• Mixed markets. US equities consolidated, while yields ticked up. The USD tread water, however the AUD outperformed with industrial metals firmer.

• China measures. China announced various steps aimed at absorbing excess inventory & propping up the property market. This is a positive for the AUD.

• Event radar. US Fed speakers will be in focus. CPI data out of Canada & the UK also due, as are the latest PMIs. RBNZ meets on Wednesday.

Most of the major global equity markets were little changed on Friday with the US S&P500 ticking a bit higher (+0.1%) and the key European indices a touch lower (EuroStoxx50 -0.2%). The Hong Kong and China markets were an exception with gains of ~1% recorded thanks to a strong performance across property related stocks. While the China activity data was a mixed bag relative to expectations (industrial production was stronger than forecast, while retail sales was weaker), developments on the policy front were more significant. Chinese authorities fired several arrows aimed at absorbing excess inventory and propping up the beleaguered property sector. The list of measures included scrapping the floor on mortgage rates, lowering the minimum downpayment, urging local governments to buy unsold homes, and creating a re-lending program to help government backed firms purchase excess stock from developers. These more forceful steps reinforce our thinking that policymakers in China just won’t sit idle and accept a sluggish growth. Even more measures could be unveiled down the track, in our view.

The announcements helped push up industrial metal prices with copper (+4.2%) closing at a new high and iron ore firmer (+0.9%). In FX, the moves helped the AUD edge back up towards ~$0.67 and outperform on the crosses. Elsewhere, the USD index was flat despite US bond yields drifting higher (US 10yr +4bps to 4.42%) after more cautious comments from the usually ‘hawkish’ US Fed Governor Bowman. Not to be out done, ECB exec board members Schnabel and Holzmann also tried to curb the markets interest rate cut enthusiasm. According to Schnabel although a rate cut in June “may be appropriate”, in her view the data may not warrant a follow up move as soon as July. Similarly, Holzmann warned of the risks of easing too soon as it could reignite inflation. Across the FX majors modest gains by the USD against the JPY offset some USD softness against GBP, with EUR/USD treading water around ~$1.0870.

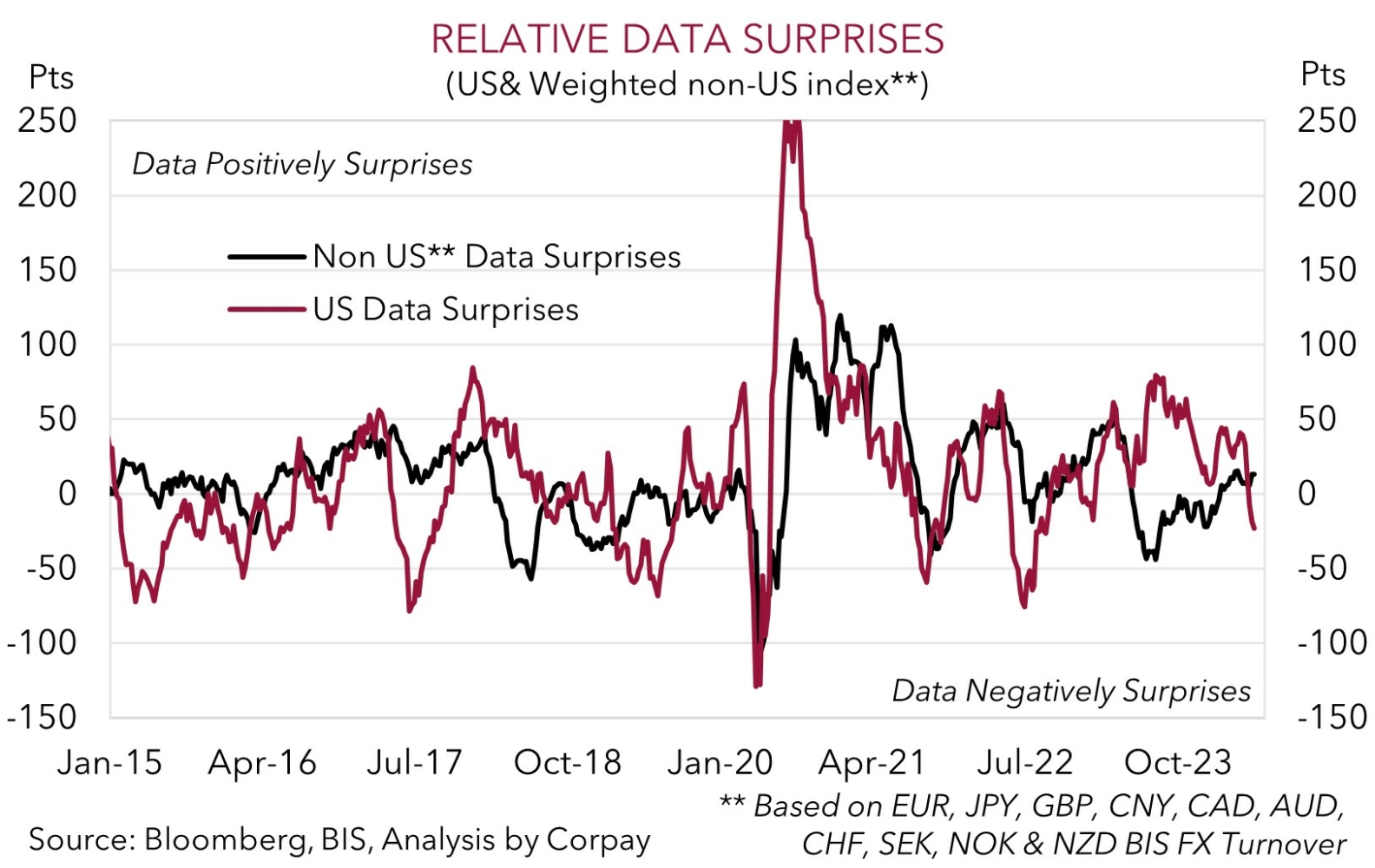

In the US the economic calendar is light this week with a few Fed speeches in focus. Vice Chair Jefferson is discussing the outlook (Tues 12:30am AEST) with influential Governor Waller also on the schedule (Tues 11pm AEST and Fri 11:35pm AEST). We believe Fed policymakers should reiterate the central case that they think settings are ‘restrictive’, but they just need more time to work, and/or if the labour market loosens and inflation moderates as anticipated some policy easing later this year is still on the table. In our opinion, given what is already priced into interest rate markets, this type of message, coupled with signs of improvement in the Eurozone business PMIs and softer US PMI prints (Thurs AEST) could see the USD slip back. As our chart shows, the US economic data has tended to come in weaker than forecast recently with data across the other major economies holding up.

AUD Corner

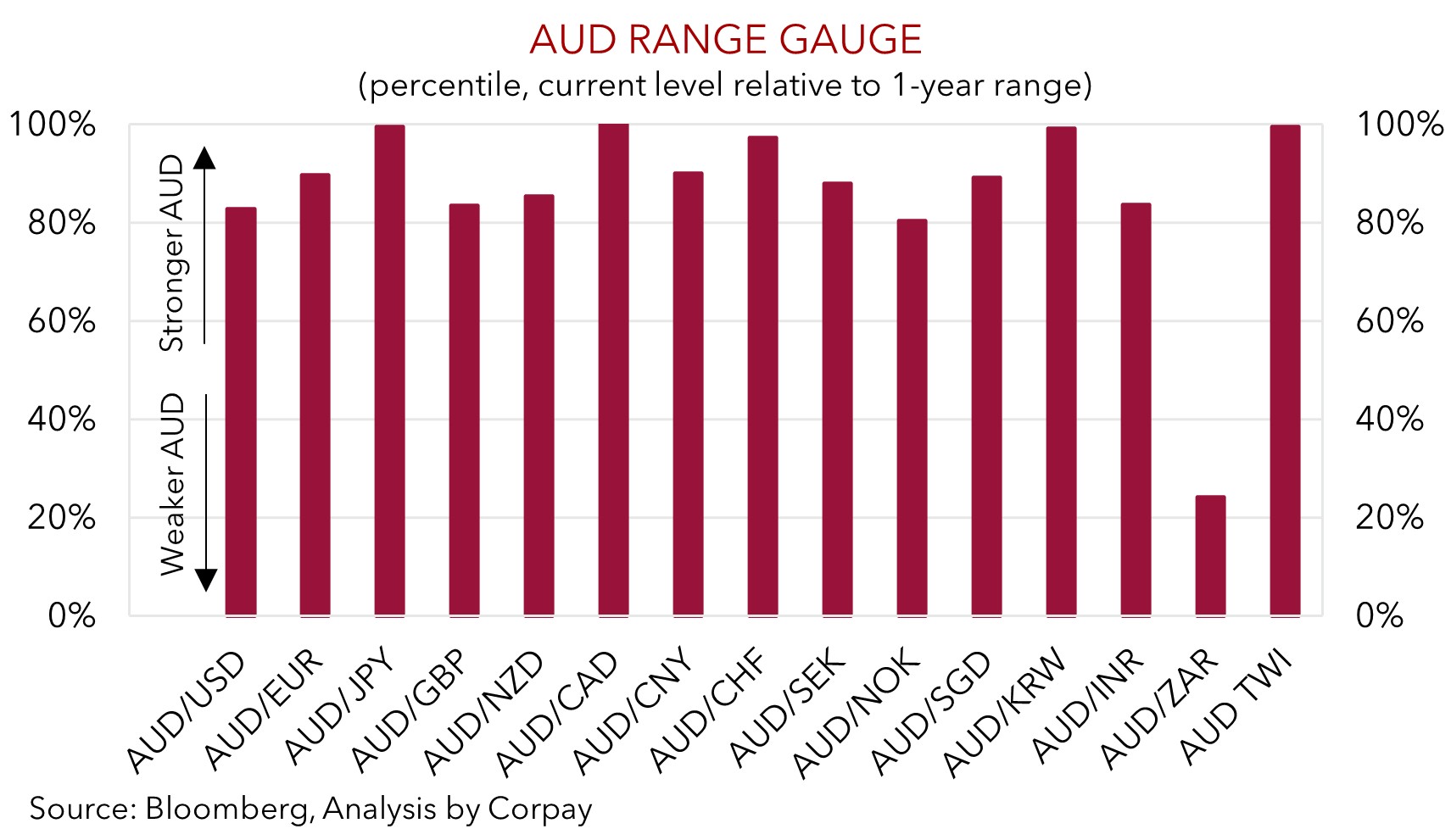

Firmer industrial metal and energy prices, buoyed by the latest round of initiatives out of China to support the property market (see above) helped the AUD edge up at the end of last week. At ~$0.6695 the AUD is just below its ~4-month highs. The backdrop also helped the AUD outperform on the crosses. AUD/EUR (now ~0.6160), AUD/GBP (now ~0.5272), and AUD/CNH (now ~4.8420) are near the top of their respective multi-month ranges. AUD/CAD (now ~0.9110) is around a 1-year high while AUD/JPY (now ~104.21) is 0.7% from its late-April peak.

This week the local macro calendar is limited. The RBA meeting minutes (Tues) are unlikely to add much to the interest rate debate given the post-Meeting press conference and detailed update contained in the Statement on Monetary Policy. But we think unfolding macro trends can be AUD supportive, especially as the average across our suite of models suggests AUD/USD is still ~2 cents below ‘fair value’. In our opinion, the policy measures announced in China should be a positive jolt for sentiment across the property sector, which in turn is likely to be a tailwind for industrial metals and growth linked currencies like the AUD.

Added to that, we remain of the view that the RBA is on a different path to its major global counterparts in terms of when it might start and how far it goes during the next easing cycle due to the stickiness in domestic services inflation, income support from the stage 3 tax cuts, and fiscal impulse. As we have highlighted, diverging monetary policy expectations between the RBA and others could see yield differentials progressively turn more AUD supportive over time (see Market Musings: AUD outperformance to continue?). This may be reinforced this week on some of the crosses. We believe the AUD’s positive run against CAD and GBP might continue as CPI data from Canada (Tues AEST) and the UK (Weds AEST) looks set to show a moderation in core inflation. If realised, this would solidify expectations that rate cuts by the Bank of Canada and Bank of England are set to kick off in the next few months.

AUD/NZD, which has fallen back towards its 50-day moving average (~1.0910), will also be in the spotlight with the RBNZ meeting on Wednesday. Interest rates should be left on hold at 5.5%. The RBNZ is facing a growth inflation trade-off given the NZ economy is underperforming and the labour market is cracking, yet domestic inflation is still elevated. We expect the RBNZ to reiterate that ‘restrictive’ settings may be needed for a little while longer, but there is a chance it starts to open the door to easing down the track by lowering the odds of another hike in its forecast track and possibly projecting the first rate cut sooner than its current Q2 2025 start date. This may see AUD/NZD bounce back.