• Data & politics. European political concerns have weighed on the EUR. This & positive US jobs data at the end of last week have supported the USD.

• US events. US CPI & Fed meeting in focus tonight. US core inflation forecast to slow & while the Fed should project few cuts this may already be priced in.

• AUD cross-currents. European issues have boosted AUD/EUR. Positive US CPI signs & the Fed failing to exceed ‘hawkish’ expectations may help AUD.

Economic and political developments in the US and Europe have shaken up markets over the past few sessions. The better-than-expected US employment report released at the end of last week, where non-farm payrolls and wages exceeded expectations, once again tempered US Fed rate cut expectations. Over in Europe, following a strong showing for right-wing parties in the weekend European Union elections French President Macron called a snap parliamentary election. The French elections will take place on 30 June and 7 July. Concerns President Macron could lose control of parliament or even resign if his party has a poor showing has rattled European nerves.

European equities declined (EuroStoxx600 -1%) with the French markets underperforming, particularly relative to the US S&P500 which has edged higher (+0.3%). In FX, the European political risks compounded the USD’s US payrolls driven strength with EUR dipping down to ~$1.0740 (a 1-month low). Elsewhere, GBP is hovering near ~$1.2740 and USD/JPY is tracking just above ~157 despite the equity market wobbles and overnight falls in bond yields. The benchmark US 10yr yield shed ~6bps (now 4.40%) with the 2yr rate (-5bps to 4.83%) also giving back some of its recent gains. USD/SGD is just below its 50-day moving average (~1.3535), while the NZD (now ~$0.6143) and AUD (now ~$0.6608) have recovered a little ground so far this week. That said, both NZD and AUD are still ~0.9% below where they were prior to last Friday’s US jobs data.

Focus will be on the US over the next 24hrs. Tonight the May reading of US CPI inflation is due (10:30pm AEST). Tomorrow morning the US Fed hands down its decision (4am AEST) with Chair Powell also speaking (4:30am AEST). Data wise US core inflation is expected to slow on the back of disinflation in goods prices as sluggish demand causes businesses to offer discounts and the moderation in rents continues. Consensus is looking for US core inflation to inch down to 3.5%pa which if realised would be the lowest pace since April 2021.

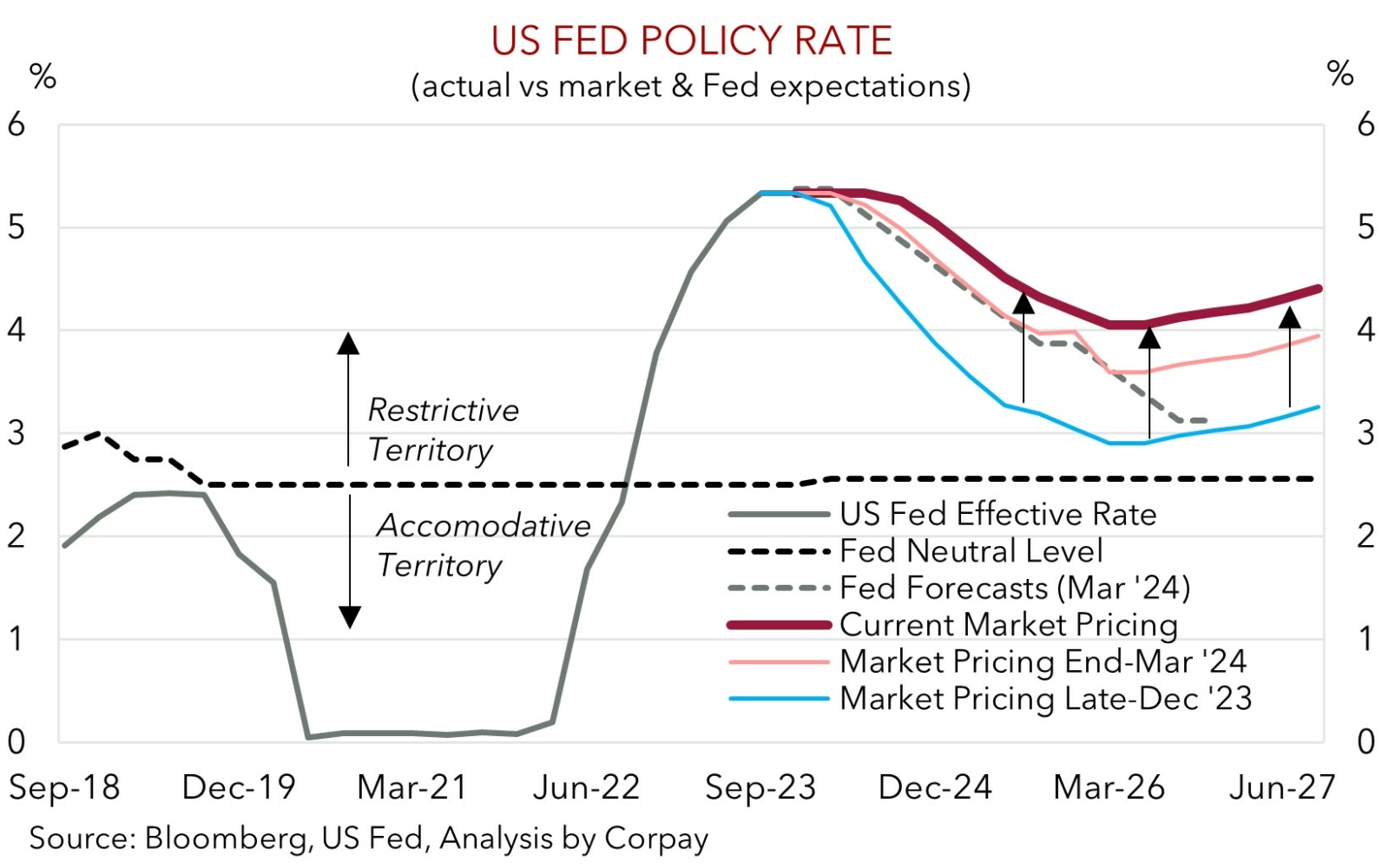

In terms of the US Fed, no policy change is anticipated with attention on the latest guidance and forecasts. We think the broad set of US data, particularly the softening growth pulse, should see US Fed continue to stress that ‘restrictive’ settings are working, and that the next move in rates should be down. In our view, although the Fed’s interest rate projections (i.e. ‘dot plot’) look set to be revised to show ~2 rather than 3 cuts over H2 2024, more easing will still be penciled in next year. And importantly, as our chart shows, interest rate markets are already factoring in an even more ‘hawkish’ outlook. Hence, we believe the mix of moderating US inflation and the US Fed failing to exceed what is already baked in could see the USD slip back.

AUD Corner

The AUD has lost some altitude over the past few sessions with last Friday’s stronger than predicted US payrolls report and European political nervousness supporting the USD (see above). On net, the AUD is back down near ~$0.6610, towards the bottom end of its ~1-month range, and ~0.9% below where it was prior to last week’s US jobs data. The AUD has also softened against the NZD (now ~1.0760). That said, it hasn’t been all one-way with concerns in Europe helping AUD/EUR tick up to the top of its multi-month range (now ~0.6150).

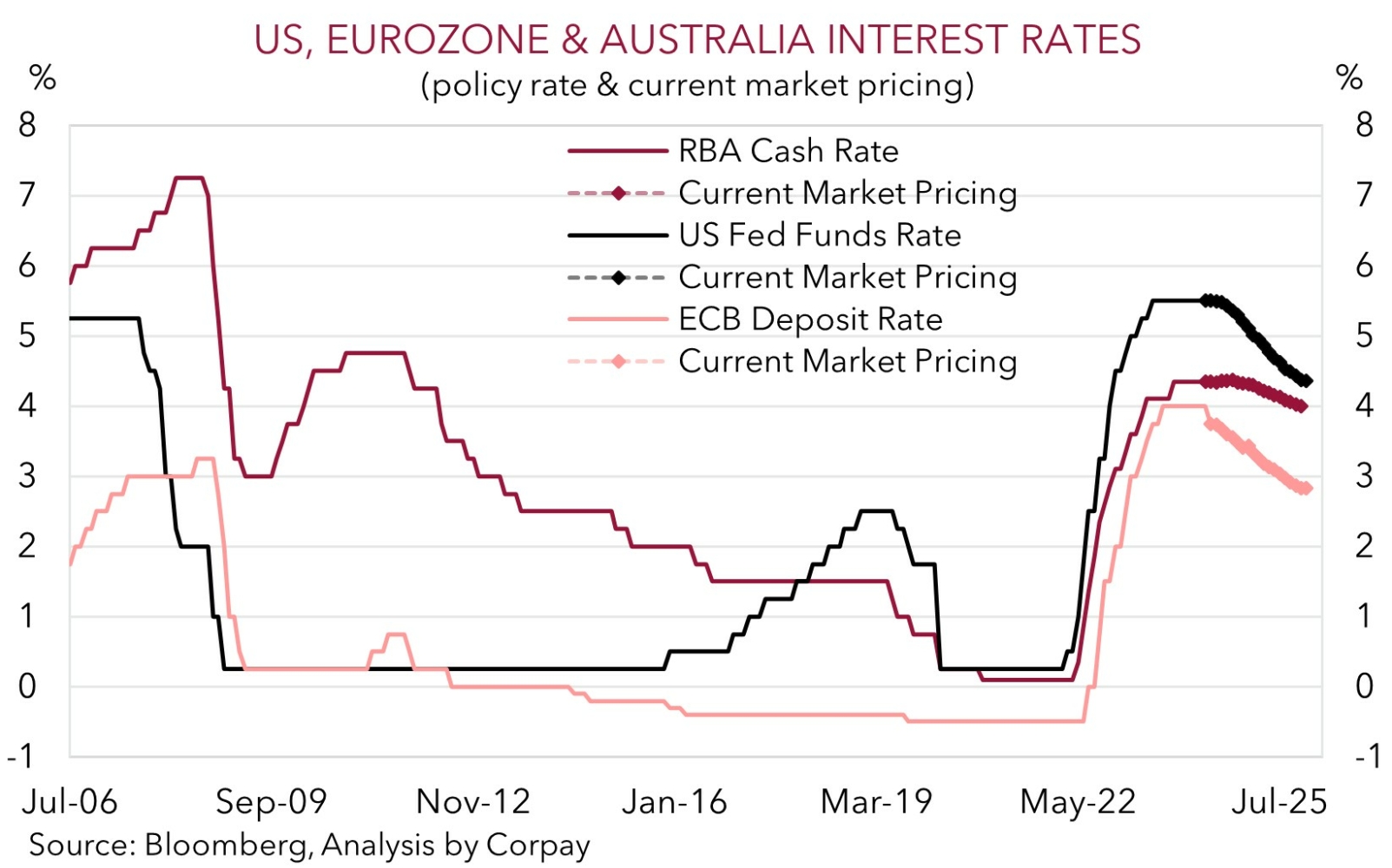

Locally, the latest NAB business survey was released yesterday. It painted an interesting picture. The slowdown in activity is dampening business confidence which has dipped into negative territory, however actual business conditions remain near their long run average with hiring intentions still holding up. Capacity utilization is also still above average, with cost and price measures also stepping up in May, a sign inflation risks continue to linger. In our view, this mix reinforces our thinking that the RBA may lag its peers in terms of when it starts and how far it goes in the next easing cycle. As our chart shows this should see relative interest rate spreads progressively shift in the AUD’s favour over the medium-term.

Near-term market focus will be on the US tonight with CPI inflation (10:30pm AEST), the Fed decision (4am AEST) and Fed Chair Powell’s press conference (4:30am AEST) on the schedule. As mentioned above leading indicators point to US core inflation moderating slightly in the year to May (mkt 3.5%pa). And although the US Fed appears set to revise up its near-term interest rate forecasts to show ~2 rather than 3 rate cuts over the remaining 4 meetings of 2024, as outlined, this should already be factored in. In contrast to the US Fed’s now stale outlook, interest rate markets are assuming only ~1.5 rate cuts over H2. In our opinion, more signs US CPI is back on its disinflation path coupled with the US Fed failing to exceed the markets already quite ‘hawkish’ bias might see the USD lose some ground. If realised, this could see the AUD bounce back particularly if tomorrow’s Australian labour force report also shows positive employment growth and a pull-back in unemployment after last months statistical driven lift.