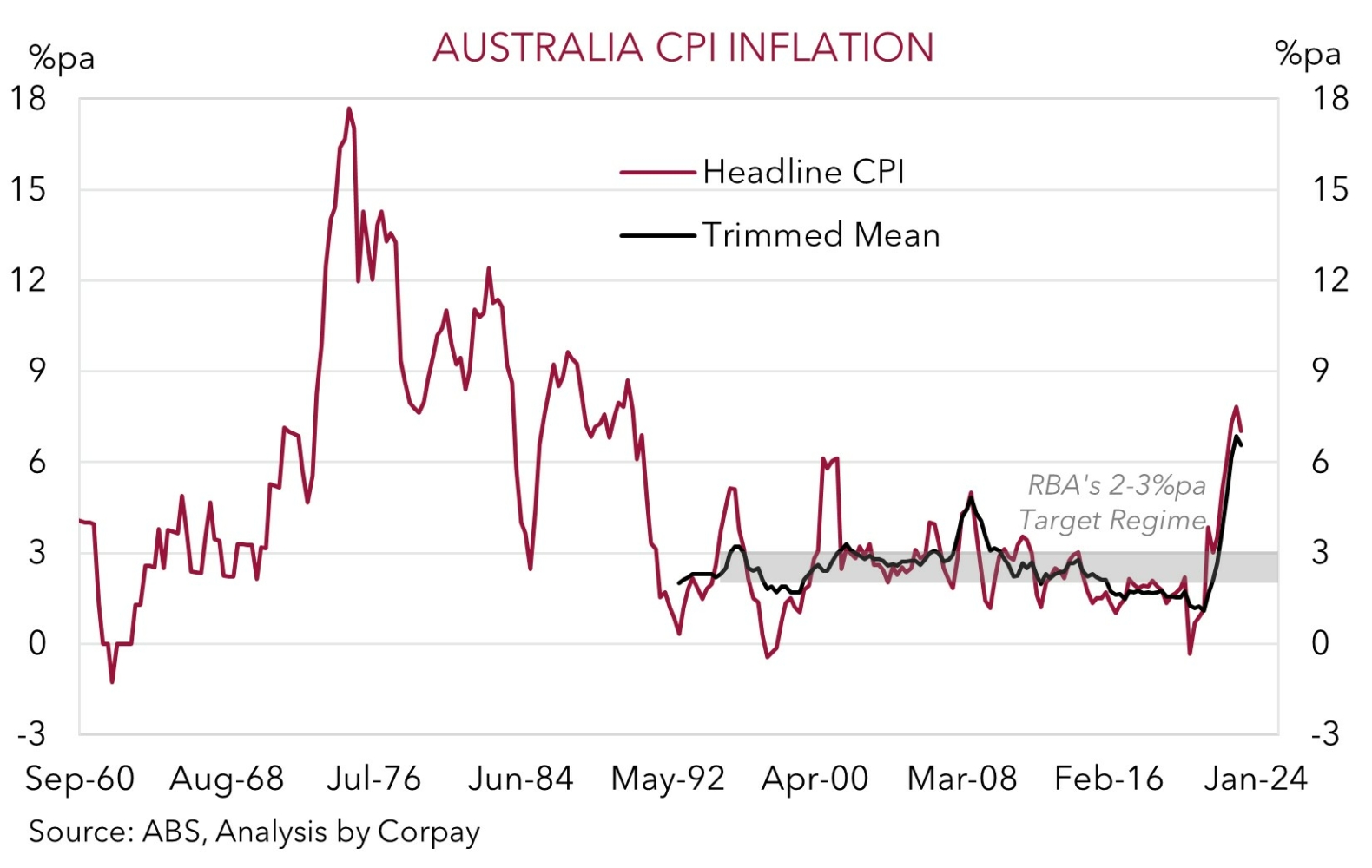

On net, the Q1 Australian CPI underwhelmed expectations, with the data confirming that inflation, which is the rate of change in consumer prices, ‘peaked’ at the end of 2022. In terms of the numbers, headline inflation stepped down from 7.8%pa to 7.0%pa. While this was slightly less than what the consensus of economists was factoring in, it was below the RBA’s February 2023 projections (mkt 6.9%pa, RBA ~7.3%pa). At the same time, trimmed mean (the RBA’s preferred core inflation gauge) eased a bit more than anticipated, slowing from 6.9%pa to 6.6%pa (mkt and RBA ~6.7%pa).

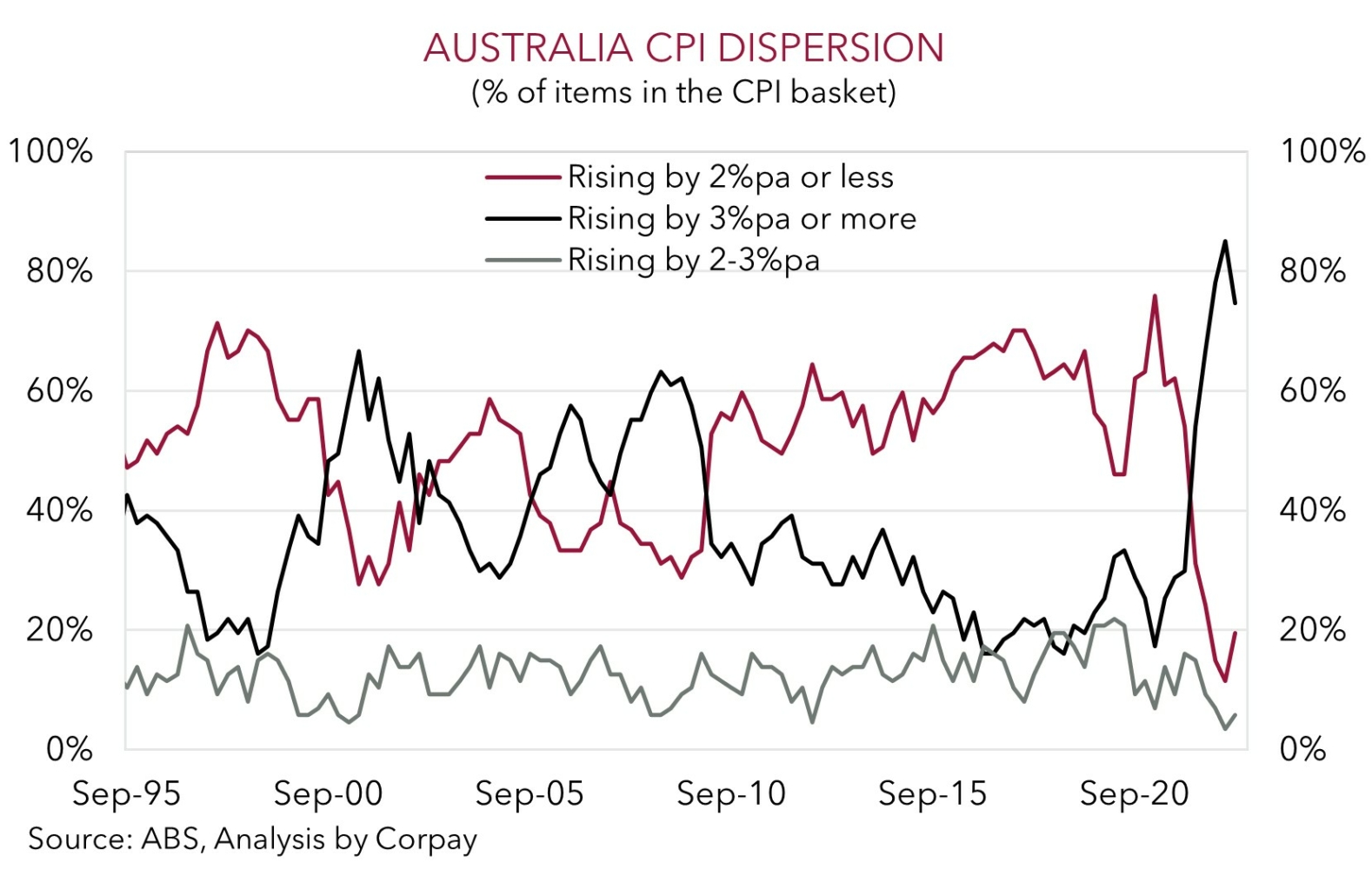

A closer look at the detail shows that many of the price increases in Q1 were smaller than they have been in recent quarters. Inflation is still high, but this is a positive development that suggests momentum is turning. Indeed, our dispersion measure, which tracks how many items in the CPI are growing at various rates, shows that in Q1 the proportion of the basket rising by 3%pa or more has fallen from its highs, with the share rising by 2%pa or less ticking up.

With respect to the price swings, at one end of the spectrum, the most significant contributors to the Q1 CPI lift were medical and hospital services, tertiary education, gas and household fuels, and domestic holiday travel. Rents also quickened on the back of the low vacancy rate, and at ~4.9%pa growth is at its highest since late-2009. This is an area that presents an upside risk to inflation that needs to be watched going forward. By contrast, discounting by retailers saw price falls in furniture, appliances, and clothing. In our opinion, softer demand on the back of the jump up in mortgage rates, the pull-back in input costs/commodity prices, and elevated inventories are a combination which we believe should see ‘goods’ prices continue to fall back in Australia and globally.

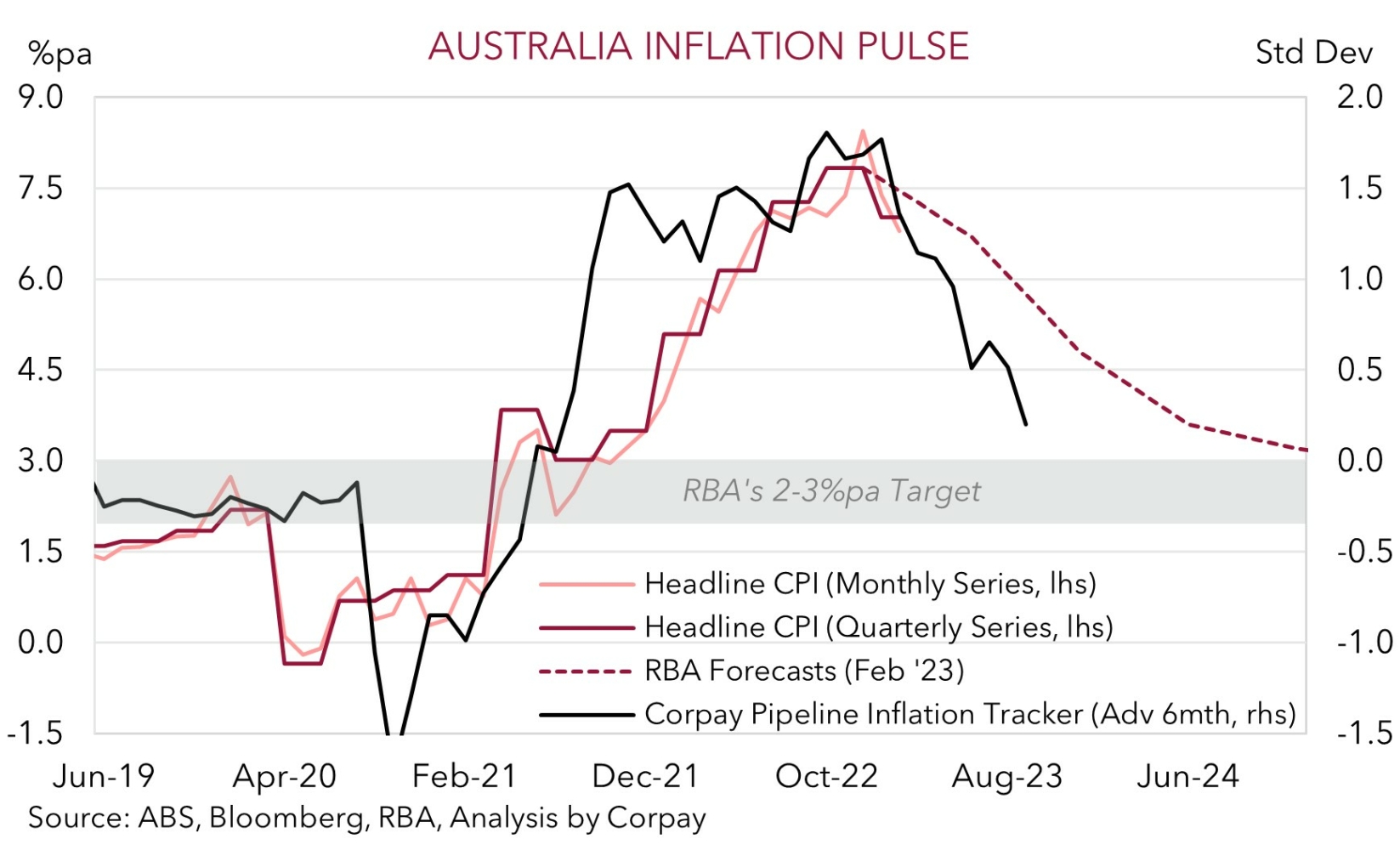

From a policy perspective, the Q1 inflation data supports our base case looking for the pragmatic RBA to remain on the sidelines once again at the 2 May meeting (see Market Wire – RBA: over and out). We think the RBA will continue to talk tough and flag the risk of additional tightening. But the burden will continue to be on the data to force the RBA’s hand to raise rates again. And based on our outlook for growth and inflation we doubt further tightening will be needed, especially with the RBA trying to achieve a ‘soft landing’ (see Market Wire: Growth Momentum Slowing). As shown, our inflation pipeline tracker is pointing to a sizeable deceleration in annual inflation over the next few quarters, and there is also still a lot of ‘natural’ tightening that will flow through over 2023 as the large pool of cheap COVID-era fixed rate loans are refinanced at higher rates. The cashflow hit on indebted households should intensify over the next few months, and in turn this should feed through to the labour market, wages, and inflation.

We think the CPI data, and subsequent paring back of near-term RBA rate hike expectations should keep the AUD on the backfoot. In our view, the AUD’s 2023 low (~$0.6565) could be under threat near-term, particularly with the US Fed meeting (where we see another rate hike coming through and some push back on market pricing looking for cuts later this year) also up next week. Beyond that, the next major AUD support zone appears to kick in around ~$0.6475-0.65.

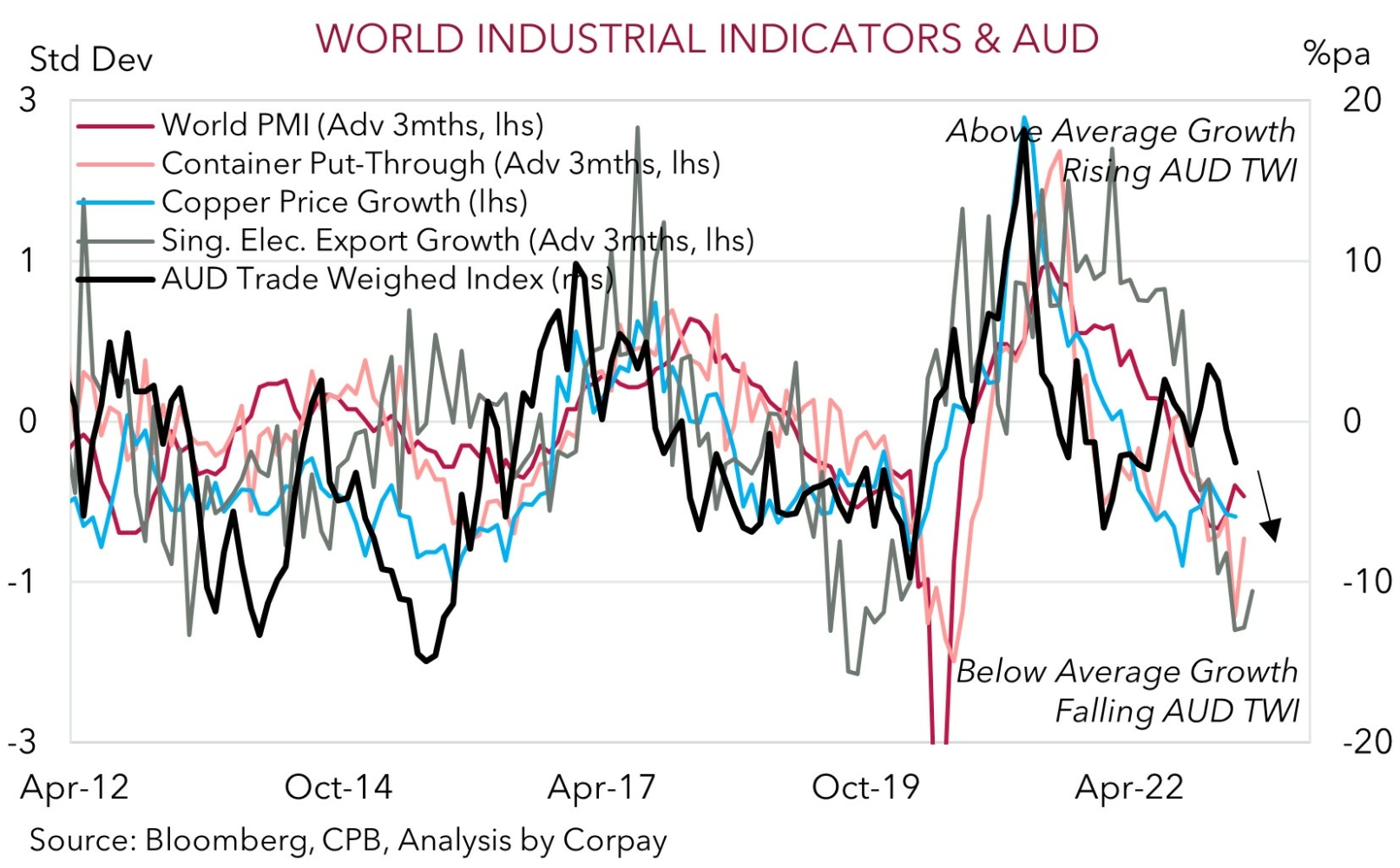

Broadly speaking, we remain of the opinion that the AUD should face an uphill battle over the next few months as the global economy slows and more ‘aftershocks’ from the fast global tightening cycle generate further bouts of volatility. As our chart illustrates, a range of forward-looking indicators for global industrial activity are signaling weaker growth over Q2/Q3. This is normally a negative backdrop for the AUD.

More specifically, when combined with China’s increasing focus on consumption driven growth rather than commodity intensive infrastructure spending, and outlook for a relatively more aggressive ECB, we expect AUD/EUR to remain heavy (see Market Wire: China’s sector divergence & AUD/EUR). Similarly, while the BoJ appears unlikely to make any major policy changes on 28 April, we think it is a matter of time. In our judgement, the eventual BoJ shift, coupled with Japan’s improving capital flow dynamics, and a global slowdown, favours a lower AUD/JPY (see Market Musings: Cross-Check: AUD/JPY – change is on the horizon).