In what we think was a finely balance decision, at least in terms of the timing not the direction, the RBA raised the cash rate by another 25bps to 4.1% at today’s meeting. This takes the cumulative tightening delivered since things started in May 2022 to 400bps, by far the most abrupt RBA rate hiking cycle since at least the early 1980s.

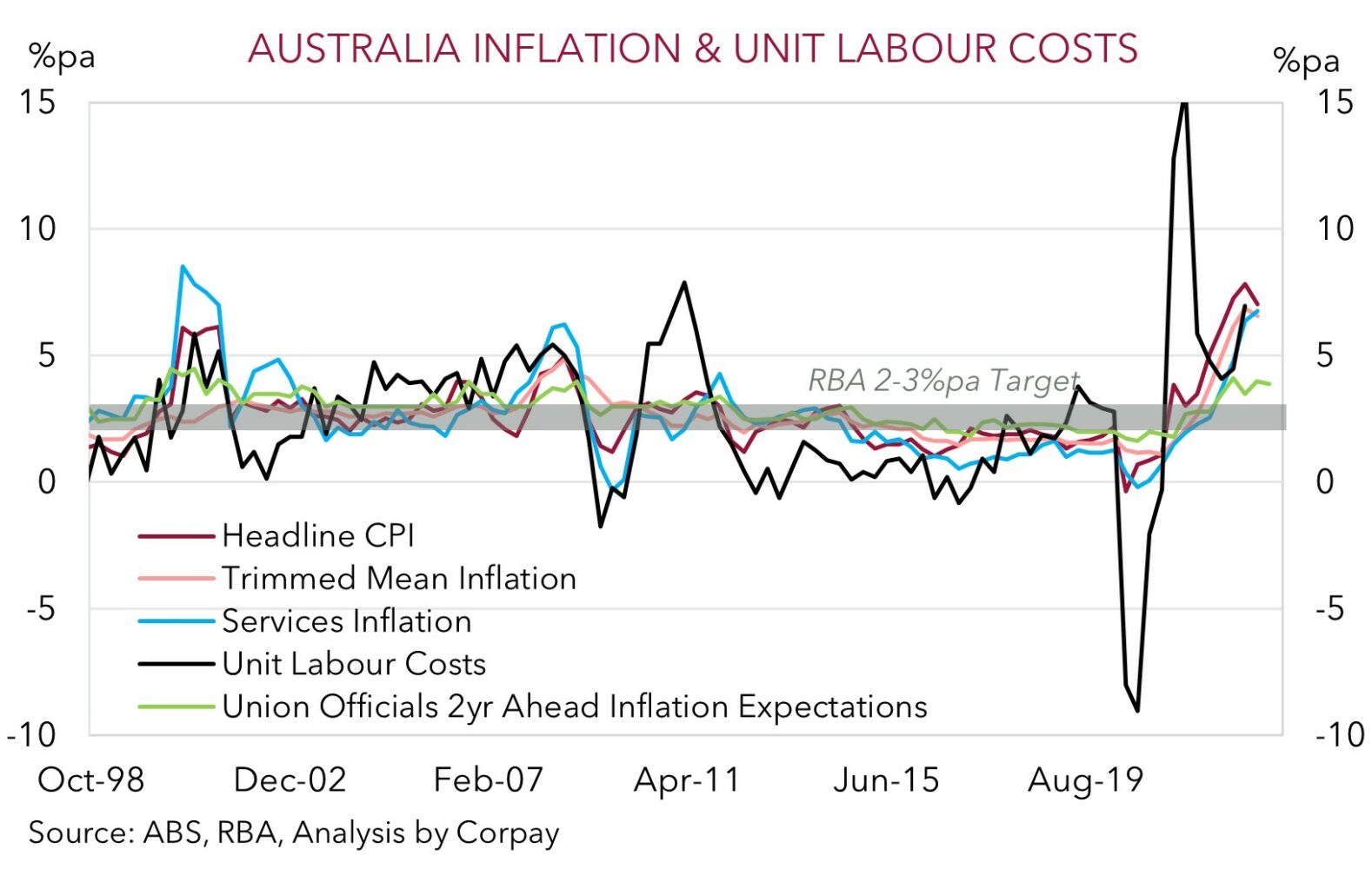

The RBA reiterated that while inflation has passed its peak, at ~7%pa it “is still too high and it will be some time yet before it is back in the target range”. And in the RBA’s assessment, “recent data indicate that the upside risks to the inflation outlook have increased, and the Board has responded to this”. Of note, wages have risen in response to the tightness in the labour market and jump up in inflation. The larger than anticipated lift in the minimum award wage, which covers ~1/4 of the workforce, and the lift in public sector pay rates, are clearly on the RBA’s mind. As our chart shows, unit labour costs are rising briskly, and without a productivity offset, this is raising concerns that a wage-price spiral could develop, and sticky/core inflation pressures may become entrenched.

In the RBA’s mind, the latest lift in interest rates provides “greater confidence” inflation will return to the 2-3%pa target band “within a reasonable timeframe”. However, the RBA also has retained its conditional tightening bias, noting that “some” further policy tightening “may be required”, with trends in the global economy, household spending, the labour market and inflation outlook inputs into its thinking. As we recently noted, we believe the upswing in services inflation and Australia’s lacklustre productivity are likely to see the RBA lift the cash rate to 4.35% over the next few months to help slay the inflation dragon (see Market Musings: The RBA has more work to do). But this won’t be costless. It is a hard pill to swallow, but to break the back of services driven inflation an extended period of weak growth and higher unemployment is the price that needs to be paid.

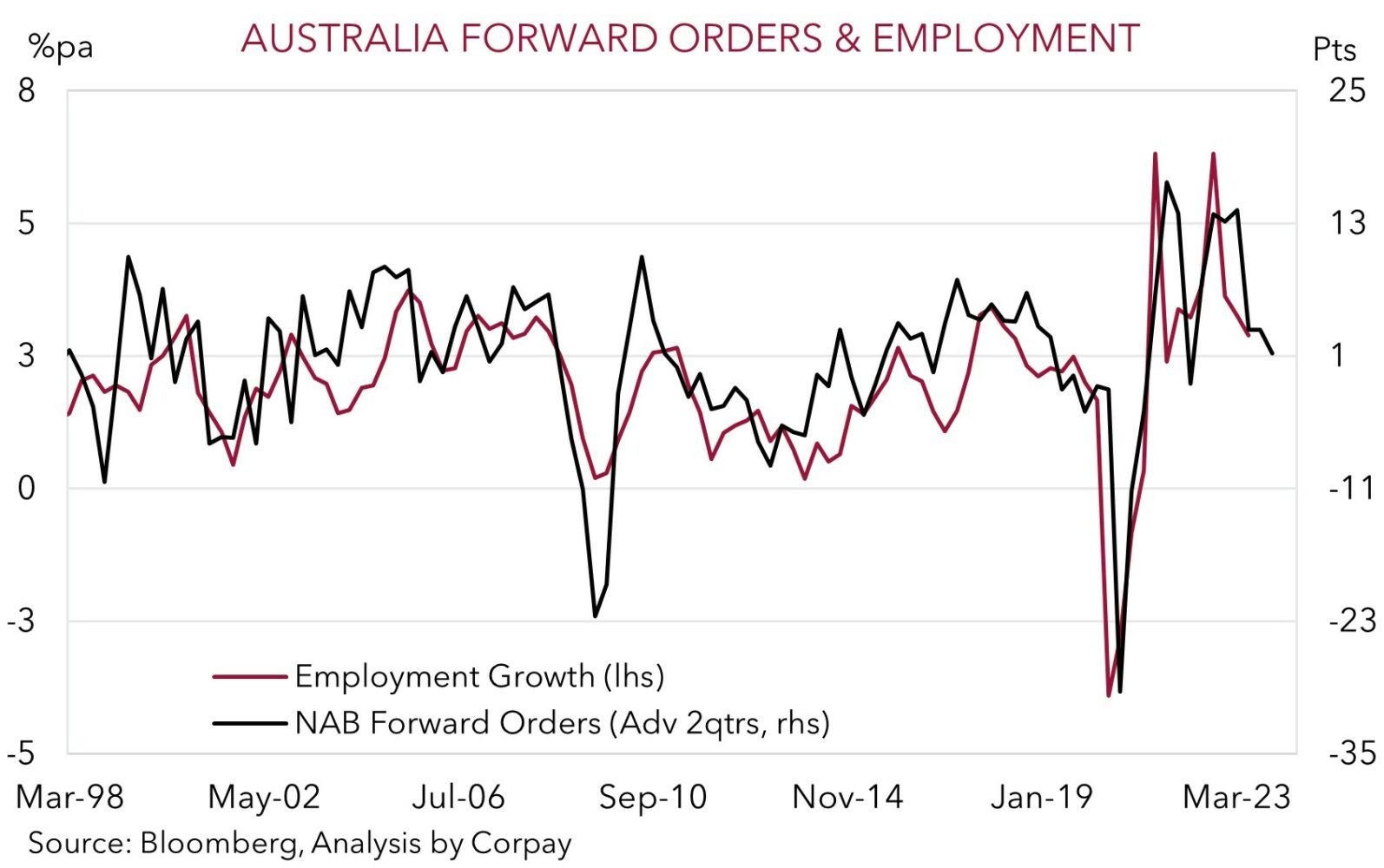

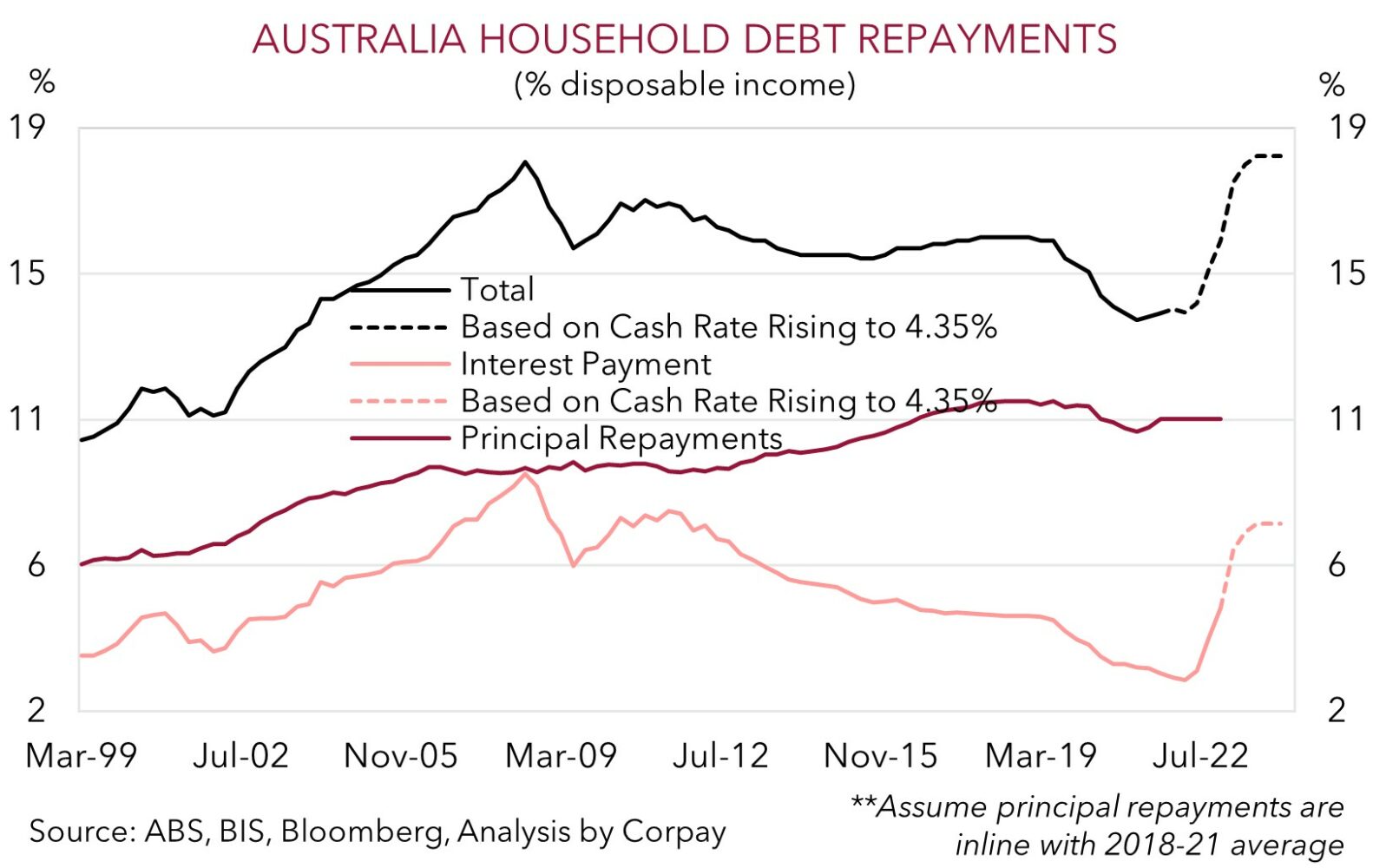

Given the high level of household indebtedness, as interest rates move deeper into “restrictive” territory, the economic impacts should gather steam. Surging population growth may help stop the economy from going backwards in aggregate (note, topline GDP is a volume measure), but on a per capita basis GDP is set to head south. As our chart above shows, based on how high household debt now is in Australia, on our figuring, the cash rate rising to 4.35% would push repayments (principal and interest) across the household sector to a historically high share of incomes. As the substantial cashflow hit on the household sector intensifies, particularly as the large amount of fixed rate refinancing takes place, we forecast consumption and broader economic growth to slow materially over the next few quarters. In time, we believe this step down in activity and added economic uncertainty could spill over into business investment, and the labour market, with unemployment projected to rise over the next year. Bottom line, these are the rate rises that should really begin to generate adverse macro impacts, and when amplifiers such as high debt levels and rising unemployment kick in the negative effects could quickly escalate.

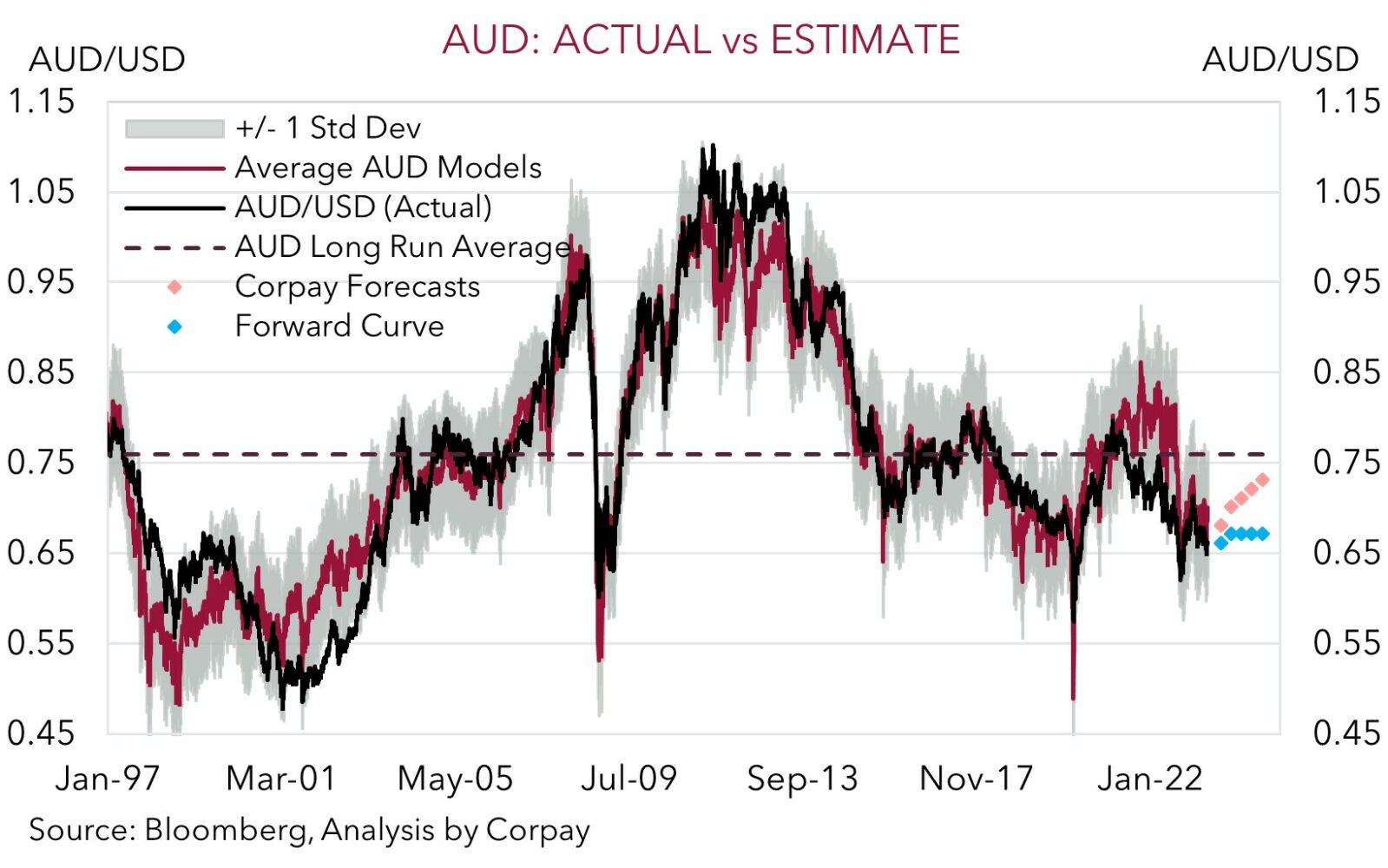

With only a ~35% chance of a rate hike was factored in today, and most market analysts were looking for the RBA to stay on hold, the AUD has popped higher. As markets factor in the chance of another move by the RBA over the near-term, we think the AUD can edge up to the 200-day moving average (~$0.6692) or a touch higher (the 100-day moving average is sitting at ~$0.6748). However, FX is a relative price and global factors often swamp domestic developments. And in our opinion, the unfolding step down in global growth on the back of the tighter credit conditions/higher interest rates, remains a headwind for the cyclical AUD.

Next week will also be an important time for the USD, with the latest US CPI inflation report and FOMC policy meeting on the calendar. In our view, while the US Fed appears more likely to hold fire and keep rates steady, the accompanying message could remain quite ‘hawkish’ given the still tight US labour market and high core inflation. Importantly, we think the Fed could stress that any thoughts of rate cuts occurring quickly are misplaced. If realised, this may help the USD recover some ground. Overall, we continue to forecast the AUD’s sustained revival to only come through later this year and over early 2024 with AUD/USD projected to grind back into the low $0.70s over that time.

On the crosses, we remain of the opinion that the slowing global economy and further rate hikes by the ECB and Bank of England later this month may counteract the RBA’s actions and expect the upswing in AUD/EUR and AUD/GBP to begin to peter-out. However, at the same time we see AUD/NZD remaining in an uptrend. Interest rate differentials are becoming more supportive of a higher AUD/NZD given the RBNZ has signaled rates may have ‘peaked’ and with a further move by the RBA anticipated.