• Risk aversion. Middle East developments have weighed on risk sentiment. Bond yields & equities lower, while gold, oil, & the USD have been supported.

• AUD pressure. The backdrop is pressuring the AUD. But we think it is starting to look stretched on several metrics. A lot of ‘bad news’ could already be priced.

• Event radar. US retail sales, China data, AU jobs, & NZ CPI due. RBA Gov. Bullock speaks, & there is a conga line of Fed speakers including Chair Powell.

Events in the Middle East have been front of mind for markets. Risks that the conflict is set to worsen and/or broaden out across the region as Israel prepares for an offensive in Gaza, and the potential negative impact this could have on energy markets and trade through the Strait of Hormuz, dampened sentiment on Friday. Equity markets lost ground with the major European indices down ~1.5%, while in the US the S&P500 and NASDAQ declined by 0.5% and 1.2% respectively. By contrast, energy prices rose with Brent crude oil up ~5.7% to be above US$90/brl for the first time in a week.

Safe-haven demand pushed bond yields lower and gold higher (+3.4% to ~US$1933/ounce, a high since mid-September). The US 10yr rate fell ~9bps to 4.61%, unwinding about half of the previous day’s US CPI driven lift. By contrast, the US 2yr yield held up (now 5.05%) as markets contemplate another Fed rate rise. Markets are assigning a ~1/3 chance of a move by year-end. In FX, the backdrop continues to underpin the USD. EUR has fallen towards ~$1.05, GBP is tracking under ~$1.2140 after shedding ~1.7% over the back half of last week, and USD/JPY is hovering near 149.50. Cyclical currencies like the NZD and AUD have remained under pressure. NZD (now ~$0.5918) has tumbled to be near its 2023 lows, though the win by the opposition National party at the weekend General Election has given it a slight boost this morning. AUD has slipped back to be just over ~$0.63 (~2.1% from last week’s peak).

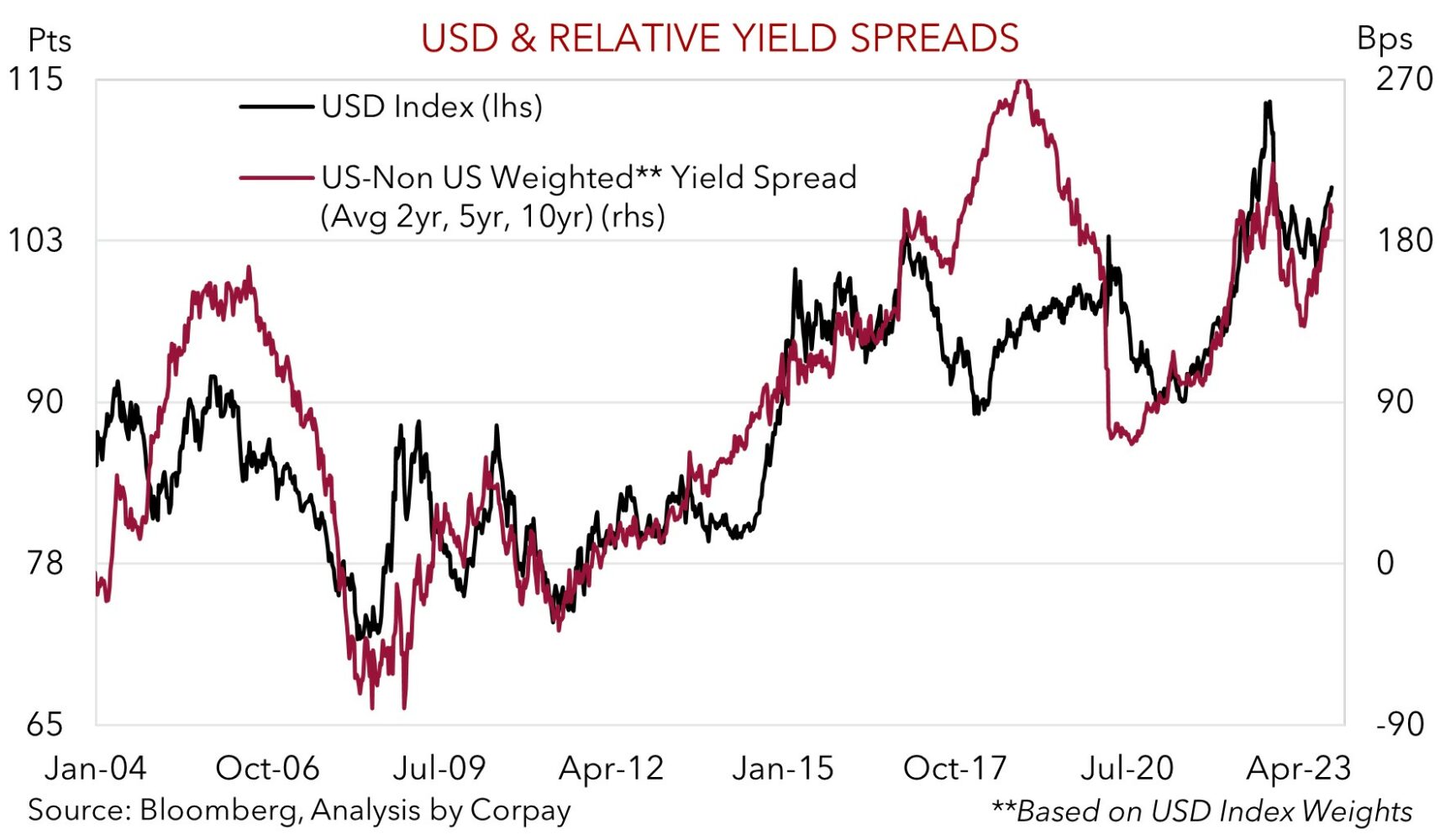

Geopolitics looks set to sap risk appetite over the near-term. This type of jittery environment typically favours the USD and JPY over growth-linked currencies such as the AUD and NZD. However, barring a sharp escalation in the conflict or large sustained deterioration in sentiment, we believe that on macroeconomic grounds the USD could lose some steam if the incoming US data (retail sales (Tues), industrial production (Weds), housing stats (Weds)) shows moderating growth momentum and/or China’s growth pulse (data also released Weds) continues to turn the corner. Added to that, we remain of the view that markets over-reacted to last week’s slight upside US inflation surprise, and US Fed interest rate pricing may be at risk of being pared back. There is ample opportunity for Fed members to reiterate their ‘cautious’ stance about the need for additional policy tightening this week with ~20 public speaking appearances scheduled including a speech by Chair Powell (Fri morning AEDT). In our opinion, a lack of a shift in views and a repeat of the ability to ‘proceed carefully’ message could underwhelm recently built-up expectations, dragging on the USD. Although as stated a lot will depend on Middle East developments.

AUD corner

The AUD has remained on the backfoot with Middle East related risk aversion exerting some pressure on cyclical assets and supporting safe havens such as bonds, gold, the USD, and JPY (see above). At ~$0.6307 the AUD is ~2.1% below last week’s peak and near the bottom-end of its ~11-month range. The AUD has also remained heavy on the crosses. AUD/EUR is tracking down around ~0.60, AUD/GBP is still sub-0.52, AUD/JPY has declined below its 100-day moving average (now ~94.20), and AUD/CNH (now ~4.61) is close to a ~5-month low. AUD/NZD (now ~1.0660) has opened a touch lower this morning with the NZD supported by the reduced uncertainty generated by the weekend National party General Election win.

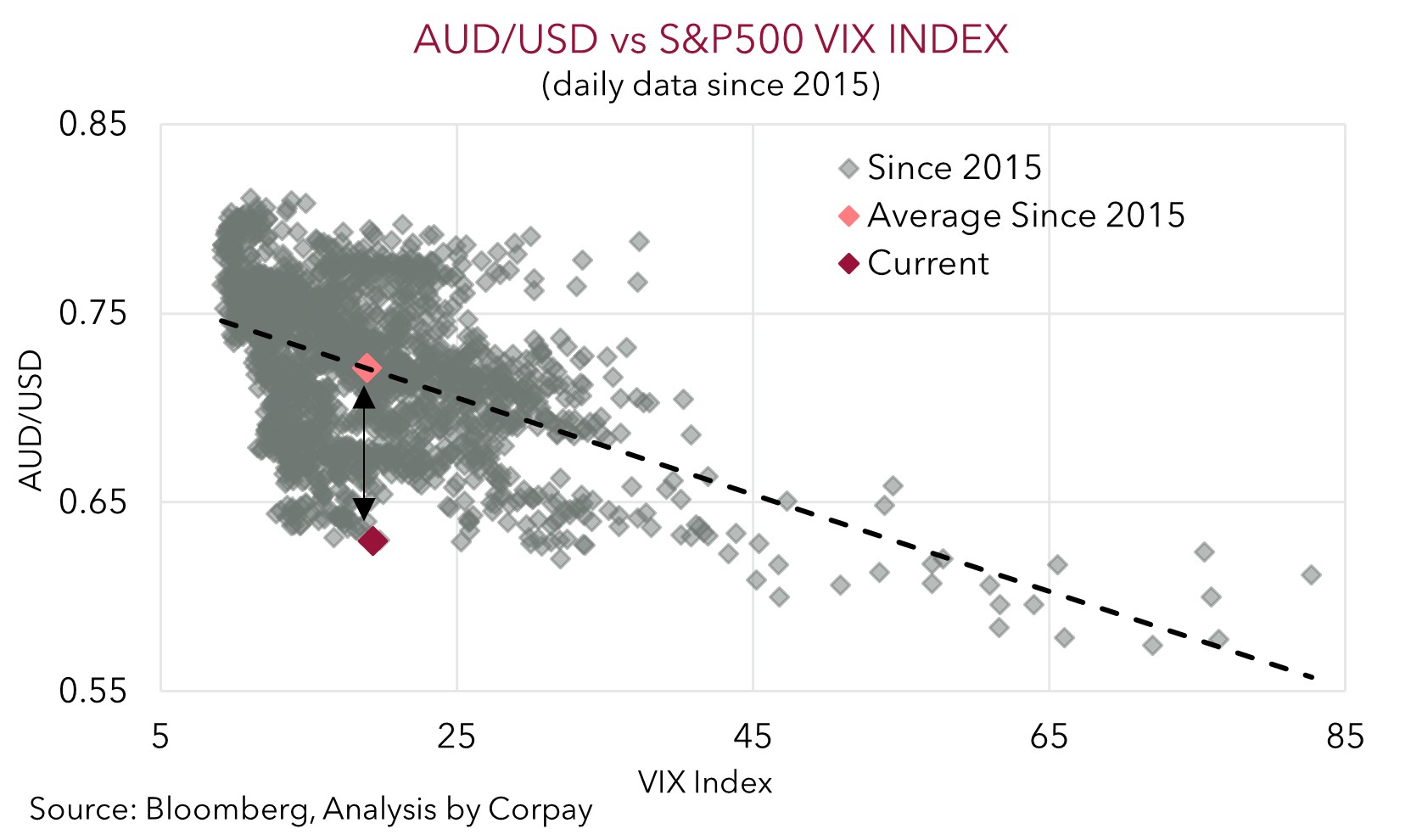

The geopolitical and macro crosscurrents point to further AUD volatility. As is typically the case given its positive correlation to risk assets like equities and base metal prices, Middle East developments may exert some further downward pressure on the AUD. However, given already stretched negative AUD positioning (as measured by CFTC futures); the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) and large pool of offshore superannuation investments; our judgement that the AUD is already trading below levels implied by broader risk sentiment (see scatter chart below); and low levels (since 2015 the AUD has only traded below $0.63 ~1% of the time), unless there is a sharp escalation in the conflict, we believe further sustained weakness may be unlikely. A lot of negatives appear factored into the AUD, and while it could be slow going we continue to see more upside than downside potential from here (see Market Musings: AUD: Always darkest before the dawn).

Indeed, from a macro perspective we think the incoming information should be AUD supportive. As discussed, we feel the USD’s post US CPI revival may be on shaky foundations. Below average consumer sentiment, depleted excess savings, autoworker strike action, and tighter credit conditions suggest there are downside risks to the upcoming US retail sales (Tues), industrial production (Weds) and housing data (Weds). In our view, signs US growth momentum is fading, coupled with non-committal rhetoric about further hikes by the cavalcade of Fed members speaking this week, including Chair Powell (Fri morning AEDT), could take some of the heat out of US interest rate pricing and the USD. Added to that, given the improvement in trade, the PMIs, and credit flows, the China data batch is likely to show that the cyclical bottom is behind us (released Weds). This, another solid Australian labour force report (Thurs), comments by RBA Governor Bullock that the door to further tightening is still open (Weds), and/or a re-acceleration in NZ inflation (Tues) which might boost forecasts for next week’s Australian CPI and RBA rate rise expectations may provide a helping hand to the beleaguered AUD, particularly on crosses such as AUD/EUR and AUD/GBP.

AUD levels to watch (support / resistance): 0.6240, 0.6280 / 0.6360, 0.6425

SGD corner

USD/SGD consolidated its post US CPI surprise jump up on Friday with the pair tracking near ~1.3680. This was inline with the broader USD which remains firm as geopolitical tensions in the Middle East triggered another bout of risk aversion (see above). On the crosses, EUR/SGD (now ~1.4383) has dipped back towards the bottom-end of its multi-month range, and SGD/JPY has eased, though at ~109.20 it remains historically high.

On Friday the Monetary Authority of Singapore didn’t rock the boat by maintaining “the prevailing rate of appreciation” of the SGD NEER (i.e. 1.5%pa) at its semi-annual policy review. The MAS also held the width of the trading band and level at which it is centered steady. In our view, maintaining the width of the SGD NEER band at 2% from the midpoint gives the MAS scope to support activity should the downside growth risks materialise, as does the shift to quarterly meetings in 2024. That said, the ongoing inflation challenge means it could be a tricky balancing act with the MAS projecting core inflation (excluding GST hike impacts) to only slow to ~2%pa by late next year. While we expect USD/SGD to remain elevated early in the week, as mentioned, barring a further deterioration in risk appetite, we judge that the lofty USD (and USD/SGD) could drift lower if the incoming data shows the US growth pulse is waning, China’s economic momentum is improving, and/or Fed officials push back on the post-US inflation lift in near-term rate hike expectations.

SGD levels to watch (support / resistance): 1.3521, 1.3607 / 1.3723, 1.3764