• Mixed moves. US equities consolidated while bond yields nudged up. USD firmer driven by USD/JPY. AUD & NZD lost some ground on Friday.

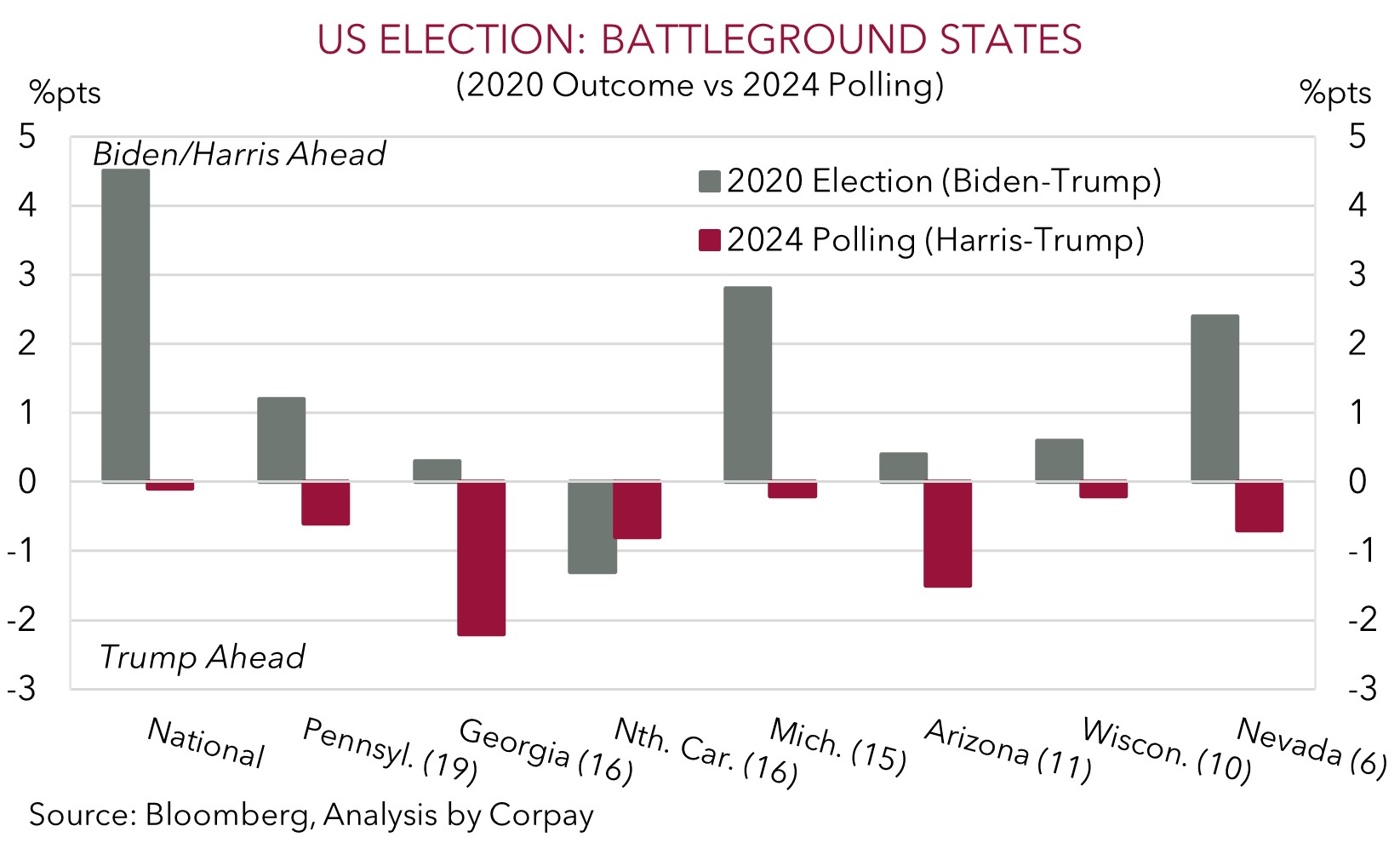

• US elections. US heads to the polls in just over a week. Trump is ahead in the battleground states. Volatility likely over the period ahead.

• Event radar. Locally, Q3 CPI is due (Weds). Offshore, US GDP & non-farm payrolls are released, as is EZ GDP/CPI & China PMIs. BoJ also meets.

Markets were rather subdued on Friday with US equities consolidating (S&P500 flat, NASDAQ +0.6%) and bond yields unwinding the previous day’s dip (US 10yr +3bps to ~4.24%, the top end of its ~3-month range). There was no new economic information to shift the needle, especially with market participants lasering in on the upcoming US election (5 November). Elsewhere, oil and base metal prices were a bit firmer with WTI crude (+1.8%) and iron ore (+2.9%) edging higher. Weekend news that Israel had struck military targets across Iran hasn’t generated much of a reaction in this morning’s Asian trade. In FX, the USD rose on Friday with the lift in USD/JPY (+0.8% to ~153.10, a high since early August) a key driver. The uptick in bond yields and the LDP’s loss of a parliamentary majority following the swing in the weekend Japanese elections has undermined the JPY with the political changes raising the risk the BoJ might not be able to raise rates further. The EUR also lost a bit of ground (now ~$1.08), as did the NZD (now ~$0.5985) and AUD (now ~$0.6620). Both NZD and AUD are tracking close to their lowest levels since mid-August.

This week the data in the US will do the talking with Federal Reserve officials in their communications blackout period ahead of next week’s meeting. There are a few important releases including Q3 US GDP (Weds AEDT), the US PCE deflator (Thurs AEDT), and US jobs report (Fri AEDT). In the Eurozone, GDP (Weds AEDT) and CPI (Thurs AEDT) are due, as are the China PMIs (Thurs AEDT), the UK Budget (Thurs AEDT), and Australian inflation (Weds AEDT). The BoJ also meets (Thurs AEDT).

Macro wise, the US Fed has telegraphed an intention to lower interest rates by 25bps next week, though we do see a chance the incoming data sees markets continue to pare back expectations about how much more easing could be delivered over the next year. US GDP growth is predicted to remain solid (mkt 3%saar), and while a step down in non-farm payrolls is anticipated (mkt 110,000 from 254,000) a lot of that stems from negative one-off impacts from Hurricane Milton and strikes at a few large US corporates. In our view, signs the underlying US growth pulse is still positive can compound rising odds former President Trump retakes the White House. As our chart shows, Trump is ahead in the polls at a national level as well across the battleground swing states. As discussed previously Trump’s combative trade policies, greater fiscal spending, and push to curb US immigration are generally viewed as being USD supportive because of the possible impacts on US inflation and in turn interest rates.

AUD Corner

The AUD slipped back a bit at the end of last week with Thursday’s modest rebound more than unwinding due to the firmer USD (see above). At ~$0.6620 the AUD is hovering near the bottom of the range it has occupied since mid-August, and it is a touch below its 1-year average. That said, on the crosses the AUD was mixed. AUD/EUR consolidated (now ~0.6130) close to its 6-month average. And while the AUD lost ground against GBP (now ~0.51) and CNH (now ~4.7215), it ticked up versus the weaker JPY (now ~101.30, near a 3-month high) and NZD (now ~1.1064).

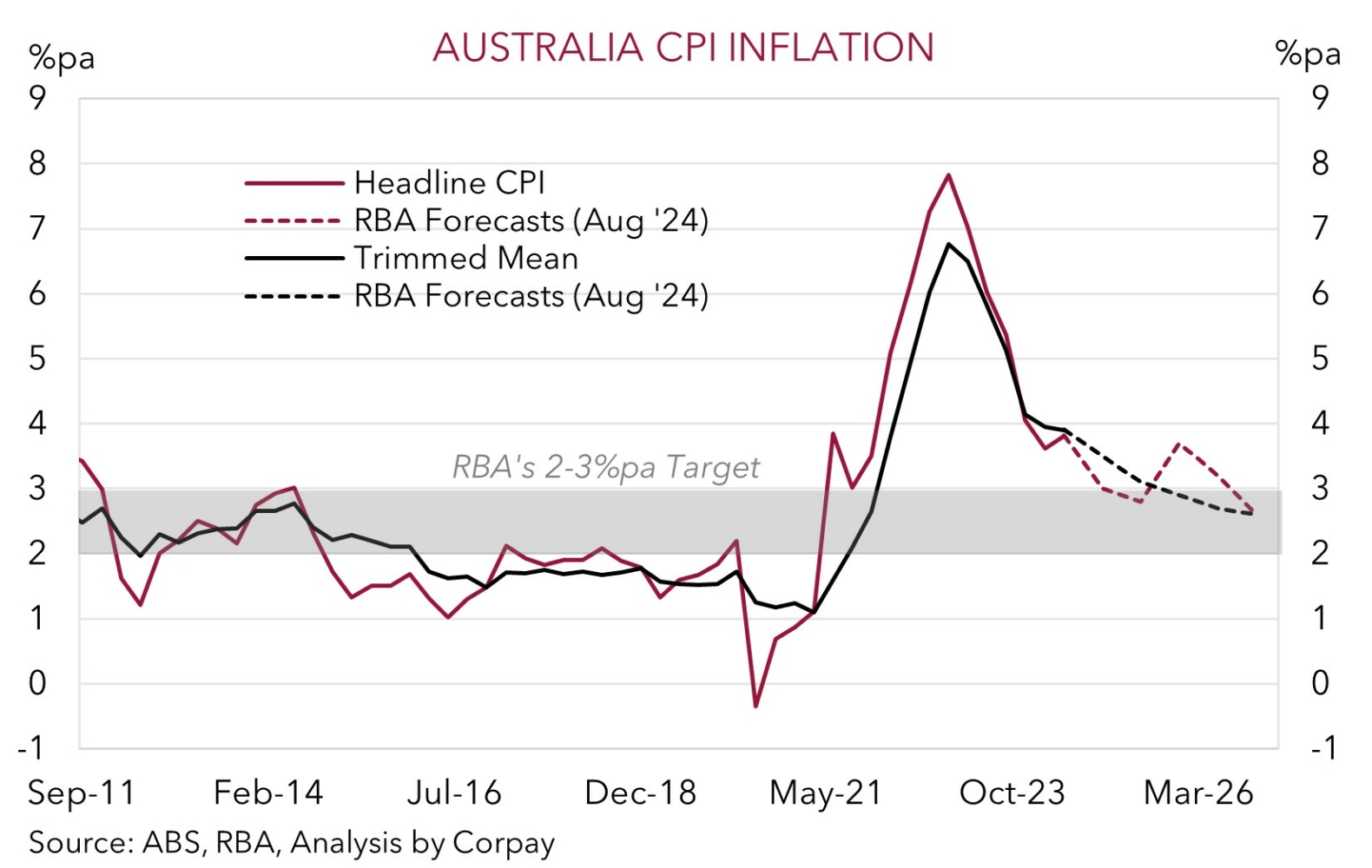

Locally, attention will be on Q3 CPI inflation this week (released Weds). There will be push-pull factors at work. Due to the mechanical drag from government subsidies/electricity rebates headline inflation is projected to decelerate back into the RBA’s 2-3% target band for the first time since Q1 2021 (mkt 2.9%pa). However, this shouldn’t trigger a RBA response. It is well known, and the improvement in core CPI (which provides a better guide to the true inflation pulse) will be more limited (mkt 3.5%pa). This is what the RBA is focusing on as headline inflation should snap back once government policies end. In our opinion, underlying inflation trends combined with the resilient labour market continue to point to a modest RBA interest rate cutting cycle kicking off in H1 2025.

Over the medium-term, we believe diverging policy trends between the RBA and others should be AUD supportive, particularly versus the EUR, CAD, GBP, and NZD where their central banks are lowering rates because of softer growth and weaker inflation. However, against the USD, we feel near-term upside is limited and downside risks remain. As mentioned above, there are several important US data releases this week including Q3 GDP (Weds AEDT) and non-farm payrolls (Fri AEDT). We think better than predicted US data could see markets further trim their US Fed easing expectations, which if realised should be USD supportive. At the same time, the US election is also fast-approaching (5 November). As discussed chances former President Trump wins and pushes through an agenda of large-scale tariffs and greater fiscal spending have risen. This mix is generally viewed as being USD positive.