• Partial unwind. Quieter markets overnight. US equities ease, bond yields rebounded, & the USD was a bit firmer. AUD gave back some ground.

• AU jobs. Employment positive, but unemployment ticked up more than predicted. Seasonality may have been at play, as it was earlier in the year.

• China data. RBA still looks set to lag its peers. Yield differentials should be AUD supportive. As would signs of improvement in China’s growth pulse.

Compared to the post US CPI moves a day ago markets were a bit quieter overnight with some retracement coming through. After touching a fresh record high US equities drifted back late in the session to end the day fractionally lower (S&P500 -0.2%). By contrast, US bond yields rose. A larger increase in the US 2yr rate (+7bps to 4.79%) flattened the yield curve slightly. The second tier US data released overnight was mixed with housing starts/building permits and industrial production softer, while weekly initial jobless claims (a measure of how many people applied for unemployment benefits) improved.

Rather than the data it looks like US interest rate expectations reacted more to a now familiar uniform call for ‘patience’ from US Fed officials. Fed members Mester, Williams, Barkin, and Bostic all reiterated a ‘higher for longer’ interest rate mantra with policymakers wanting to see a few more US CPI prints to be sure the disinflation trend is reasserting itself and interest rates can be recalibrated lower. Markets unwound a little of the post-CPI repricing with the first full rate cut by the US Fed once again not discounted until November. A second move by the US Fed is factored in by January.

The rebound in front-end US yields helped the USD claw back ground. USD/JPY edged back up towards ~155.40. EUR (now ~$1.0870) and GBP (now ~$1.2670) eased a touch. And although USD/SGD (now ~1.3460) and NZD (now ~$0.6120) tread water the uptick in Australian unemployment and slight adjustment in RBA expectations pushed the AUD modestly lower (now ~$0.6675).

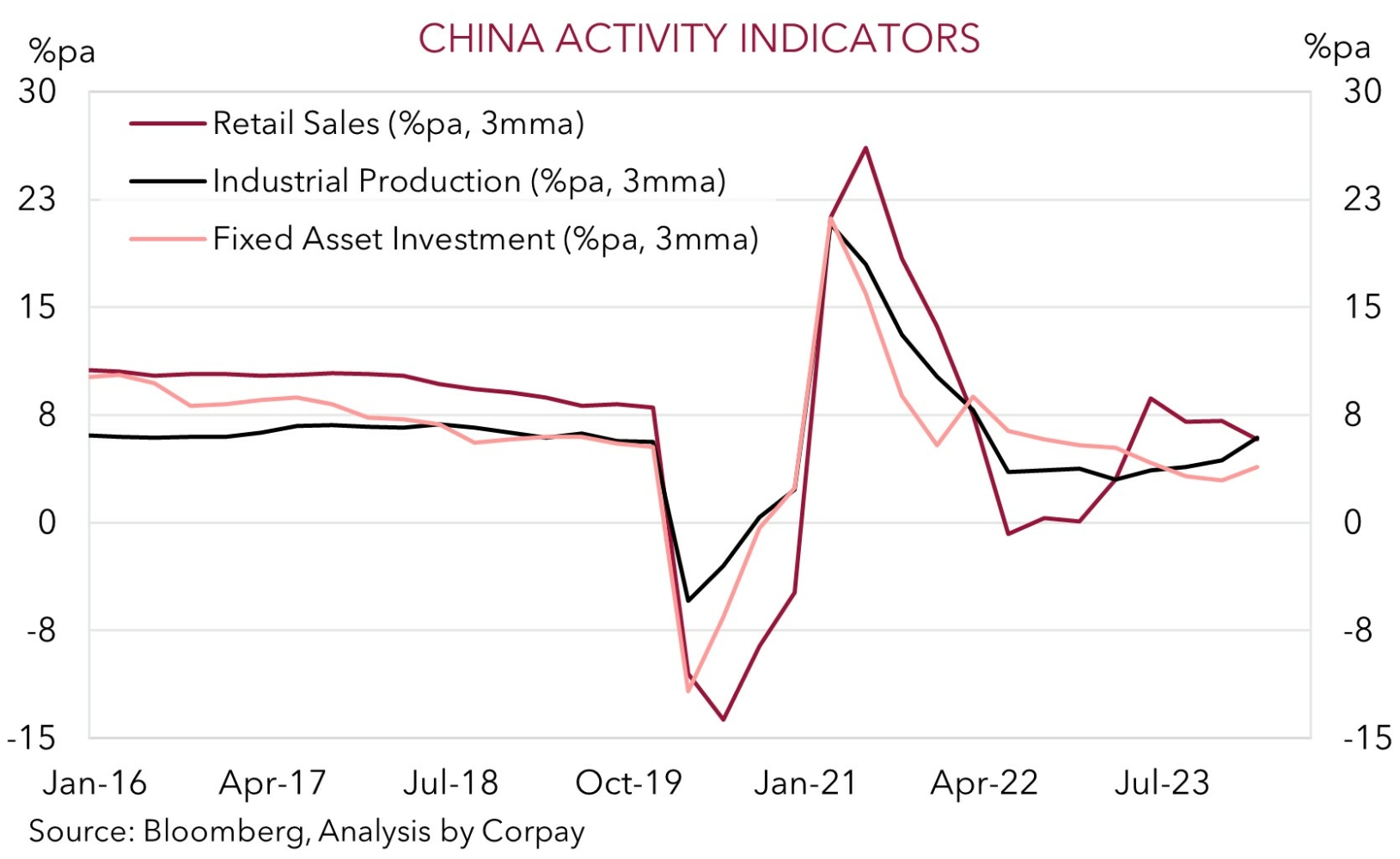

Today, focus will be on the China activity data for April (12pm AEST). After some lackluster Lunar New Year impacted data last month, annual growth of retail sales, industrial production, and fixed asset investment is projected to accelerate as stimulus measures gain more traction. From our perspective signs of improvement in China at the same time US activity is slowing could exert pressure on the USD as growth differentials shift against the US.

AUD Corner

After touching a 4-month high in the wake of the US CPI report the AUD drifted back a little (now ~$0.6675) as the mix of a partial rebound in the USD overnight and soft underbelly in yesterday’s Australian jobs report exerted some downward pressure. The AUD also slipped back against most of the other major currencies with falls of 0.1-0.2% recorded against the EUR, GBP, CAD, and CNH over the past 24hrs. AUD/NZD has shed ~0.3% to be back down near its 50-day moving average (~1.0907).

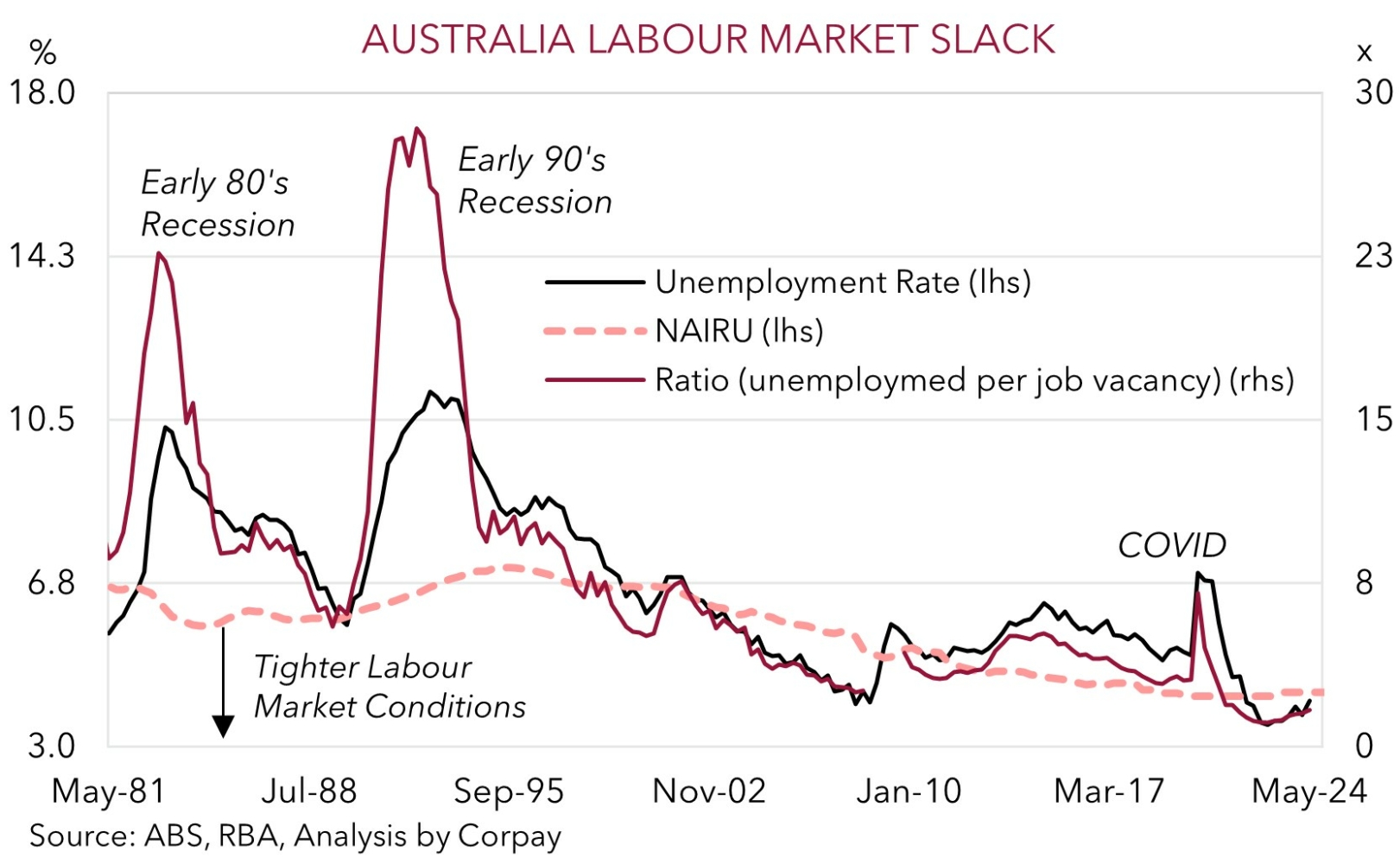

In terms of the data, some typical labour force statistical jiu-jitsu was again on display. Total employment rose 38,500 in April, driven by a jump in part-time jobs (+44,600). The labour force participation rate increased (now 66.7%), and this was a factor behind the bigger than predicted uptick in unemployment (now 4.1%). While this puts unemployment ~0.6%pts above last year’s historic lows, this is still below ‘full employment’ with much of the gentle upturn due to greater labour supply thanks to robust population growth rather than job losses. Mathematically, the larger population means more jobs now need to be created each month compared to pre-COVID just to keep unemployment steady (i.e. ~35,000/mth vs ~18,000/mth pre-COVID). That said, although labour market conditions are loosening we believe the April labour force data may have also been negatively impacted by some seasonality. The ABS noted that in April “more people than usual” deemed to be out of work “had a job that they were waiting to start in”. Something similar occurred in early-2024, and an unwind might see the unemployment rate fall back in May.

Overall, while the slowly emerging cracks in the labour market should see the RBA refrain from hiking rates again we think rate cuts are still some way off. The still ‘tightish’ labour market, elevated wages and rents, and Australia’s lackluster productivity means the services/core inflation challenge is far from over. This, and the income support from the stage 3 tax cuts, underpin our long-held view that the RBA could lag its global central bank counterparts in terms of when it starts and how far it goes during the next easing cycle. Diverging monetary policy expectations between the RBA and others should see yield differentials progressively turn more AUD supportive over time, in our view (for more see Market Musings: AUD outperformance to continue?). As would signs of improvement in global industrial activity and China’s economy. We believe an acceleration in commodity intensive Chinese industrial production and fixed asset investment (12pm AEST) could help the AUD bounce back.