• US debt ceiling. Talks are set to restart today. A deal is needed to be agreed quickly given the ‘x-date’ is fast approaching.

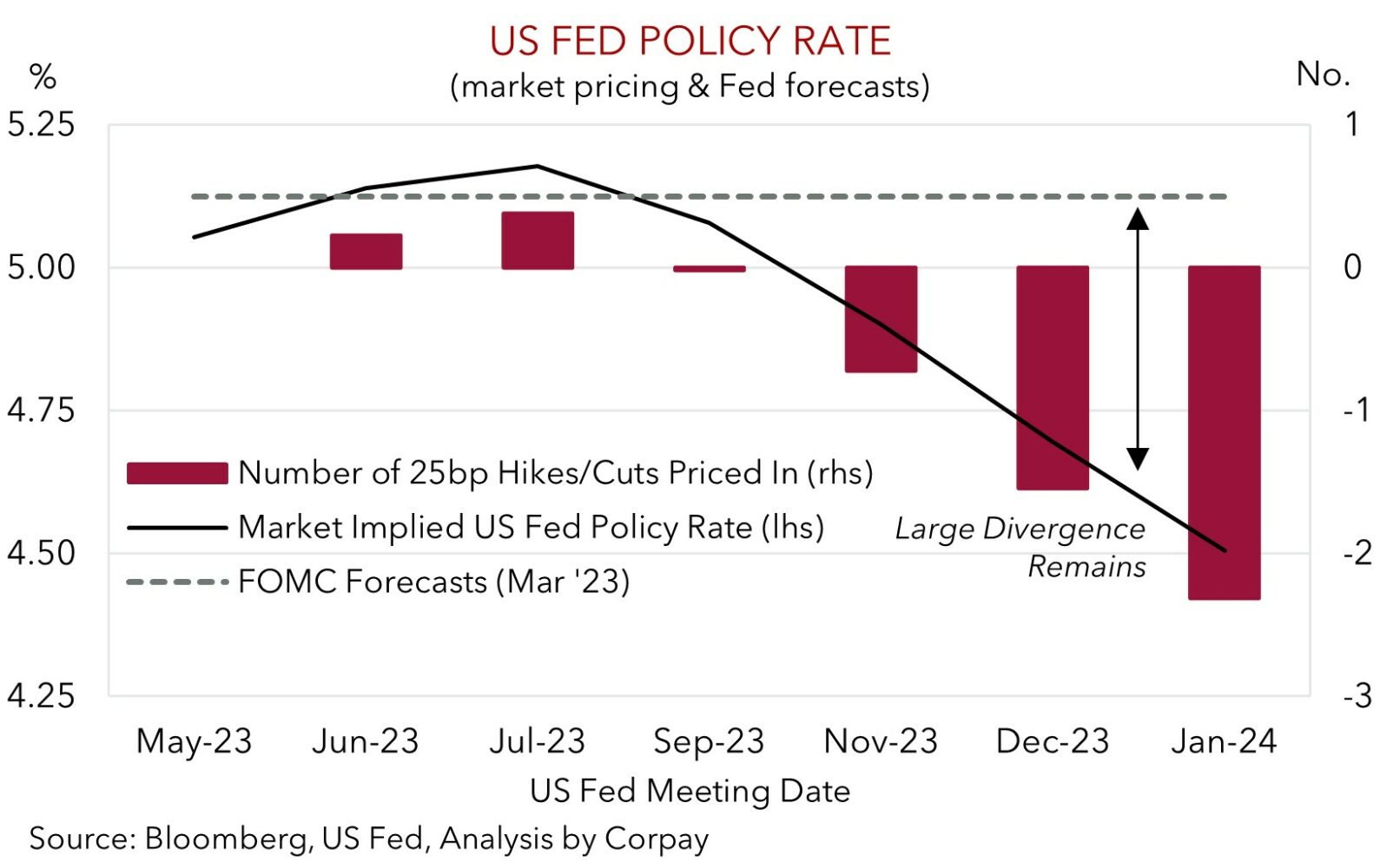

• Fed pricing. Markets pricing in a chance of a June Fed hike, but are still looking for ~2-3 cuts by January. An unwind of these bets could be USD positive.

• AUD holding. Limited local data flow. Global events will drive the AUD near-term. AUD/NZD sub 1.06. Tomorrow’s RBNZ meeting is in focus.

It has been a quiet start to the new week with limited moves across markets as participants await the latest round of US debt ceiling negotiations. President Biden and Republican House Speaker McCarthy are set to recommence talks this morning, with a deal needed to be agreed quickly given the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) is fast approaching. As we have been down this road a few times before, sanity prevailing, and some type of deal being struck remains the base case for most. However, that doesn’t mean the current calm will continue indefinitely. The longer the tricky negotiations drag out and the closer the ‘x-date’ becomes, the higher anxiety levels (and volatility) are likely to go, in our view, especially as many asset classes don’t look to be pricing in much of a downside scenario. For more see Market Musings: Dancing on the US Debt ceiling.

Overnight, US and European equities consolidated, and bond yields edged a little higher. The US 2-year yield rose ~5bps to 4.32%, while the 10-year recorded its 7th straight rise to be up at 3.72%, a high since mid-March. In FX, the USD Index is a touch stronger thanks to a weaker JPY, with USD/JPY continuing to track the upswing in US bond yields. USD/JPY is near its 2023 highs, and AUD/JPY is back above its 200-day moving average (~91.97). EUR continues to track just above ~$1.08, NZD is up around its 100-day moving average (~$0.6275) ahead of tomorrows RBNZ meeting, and the AUD is hovering near ~$0.6650.

In terms of US interest rate expectations, market pricing for another 25bp hike by the FOMC in June has ticked up, with a ~23% probability of a move now factored in. That said, markets continue to discount a bit over two rate cuts by January. Fed members speaking overnight have remained somewhat ‘hawkish’, at least relative to current market thinking. Non-voting member Bullard reiterated that he continues to favour two more hikes, while voter Kashkari stressed that although a move in June looks like a ‘close call’ it is important that the Fed continues to signal that a ‘pause’ doesn’t mean the cycle is over and that given the high sticky services inflation rates may have “to go north of 6%”. Assuming a debt ceiling deal is reached, we believe the US Fed is unlikely to crystallise market pricing looking for ~2-3 cuts by January. In our view, a further paring back of these rate cut expectations is likely to be USD supportive.

Global event radar: Eurozone & UK PMIs (Today), RBNZ Meeting (Weds), US PCE Deflator (Fri), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

AUD corner

AUD is treading water near ~$0.6650 with markets awaiting further updates on the US debt ceiling situation. Talks between President Biden and Republican House Speaker McCarthy are set to recommence today. As discussed above, a deal needs to be agreed quickly given the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) is around the corner. Some estimates put this as early as 1 June. In our opinion, the longer the talks go and the closer to the ‘x-date’ we are without a deal, the higher market volatility could become. This is normally an environment which is a headwind for the AUD given its elevated correlation to risk assets such as equities.

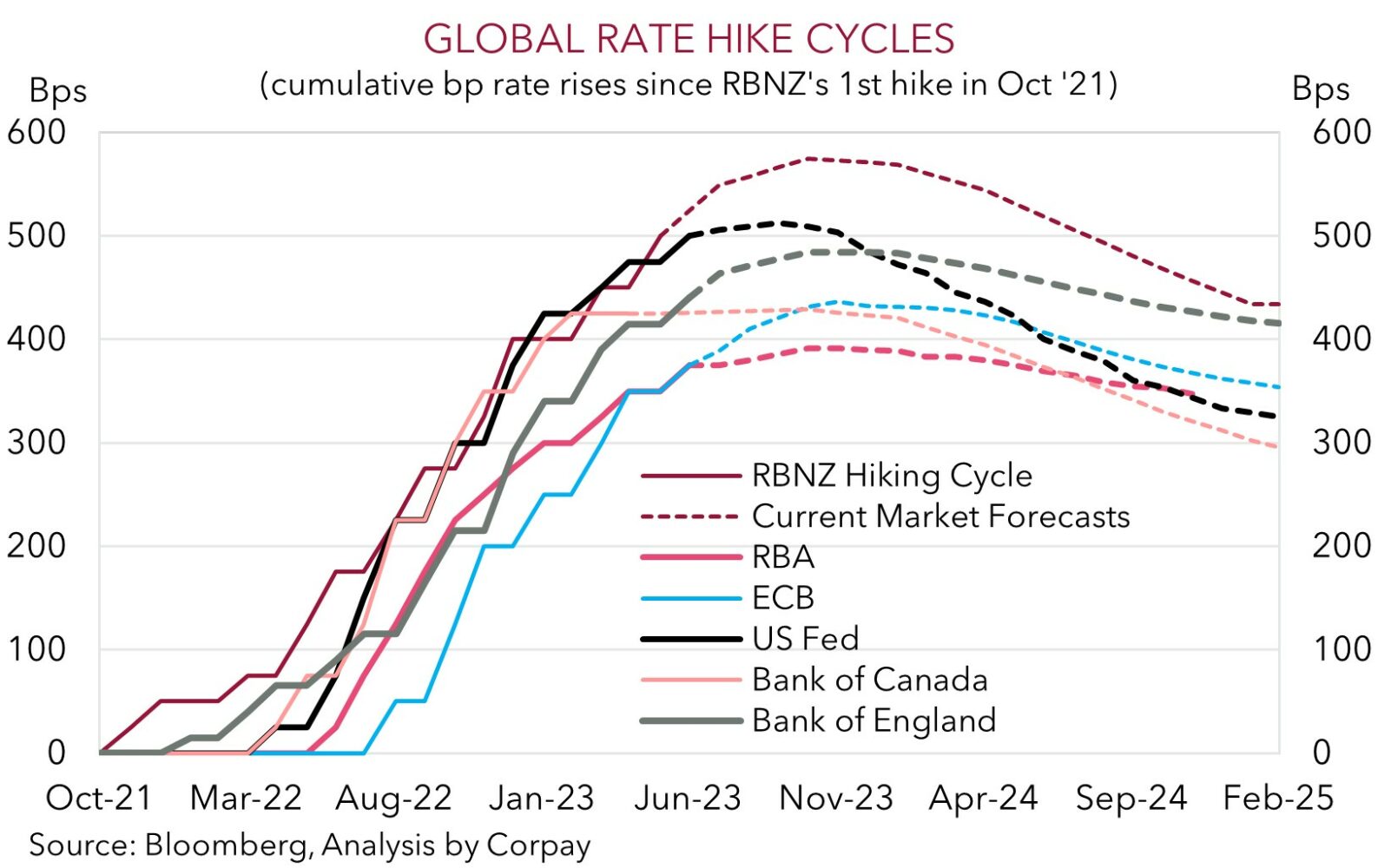

On the assumption a debt ceiling deal is reached, we doubt any knee-jerk rise in the AUD will extend too far. Underlying downside forces are still in place. Importantly, the global economy is slowing, with a range of forward-looking indicators for industrial activity pointing to a step down in momentum over the next few months. This, combined with China’s faltering post lockdown recovery, is expected to keep the pressure on commodities. We also judge that pricing looking for multiple rate cuts by the US Fed over H2 is unlikely to be crystalised based on the US’ high inflation and tight labour market. A reduction of longer-term US rate cut bets should, in our opinion, see relative interest rate differentials shift in favour of a bit more USD strength.

On the crosses, AUD/NZD remains sub ~1.06 with tomorrows RBNZ meeting in focus. The debate is whether the RBNZ delivers a 25bp hike or surprises once again with another larger 50bp move. We think a 25bp rise is more likely, which would take the OCR up to 5.5%, however a bigger increase can’t be ruled out as we think NZ’s fiscal picture and jump in net migration means there is more work to do to tame inflation. The RBNZ’s forward guidance will be looked at closely, and we believe that the bank could signal an ongoing tightening bias by lifting the peak in its Official Cash Rate forecast track to incorporate a probability of a further rate rise. Another RBNZ hike and ‘hawkish’ rhetoric is expected to keep AUD/NZD on the back foot in the near-term.

AUD event radar: Eurozone & UK PMIs (Today), RBNZ Meeting (Weds), AU Retail Sales (Fri), US PCE Deflator (Fri), AU CPI (31st May), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June).

AUD levels to watch (support / resistance): 0.6565, 0.6620 / 0.6687, 0.6712

SGD corner

USD/SGD has traded in a tight range near ~$1.3460 over the past 24hrs. This is around the top end of its two-month range. As outlined above, the market focus remains on US debt ceiling negotiations. Talks are set to restart today, with a deal needed quickly given the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) is coming into view. In our judgement, the longer the talks drag out, the more anxious markets could become, and this is typically USD supportive.

On the assumption a deal is reached, we expect markets to quickly turn their attention back to the US inflation problem and Fed policy outlook. In our view, based on the uncomfortably high services inflation and tight labour market, market pricing factoring in ~2-3 Fed rate cuts by January is unlikely to unfold. We think an unwind of these rate cut bets is likely to give the USD (and USD/SGD) some support. In today’s trade the April reading of Singapore CPI inflation is released. Base effects, as last year’s large price increases roll out of calculations, and a reduction in electricity tariffs are predicted to bring down core inflation from 5%pa to 4.7%pa. The turn down in inflation is supportive for our thinking that the MAS’ tightening phase is over.

SGD event radar: Singapore CPI (Today), Eurozone & UK PMIs (Today), US PCE Deflator (Fri), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

SGD levels to watch (support / resistance): 1.3337, 1.3377 / 1.3500, 1.3540