking around ~1.07, near the bottom end of the range occupied since late-May. As expected the RBNZ kept rates on hold at 5.5%, and it repeated that a “prolonged period of subdued activity is required to reduce inflationary pressure”. We think the downward pressure on AUD/NZD can continue over the near-term. Dairy prices have started to turn up. This is partly seasonal but the forming El Nino weather pattern and dry hot conditions may create future supply issues. Added to that the mid-October NZ General Election might also (indirectly) give the NZD a helping hand. Polling points to a coalition led by the conservative National party coming to power. If realised, as the Nationals are looking to implement income tax changes to provide cost of living relief, markets may reduce future RBNZ rate cut expectations.

AUD levels to watch (support / resistance): 0.6170, 0.6250 / 0.6460, 0.6547