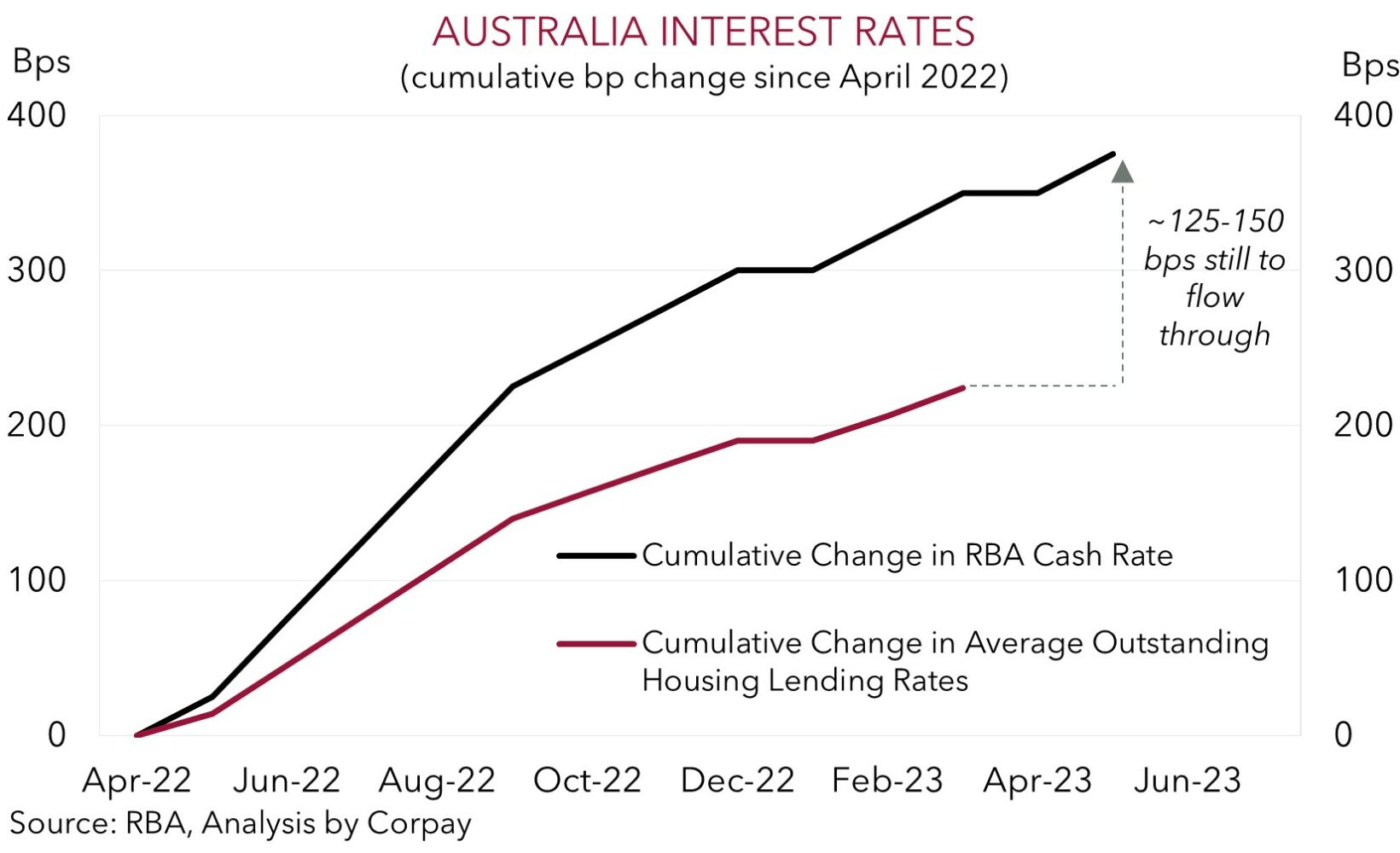

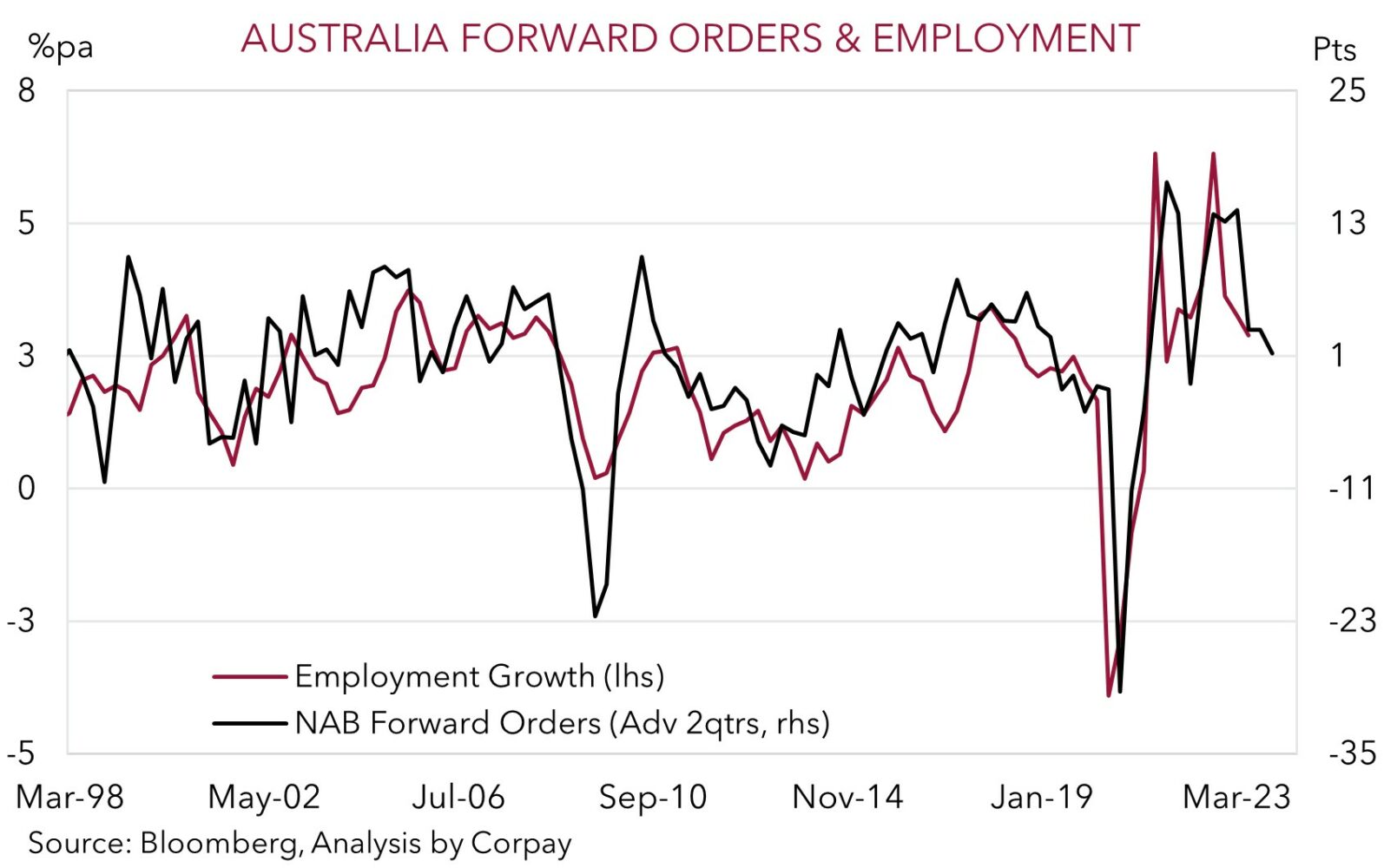

It’s a lagging indicator, but cracks are beginning to appear in the Australian labour market. In our view, these cracks should widen over time as the weight of higher mortgage rates, negative consumer and business sentiment, and other cost pressures act to constrain economic activity. While the larger than normal share of households on fixed rate loans diluted the initial rate hike impacts this cycle, the result should ultimately be the same. We expect growth to slow materially over the next few quarters as the substantial cashflow hit on the heavily indebted household sector intensifies. Indeed, there is still a decent amount of policy tightening that has yet to flow through to households and businesses due to the normal policy ‘lags’ and because of the fixed rate refinancing that has yet to take place.

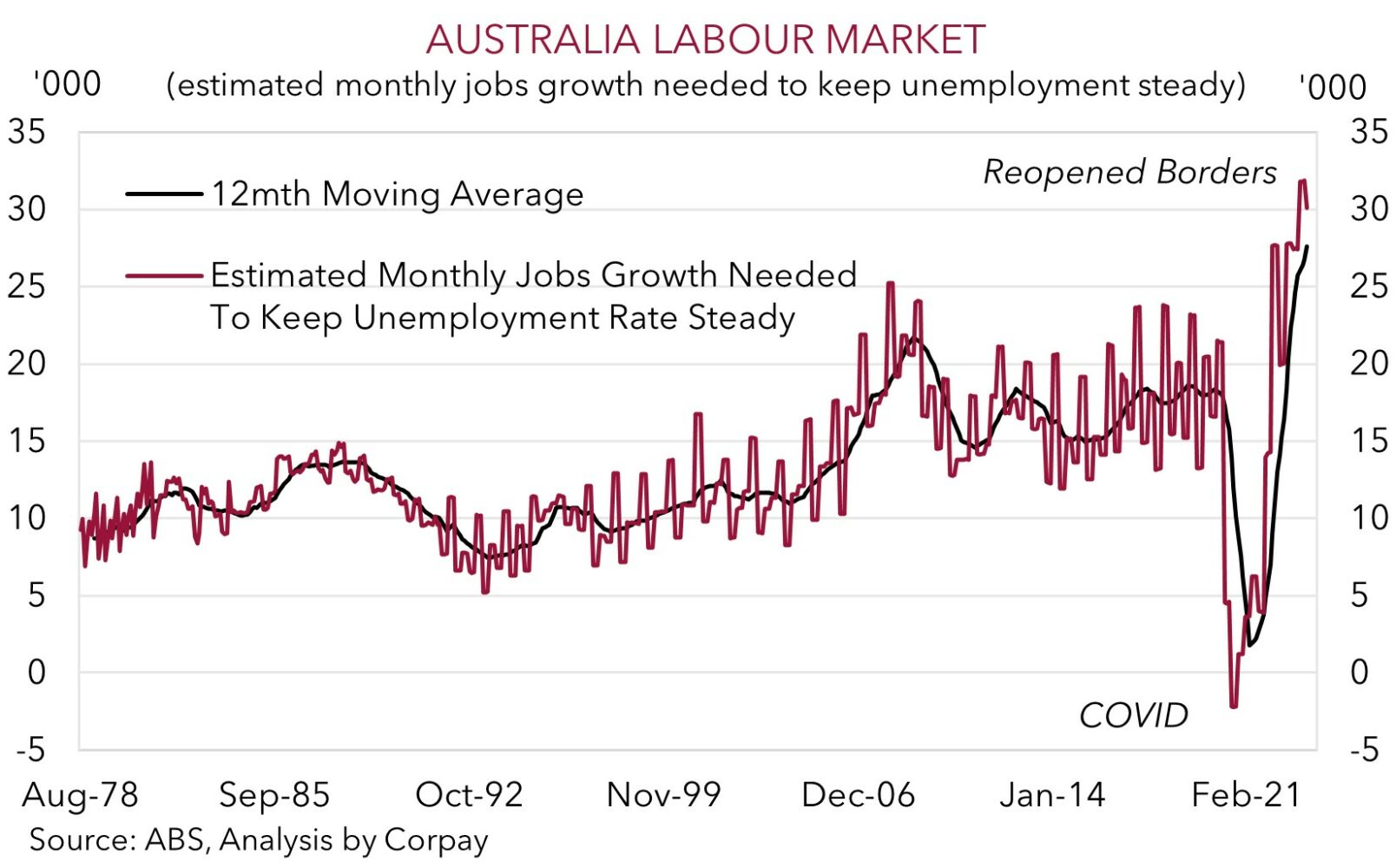

In terms of the labour force report, employment fell 4,300 in April, led by a 27,100 drop in full-time jobs. Given the high participation rate (still up at 66.7%) and increased labour supply on the back of reopened international borders, the unemployment rate edged up to 3.7%. The monthly data has been volatile recently, and seasonality around the moving Easter holiday may have played a bit of a role in April, but broadly speaking employment growth is slowing (now 2.9%pa). We are looking for this trend to continue over coming months as growth momentum across the private sector decelerates and labour demand weakens. Importantly, the burgeoning population and labour supply means that the hurdle rate to keep the unemployment rate steady is now much higher than it was during COVID. We estimate that ~30,000 jobs now need to be created each month to prevent the unemployment rate rising. This is a challenge in a normal operating environment, never mind when the local and global economic cycle is turning down.

The weaker than anticipated employment report has seen the AUD slip back slightly as doubts around whether the RBA will raise rates further creep back into the markets thinking. While we believe the RBA will continue to talk tough and flag the ongoing inflation risks, we doubt that further policy tightening will be delivered from here without a run of stronger than expected data. The burden remains on the data to justify further moves, in our view, given settings are in ‘restrictive’ territory and the RBA is at the point where it should no longer be in rate hiking auto pilot. After today’s data, the retail sales report (26 May), the monthly CPI (31 May), and the Q1 GDP (which will include a more detailed view on spending, productivity growth etc, but is due the day after the 6 June RBA meeting) are the major upcoming local releases that could shape near-term RBA expectations.

For the AUD, the external environment remains far more important than the debate on whether the RBA will or won’t raise rates again. Based on the global backdrop we continue to think that near-term AUD upside should remain limited, and that downside pressures are still in place. As we have highlighted previously, the global settings are ones that tend to favour currencies like the USD, EUR and JPY over cyclical ones like the AUD that are leveraged to industrial activity (see Market Musings: Buckle up, volatility should continue). More specifically, data released earlier this week provided more evidence that China’s post lockdown recovery is faltering, and more generally the world economy is slowing.

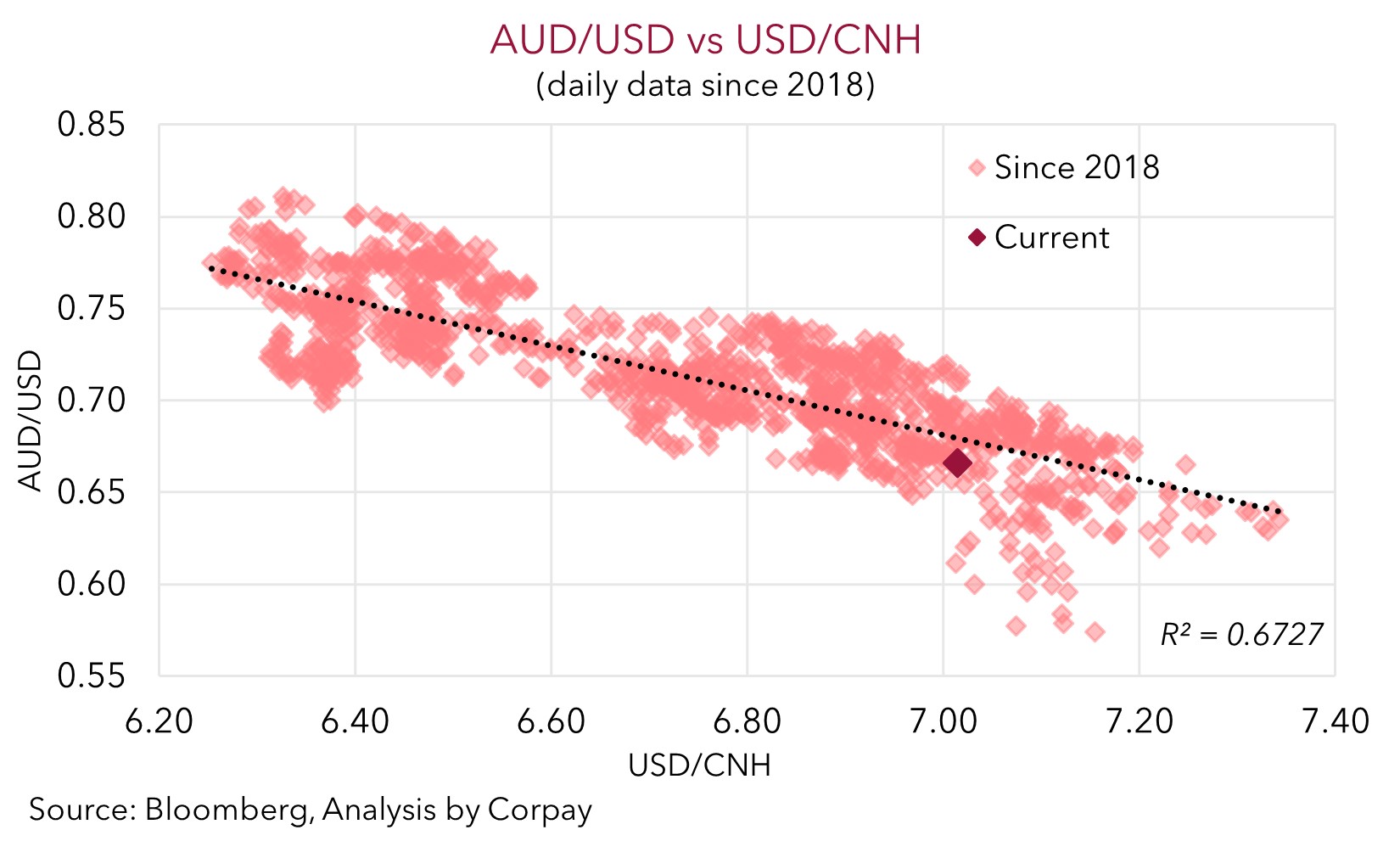

We expect the global downturn to intensify over the next few months as tighter credit conditions bite, which is a headwind for commodity demand. The underwhelming recovery in China is also starting to bolster expectations that more monetary policy easing could be unveiled. Notably, this has seen USD/CNH push through ~7 for the first time this year. As our scatter chart illustrates, there is a tight relationship between the AUD and USD/CNH, with a further move higher in the latter likely to correspond with a lower AUD. For the USD, we also think the recent rebound can extend further. Based on the US’ still high/sticky inflation pulse we believe that pricing for multiple rate cuts by the US Fed over H2 is unlikely to materialise (see Market Musings: US inflation: still a long way from home). A paring back of US rate cut bets should, in our judgement, provide further support for the USD.