• Positive jolt. Soft US producer prices boosted risk sentiment. US equities rose, while bond yields & the USD declined. AUD’s rebound has extended.

• RBNZ today. AUD/NZD on the radar. RBNZ meets today. Markets & economists split on whether a cut is delivered. AUD/NZD volatility likely.

• Data flow. US CPI inflation out tonight. UK CPI also due. Tomorrow, Australian jobs, the China activity data batch, & US retail sales are released.

A subdued US Producer Price Index, a sign upstream inflation pressures are moderating, generated a positive jolt for risk sentiment overnight. US headline PPI rose just 0.1% in July, to be up 2.2%pa, while the core reading (i.e. excluding food and energy) decelerated to 2.4%pa thanks in part to slowing services prices. Importantly, the bits and pieces from the PPI which flow into the US PCE deflator (the US Fed’s preferred inflation gauge) such as medical costs were also encouraging.

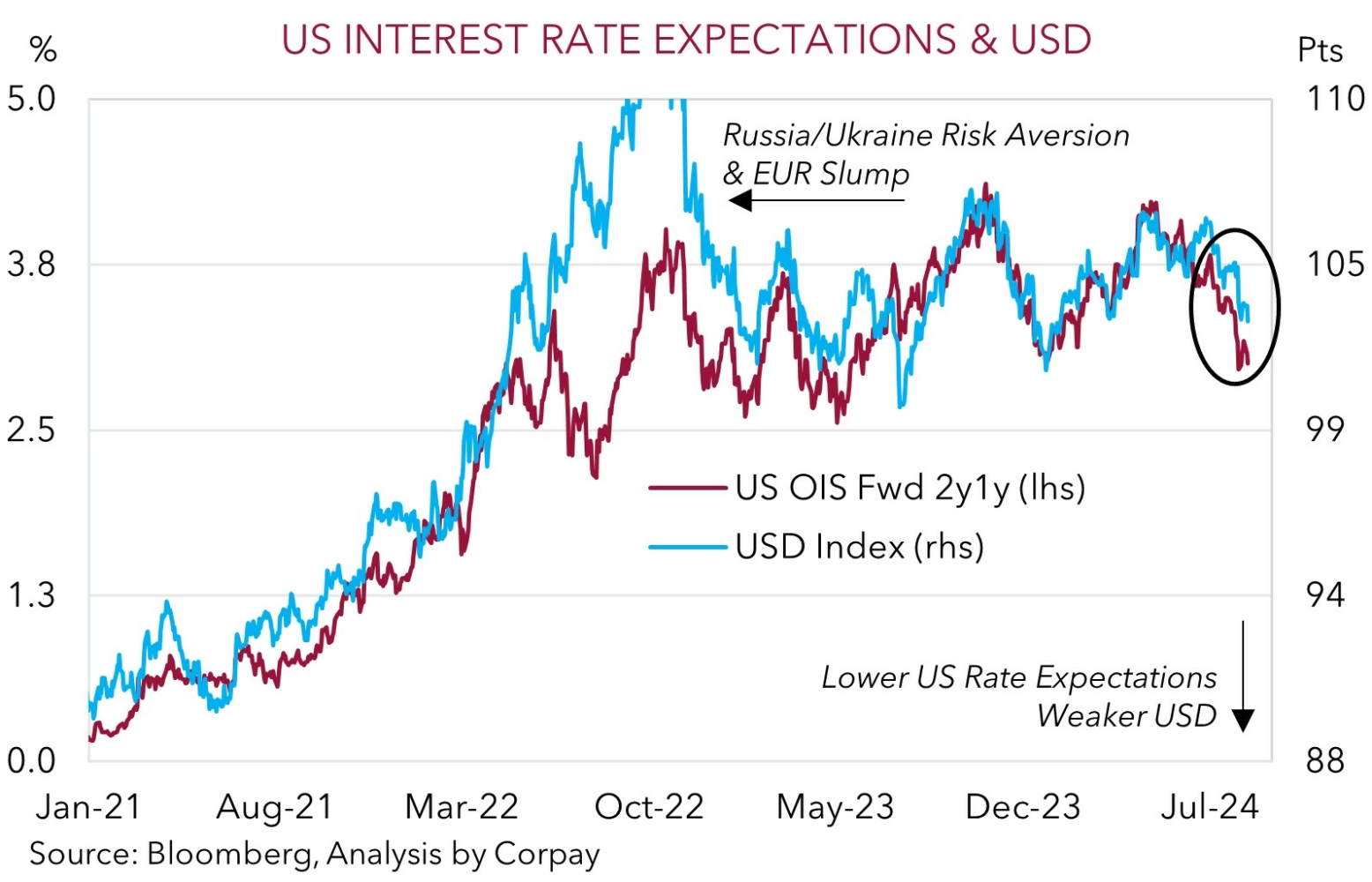

The data helped reinforce expectations the US Fed’s easing cycle is coming into view. Markets are factoring in a ~40bp rate cut by the US Fed in September, with a steady series of reductions discounted after that. The Fed funds rate (now 5.5%) is priced in to fall towards 3.3% by this time next year. US bond yields declined with the benchmark 10yr rate shedding ~6bps to be at ~3.84%. The US 2yr rate is at ~3.93%. By contrast, thoughts of less ‘restrictive’ Fed policy and lower bond yields pushed up equities. The US S&P500 increased ~1.7%, with the tech-focused NASDAQ outperforming (+2.4%). In FX, the USD lost ground. EUR has edged up towards ~$1.10 (the top end of its ~7-month range), and USD/JPY tracked the decline in US yields to be back under ~147. GBP strengthened with a surprise dip in UK unemployment (from 4.4% to 4.2%) tempering thoughts of a follow up Bank of England rate cut in September. Elsewhere, ahead of today’s RBNZ meeting (12pm AEST) where we think there is a strong chance a rate cut is delivered the NZD appreciated (now ~$0.6075). The AUD’s revival also extended (now ~$0.6633) with sticky Australian wages supporting views the RBA is on a different interest rate path to its global peers.

Today, in addition to the RBNZ meeting global attention will be on the UK CPI (4pm AEST) and the important US CPI inflation report (10:30pm AEST). In our view, there is a risk GBP reverses course if UK services and core inflation moderates. In terms of the US, as we have been outlining over recent days and as observed in the overnight PPI data, the slowdown in US activity, cooling labour market, and downturn in key services price drivers like rents points to a softening inflation pulse. Consensus is predicting the annual run-rate of US core CPI inflation to tick down from 3.3%pa to 3.2%pa. If realised, we think lower US rate expectations could exert more pressure on the USD.

AUD Corner

The AUD’s reversal has continued over the past 24hrs. Positive risk sentiment, as illustrated by the jump up in US equities, and lower bond yields on the back of softer US producer prices has weighed on the USD (see above). At ~$0.6633 the AUD is around a three-week high and ~4.5% above last Monday’s panic equity sell-off low. While AUD/GBP (now ~0.5155) and AUD/NZD (now ~1.0920) have consolidated, the AUD has extended its rebound against the EUR (now ~0.6035), JPY (now ~97.40), CAD (now ~0.9090), and CNH (now ~4.7415).

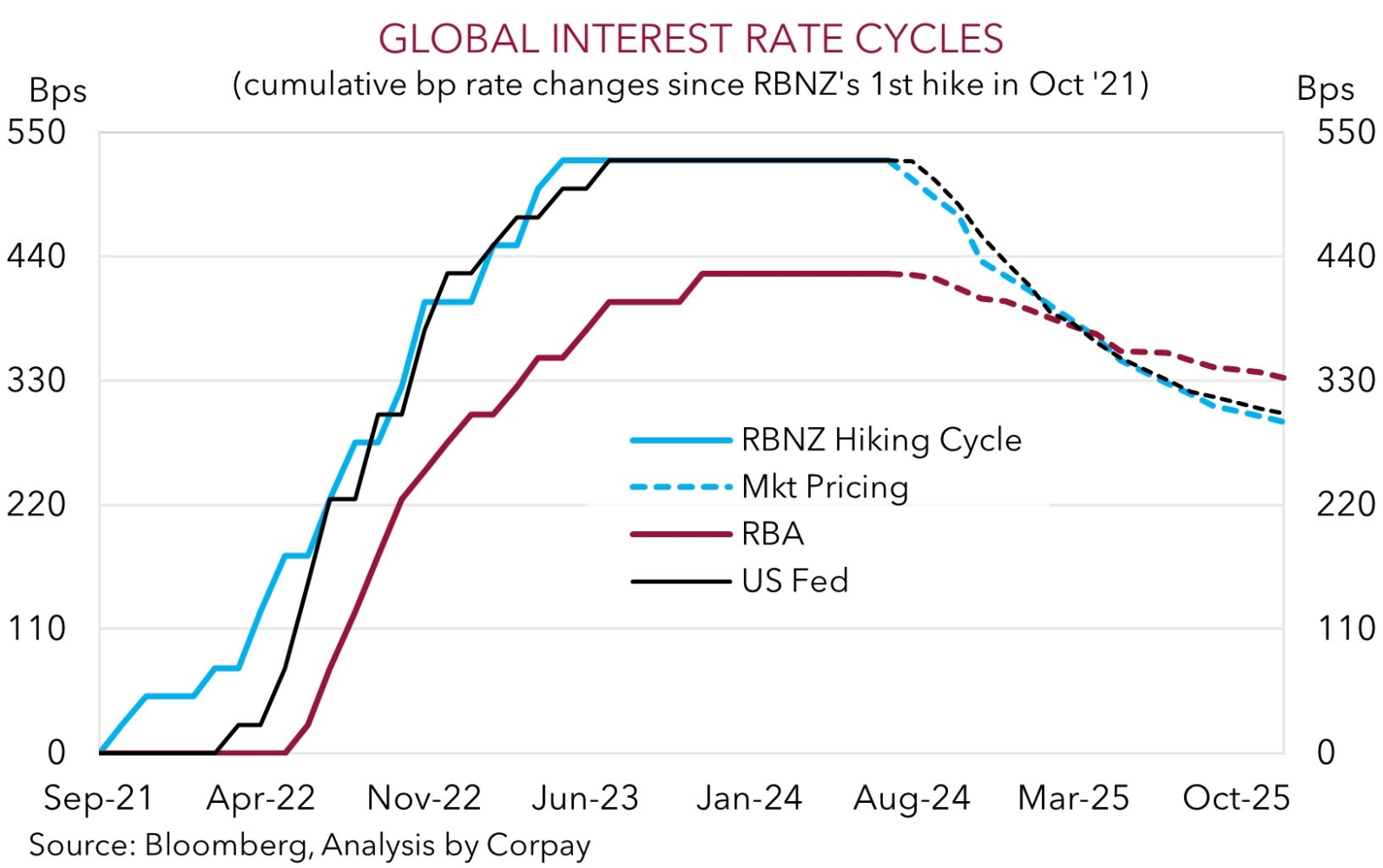

Also underpinning the AUD was domestic data reinforcing the theme that the RBA should lag its peers in terms of when it starts lowering interest rates and how far it goes during the next easing cycle. The annual growth rate of aggregate wages held steady at 4.1%pa. Under the surface there are a few signs wages will moderate from here, however based on the high share of multi-year enterprise bargaining agreements utilised in Australia the slowdown could be drawn out. In our opinion, based on Australia’s lackluster productivity wages still aren’t where they need to be for inflation to be consistent with the RBA’s target. More ‘slack’ is needed in the labour market, and this will take time to develop. As such, we remain of the opinion that the monetary policy impulses between the RBA and other central banks are diverging, and that the shift in relative yield spreads in Australia’s favour should be AUD supportive. A softer US CPI inflation reading (10:30pm AEST) and/or another solid Australian jobs report (released Thursday) is likely to bolster this view.

AUD/NZD will also be on the radar. After touching a multi-quarter high AUD/NZD has given back some ground over early August. The RBNZ hands down its policy decision (12pm AEST), with Governor Orr also speaking (1pm AEST) today. This is an important meeting as it is a quarterly update where the RBNZ releases new forecasts. The RBNZ went hard and early during the tightening phase and the NZ economy is responding. Based on the stumbling NZ economy, upswing in unemployment, weakening inflation, and prospect of downgraded forecasts, we believe the RBNZ could deliver its first interest rate cut of the cycle. This isn’t a consensus view. Markets are discounting a ~65% chance the RBNZ lowers rates by 25bps, while 13 of 23 analysts surveyed see the RBNZ holding fire. In our judgement, a RBNZ rate cut and signal more should follow could push AUD/NZD back up towards the top of its cyclical range. By contrast, a no change outcome would see AUD/NZD dip.