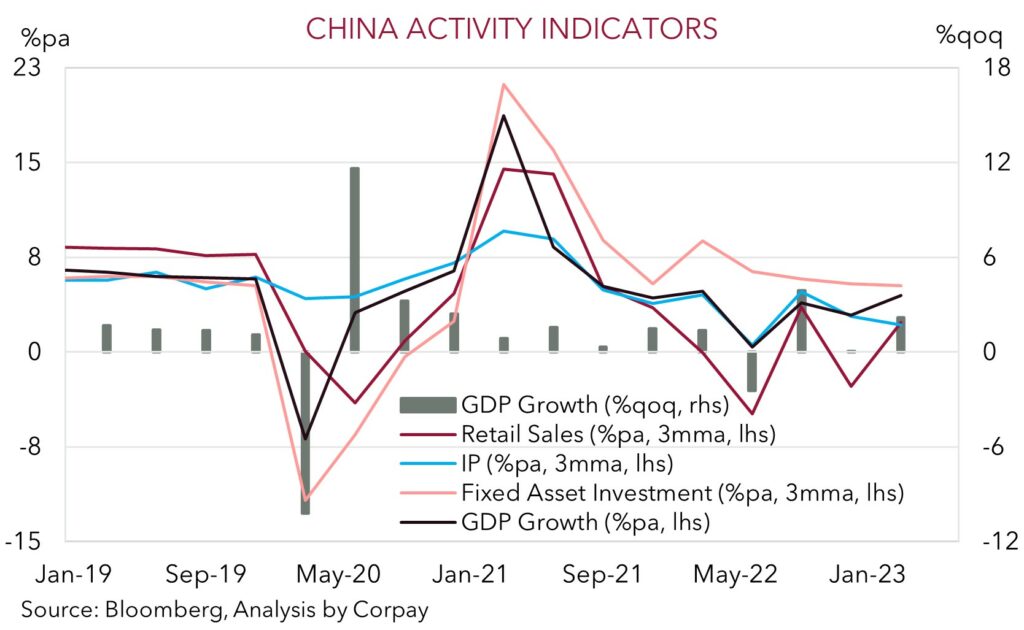

China’s activity batch for March, which included Q1 GDP, confirmed that the economic rebound following the shift away from the COVID zero policy is unfolding. GDP growth was a bit stronger than predicted, with China’s economy expanding by 2.2% over Q1. As a result, annual growth momentum stepped up to 4.5%pa. A look across the underlying drivers shows that, as per other economies when COVID health/mobility restrictions were lifted, spending by households is doing the heavy lifting as pent-up demand is unleashed. Retail sales rose 5.8%pa over Q1 compared to the same period last year. Less encouraging was the underwhelming performance in industrial production (3%pa vs mkt 3.5%pa) and fixed asset investment (5.1%pa vs mkt 5.7%pa) which came in below consensus forecasts.

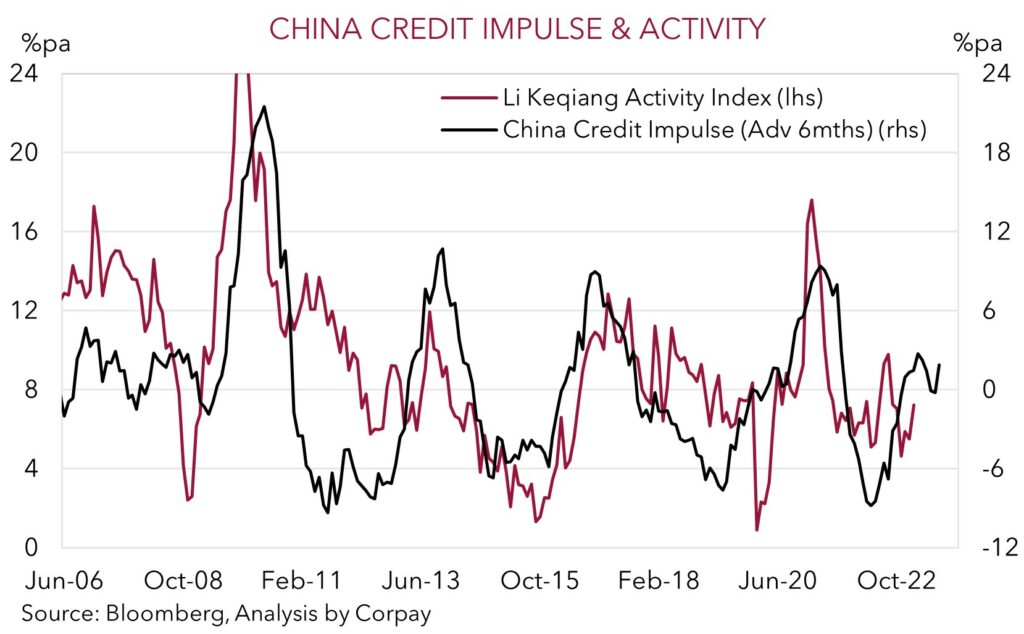

We expect China’s economic revival to continue over 2023. Forward indicators that we track like the credit impulse are pointing to a pick-up in activity over coming months. For global growth, this is helpful, but we don’t believe it will be enough to fully offset the slowdown underway across the other major economies stemming from the sharp rise in interest rates and tighter credit conditions. Indeed, even in China, we are anticipating diverging sector performance to continue.

China’s services sectors are predicted to outperform as consumers continue to catch up and spend on things such as entertainment and travel. An increased focus on labour-intensive consumer spending was a central message contained in the annual National People’s Congress in early-March. By contrast, more restrained fiscal support, combined with weaker growth across the rest of the world, and already elevated inventory levels points to relatively more subdued momentum across industrial activity in China.

For the AUD, the more positive headline China GDP outcome may provide a bit of short-term support, though the stronger USD backdrop generated by the upward US interest rate repricing is working in the other direction. Near-term upside in AUD/USD is likely to remain limited, in our view, despite the China GDP data. We remain of the opinion that the AUD should face an uphill battle over the next few months given our expectations for more economic and market ‘aftershocks’ to bubble to the surface as the effects from the most abrupt global tightening cycle in several decades crystallise, and with the RBA shifting to a more measured approach with the aim of achieving a ‘soft landing’ front-of-mind for policymakers (see Market Wire: Australian labour market: As good as it gets). Renewed market volatility and slower global activity has traditionally been an environment that has favoured currencies like the USD, JPY, and EUR over ones like the AUD which are leveraged to the global cycle (see Market Musings: Buckle up, volatility should continue).

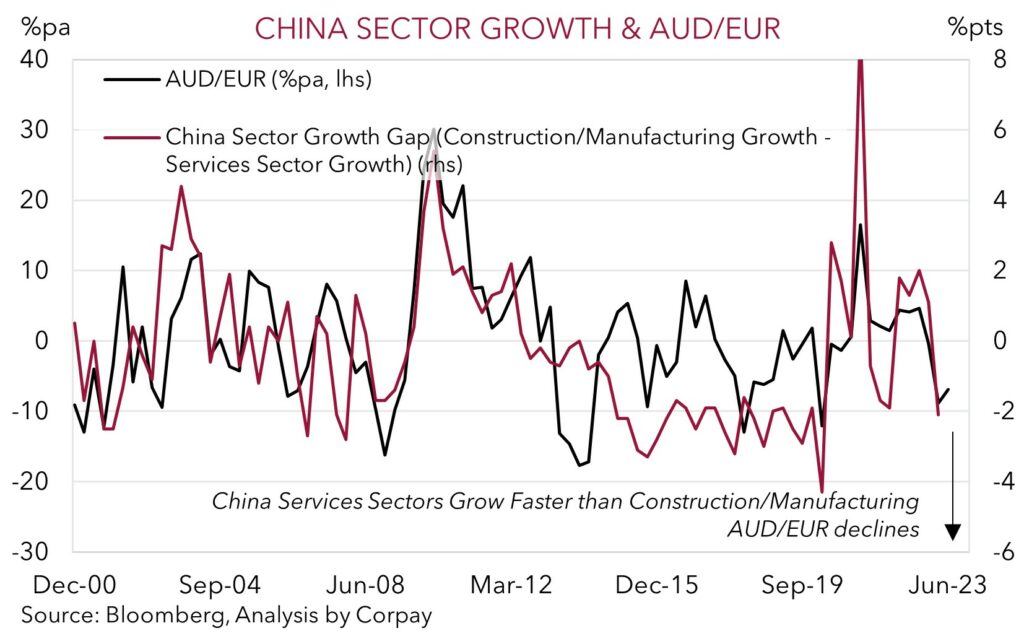

Moreover, we remain of the belief that China’s growth mix is more important than the aggregate result when it comes to the AUD. As the data shows, the commodity intensive industrial side of China’s economy hasn’t picked up as fast as analysts were thinking, and as discussed, we expect this part of the story to remain somewhat sluggish given the domestic and external headwinds. By contrast, China’s consumption/services sectors are predicted to outperform as consumers continue to bounce back from their COVID hibernation. As our chart below illustrates, periods when growth across China’s ‘tertiary’ sectors (i.e. services, consumption etc) outpaces ‘secondary’ sector growth (i.e. infrastructure, construction) normally sees the EUR outperform the AUD given the Eurozone’s stronger ties to the services part of China’s economy.

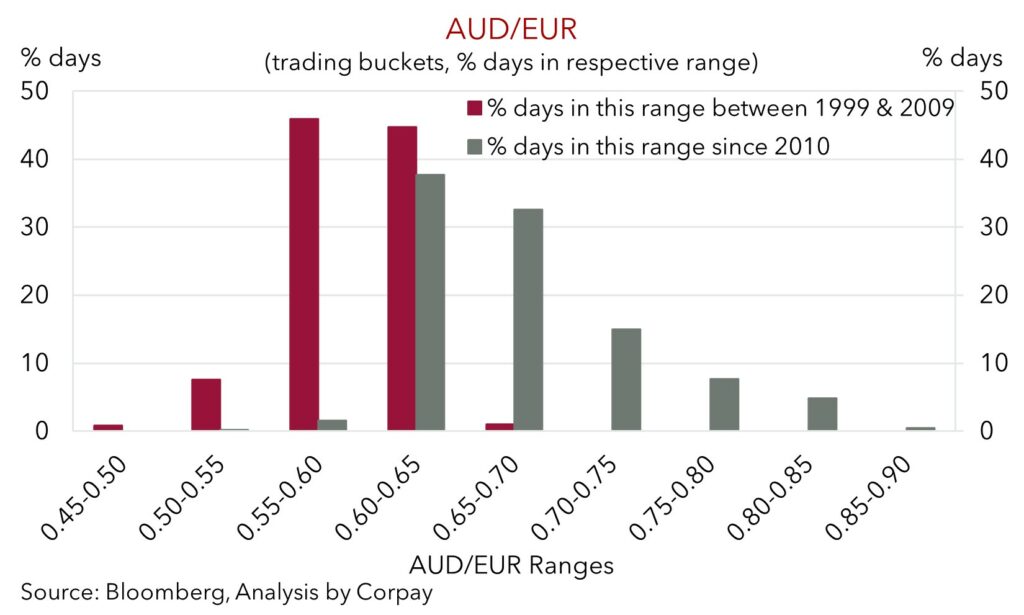

These trends further reinforce our previous guidance looking for AUD/EUR to fall to ~0.60 and for intermittent bounces to be short-lived (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations). In our judgement, it wouldn’t be surprising to see AUD/EUR spend some time in the mid-to-high 0.50’s over the period ahead if the RBA continues to hold policy steady and the ECB delivers further rate hikes to get on top of inflation. Notably, our analysis finds that these lower levels in AUD/EUR aren’t that unusual. Rather, people’s views about where AUD/EUR trades may be clouded by their more recent experiences. Since 2010, AUD/EUR has only traded at 0.60 or lower ~2% of the time (grey bars in chart), with Australia’s terms-of-trade and mining booms, the Eurozone crisis, and the Ukraine war factors helping to hold the pair above its long-run average (~0.64) for long periods. However, when you look back further the current low (or lower) levels in AUD/EUR used to be more the norm. Between 1999 and 2009 AUD/EUR traded at 0.60 or lower ~54% of the time, and it spent another 44% of days between 0.60 and 0.65 (red bars in chart).