The AUD continues to fall back down to earth with the larger than expected slowdown in Australia’s monthly CPI indicator the latest piece of news that has exerted pressure on the currency. At ~$0.6640 the AUD is ~3.7% below its mid-June highs. The pull-back has been inline with our thinking, given we believed that the AUD had run too far too fast earlier this month (see Market Musings: AUD: break-out or bull-trap?)

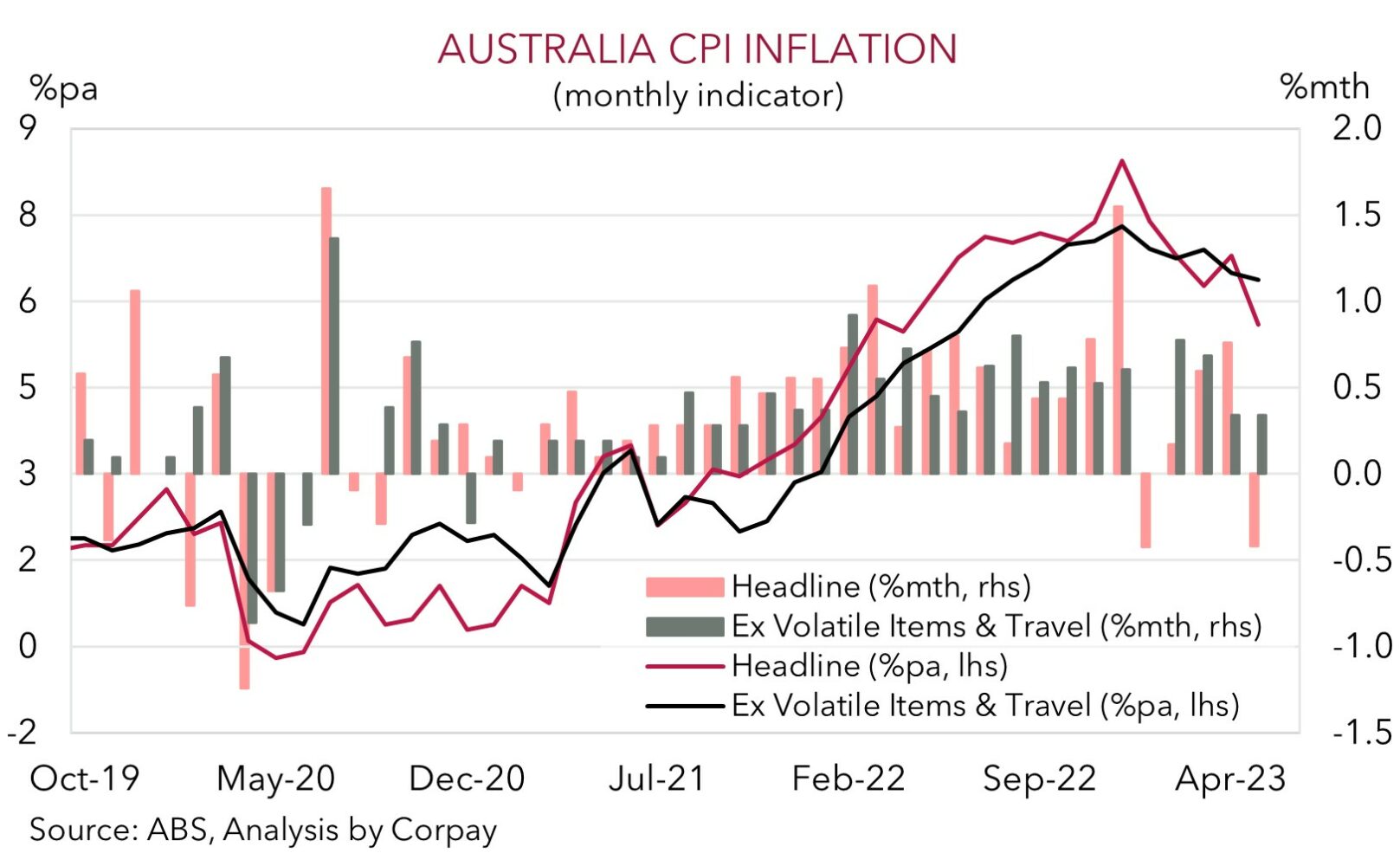

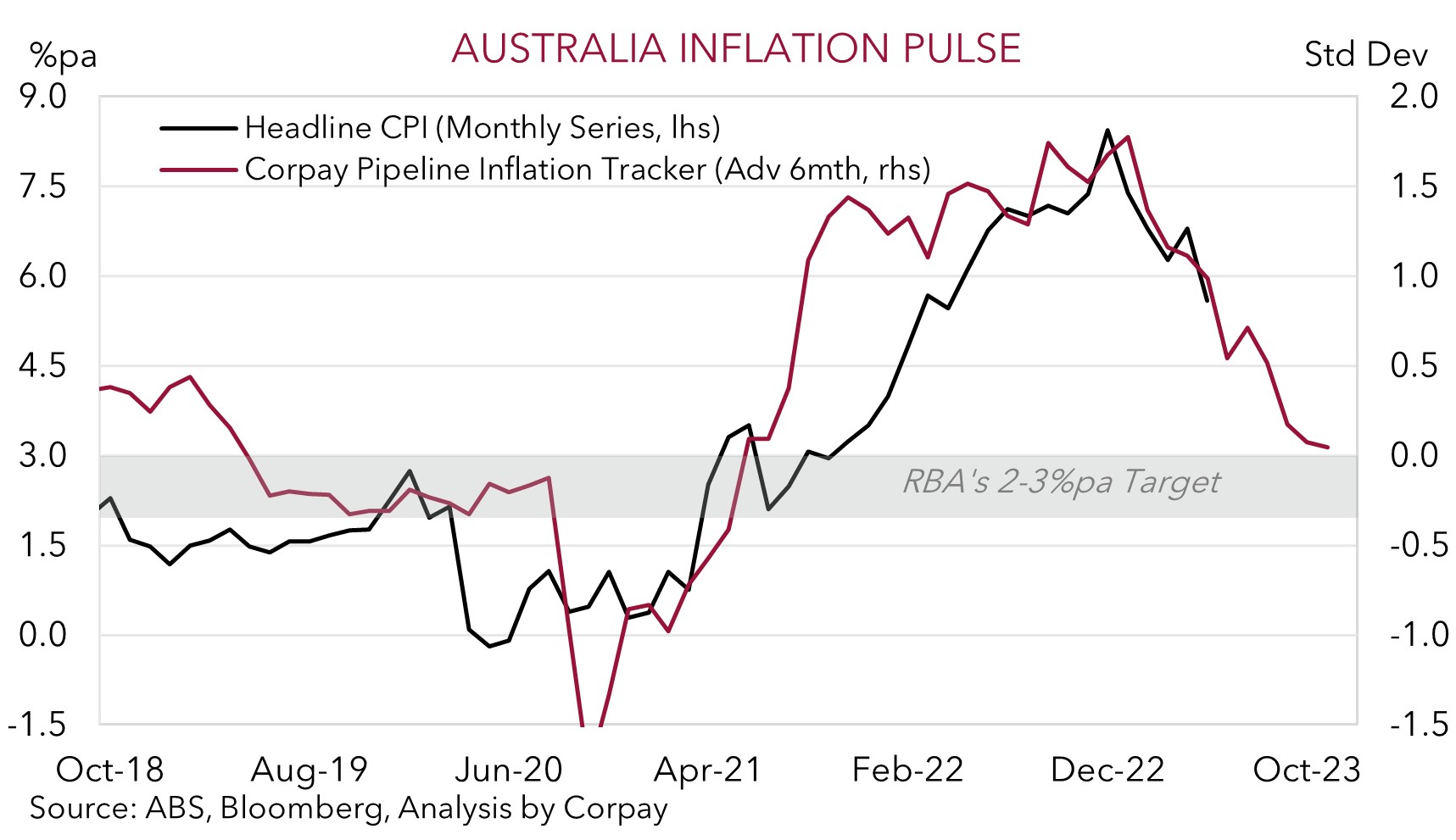

Data wise, the monthly headline inflation measure slowed sharply, from 6.8%pa to 5.6%pa in May (market forecast 6.1%pa). This is the slowest annual run rate in headline inflation since April 2022. A closer look under the hood shows that base-effects from lower petrol prices and an unwind of the spike in holiday travel prices over Easter played a role. There were also falls in clothing & footwear prices, and recreation & culture. The signal from our pipeline tracker is for headline inflation to decelerate further over the period ahead.

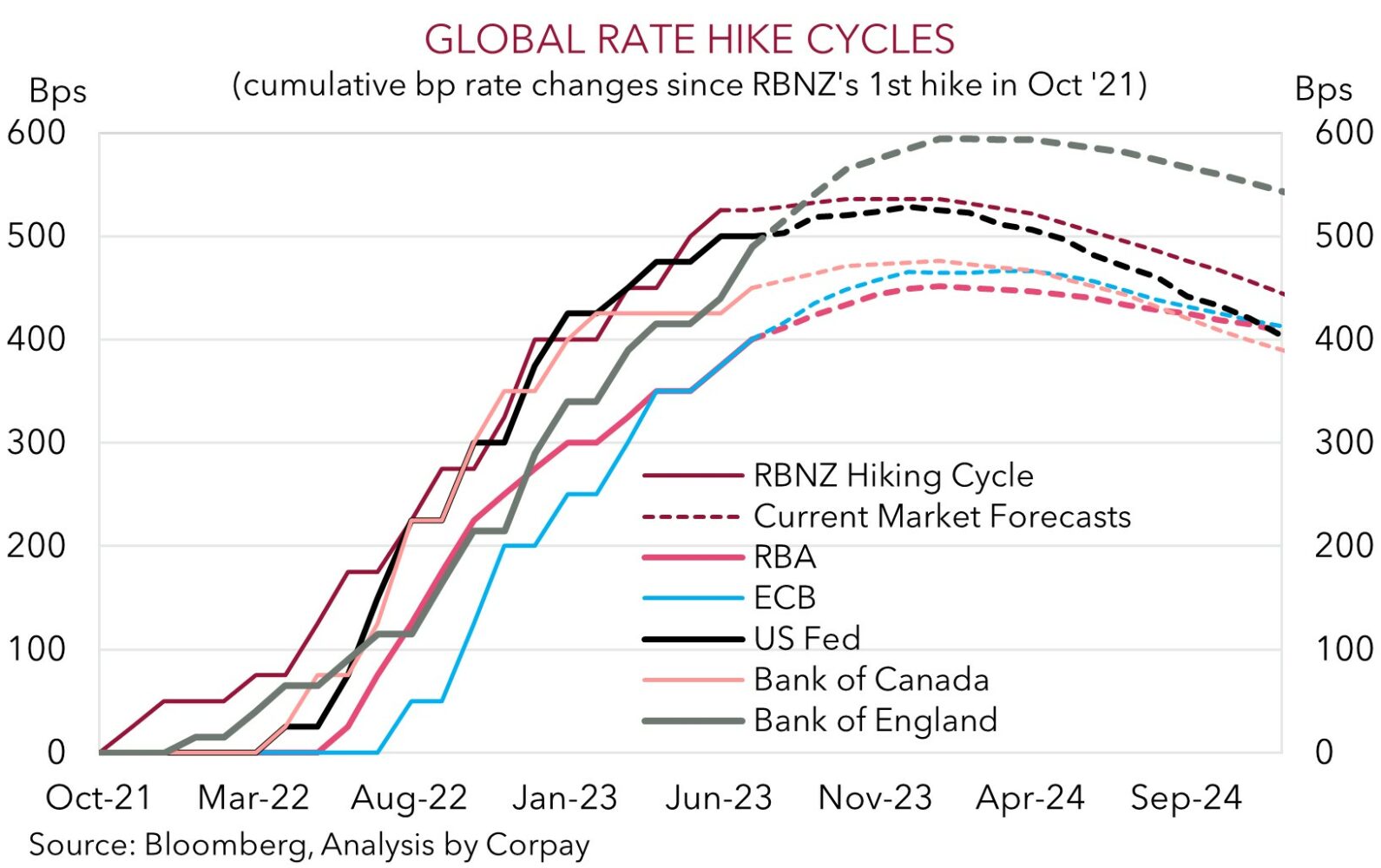

However, core inflation pressures are improving far more slowly. The monthly measure that excludes volatile items and holiday travel, which is a gauge the RBA has been paying close attention to, only eased back from 6.5%pa to 6.4%pa. On this basis, the underlying inflation pulse is improving very gradually. Components like rents remain firm (within the monthly CPI indicator rents rose 6.3%pa in May, up from 1.5%pa a year-ago). The stickiness in some of the less volatile sub-components, still tight labour market conditions, Australia’s lacklustre productivity growth, and upside surprises in offshore services inflation suggests the RBA still has more work to do. And while we think the RBA is more likely to hold at firm at 4.1% at next week’s meeting, it should still be considered ‘live’ for a change. Over the past few months the RBA has shown its willingness to surprise markets. In our opinion, it is still a matter of when, not if the RBA tightens further. We continue to expect another RBA rate hike over the next few months as the battle against inflation is still far from over.

Australian retail sales for May are due tomorrow. A softer print given the squeeze on household budgets from higher mortgage costs and below average confidence is where we think the risks reside. If realised, we expect this to add to the downside pressure on the AUD, particularly against currencies like the EUR and GBP, and to a lesser extent the USD, as markets continue to reassess their near-term RBA hiking expectations. More generally, we think the case for a sharp/extended pull-back in AUD/JPY is building (see Market Musings: JPY: Asymmetric risks building).

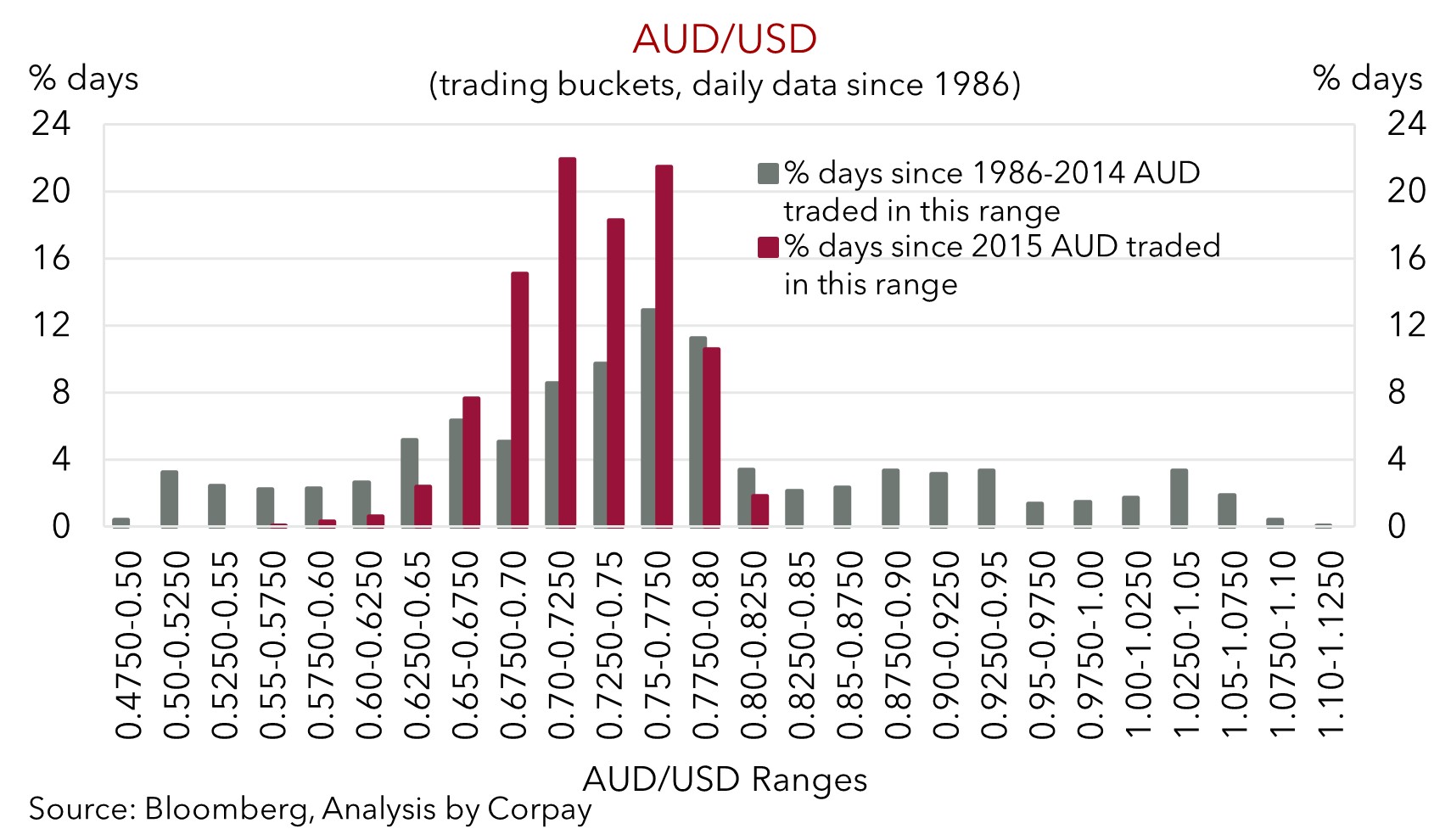

That said, while we see a bit more downside in AUD/USD we also don’t want to be overly bearish down around current levels. While we don’t see the AUD snapping back sharply given the slowing global growth pulse, we also think that fundamentals such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should act as downside cushions. As we have seen repeatedly over the past few years the AUD has tended to find solid support just below where we are now because of these factors. As our chart illustrates, since 2015 the AUD has only traded sub-$0.6650 ~6% of the time. Added to that, signs that officials in China are becoming uncomfortable with the weakening CNY could help support the AUD. Yesterday the PBoC set a stronger CNY fix for a second straight day. A further run of stronger fixings and/or an announcement of fiscal support measures to bolster China’s faltering recovery could, in our view, be a shot across the bow of markets. And given its tight/inverse correlation a firmer CNY would be helpful for the AUD.