• Quiet start. Minimal moves in equities, bonds & FX overnight. AUD little changed despite the jump in base metal prices.

• AU Budget. A lot has been pre-announced. Relief measures look set to be designed to lower near-term headline CPI. But this may not impact core CPI.

• US & UK data. Ahead of the US CPI report, US Producer Prices are released tonight. Fed Chair Powell also speaks. In the UK, jobs/wages data is due.

A quiet start to the new week. The limited news flow has kept markets range bound. The US S&P500 ended the session unchanged. US bond yields also consolidated with the benchmark 10yr rate a fraction lower (now 4.49%). Across FX, the USD index tracked sideways with a softer JPY offsetting a slight uptick in EUR and GBP. USD/JPY has edged back above ~156 and has now unwound about half of its late-April/early-May Japanese intervention driven pull-back. Elsewhere, USD/SGD is treading water near ~1.3540, the NZD is where it was this time yesterday (now ~$0.6017), as is the AUD (now ~$0.6608). The AUD has shown limited reaction to the strength in base metal prices with copper (+2.3%) touching a fresh cyclical high in response to news that China’s Finance Ministry will sell a batch of ultra-long ‘special’ government bonds later this week. These types of bonds are usually used to fund commodity intensive infrastructure investment.

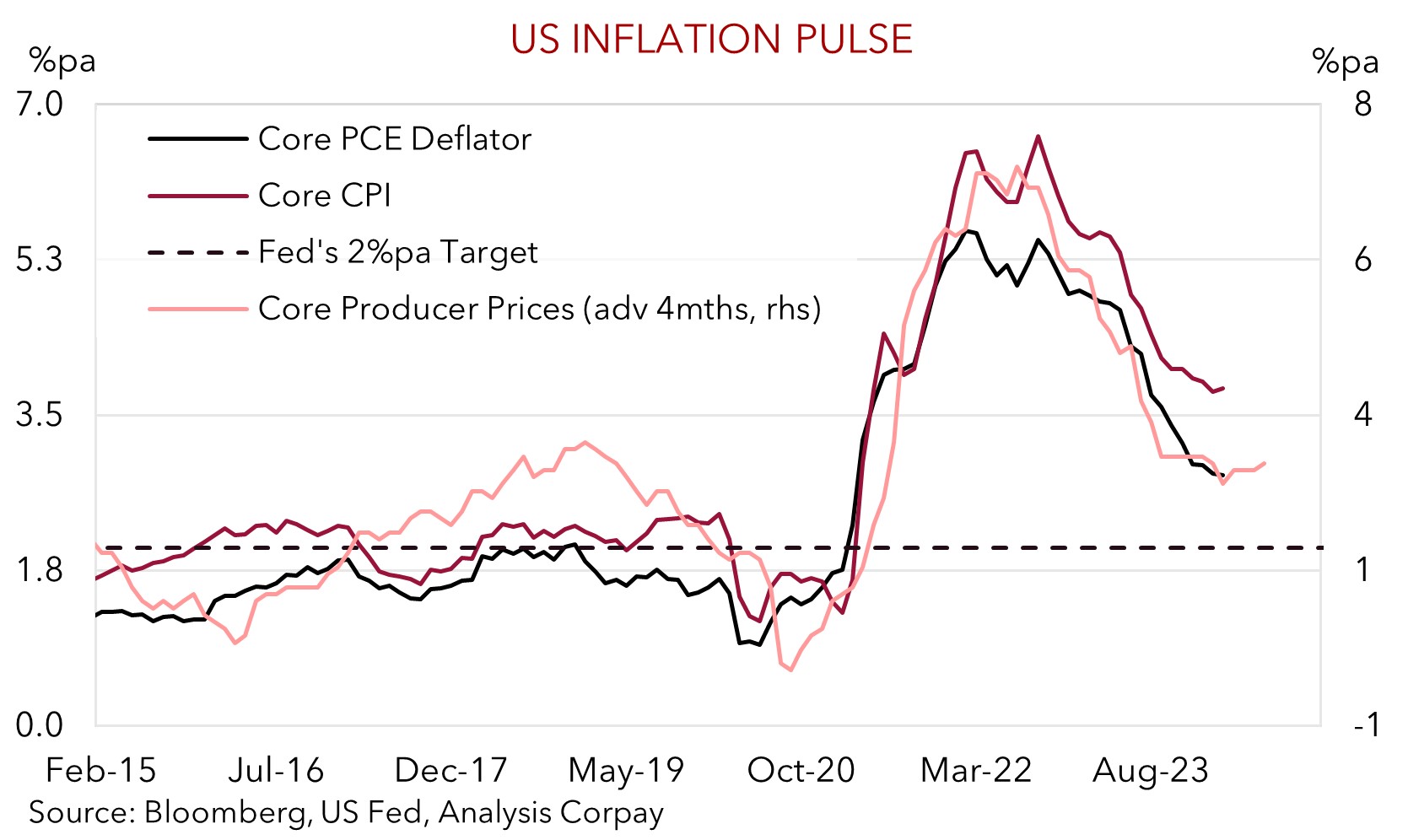

The April reading of US CPI inflation is the markets focal point this week (Weds night AEST). But ahead of that the US Producer Price Index is due (10:30pm AEST) and Fed Chair Powell is speaking at a banking event in the Netherlands (12am AEST). The PPI provides an imperfect gauge of upstream price pressures. Nevertheless, markets will be sensitive to the results given the laser-like focus by central banks on inflation trends. The US data is expected to show annual growth in core producer prices eased, which if realised, should support our thoughts and the broader market expectations that underlying CPI inflation moderated in April after the strong start to the year. Signs of receding inflation could revive longer-dated US Fed policy easing bets and drag on the USD, especially if Fed Chair Powell reiterates his views that the next move in rates should be down not up. Interest rate markets are factoring in the first US Fed rate cut by November with a second move fully discounted by January.

Later today the latest batch of UK labour market data is also released (4pm AEST). The report is forecast to show the cracks in the UK jobs market are widening with employment contracting, unemployment nudging higher, and wages moderating. This type of mix may reinforce assumptions that the Bank of England might begin its rate cutting sooner rather than later and exert some downward pressure on GBP, in our view. Markets are penciling in the first full BoE rate cut by August, with a ~50% chance assigned to a move occurring at the late-June meeting.

AUD Corner

The AUD has held steady at the start of the new week, in line with the minimal net moves in other major currencies. This is despite the jump in base metal prices on the back of the announcement in China that additional ‘special’ government bond issuance aimed at funding infrastructure investments would kick off later this week (see above). At ~$0.6607 the AUD is slightly above its ~6-month average. On the crosses, the AUD has had a mixed 24hrs although moves have been limited. The AUD has softened modestly against EUR and GBP, while it outperformed the JPY. AUD/JPY has clawed its way back above ~103 over the past week and is less than 2% from its late-April cyclical peak as the impacts from Japanese FX intervention wanes.

Locally, the monthly NAB business conditions survey was released yesterday. It showed that tighter monetary policy is having an effect. Overall conditions eased with the three main subcomponents (profitability, trading, and employment intentions) dipping back to around their respective long-run averages. A period of below trend economic growth is anticipated. There was also some moderation in labour and input costs, a positive sign for a further gradual improvement in inflation.

Tonight, local attention will be on the Federal Budget (7:30pm AEST). As is the norm a lot of the topline figures and initiatives have been pre-announced. Some more measures are likely to be unveiled tonight with subsidies for low-to-middle income households a key focus. These measures look set to again be crafted in a politically savvy way that temporarily reduces measured headline inflation in the short-term. However, we don’t think it will be that easy for the economy and RBA further out, particularly when it comes to trends in core inflation. The savings for households and businesses stemming from things like rental assistance or electricity rebates may be re-circulated back into the economy and this may create more demand and stickier core inflation down the track than would otherwise be the case. In our view, markets should look through the political ‘smoke and mirrors’ and continue to forecast the RBA to be on a different path to its major central bank counterparts given the still tight labour market, elevated services inflation, and income support from the stage 3 tax cuts.

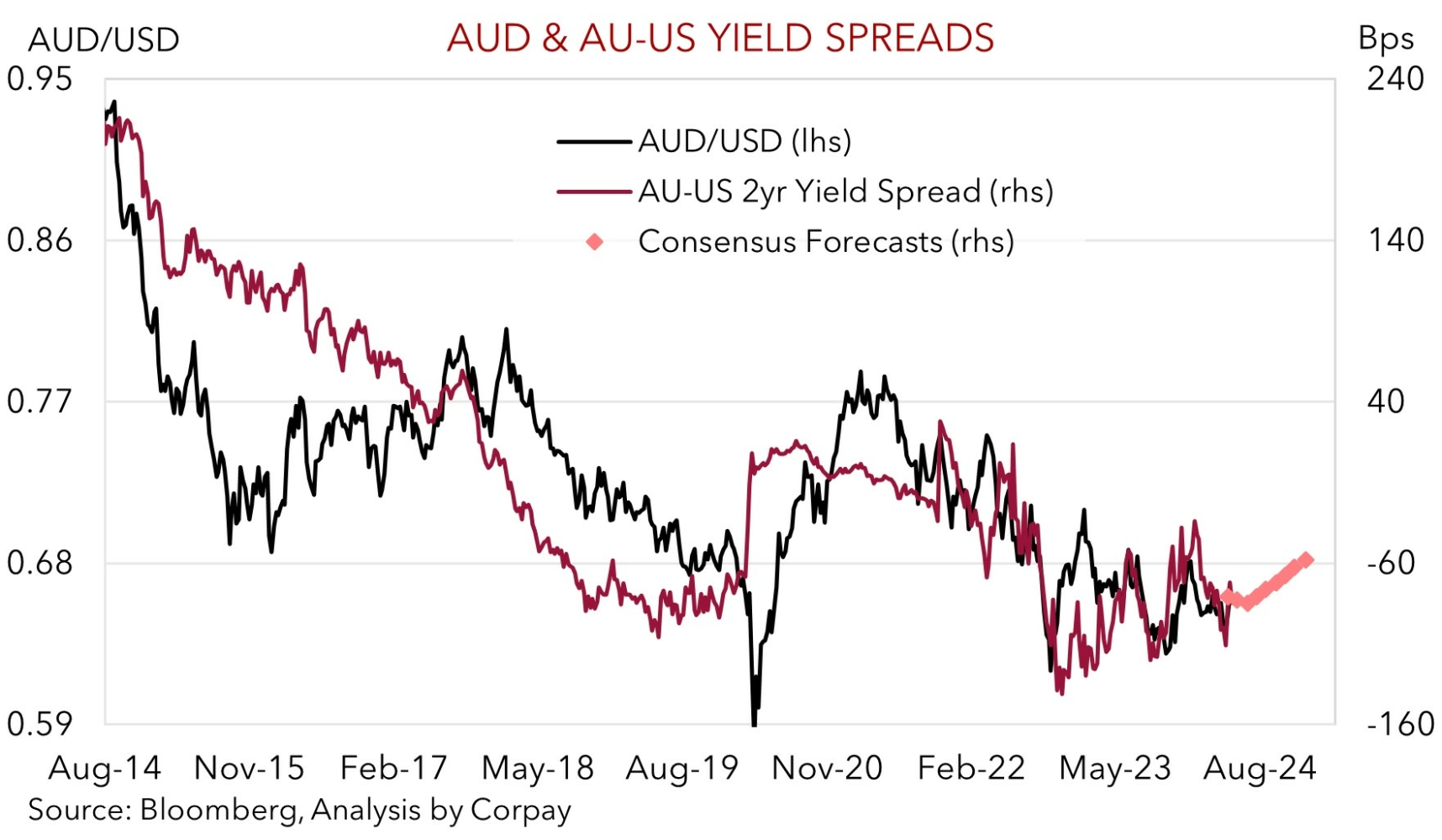

Diverging monetary policy expectations in the AUD’s favour may be bolstered today by a soft UK employment report (4pm AEST) which would be AUD/GBP supportive, and/or a moderation in US PPI inflation (10:30pm AEST). As our chart shows, after being a headwind over recent years we think the projected swing in yield differentials should become an AUD tailwind over coming quarters.