• Quiet start. Subdued start to the new week. US equities consolidated, bond yields slipped back. Commodities firmer. This helped the AUD drift higher.

• Data flow. UK jobs & US PPI due today. US inflation, RBNZ meeting, & UK CPI out tomorrow. Will the US PPI/CPI show moderating inflation pressures?

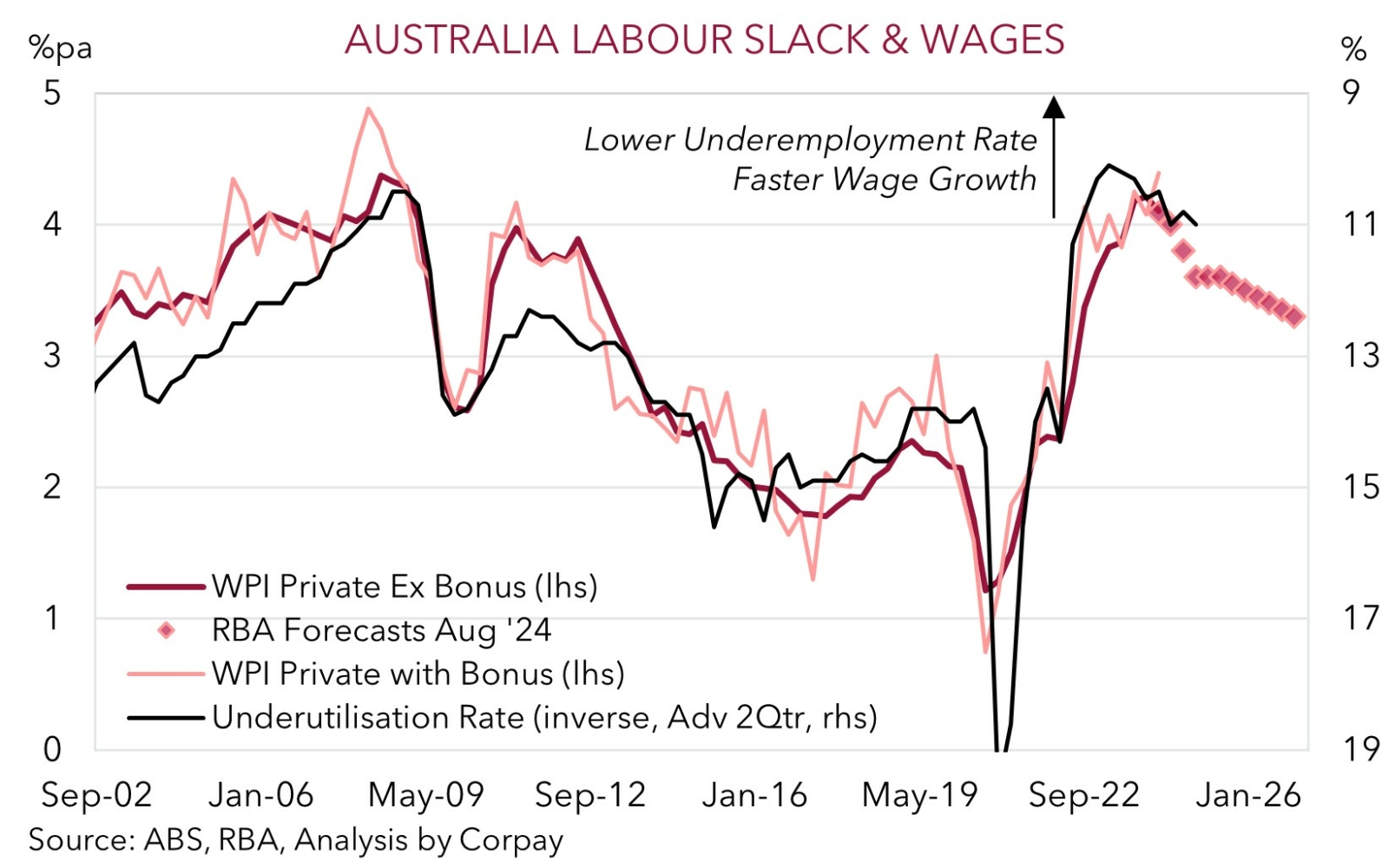

• AU data. Q2 wages & business conditions in focus today. Wages drive services inflation. The monthly Australian jobs report out on Thursday.

In contrast to the panic sell-off across markets last Monday it was a typical quiet start to the week yesterday. US equities consolidated (NASDAQ +0.2%, S&P500 flat), bond yields slipped back a bit further with the benchmark 10yr rate shedding ~4bps to be at ~3.90%, and the USD tread water. Although cross-currents below the surface help explain the lack of net changes in the USD. While the EUR nudged up (now ~$1.0930), the JPY softened with USD/JPY edging over ~147. Comments yesterday by a former Bank of Japan official that he thought they may not “be able to hike again, at least for the rest of the year” exerted a bit of downward pressure on the JPY.

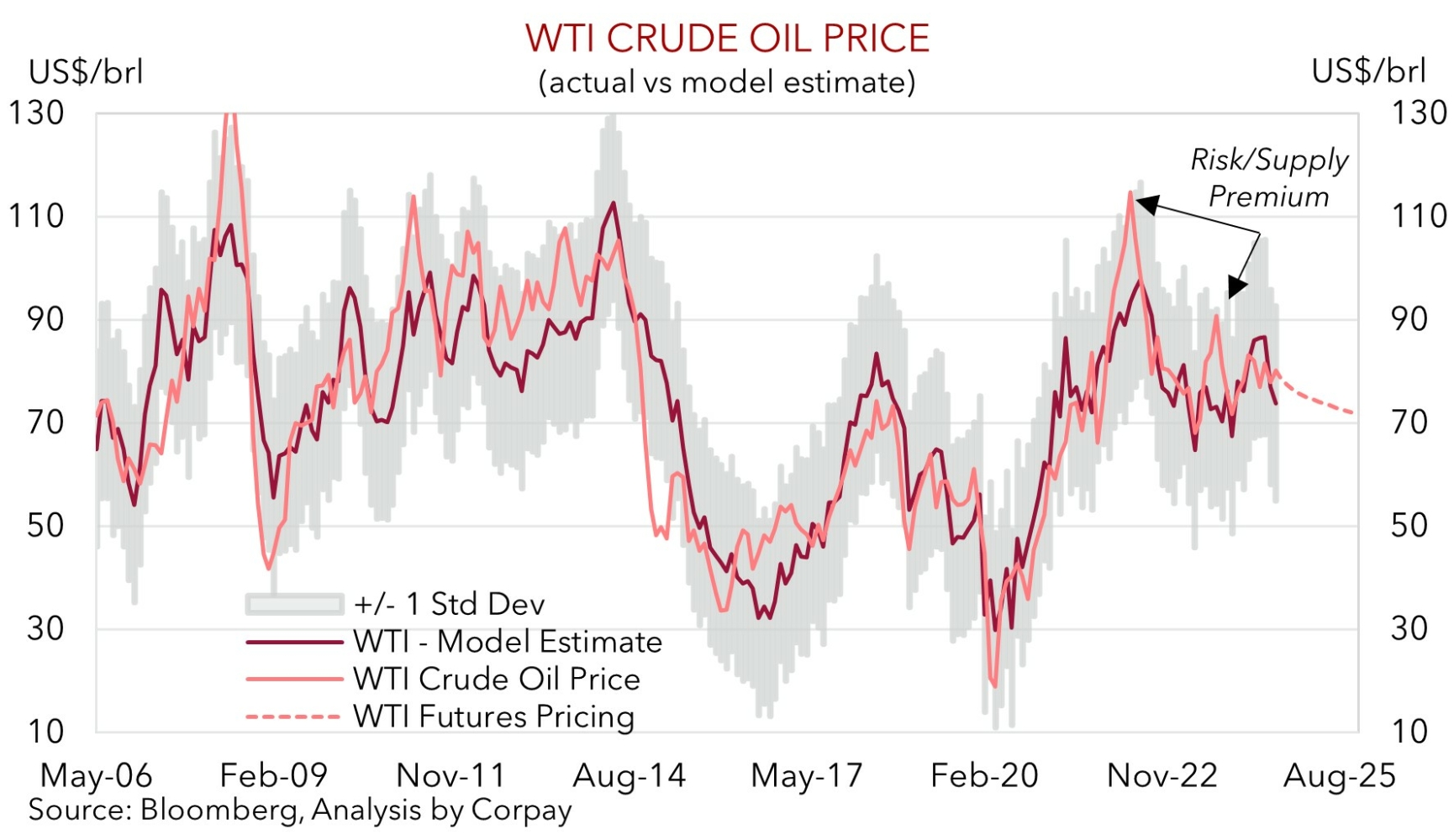

Elsewhere, ahead of tomorrow’s RBNZ meeting (where we think there is a strong chance of a rate cut) the NZD rose (now ~$0.6020), as did the AUD (now ~$0.6585). Firmer commodity prices were a factor with copper up ~1.8%, and WTI crude oil nearly 4% higher (now ~US$80/brl) due to lingering geopolitical risks. Media reports indicate Israel has put its military on high alert and the US is speeding up the arrival of a second aircraft carrier because of concerns about possible Iranian/Hezbollah actions. That said, at ~$US80/brl, WTI is broadly inline with its one-year average, and as shown, prices aren’t that far from our demand/supply model estimate.

The global economic release calendar heats up over the next few days. Today the UK jobs report (4pm AEST) and US Producer Price Inflation (10:30pm AEST) are due. This will be followed by US CPI inflation (Weds AEST) and retail sales (Thurs AEST), the RBNZ meeting (Weds), the monthly China activity data batch (Thurs), Australian jobs data (Thurs), UK inflation (Weds) and GDP (Thurs), and Japan GDP (Thurs). As outlined yesterday, we think the data should show the cracks in the UK labour market are widening, which if realised could bolster Bank of England rate cut expectations and drag on GBP. Similarly, we believe the US PPI (and CPI) may indicate inflation pressures are moderating. Signs the US’ inflation pulse is weakening might reinforce US Fed rate cut assumptions, with the lower level of US interest rate expectations a negative for the USD, in our opinion.

AUD Corner

The AUD has drifted a bit higher over the quiet start to the new week thanks to firmer commodity prices and subdued volatility (see above). At ~$0.6585 the AUD is within a whisker of ticking back over its 200-day moving average, a technical indicator it hasn’t been above for several weeks. The backdrop has also helped the AUD generally outperform on the crosses. AUD/EUR (now ~0.6025) has been making its way back towards its one-year average, while AUD/JPY (now ~96.95), AUD/CNH (now ~4.7270) and AUD/GBP (now ~0.5158) have also extended their respective rebounds.

Yesterday, RBA Deputy Governor Hauser spoke and although he took a few shots at analysts and commentators by labelling them ‘false prophets’ whose predictions might make people worse off, he didn’t really add anything new about the policy debate other than noting things are uncertain. Today, Q2 wages are released (11:30am AEST), as are the latest reads on consumer sentiment (10:30am AEST) and business conditions (11:30am AEST). Wages are important as they are a key input into trends in core/services inflation, the areas that the RBA has been lasering in on. The market consensus is looking for wages growth of 0.9%/4%pa in Q2, similar to the RBA’s expectations, as past tight conditions continue to work their way through the system. In our opinion, this type of result, coupled with still solid business conditions could support the view that the RBA is on a slightly different trajectory with its rate cutting cycle set to lag its peers in terms of when it starts and how far it goes. If realised, we believe the diverging monetary policy impulses and shifting yield differentials can help the AUD recover more lost ground.

On the crosses, AUD/GBP may also receive a boost if we are right and the upcoming UK jobs report (4pm AEST) and CPI data (Weds) show the labour market is losing steam and/or UK services inflation is slowing as this mix should reinforce Bank of England rate cut bets. Likewise, we feel AUD/NZD may lift. Based on the stumbling NZ economy, upswing in unemployment, and weakening inflation pulse we think there is a chance the RBNZ delivers its first rate cut at tomorrow’s meeting. This isn’t a consensus view. Markets are discounting a ~60% probability the RBNZ lowers rates by 25bps, however 12 of 21 analysts surveyed see the RBNZ holding fire.