• Market jolt. A slowdown in US inflation & weaker retail sales revived Fed rate cut expectations. US yields & the USD lower. Equities & AUD higher.

• AUD outperformance. The backdrop & diverging monetary policy expectations have boosted the AUD. AUD/USD at a ~4-month high.

• AU jobs. The monthly jobs report is due today. There have been some wild swings in recent months. A solid report could give the AUD more support.

The latest read on US CPI inflation and retail sales took center stage overnight. And as we had been flagging in our recent Market Briefings and weekly Currency Chat Podcast a soft set of figures revived US Fed rate cut expectations, weighed on the USD, and boosted risk assets like equities and the AUD.

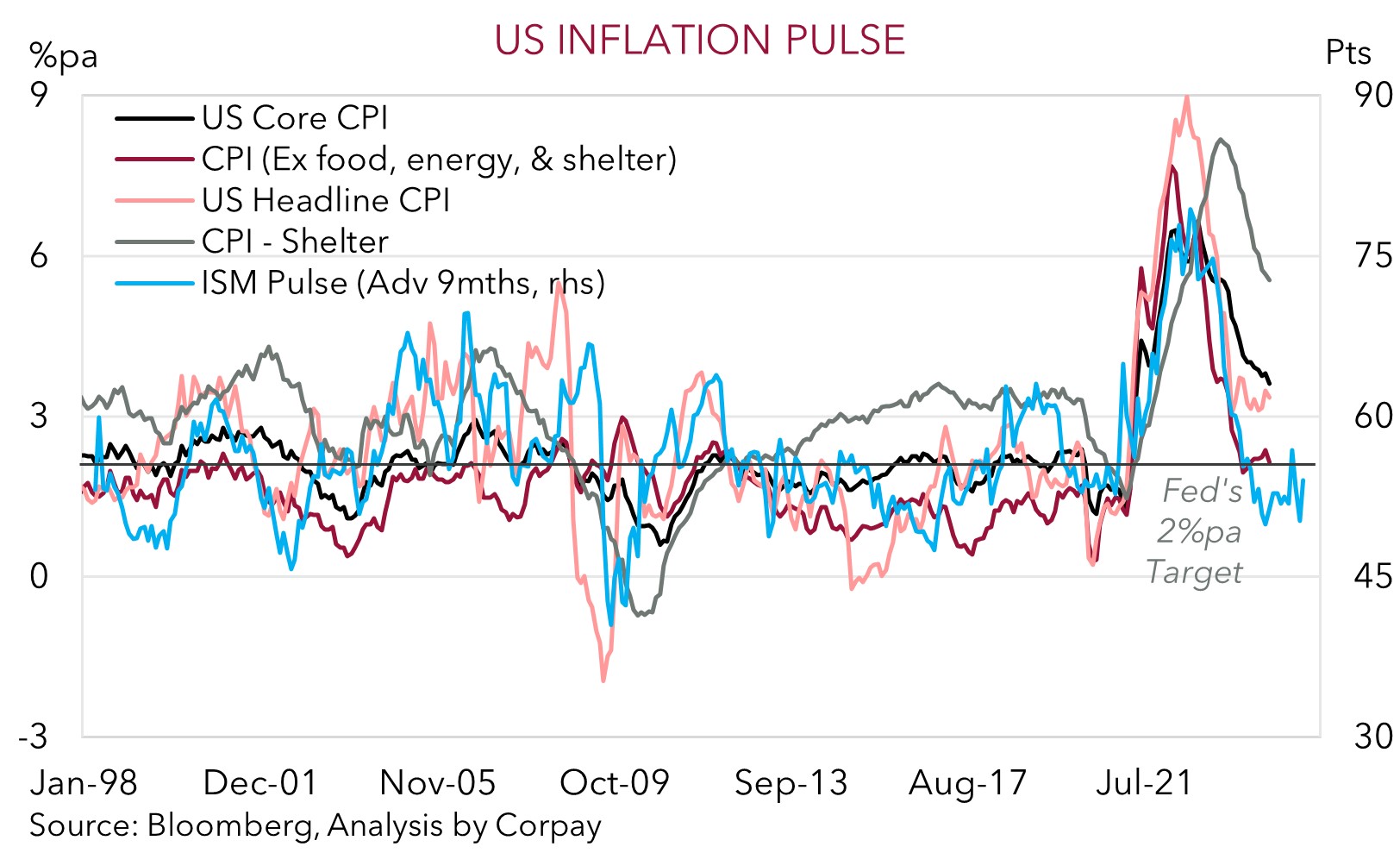

In terms of the data, after the string of higher-than-expected prints at the start to the year US core CPI inflation decelerated in April with a moderation in the monthly pace pushing the annual run-rate down to 3.6%pa, a 3-year low. Importantly, while services inflation is still elevated, there were welcomed signs of improvement. Slow-moving shelter/rents eased, and a large jump up in auto insurance prices in April explained the bulk of the monthly performance in core services inflation. Things are moving in the right direction, albeit more gradually than previously anticipated, but we think US Fed officials would be somewhat encouraged by the outcome, especially given the signals from leading indicators and with economic activity slowing. US retail spending (the engine room of the US economy given household consumption accounts for ~¾’s of GDP) also undershot forecasts. The retail sales ‘control group’ (which feeds into US GDP) fell 0.3% in April, and there were downward revisions to prior months. With COVID-era ‘excess savings’ dwindling, consumer confidence below average, and the labour market softening, headwinds for US consumer spending are building.

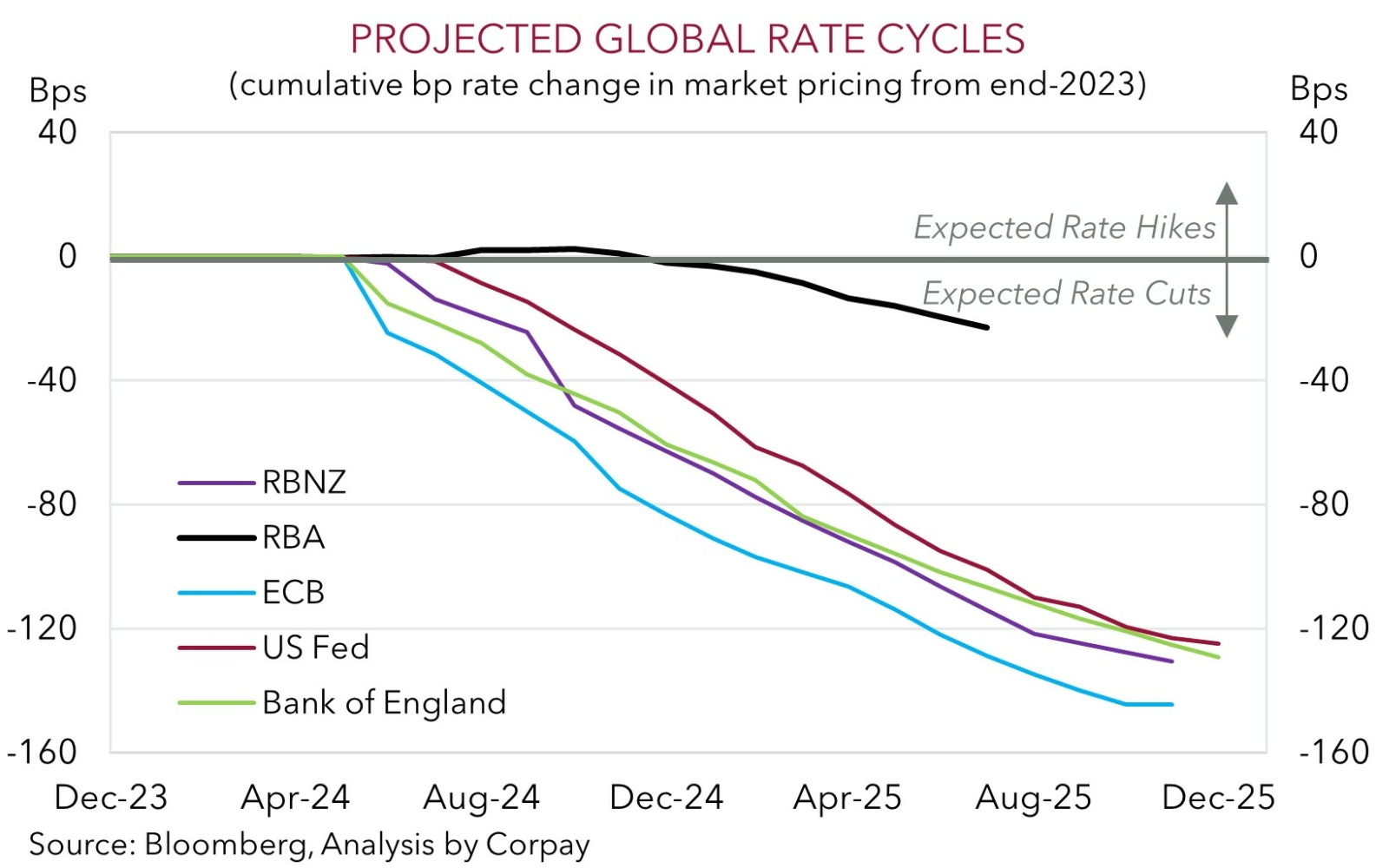

US interest rate expectations adjusted in the wake of the data. The first US Fed rate cut is now factored in by September, with a second move discounted by year-end. US bond yields declined ~10bps across the curve with the US 2yr rate now down at 4.72%, a 1-month low. The rekindled US Fed easing assumptions underpinned equities with the S&P500 (+1.2%) hitting a fresh record high. Base metal prices were also firmer with copper extending its upswing. In FX, lower US yields exerted downward pressure on the USD with EUR (now ~$1.0880) at the top of its 6-week range. GBP also rose (now ~$1.2685), while USD/JPY (-1% to ~154.80) and USD/SGD (now ~1.3450) dipped. Cyclical currencies like the NZD (+1.3% to ~$0.6117) and AUD (+1% to ~$0.6690) outperformed.

We think the USD should remain on the backfoot in the near-term as markets continue to tinker with their US Fed easing views. Further weakness across the incoming US data could see rate cut expectations pick up further. This would be a drag on the USD, in our view, as would signs of a relative improvement in non-US economic growth. The China activity data is due tomorrow, and we believe activity is likely to have accelerated in the year to April.

AUD Corner

The weaker USD stemming from the repricing in US interest rate expectations following the slowdown in US CPI inflation and weak US retail sales print has propelled the AUD higher. At ~$0.6690 the AUD is at a ~4-month high, with the upbeat market mood also helping the AUD appreciate against the EUR (now ~0.6150) and GBP (now ~0.5275). AUD/EUR and AUD/GBP are now at the upper end of their respective multi-month ranges. AUD/CAD (now ~0.9105) has risen to its highest level since last June, and AUD/CNH (now ~4.83) is also at a ~4-month high. By contrast, AUD/NZD has lost a bit of ground with the NZD slightly outperforming in the ‘risk-on’ environment.

Locally, Q1 wage data was released yesterday. Annual wage growth was slightly below forecasts and is running at 4.1%pa. This was broadly inline with the RBA’s thoughts that wages growth has started to moderate in parts of the private sector. While the slightly earlier/lower peak in wages should alleviate some of the ‘hawkish’ risks for the RBA, our assessment that the RBA is on a different path to many of its peers in terms of when it starts and how far it goes during the next easing cycle remains intact given the stickiness in domestic services inflation, support from the incoming stage 3 tax cuts, and with China’s economy starting to turn the corner.

Today, the April Australian labour force report is due (11:30am AEST). After a few wild swings over recent months jobs growth in line with the current above average underlying trend pace is projected (mkt +23,700). Although due to the surging population this could still see unemployment nudge up a fraction (mkt ~3.9%). Nevertheless, these types of outcomes would confirm that overall labour market conditions remain tight by historical standards, albeit not as tight as they were a year ago. In our opinion, a solid labour market report could reinforce the diverging monetary policy expectations theme with a flow on adjustment in bond yield differentials AUD supportive, not just against the USD but also versus EUR, GBP, and CAD given their central banks are nearing the start of their interest rate cutting cycles.