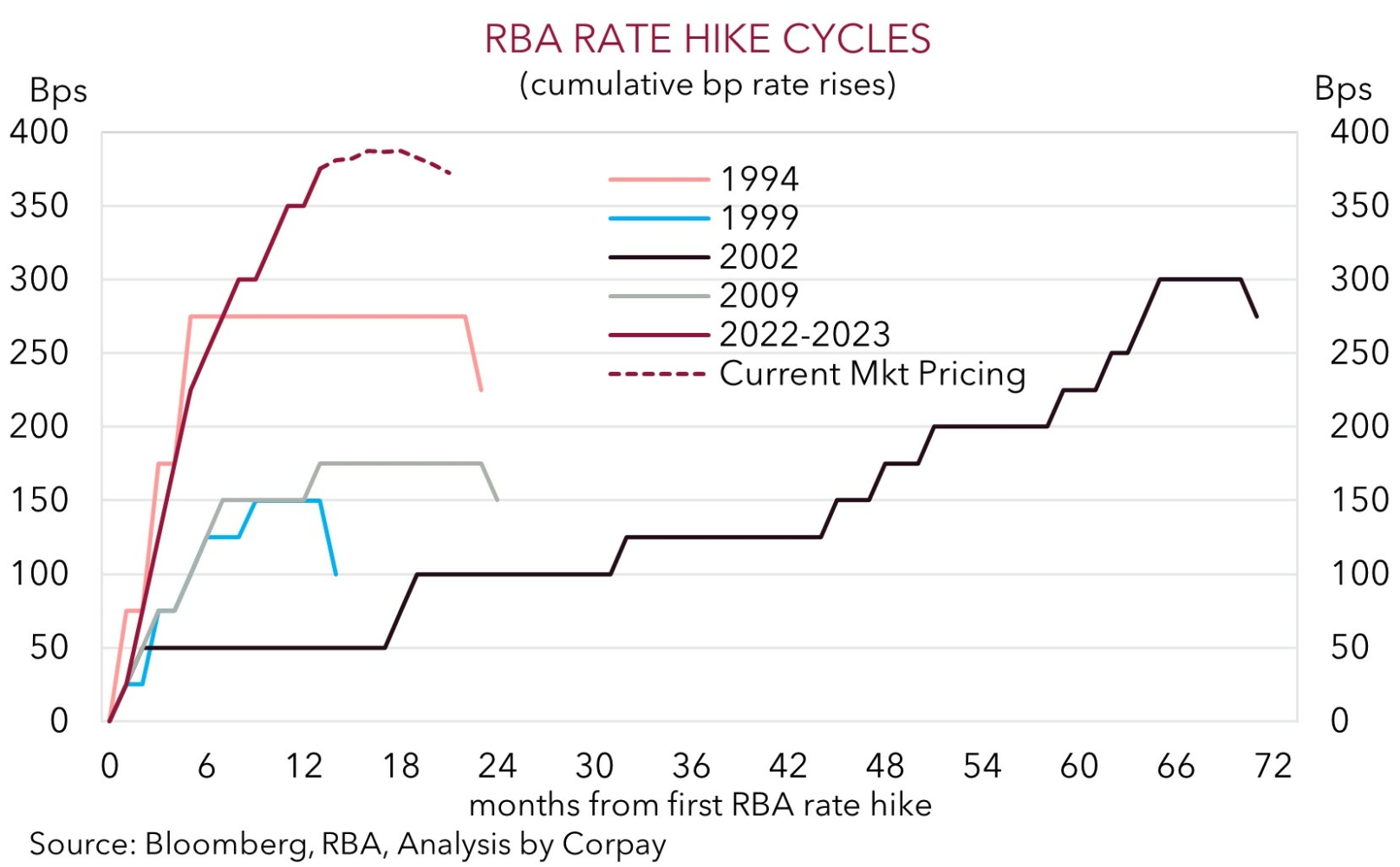

A ‘pause’ doesn’t last as long as it used to. In a surprise to most analysts and interest rate markets, the RBA raised the cash rate by another 25bps at today’s meeting, taking it up to 3.85%. The move means that a cumulative 375bps worth of rate hikes have been delivered so far this cycle. As our chart shows, this is by far the most aggressive tightening cycle the RBA has unleashed for several decades.

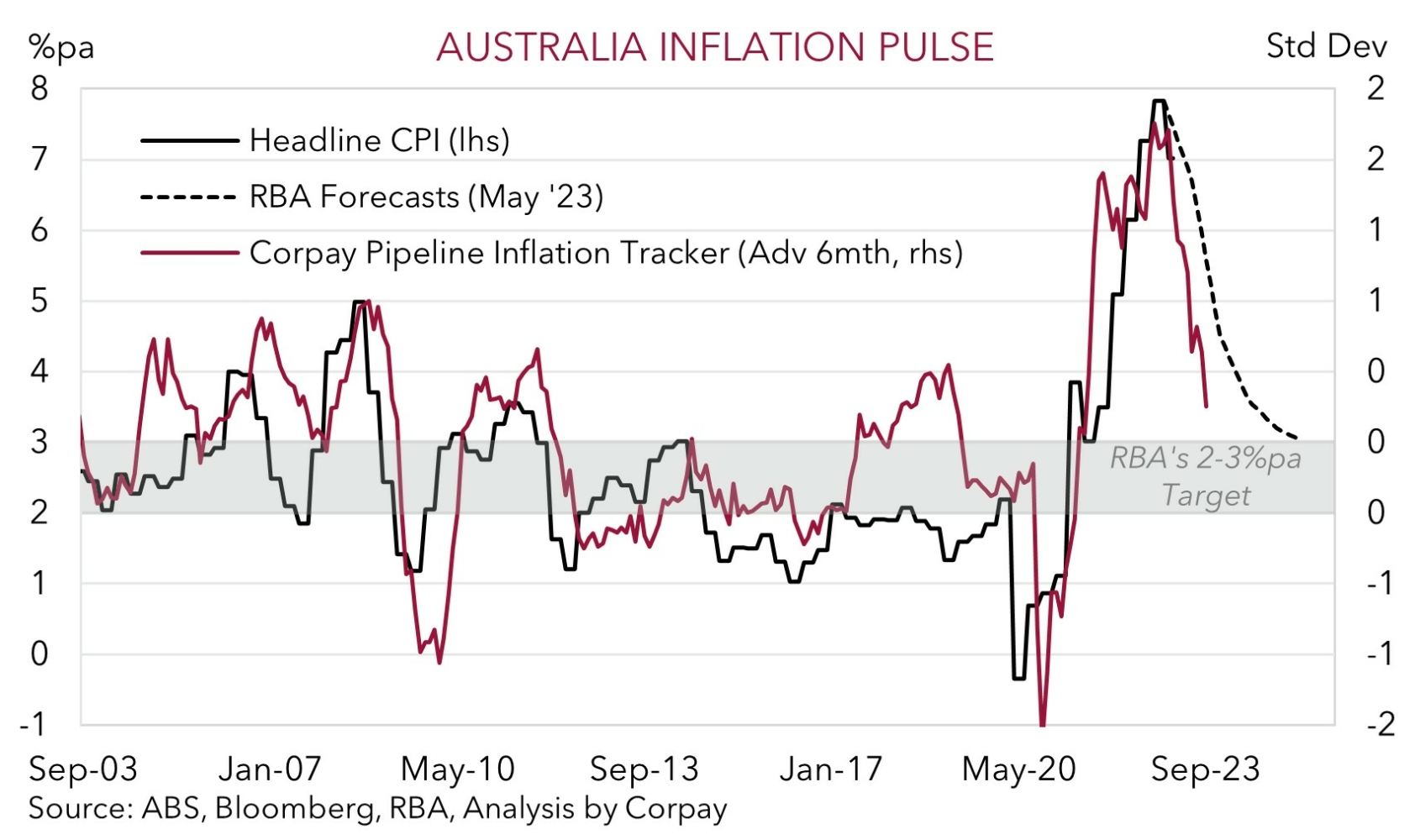

According to the RBA, inflation has “passed its peak” but at 7% it is “still too high and it will be some time yet before it is back in the target band”. And the “importance” of getting inflation back down in a “reasonable timeframe” underpinned today’s decision. The RBA is still only forecasting inflation to be back at ~3%, the top of its target band, in mid-2025. The uplift in ‘sticky’ services inflation (which is heavily linked to the tight labour market and wage trends) is on the RBA’s radar given the offshore experience, and it continues to keep a close eye on whether ‘inflation expectations’ remain “well anchored” as views on inflation are important cogs in the wage/price setting process.

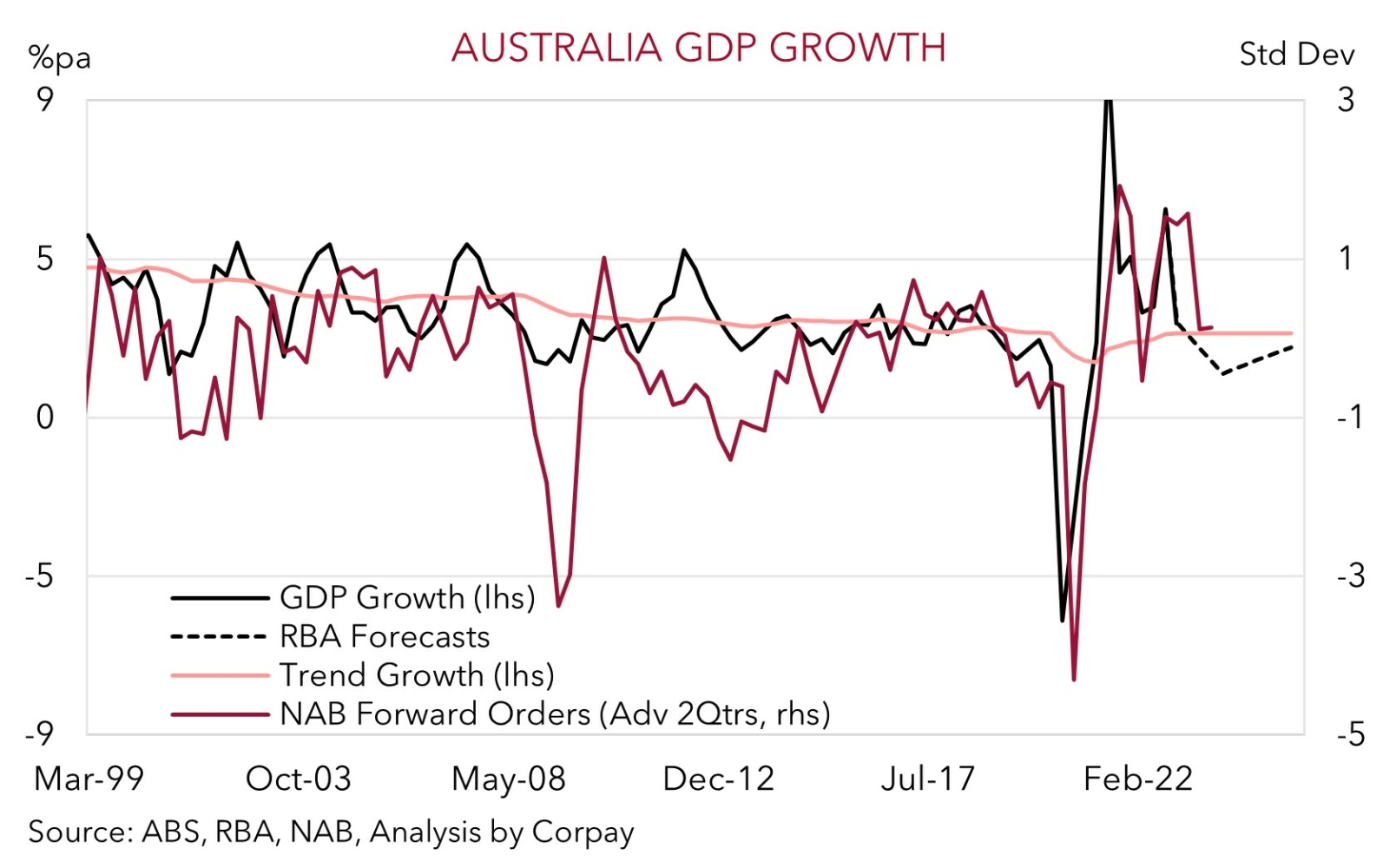

Looking ahead, the RBA has retained a conditional hiking bias, noting that “some further tightening” of policy “may be required” to ensure inflation gets back to target “in a reasonable timeframe”, however it continues to stress that any future moves will “depend on how the economy and inflation evolve”. On this score, the RBA is now forecasting Australian growth to decelerate to a sub-trend 1.25% pace over 2023, and for sluggish momentum to continue over the following couple of years. The RBA’s forecasts imply that outside of an expanding population there could be little growth in demand. This in turn should feed through negatively to the labour market with unemployment projected to inch up to ~4.5% by mid-2025.

In our view, while the RBA is still talking tough and has left the door open to do more, if needed, we doubt the economic trends will justify further hikes from here, especially with policymakers still trying to keep things on “an even keel” and looking to navigate the narrow path to a “soft landing”. We think the risks around the RBA’s growth and inflation forecasts are tilted to the downside.

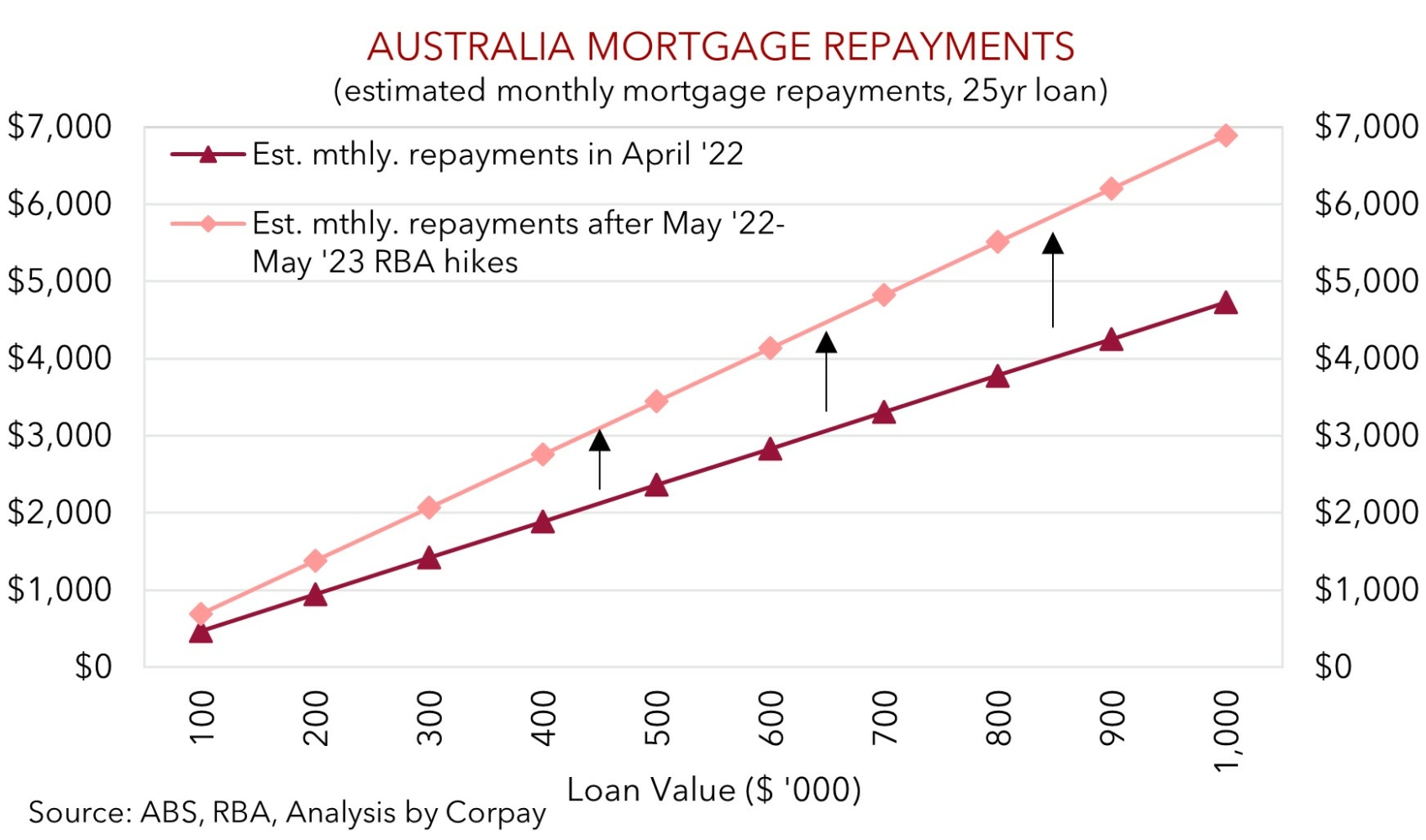

The jump up in mortgage rates is a substantial hit to indebted households which is compounding other cost of living pressures. And importantly, there is a lot of ‘natural tightening’ that will unfold over the next few quarters as the large pool of COVID-era fixed rate mortgages are refinanced at much higher rates. On our calculations, following today’s move a household with a ~$600,000 mortgage will be paying an extra ~$1,300 per month in repayments compared to before the RBA’s cycle kicked off a year ago. Based on the usual policy lags and mortgage refinancing cliff, the cashflow hit on indebted households should intensify over the period ahead, and we believe this should act to materially constrain consumer spending. In time, we expect this to flow through negatively to investment, the labour market, and inflation. Indeed, our pipeline tracker is pointing to a sharp slide in headline inflation over 2023.

With limited expectations for another rate hike by the RBA today, the AUD has unsurprisingly spiked on the announcement (now ~$0.6708). We think a further lift looks possible near-term, as the market digests the surprise move, with the 200-day moving average (~$0.6734) in the AUD’s sights. However, based on the underlying global growth and commodity prices trends and upcoming events, we doubt the AUD’s upswing will extend much beyond that or be sustained. The US Fed meeting (Thursday morning AEST) is the upcoming USD and market event risk. We are looking for the US Fed to hike interest rates by another 25bps and think there are ‘hawkish’ risks to its guidance compared to market thinking given the still strong US inflation pulse. In our opinion, a push back by the US Fed on the markets rate cut pricing for later this year could see US interest rates adjust upward, supporting the USD and potentially dragging the AUD back down.