Given its influence over US monetary policy and interest rates, which in turn shape broader asset and FX markets, trends in US inflation are critical to watch. Indeed, we would argue that while Australia’s inflation pulse influences domestic interest rates and the AUD, these impacts are swamped by US inflation developments as they can affect not only US macro-outcomes but also global growth expectations, credit spreads, commodity prices, global equities, and world bond markets.

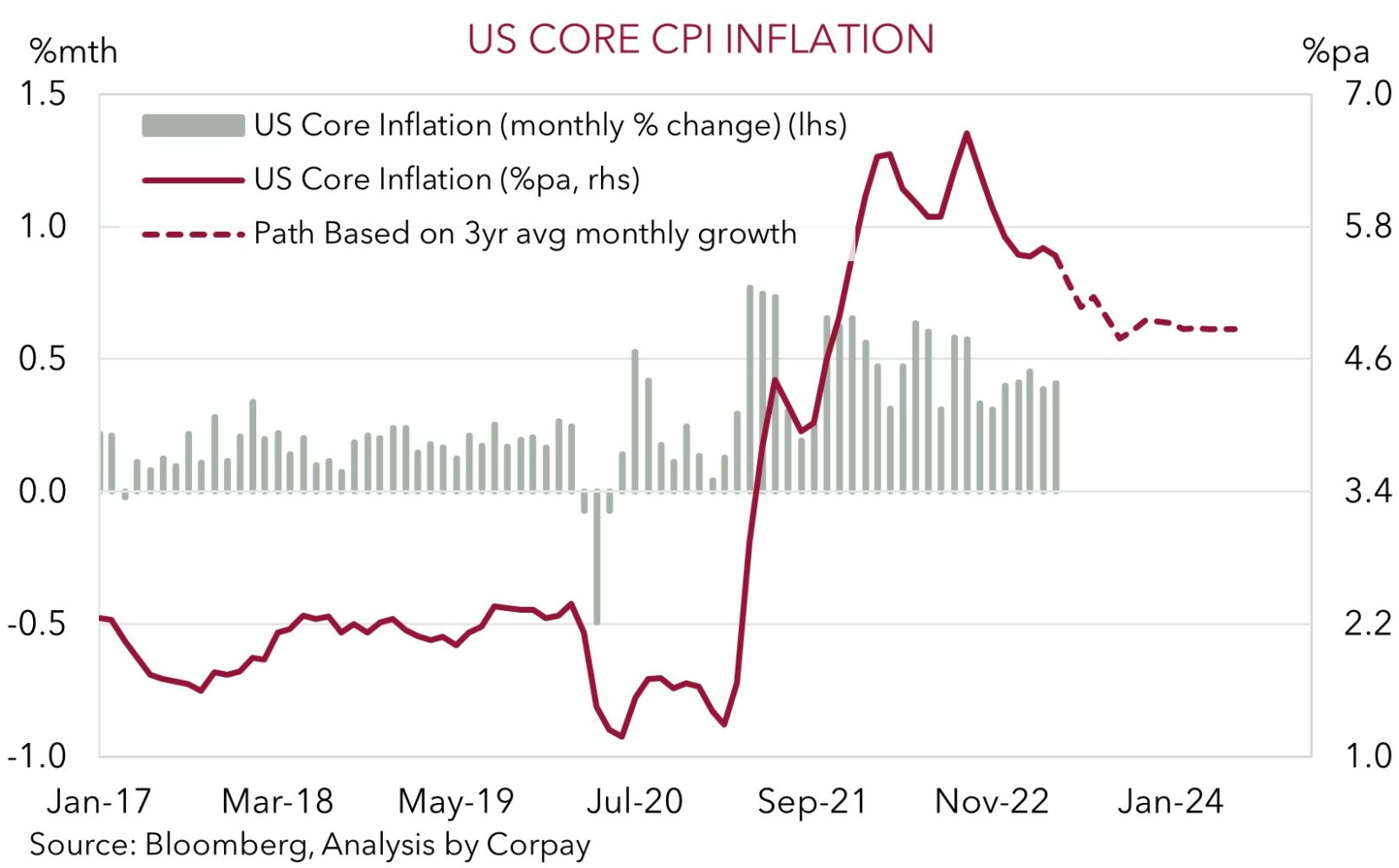

At a topline level, the April reading of US inflation shows that things are moving in the right direction. ‘Peak’ inflation is behind us, but genuine progress remains gradual, and we doubt Fed policymakers are as eager to declare ‘mission accomplished’ as what interest rate markets now imply. In terms of the numbers, US headline inflation cooled ever so slightly from 4.987%pa to 4.957%pa, with core inflation (i.e. excluding food and energy) still tracking at an uncomfortably high 5.5%pa (down from 5.6%pa last month). Markets, particularly bond participants, appear to have been buoyed by a slowing in services inflation excluding housing, a sub measure closing watched by the US Fed. However, a closer look suggests some outsized, and likely temporary falls, in travel related components were a driver. Other non-housing services prices remain strong, consistent with the still tight US labour market and high wage growth, which in our view indicates the battle against inflation is far from over.

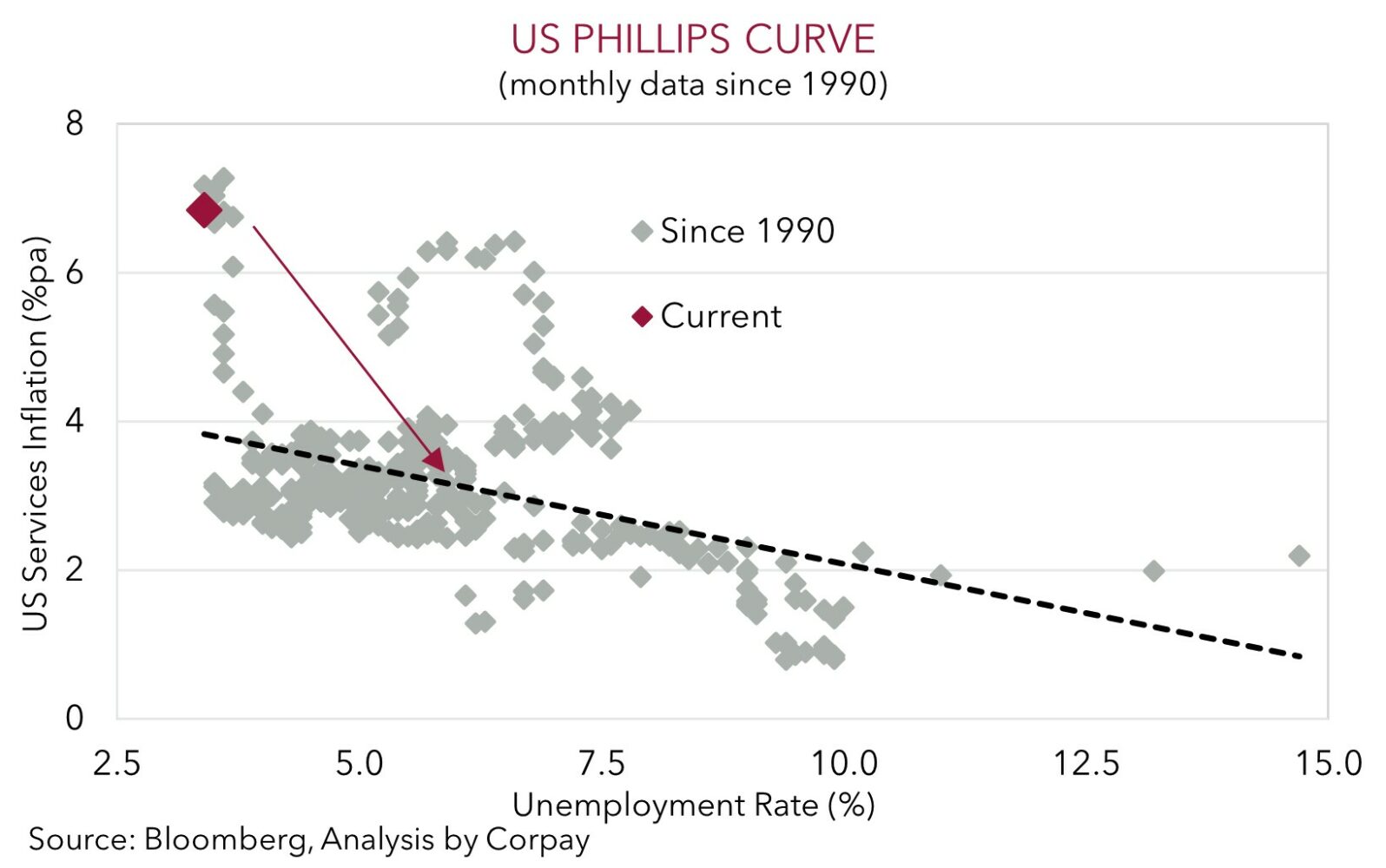

Looking ahead, while annual US inflation should mechanically moderate a bit further over the next 1-2 months, as the last of last year’s large price rises roll out of calculations, on our reading of the various inputs it looks like inflation could settle well north of the Fed’s target once these base-effects run their course. Specifically, services driven inflation tends to be quite sticky. Services inflation takes time to unwind, with a recession and higher unemployment typically needed to bring down wages. As our scatter chart shows, to get US services inflation to a rate more consistent with the Fed’s target, US unemployment (now 3.4%) may need to rise towards ~5-5.5%. Although there has been some softening across the US labour market, things are still a long way from where they need to get to.

Expectations for US Fed policy have swung around substantially over the past little while. Notably, not only are interest rate markets assuming the US Fed won’t lift rates any further from here (the Fed funds target range is now 5-5.25%), but a rate cutting cycle is now also expected to start quite soon. Markets are baking in nearly half a rate cut by the July 2023 Fed meeting and around four full rate cuts by January 2024. The downward adjustment in US rate expectations has weighed on the USD recently, and this has helped push the AUD up towards the top of its multi-month range.

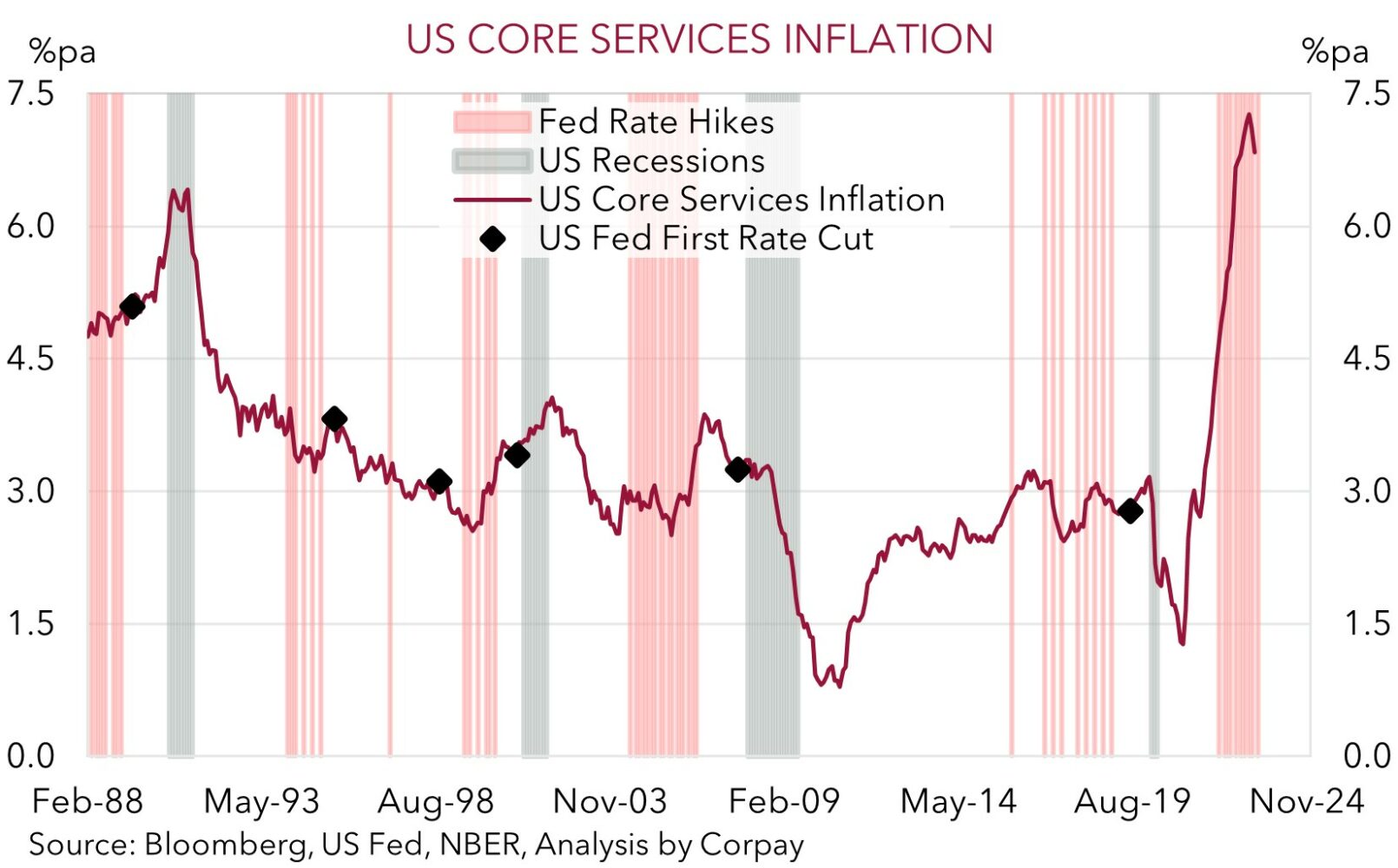

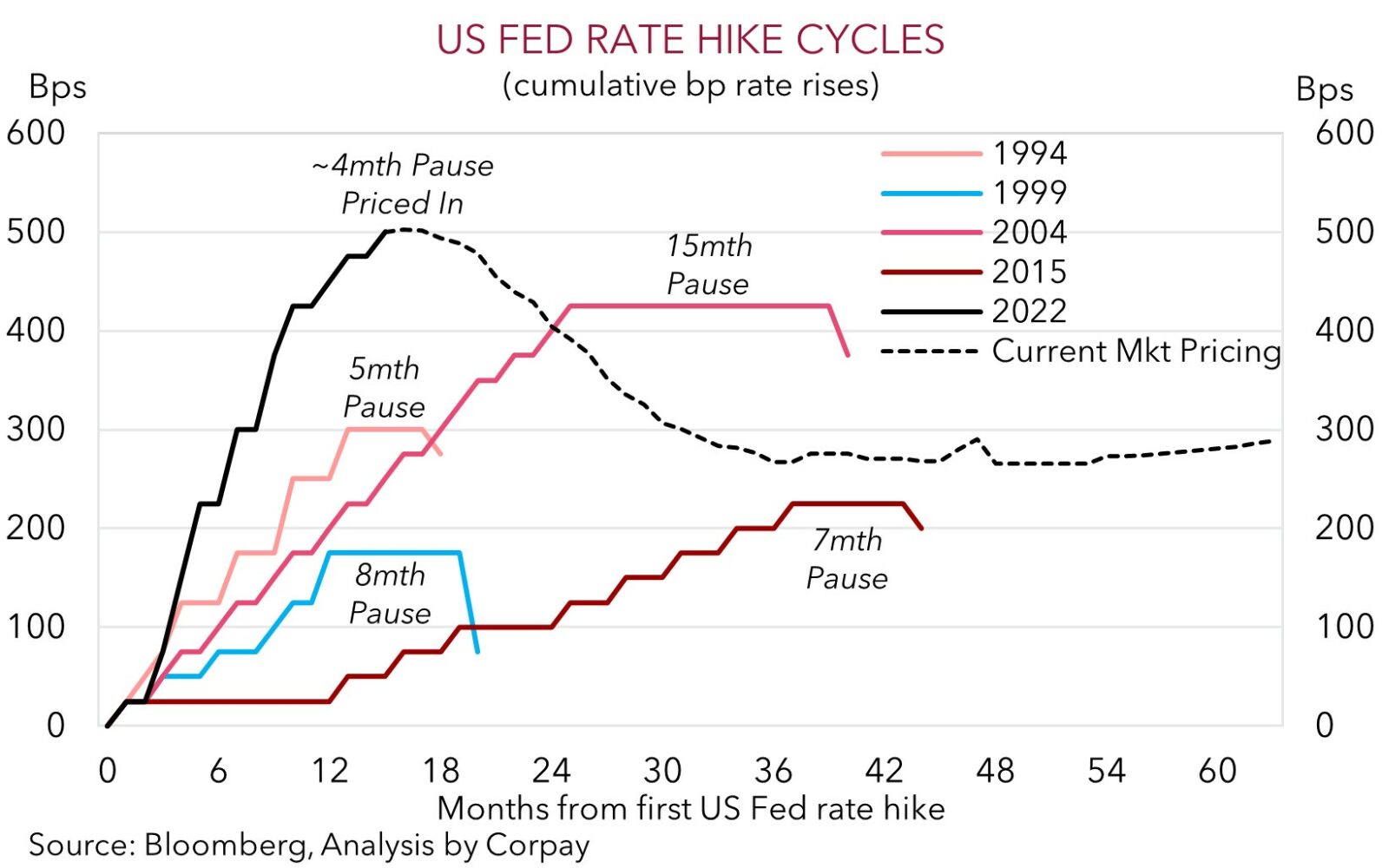

From our perspective, the embedded optimism regarding how far/fast US inflation may slow and what this could mean for US interest rates and the USD over coming months is at risk of unravelling given the tight US labour market, still high core inflation, and the US Fed’s resolve to keep settings ‘restrictive’. Barring an exogenous shock (which would also be quite a negative for risk markets and the AUD) we don’t think the market’s current outlook for the US Fed is consistent with historical trends and US’ underlying inflation dynamics. The US Fed is a student of history. A key lesson from the 1970’s experience was that policymakers should err on the side of doing too much in the first instance to ensure the inflation dragon has truly been slayed, so that further rate rises (and an even bigger economic downturn) don’t eventuate down the line. More recent history also suggests US Fed rate cuts could be some way off. As our charts illustrate, over the past five US Fed easing cycles, core services inflation (now 6.8%pa) has averaged ~3.1%pa at the time of the first cut, while the average gap between the last hike and first easing has been ~9-months. Given the current inflation challenges, we believe the time gap is more likely to be above rather than below average this cycle.

In our opinion, risks are skewed to complacent and short-sighted markets being caught out and for aggressive US Fed rate cut bets to be pared back over the period ahead. An upward adjustment to a ‘high for longer’ plateau in US interest rates could see the USD recover some lost ground. This in turn could generate renewed headwinds and act to bring the AUD back down, particularly as it is likely to be occurring at the time the global growth slowdown is intensifying. This fits in with our existing bigger picture thinking looking for the AUD/USD to remain within a ~$0.66-0.6850 range over the next few months, before kicking on into the low ~$0.70s by early-2024 as the worst of the downturn passes, and cyclical currencies like the AUD receive a boost from improved risk appetite and a relative improvement in global growth momentum.