• Tariff news. US/UK trade deal ‘framework’ unveiled. Baseline 10% tariff remains. Many details still to be worked out. US/China talks this weekend.

• Upbeat markets. Equities rose as did bond yields. USD claws back more lost ground. NZD & AUD drift lower. AUD outperforms NZD, JPY & EUR.

• Upcoming events. China trade data released today. Several US Fed members also due to speak. Will the USD’s recovery extend?

Global Trends

US trade developments remain in the spotlight. After signaling that an announcement was in the pipeline yesterday the US unveiled a ‘framework’ for a deal with the UK. A positive step but with the details still to be worked out some of the initial knee-jerk enthusiasm faded. In terms of the nuts and bolts the US/UK deal so far includes a 10% baseline tariff on most goods remaining in place, with tariffs on steel and aluminium dropping from 25% to zero. Added to that the UK will be able to export 100,000 cars to the US at a 10% tariff, and there will be reduced barriers on agriculture, chemical, energy and industrial exports.

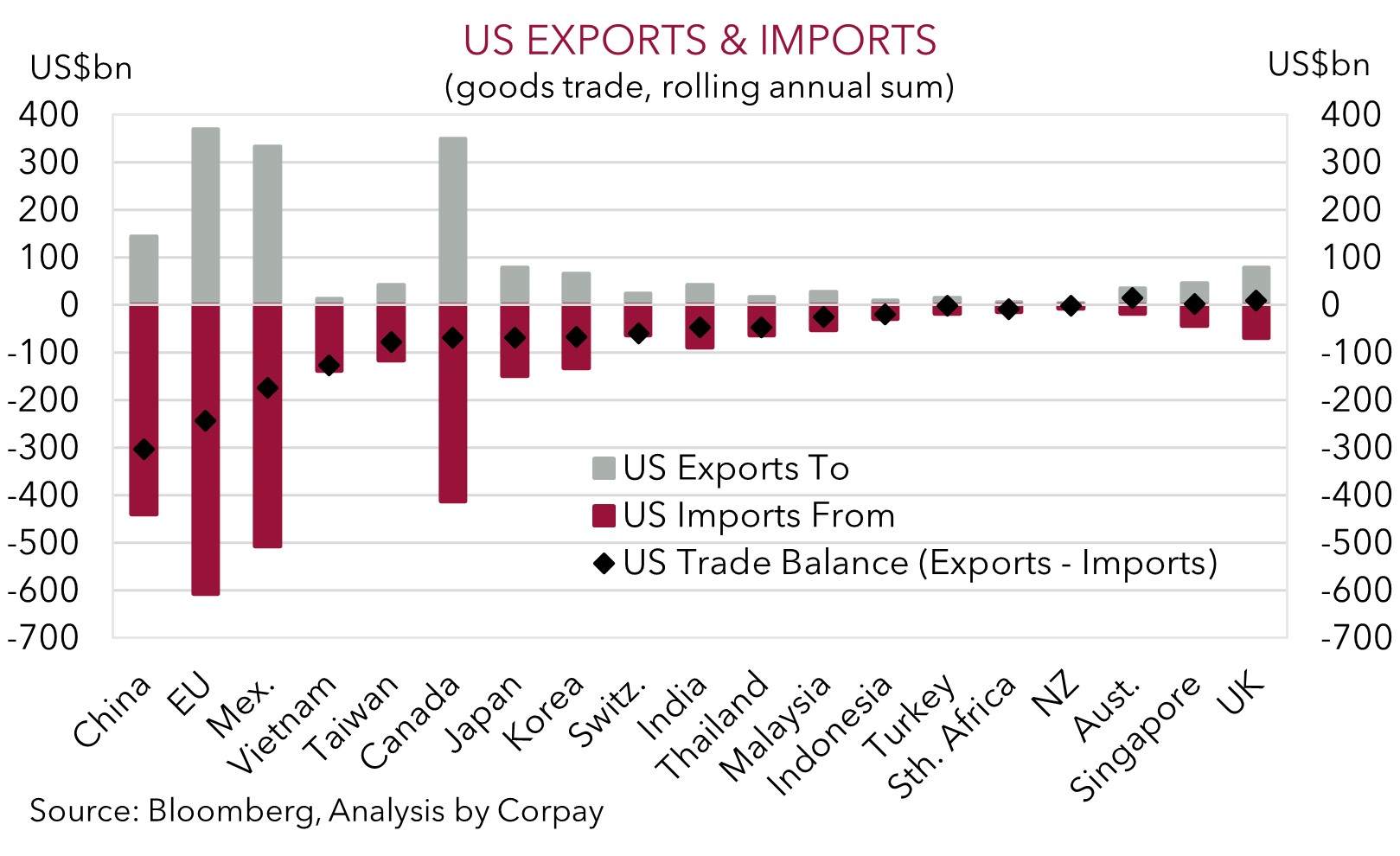

The US Administration noted that other nations should view the UK ‘framework’ as a benchmark for negotiations. We would highlight that given the UK is one of the few nations the US runs a trade surplus with (i.e. the US exports more to the UK than it imports from the UK) other deals may not be as easy to negotiate, and some form of higher tariff will be here to stay (goods imported from the UK are still going to be charged a 10% levy even with the US’ more favourable position in this trade relationship). Moreover, from an economic perspective there is a long way to go as the US’ trade with the UK isn’t significant (only ~2% of US imports come from the UK, while ~4% of the US’ exports are sent the other way). What matters is how negotiations with major sources of US imports go (i.e. the EU, China, Canada, Mexico, Vietnam, Japan, Korea, Taiwan). On this front talks between the US and China take place this weekend and President Trump stated that “I think it’s going to be substantive” and quipped that people “better go out and buy stocks now”. The outcome of the discussions should set the market tone at the start of next week.

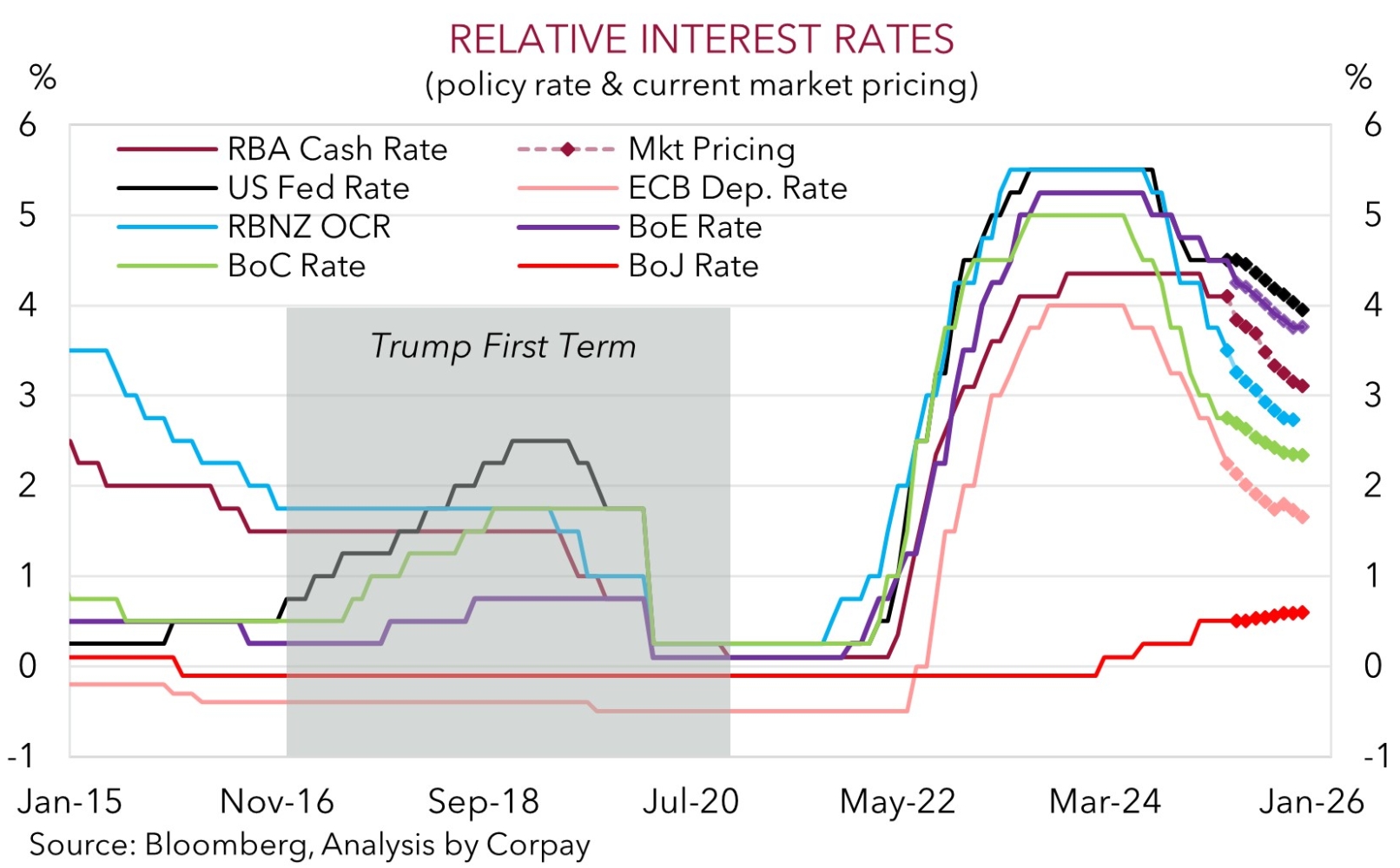

The US S&P500 rose 0.6% with the tech-sector outperforming (NASDAQ +1.1%). That said, the S&P500 had been up as much as 1.6% during the session. Bond yields rose with the trade optimism seeing traders pare back interest rate cut expectations. The US 10yr yield increased ~11bps (now ~4.38%). In the UK, the Bank of England lowered rates by 25bps to 4.25%. This was anticipated, however the guidance and voting pattern of policymakers was a bit more ‘hawkish’ with 2 committee members wanting to keep rates steady given inflation trends. In FX, the USD edged higher with EUR (now ~$1.1227) and GBP (now ~$1.3248) slipping back, and the interest rate/risk sensitive USD/JPY climbing (now ~145.95). Elsewhere, NZD drifted lower (now ~$0.5904), as did the AUD (now ~$0.64) however it generally outperformed on the crosses. On net, as outlined the last few days, we believe that over the near-term the beleaguered USD has scope to claw back more lost ground.

Trans-Tasman Zone

The uptick in the USD on the back of the optimism injected by the US/UK trade deal ‘framework’ overnight has seen the NZD and AUD drift back (see above). At ~$0.5904 the NZD is where it was trading a week ago and is just below its ~1-year average. The AUD (now ~$0.64), which is also tracking where it was this time last week, has held up a bit better thanks to relative strength on a few of the major crosses. AUD/JPY rose ~1.1% (now ~93.40), with the AUD also appreciating by ~0.2-0.3% versus the EUR, NZD, and CAD. AUD/GBP tread water (now ~0.4830), and AUD/CNH drifted a touch lower (now ~4.6355).

As mentioned above, the trade discussions between officials from the US and China set to take place this weekend are likely to set the tone for markets at the start of next week. There may be another burst of volatility. Constructive comments and steps to de-escalate the US/China trade war could boost risk markets which in turn can be AUD supportive. By contrast, signs a deal might be hard to negotiate may see sentiment sour which could exert some downward pressure on the AUD, in our view.

More broadly, as discussed over the past few days, given the sharp rebound in the AUD over recent weeks we aren’t surprised that it has given back a bit of ground over recent days. We have been flagging the potential for the beaten-up USD to rebound over the near-term. However, as also outlined, we believe this should be a short-term phenomenon with retracements in the AUD unlikely to be too deep and/or last too long. In our judgement, the USD should depreciate over the medium-term as the economic impacts of US tariffs and higher import costs slow growth and push up unemployment. This in time might see the US Fed lower interest rates further which drags on the USD. Added to that, we think the AUD has scope to outperform other currencies such as the EUR, NZD, and CNH because of diverging trends between the RBA and other central banks, the resilience in the Australian economy/jobs market, and moves by authorities in China to offset pain in its export sector via measures to boost domestic activity. This is where Australia’s key commodity exports are plugged into.