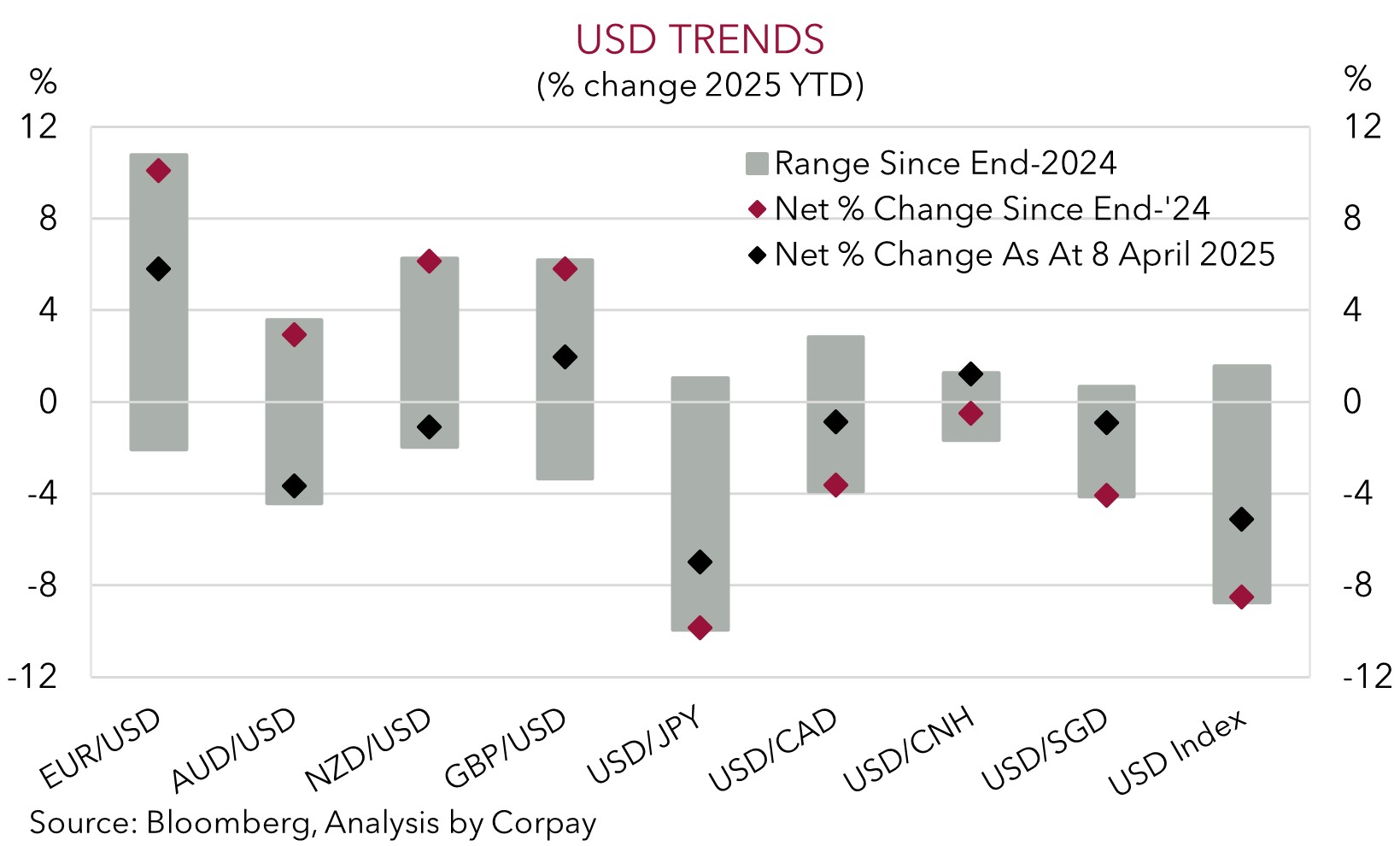

• US trends. US equities lost ground, as did bond yields & the USD. This helped currencies like EUR, AUD, & NZD lift. USD/JPY at multi-month lows.

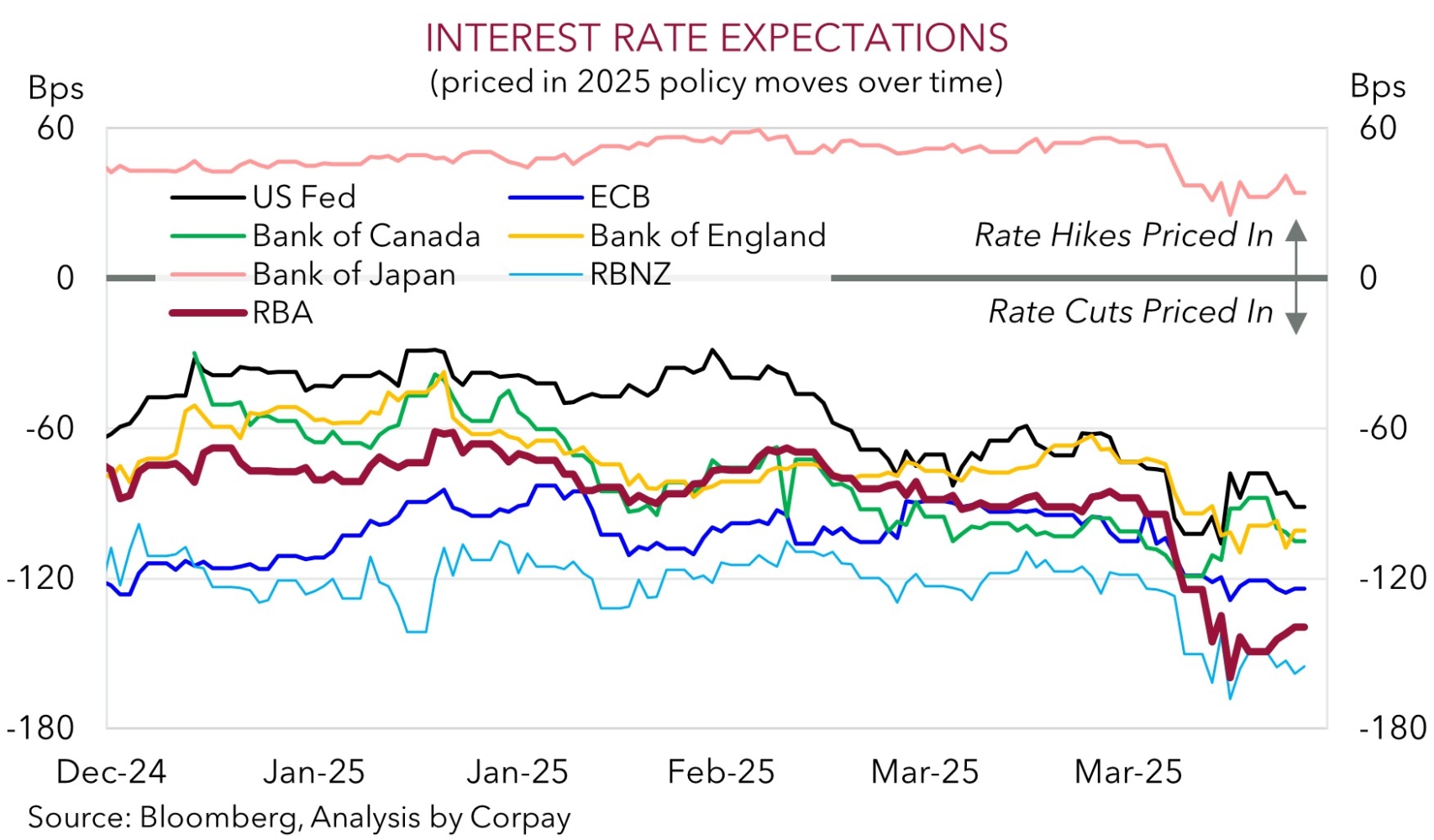

• Central banks. BoC surprised by keeping rates steady. US Fed Chair Powell indicated tariff impacts leave policymakers in a difficult spot.

• Macro events. NZ CPI a bit hotter than forecast. China growth stronger. AU jobs report due today. ECB also expected to cut interest rates again.

Global Trends

A ‘risk off’ tone returned to US markets overnight with equities losing altitude (S&P500 -2.2%, NASDAQ -3.1%) and bond yields declining for the third straight day (10yr yield -6bps to 4.28%). That said, there was a limited spillover into FX markets. Indeed, as per the recent swing in correlations the USD index drifted lower inline with the US equity market falls. EUR rebounded to be near ~$1.14 (the upper end of the range occupied since 2022), USD/JPY dipped to ~141.75 (a ~7-month low), and GBP edged higher (now ~$1.3242). Cyclical currencies like the NZD (now ~$0.5934) and AUD (now ~$0.6373) extended their respective upswings. The CAD also strengthened with the surprise decision by the Bank of Canada to keep interest rates steady after delivering seven consecutive cuts a factor. In a sign of the times the BoC ditched its usual point forecasts and reiterated that the uncertainty means they will “proceed carefully” as they see how President Trump’s trade policies take shape.

In terms of the drivers behind the overnight US market wobbles, yesterday’s announcement by megacap tech firm Nvidia that the US government requires it to have a license to export products to China dampened sentiment. As did comments by Fed Chair Powell who reiterated that while the economic impacts from tariffs will be larger than anticipated policymakers are “well positioned” to wait for clarity. He added that the situation is “a difficult place for a central bank to be” given the potential positive inflation and negative growth/employment ramifications of what is unfolding. The Fed’s ongoing attentiveness to the inflation side of its mandate suggests near-term interest rate relief is off the table, although it doesn’t mean it should be ruled out further down the track, in our opinion. On the growth side, US retail sales for March showed a pickup in spending. However, this largely reflected strength in auto sales, possibly due to a bring forward of activity as consumers looked to beat incoming tariff-related price hikes. ‘Control group’ retail sales, which feed directly into US GDP, were softer, another sign US economic momentum slowed in Q1.

In addition to the Australian jobs report (11:30am AEST), the ECB meets tonight (10:15pm AEST). Another 25bp ECB interest rate cut is predicted. Beyond the policy change, focus will also be on the ECB’s forward guidance. In our view, no strong signals about further easing could be EUR supportive. This in turn may keep the USD on the backfoot. As outlined previously, more headline driven bursts of volatility should be anticipated, however we remain of the view that downside US growth risks and shaken investor confidence can see the USD trend lower over the medium-term.

Trans-Tasman Zone

Despite the decline in US equities overnight the AUD and NZD have ticked higher over the past 24hrs. This is inline with the shifting correlation between currencies and equities (see above). The softer USD, as well as higher energy/base metal prices and positive surprises in yesterday’s China data, have provided a helping hand (see above). At ~$0.6373 the AUD is more than 7.5% from last week’s panic sell-off low, and above its ~6-month average. NZD (now ~$0.5934) has also nudged up to a fresh multi-month high. This morning Q1 NZ CPI inflation came in a little hotter than anticipated (2.5%pa) with firmer domestic prices (i.e. non-tradeables) something that may dampen the markets enthusiasm about additional aggressive RBNZ policy easing down the track.

In terms of the China data, annual GDP growth came in stronger than projected with the economy expanding at a 5.4%pa pace in Q1. The high frequency data was also solid with retail sales (+4.6%pa YTD), industrial production (+6.5%pa YTD), and fixed asset investment (+4.2%pa YTD) all picking up speed. The flow through from past stimulus efforts seems to be gaining traction, and there is also likely to have been bring forward of production/spending to beat US tariffs. As mentioned before, to combat the headwinds in China’s export sector from US trade policy we expect authorities to pull more stimulus levers to boost domestic demand. This is where Australia’s key exports are plugged into. Over time, we feel this can help the AUD, which still looks a bit undervalued even after the sharp rebound that has come through (the AUD is trading a couple of cents under our suite of ‘fair value’ models).

Today, the monthly Australian labour force data is due (11:30am AEST). This data set can be volatile. We believe there is scope for monthly employment to snap back after the surprising fall in February. A lot of the weakness last month seems to have been because of older employees delaying a return to work. If this is correct employment could recover. We think signs the Australian jobs market is still on solid ground might see markets pare back some of the built-up RBA interest rate cut expectations and this can be AUD supportive. Interest rate markets are factoring another ~120bps worth of RBA interest rate reductions by year-end, with odds of an outsized 50bp move being delivered in May still somewhat elevated (now deemed a ~24% chance).