• Steady ship. US CPI largely as expected. Consolidation in markets. NZD underperformed. This also exerted a bit of pressure on the AUD.

• RBNZ cut. RBNZ delivered a 25bp cut & flagged many more to come. Fundamentals between AU & NZ are diverging. This is AUD/NZD positive.

• Data flow. Today, the volatile AU jobs report, China activity data, UK GDP, & US retail sales are due. A couple of US Fed members also speak tonight.

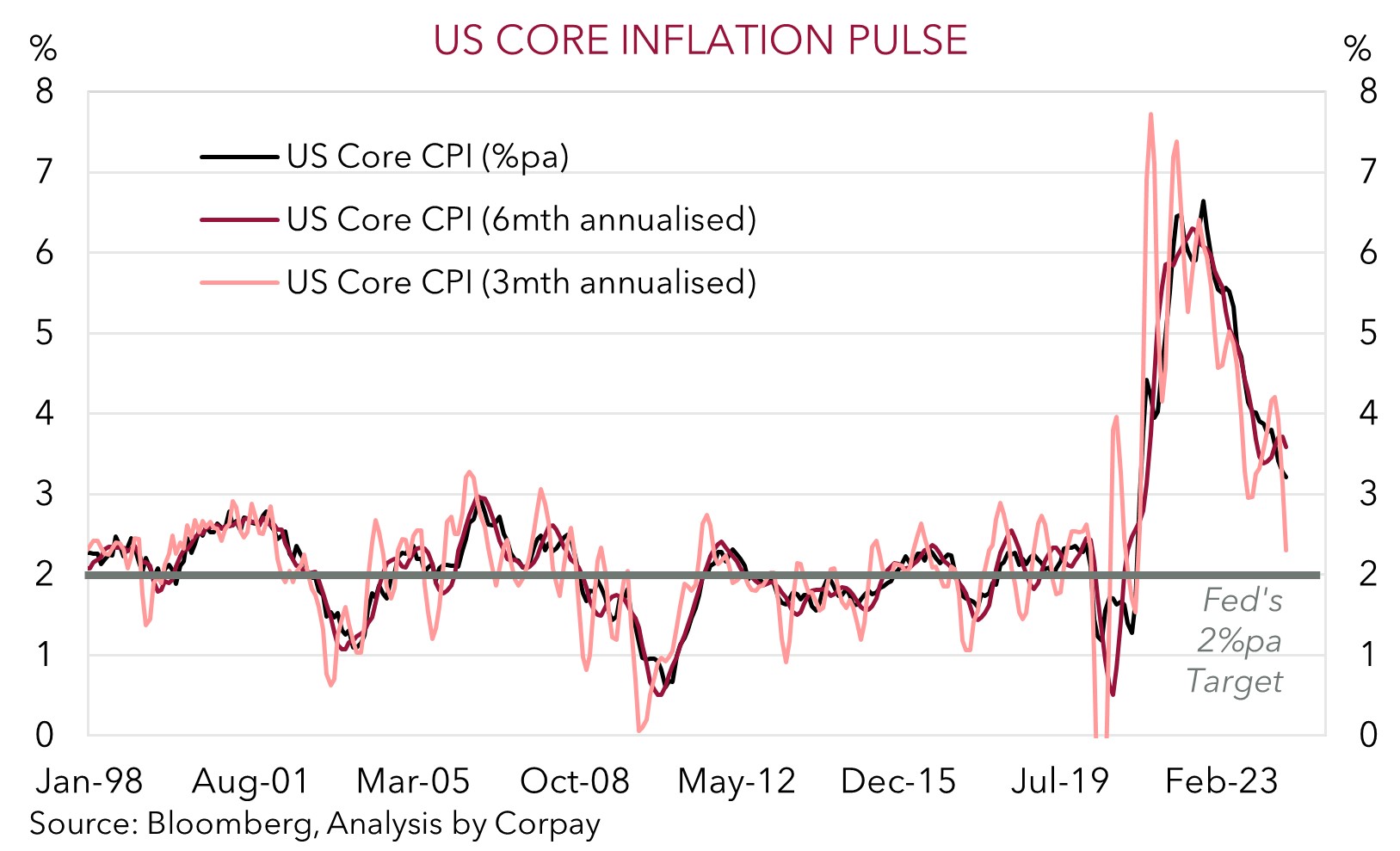

The latest US CPI inflation report was in focus overnight, and the largely as anticipated results generated a rather benign response. The annual pace of US headline and core CPI ticked down to 2.9%pa and 3.2%pa, respectively. Below the surface there were encouraging signs the US’ inflation pulse is moderating. As our chart shows, the 3-month annualised run rate of US core inflation has stepped down towards the Fed’s 2% target. Disinflation across goods prices remains, and while rents and services inflation were firmer than expected in July, part of that looks to reflect monthly volatility across the West Coast states. The data supports the assessment that the US Fed is set to kick off its rate cutting cycle at its mid-September meeting. Markets seem assure whether the Fed might deliver a 25bp or 50bp reduction given a ~35bp rate cut is priced in. We think that barring a deterioration in economic and labour market conditions a 25bp move is more likely.

Across markets US equities nudged up with the S&P500 (+0.4%) recording its 5th straight positive day. The questions over the size of the Fed’s potential rate cut saw the US 2yr yield edge a bit higher (+3bps to 3.96%), while the benchmark US 10yr rate consolidated (now ~3.84%). Elsewhere, energy prices continued to unwind the geopolitical risk premium factored in earlier this week with WTI crude oil shedding ~1.4%. Iron ore prices also lost ground (-2.8%) after China steelmaker Baowu warned of an industry crisis. In FX, the USD index tread water with a firmer EUR (now ~$1.1015, its highest level since early-January) offsetting a softer JPY (USD/JPY has poked its head over ~147) and weaker GBP (now ~$1.2830). UK CPI inflation undershot forecasts with the important services gauge decelerating to 5.2%pa, its slowest pace since mid-2022. This dragged down UK bond yields. The NZD (now ~$0.60) underperformed with its recent revival washed away in the blink of an eye after the RBNZ delivered a 25bp rate cut and flagged many more moves are in the pipeline. The AUD (now ~$0.66) drifted lower in sympathy.

Today there are a few key data points of note. In addition to the Australian jobs report (11:30am AEST), the China activity data batch for July is due (12pm AEST). Q2 UK GDP is released (4pm AEST), and tonight US retail sales and initial jobless claims are out (10:30pm AEST) with the Fed’s Musalem (11:10pm AEST) and Harker (3:10am AEST) also speaking. In our opinion, signs of improving momentum in China, combined with subdued but still positive US retail spending could be a favourable mix for risk sentiment and exert downward pressure on the USD.

AUD Corner

After touching a multi-week high the AUD drifted back over the course of yesterday afternoon and overnight with the’ dovish’ RBNZ rate cut (see below) and softer base metal prices taking the heat out of the currency. That said, at ~$0.66 the AUD is still above its 1-month average. The backdrop also saw the AUD lose a little ground on the crosses with falls of ~0.3-0.7% recorded against the EUR, JPY, GBP, CAD, and CNH over the past 24hrs.

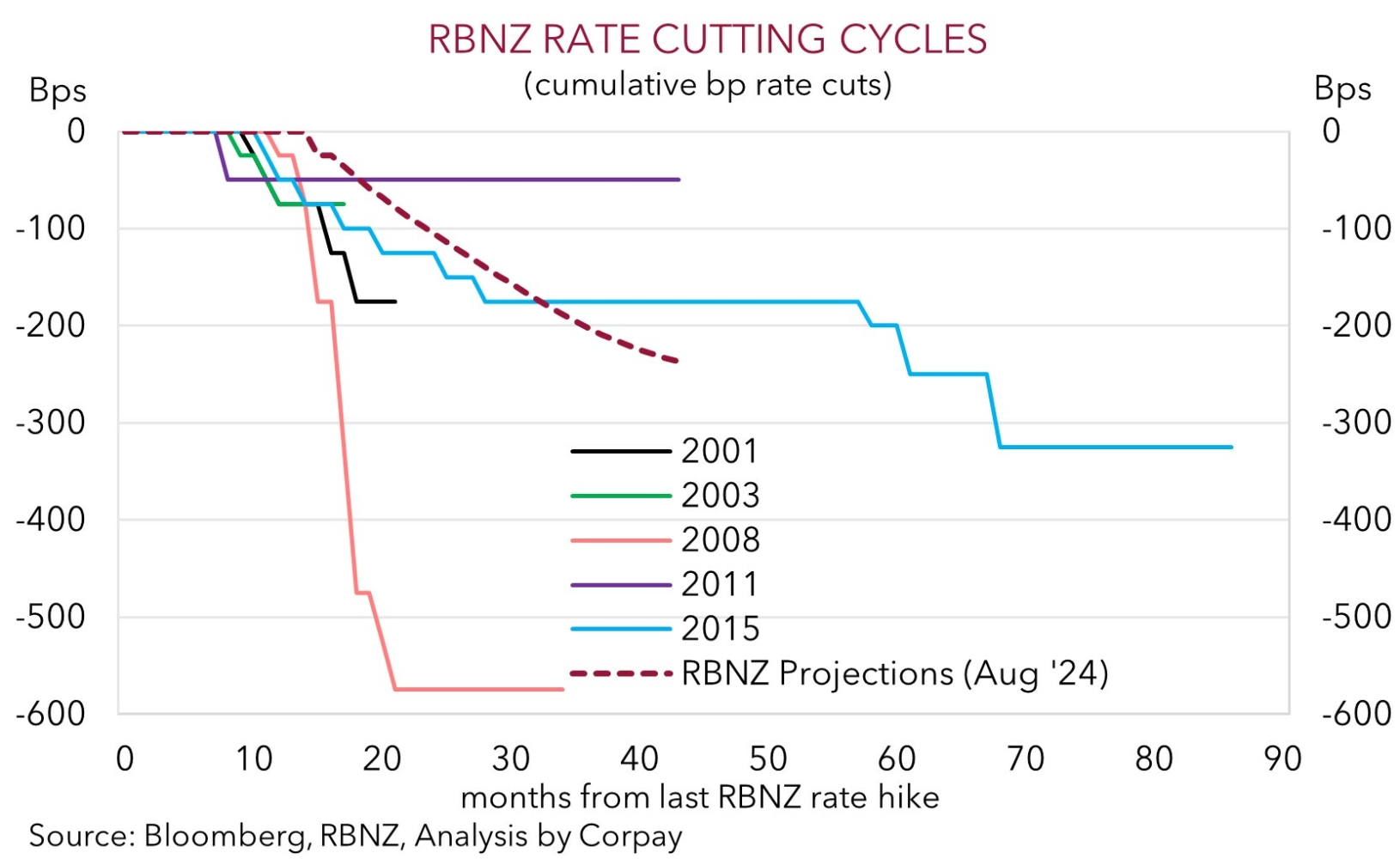

By contrast, AUD/NZD has pushed up to ~1.10, with the diverging macro fundamentals between Australia and NZ becoming clearer. The negative impacts from 15-months of very ‘restrictive’ settings are being felt across the NZ economy, and in response the RBNZ lowered interest rates by 25bps to 5.25% yesterday. Notably, based on the weak NZ growth outlook and inflation signals the RBNZ is now indicating interest rates could steadily fall towards ‘neutral’. In its forecasts the RBNZ is implying ~165bps worth of cuts between mid-2024 and end-2025 (up from only ~40bps of easing predicted in May). We think this should be a headwind for the NZD, with more medium-term upside in AUD/NZD anticipated. Our long-held forecast has been for AUD/NZD to edge up towards ~1.13 by Q4. This may arguably be on the low and slow side. For more see Market Musings: AUD/NZD – RBNZ joins the rate cut club.

From our perspective, the RBA is in a different spot to the RBNZ. Growth has slowed, but the level of activity across the Australian economy remains above its pre-COVID trend, especially in the labour-intensive services sectors. This is keeping Australian inflation sticky, and suggests the RBA is some time away from starting its easing cycle. Indeed, we remain of the view that when the time comes (we think the first RBA rate cut is likely in H1 2025) the RBA’s easing cycle will be more limited than many other central banks based on its lower starting point and given the fiscal/income support that is flowing. Over time, the contrasting monetary policy impulses between the RBA and its peers, and shift in relative yield spreads in Australia’s favour should be AUD supportive, in our opinion. This theme may receive a kick along today if the Australian jobs report (11:30am AEST) shows conditions remain positive. Consensus is forecasting jobs growth of 20,000 in July and for the unemployment rate to hold steady at 4.1%. Importantly, this is below estimates of ‘full-employment’. Added to that, we believe signs of improving momentum in the China activity data (12pm AEST) and/or soft US retail sales and jobless claims reports (10:30pm AEST) could give the AUD a helping hand with the latter likely to reinforce assumptions the US Fed’s easing cycle is approaching. If realised, we feel this might weigh on the USD.