• Recession worries. Softer US labour and services data has fanned recession fears. Cyclical assets have weakened. US bond yields have fallen.

• Firmer USD. The USD has edged up with safe-haven flows counteracting the step down in rate expectations. NZD unwound yesterday’s spike generated by the larger RBNZ rate hike.

• AUD/NZD lower. AUD/NZD hit a fresh 2023 low after the RBNZ announcement. We expect AUD/NZD to rebound over the medium-term. The RBNZ’s actions should lead to a meaningful NZ downturn.

Markets have remained on the defensive overnight as US recession risks continue to build. US equities slipped back. The S&P500 dipped -0.3%, but under the hood economically sensitive and growth stocks underperformed. The tech-heavy NASDAQ fell 1.1%, and industrials and consumer discretionary sectors declined by ~1.3-2%. Similarly, across commodities, industrial metals, which are leveraged to the economic cycle declined (copper dropped another 1.9%), while safe-haven precious metals like gold held up. At ~$2020/ounce gold remains within striking distance of its record high.

US bond yields have remained under pressure. The policy-sensitive US 2yr yield slipped another 3bps to be back at 3.79% (though at one stage during the session it was as low as 3.64%). The US 10yr yield (now 3.31%) is at its lowest since September. The weakening growth pulse continues to fuel bets that the US Fed is very close to, if not already at, the end of its hiking phase, and that rate cuts could occur later this year. In FX, the USD strengthened with safe-haven flows counteracting the step down in interest rate expectations. EUR unwound yesterday’s lift to be back near 1.09, and GBP edged down to 1.2455. A stronger JPY, which typically does well in bouts of market unease, kept the USD from appreciating further. Cyclical currencies like the AUD and NZD also came under some pressure. NZD has given back yesterday’s larger than predicted RBNZ rate hike induced gains, while the AUD has ticked back under its 200-day moving average (~$0.6749).

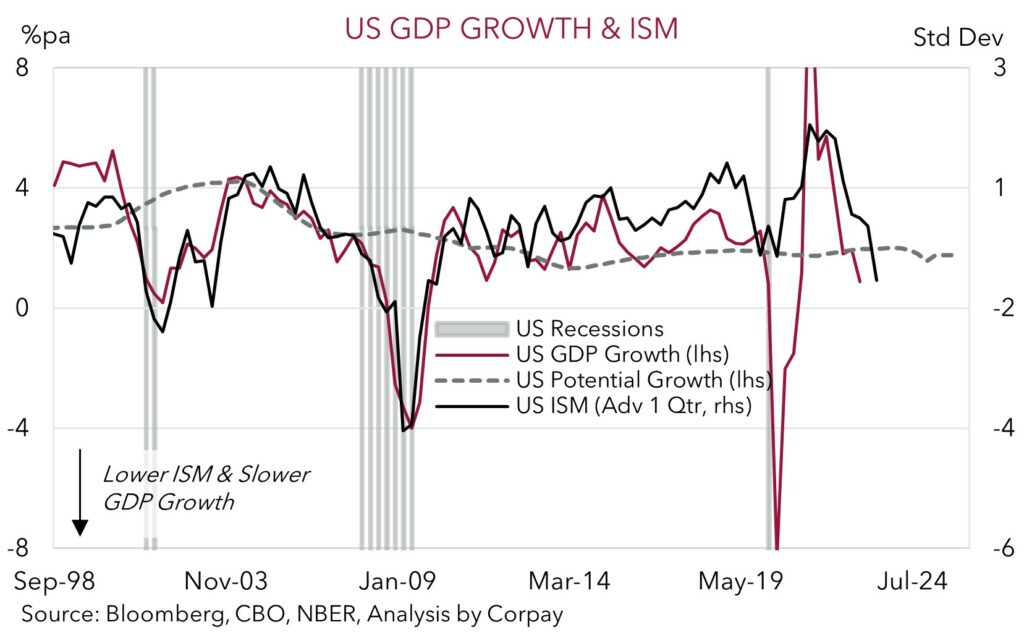

In terms of the US data, ADP employment and the services ISM undershot expectations. ADP payrolls rose by 145,000. This was below all surveyed estimates. The services ISM fell to a below average 51.2, with a large drop in new orders pointing to further weakness down the track. The employment and prices measures also declined, indicating that inflation/wage pressures across the sector may be turning. As our chart shows, the lower ISM points to slower US GDP growth over Q2/Q3. As tighter policy settings and credit conditions continue to bite, we expect the US downturn to gather pace over the next few months. In our view, this should keep market volatility elevated. This is a backdrop that normally supports currencies like the USD, EUR and JPY over global growth-linked ones such as the AUD and NZD (see Market Musings: Buckle up, volatility should continue). The important US non-farm payrolls labour market report is released on Friday. Given the Easter Holiday period, the full market reaction won’t occur until early next week.

Global event radar: US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD corner

AUD has edged a little lower overnight, falling back under its 200-day moving average (~$0.6749) to be ~1% below this week’s high. The firmer USD and more negative risk sentiment, as softer US economic data fanned recession fears, has weighed on cyclical assets like equities, industrial metals, and growth-linked currencies like the AUD and NZD (see above). Indeed, the NZD has unwound yesterday’s spike generated by the larger than forecast RBNZ rate hike.

In our opinion, the AUD faces an uphill battle over the next few months as the impacts of abrupt tightening cycles continue to show up in markets and the economy. Bouts of volatility and slower growth has normally been an environment where currencies like the AUD, which are leveraged to the global economic cycle, underperform. Added to that, the diverging policy outlooks between the RBA and other central banks such as the ECB, BoE, and US Fed which we think still have a bit more work to do to get on top of inflation, and the Bank of Japan who we expect to soon embark on a policy normalisation path should also keep the AUD on the backfoot.

RBA Governor Lowe spoke yesterday on “Monetary Policy, Demand and Supply”. While Governor Lowe noted that the April pause “does not imply that interest rate increases are over”, we think the burden is on the data to justify further action. The late-April quarterly CPI and next week’s labour market data will make or break the case for a move in May. But on our reading of how things are unfolding and the outlook, we believe the RBA cash rate has mostly likely peaked (see Market Wire – RBA: over and out). Today the semi-annual RBA Financial Stability Review is released (11:30am AEST). The FSR should have a heavy focus on the risks to households from the hiking cycle and upcoming “mortgage cliff”. These risks should support the case for the pragmatic RBA to keep rates on hold from here.

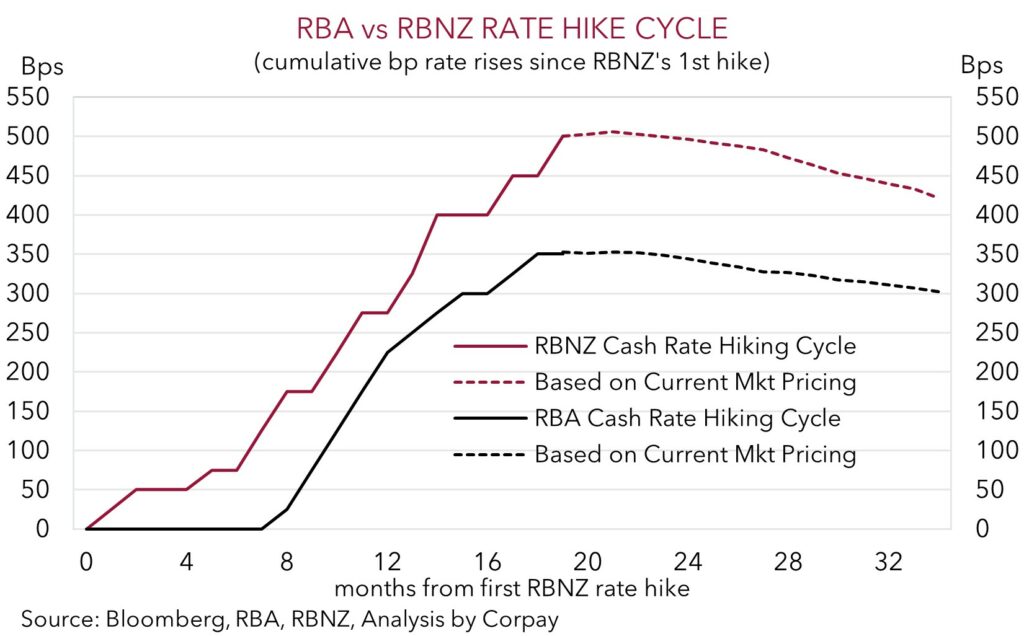

AUD/NZD fell back sharply yesterday, briefly dipping below 1.06, after the RBNZ surprised by lifting rates another 50bps. This has taken the RBNZ cash rate to a very ‘restrictive’ 5.25%. We think AUD/NZD could linger down around ~$1.05-1.06 for a bit of time. However, over the medium-term we continue to project AUD/NZD to rebound. Once the tightening phase is over, we expect FX markets to focus more on other differentials such as growth, labour market trends, and commodity prices. And on these metrics, we judge that the AUD should outperform the NZD. Growth-wise, the RBNZ moved earlier and has been far more aggressive than the RBA. As such we expect NZ to underperform with the negative impacts set to pile up across an economy already on the cusp of another recession. For more see Market Musings: Cross-Check: AUD/NZD – RBNZ Shock & Orr.

AUD event radar: US Jobs Report (Fri), US CPI (12th Apr), Bank of Canada Meeting (13th Apr), AU Jobs Report (13th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), NZ CPI (20th Apr), Eurozone PMIs (21st Apr), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

AUD levels to watch (support / resistance): 0.6520, 0.6680 / 0.6800, 0.6820

SGD corner

USD/SGD has clawed back some ground over the past 24hrs, with the pair nudging up to ~$1.3280. The firmer USD and more negative risk sentiment, stemming from the run of weaker US employment and services data and resultant US recession fears, have been the driver (see above).

Our view remains that USD/SGD is likely to consolidate and push a little higher over the near-term. The economic and market aftershocks from the most abrupt global tightening cycle in over a generation should continue to materialise over the period ahead, in our view. This is typically an environment that generates ongoing bouts of market volatility. Market gyrations, combined with slower global industrial activity, is a mix that tends to exert downward pressure on cyclical currencies like Asian FX. The US non-farm payrolls report is released on Friday. Given the Easter Holiday period the full market reaction shouldn’t occur until early next week. The MAS’ policy review is also set to occur next week. This will be another potential source of SGD volatility.

SGD event radar: US Jobs Report (Fri), MAS Review (by mid-Apr), US CPI (12th Apr), US Retail Sales (14th Apr), China GDP (18th Apr), Eurozone PMIs (21st Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr).

SGD levels to watch (support / resistance): 1.3200, 1.3220 / 1.3342, 1.3411