• Push/Pull. Oil prices tumbled, while US equities, bond yields & USD ticked higher. AUD on the backfoot & is at levels last traded in mid-August.

• USD upswing. Higher US yields as well as the weaker EUR & JPY pullback are underpinning the USD. US data could generate more strength.

• US politics. US election next week. Odds of Trump winning have risen. Volatility likely with his policy platform also viewed as being USD supportive.

There has been a bit more volatility in markets at the start of the week. Oil prices have tumbled with brent crude shedding ~5% (now ~$72/brl). Israel’s limited and targeted attacks on Iran’s military sites over the weekend was a relief and has seen markets pare back their geopolitical risk premium. Elsewhere, increased odds of former President Trump retaking the White House at next weeks election and prospect of the Republicans also gaining control of Congress has underpinned various ‘Trump trades’. US equities have pushed higher (S&P500 +0.3%) as have bond yields. The benchmark US 10yr rate rose ~4bps to be around the top of its 3-month range (now ~4.28%), with the US 2 yr rate near multi-month highs (now ~4.13%). This has helped the USD extend its upswing. As has the softer JPY. USD/JPY (the second most traded currency pair) has ticked up to ~153.25, its highest level since late-July, with the political uncertainty in Japan stemming from the ruling LDP’s loss of a parliamentary majority at the weekend elections undermining the JPY. Across the other FX majors EUR (now ~$1.0815) and GBP (now ~$1.2972) consolidated. Closer to home NZD (now ~$0.5980) remains weighed down at levels last traded in mid-August while the AUD has lost more ground (now ~$0.6585, also a low since mid-August).

The US election is on 5 November, and while markets have adjusted, we still don’t think a Trump victory has been fully factored in. This suggests that if he does come out on top a further rise in the USD should be anticipated as markets re-price the macro-outlook due to his policy platform of trade tariffs, greater fiscal spending, and moves to curb US immigration. We believe this mix could generate a positive US inflation impulse, which in turn keeps US interest rates and the USD higher than would otherwise be the case. For more see Market Musings: US election – FX inflection point.

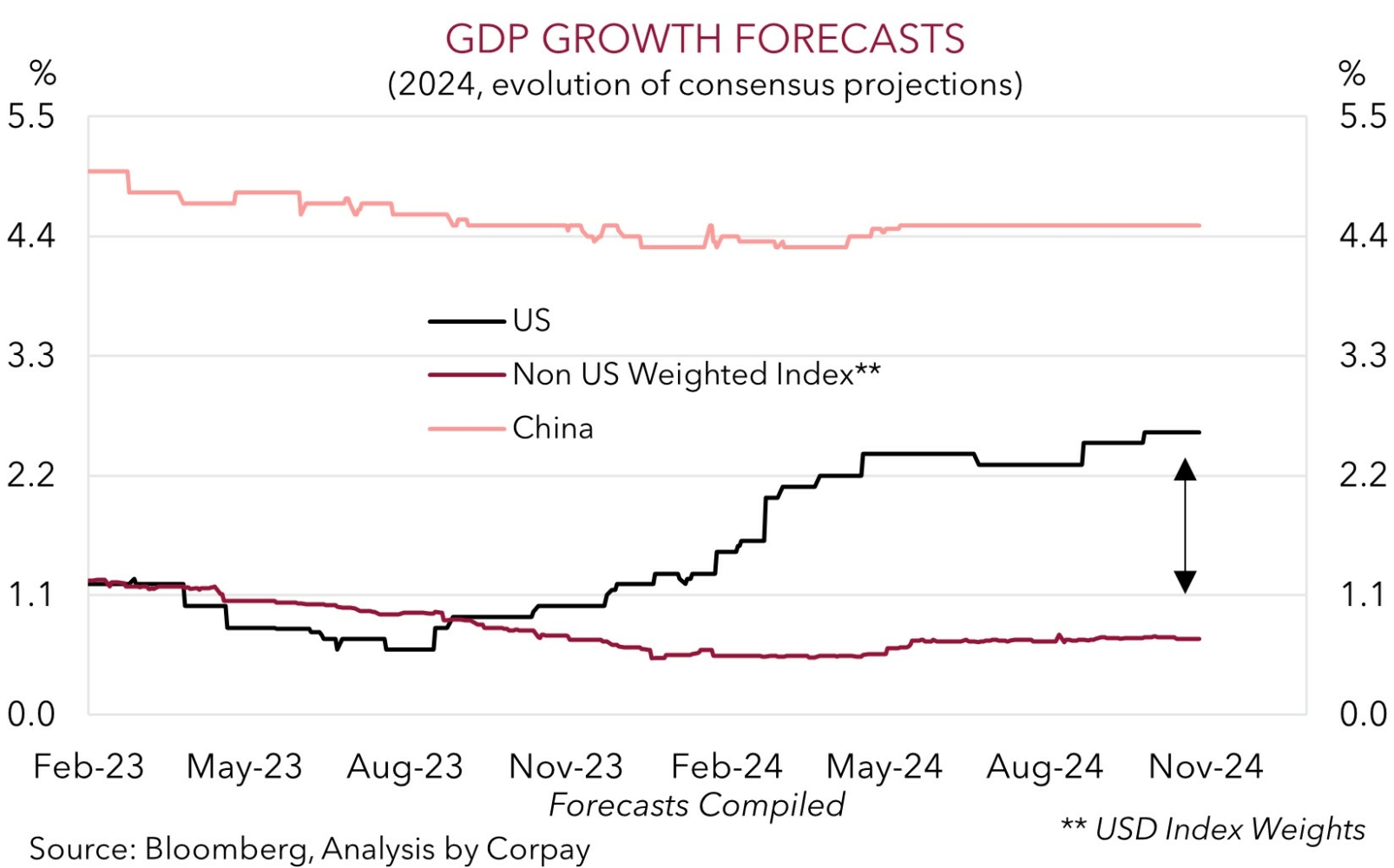

Ahead of the election there are several important pieces of US economic data to contend with. US JOLTS job openings are due tonight (1am AEDT), Q3 US GDP is released tomorrow, the PCE deflator (the Fed’s preferred inflation gauge) and employment cost index (a broad wages measure) are out on Thursday, and non-farm payrolls are scheduled for Friday. In our opinion, US GDP growth looks to have been solid in Q3 (mkt 3%saar), and although non-farm payrolls might have weakened in October a lot of that probably reflected temporary one-offs such as the impacts of Hurricane Milton and strikes at a few US corporates. We think more signs the underlying pulse of the US economy remains positive, and is outperforming its peers, can see markets trim expectations about how much policy easing the US Fed delivers over the next year. If realised, this would also be USD supportive.

AUD Corner

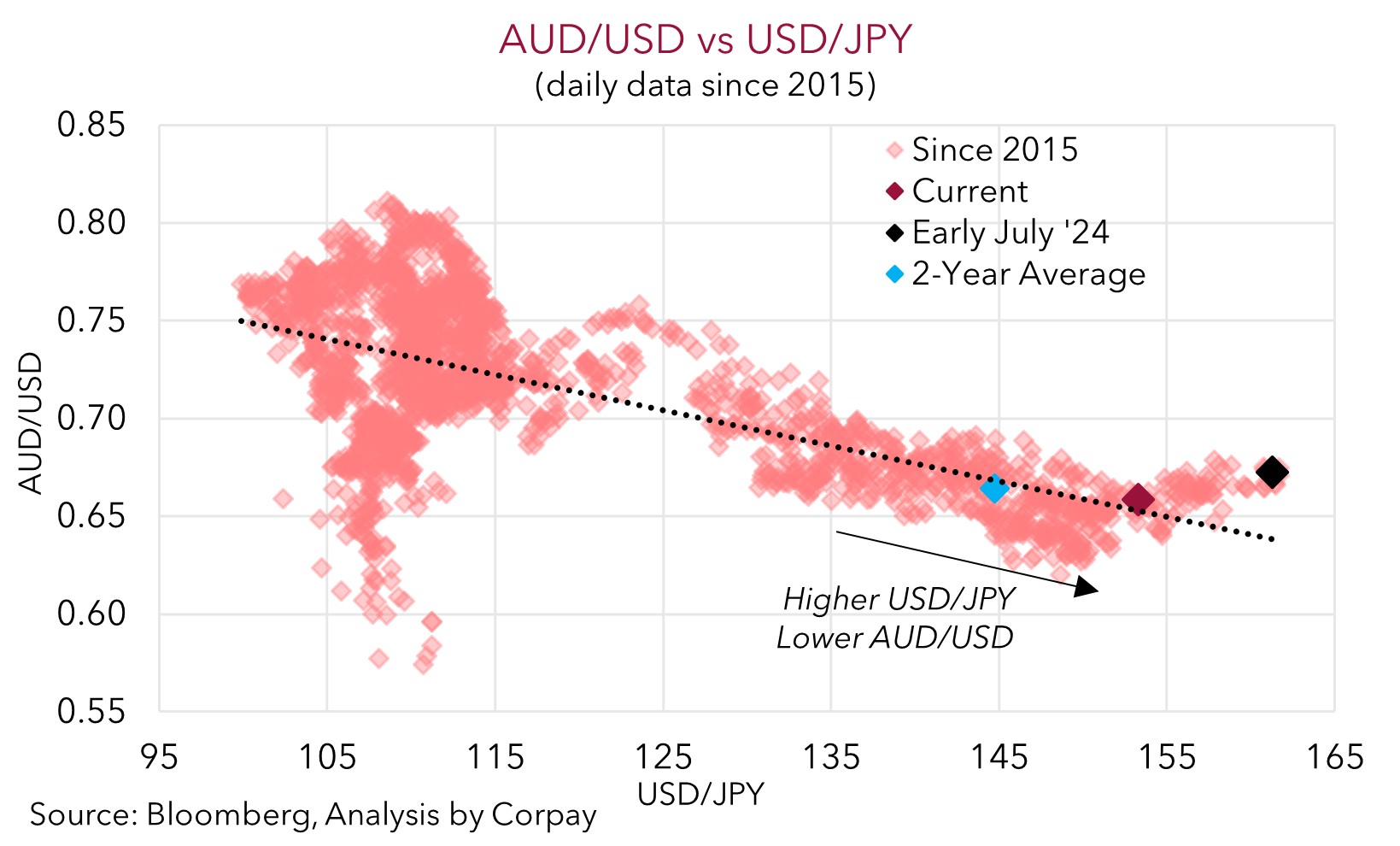

The AUD remains on the backfoot. The sharp drop in energy prices following the targeted and limited attacks by Israel on Iran, and stronger USD has exerted more downward pressure on the AUD (see above). The AUD is now trading at ~$0.6585, around its lowest level since mid-August, with the AUD also shedding ~0.4-0.7% on the crosses over the past 24hrs. As discussed above, the USD is being supported by the upswing in US bond yields and the softness in other major currencies. Over recent weeks the EUR (the major USD alternative) has weakened due to Eurozone growth concerns and ‘dovish’ policy steps by the European Central Banks. The renewed depreciation in the JPY has also been a factor (USD/JPY is the second most traded currency pair). These are AUD headwinds. As our chart illustrates, the AUD has an inverse relationship with USD/JPY (i.e. a higher USD/JPY translates to a lower AUD).

Domestically Q3 CPI is released tomorrow. There will be conflicting signals in the data. The mechanical drag from government subsidies/electricity rebates should help lower headline inflation back into the RBA’s 2-3% target band for the first time in a few years (mkt 2.9%pa). But this shouldn’t trigger a RBA policy response. This is a known known, and the slowdown in core CPI (which provides a better measure of inflation persistence) will be more limited (mkt 3.5%pa). This is what the RBA is lasering in on as headline inflation will also mechanically rebound once government policies end. Overall, we think underlying inflation trends, coupled with the still resilient labour market point to a modest RBA interest rate cutting cycle starting in H1 2025.

Over the medium-term we believe the diverging policy trends between the RBA and others and shifting yield differentials should be a relative AUD support, especially versus the EUR, CAD, GBP, and NZD where their central banks are cutting rates. That said, against the USD, we feel near-term downside risks remain. As outlined, there are a few important pieces of US data released over coming days including Q3 GDP (Weds AEDT) and non-farm payrolls (Fri AEDT). In our opinion, better than predicted US data may see markets continue to pare back their US Fed easing assumptions, which if realised should see US yields and the USD climb even higher. At the same time, the US election is just around the corner (5 November). Odds former President Trump wins and pushes through an agenda of large-scale tariffs and greater fiscal spending are rising. This mix is also assumed to be USD positive. For more see Market Musings: US election – FX inflection point.