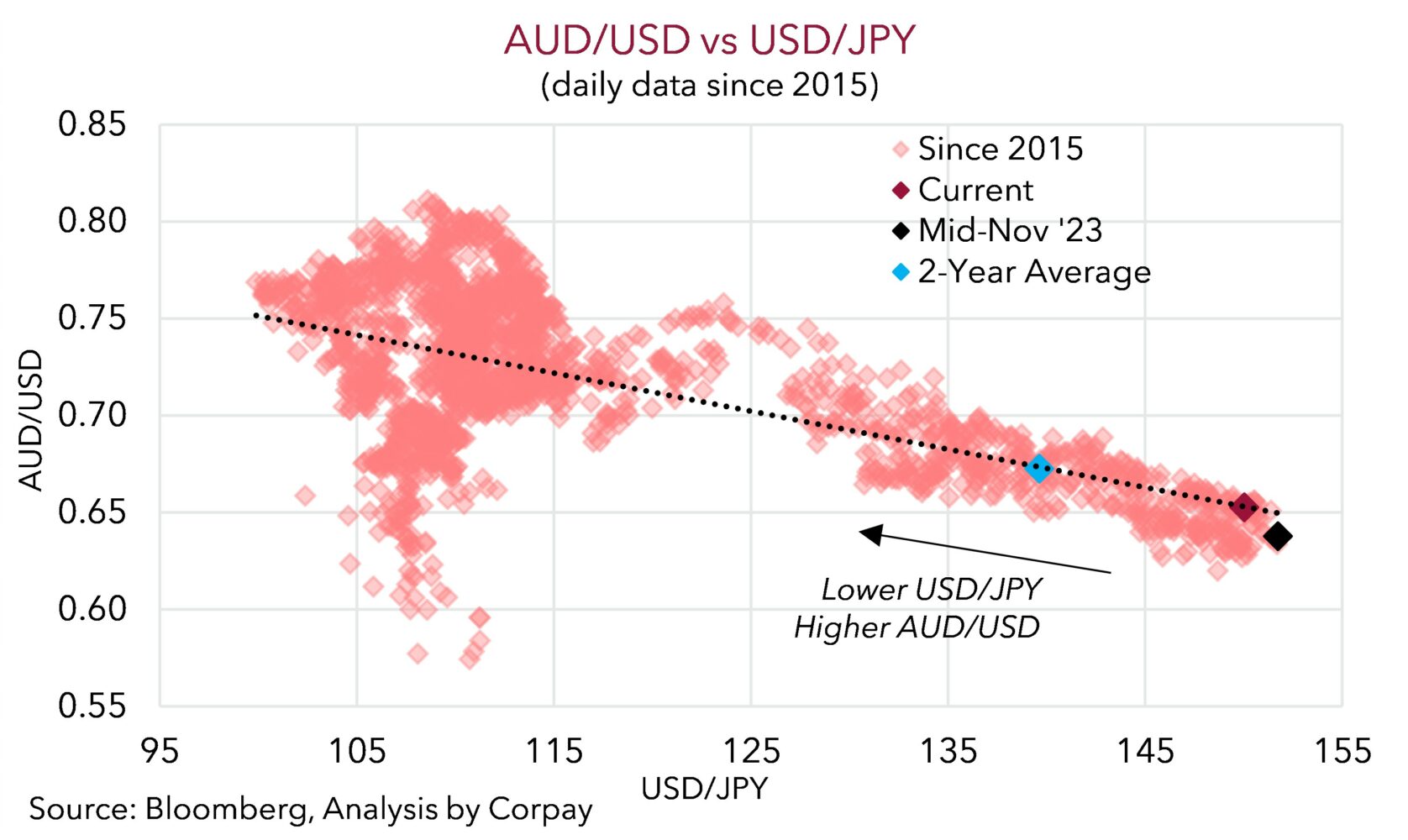

Some central bank action in today’s Asian session with the RBA and Bank of Japan meeting. The former had a bit of wordplay in its post meeting statement, while the latter finally relented and took steps to normalise its ultra-loose policy stance. Although market participants appear underwhelmed with the BoJ’s actions. The resultant lift in USD/JPY has flowed through and exerted downward pressure on the AUD.

In terms of the RBA, as expected interest rates remained at 4.35%. In its view, while there are “encouraging signs” inflation is coming down it “remains high” and “the economic outlook remains uncertain”. As such the path of interest rates that will best get inflation down to target in a reasonable time remains “uncertain” and as a result “the Board is not ruling anything in or out” from here. While this is different to the previous post meeting statement when the Board noted “a further increase in interest rates cannot be ruled out” it is inline with what RBA Governor Bullock outlined in the last post meeting press conference and appearance before the House of Representative Parliamentary Committee. It is also indicative of the bumpy ride ahead for the economy as various cross-currents play out.

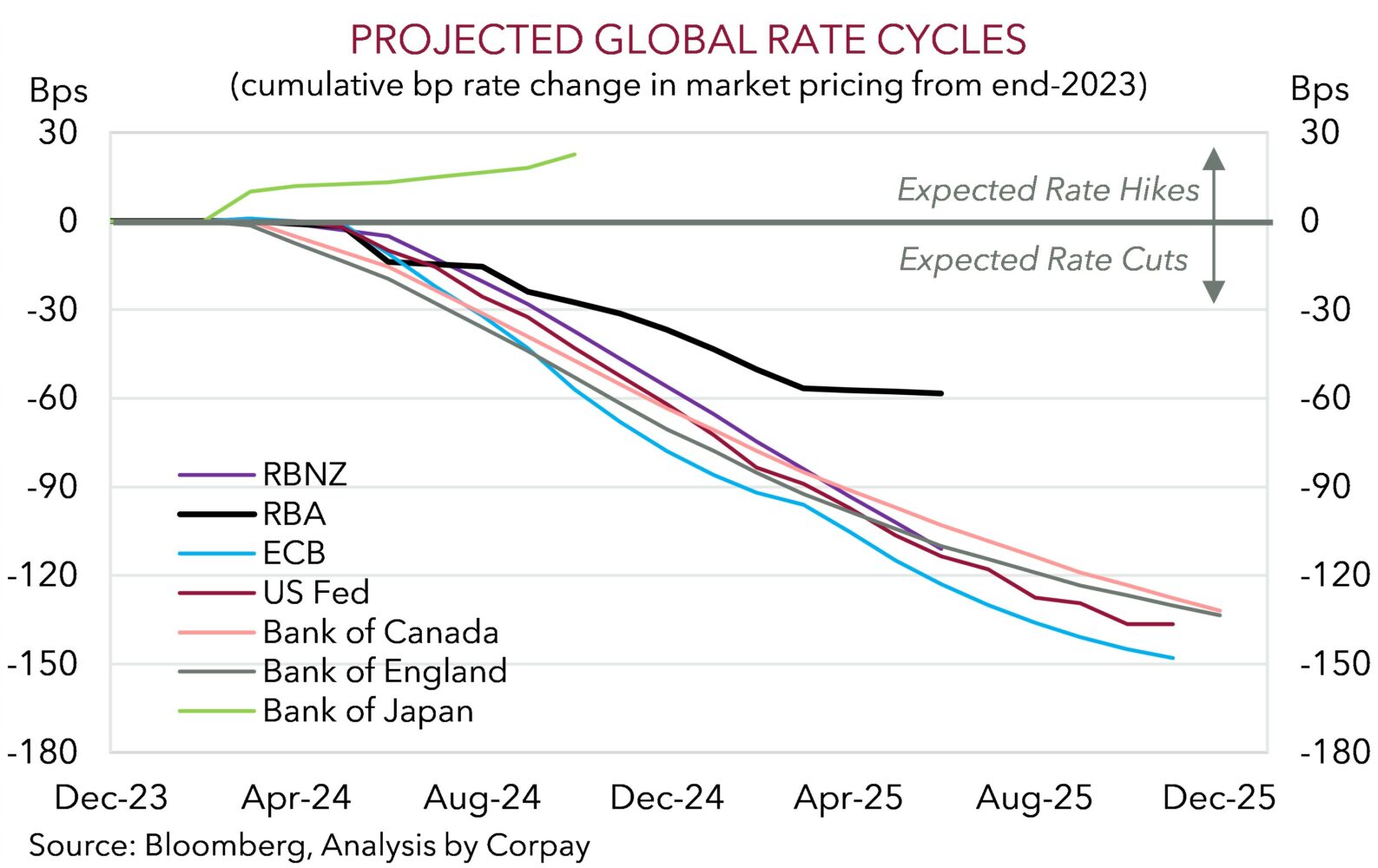

In a practical sense the RBA is watching how the data and balance of risks unfold. No surprises there. In reality, despite its rhetoric further rate hikes this cycle weren’t genuinely on the table. But at the same time, interest rate cuts still look some time away, in our view, given the positive income support set to flow from the incoming stage 3 tax cuts, still tightish labour market conditions, slow moving wage dynamics in Australia given the high prevalence of multi-year enterprise bargaining agreements, and stickiness across parts of the services CPI bucket. We continue to think that this mix, coupled with signs momentum in China’s economy is turning the corner, should see the RBA lag its peers in terms of how fast and far it moves during the next easing cycle (see Market Wire: RBA: A more balanced approach). Australian economic growth is set to remain sub-trend over H1 2024, unemployment should edge higher, and inflation is predicted to moderate. This points to the next move by the RBA being to lower rates. But we don’t see the first RBA rate cut occurring until late Q3/Q4 2024. And for the AUD, a move slower moving RBA relative to other major central banks should, in our judgement, see bond yield differentials move in favour of a higher currency over time.

In contrast to the RBA’s semantics the BoJ has taken some noteworthy steps down the policy normalisation path by making several changes to its framework. For the first time since 2007 the BoJ raised interest rates, with the policy target band increased to 0-0.1%. The BoJ’s policy rate had been in negative territory since 2016. The BoJ also ended its ETF and J-REITs purchase programs, and the 10-year JGB yield target was jettisoned. The BoJ has stated it will continue to buy Japanese government bonds, though this looks like it will be more ad hoc to smooth out and safeguard a rapid jump in long-term interest rates.

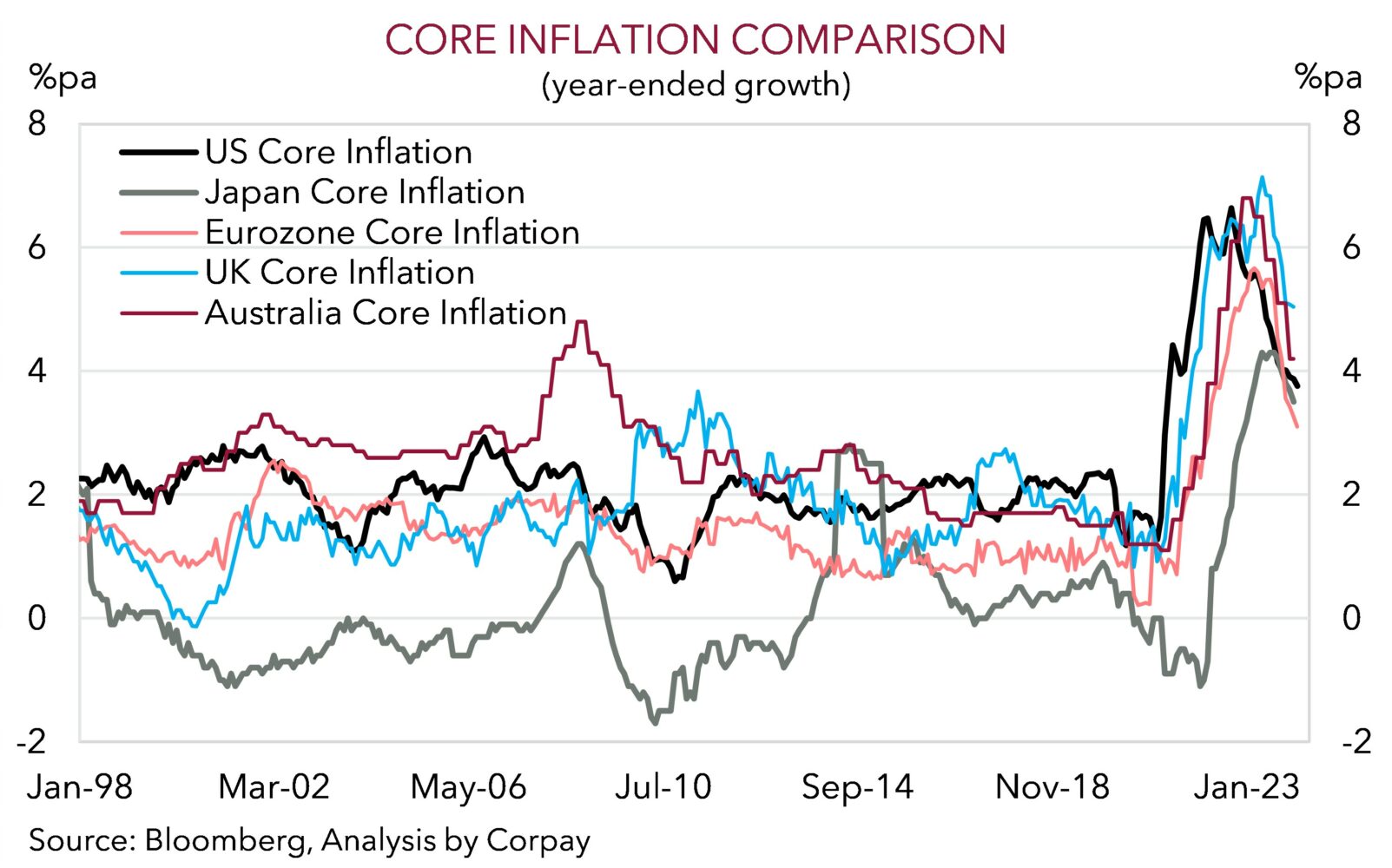

Markets seem disappointed by the BoJ adjustments with USD/JPY rising. This is surprising given ahead of the event markets were only discounting a ~50% chance of a rate rise today. We don’t believe this latest move higher in USD/JPY will last or extend much further. We think that the turn in the BoJ’s policy stance has further to run. Over time, based on the services/core inflation and wages pulse in Japan further modest BoJ rate hikes are likely, in our opinion. Today’s BoJ moves shouldn’t be viewed as ‘one and done’. Importantly, the shift by the BoJ is occurring just as other central banks appear to be starting to contemplate interest rate reductions as the focus swings from fighting rampant inflation to boosting sluggish growth.

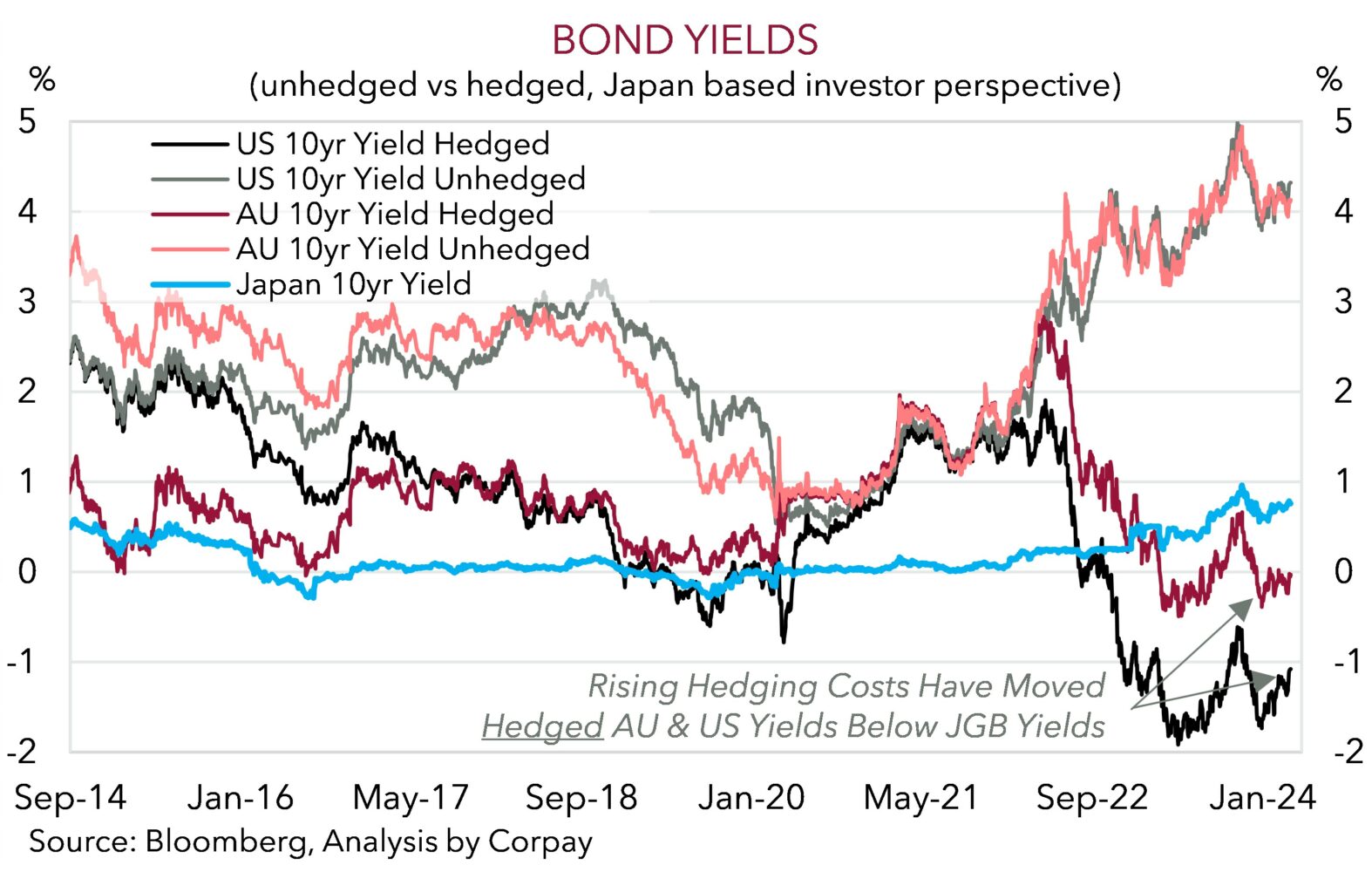

Down the track these diverging central bank trends should see nominal yield spreads swing in support of a firmer JPY, particularly as the JPY looks undervalued on various fundamental metrics. The more detailed capital flow dynamics are also important to consider. Although nominal bond yields in places like the US and Australia will continue to be above Japanese equivalents, after accounting for increased hedging costs, from a Japan-based investors perspective, offshore bond investments now appear to be unattractive. Less funds being sent offshore because investment into domestic Japanese markets is more favourable for local asset managers, and/or a repatriation back to Japan of offshore assets could be a positive JPY tailwind over the longer-term that hasn’t been there for quite a while.