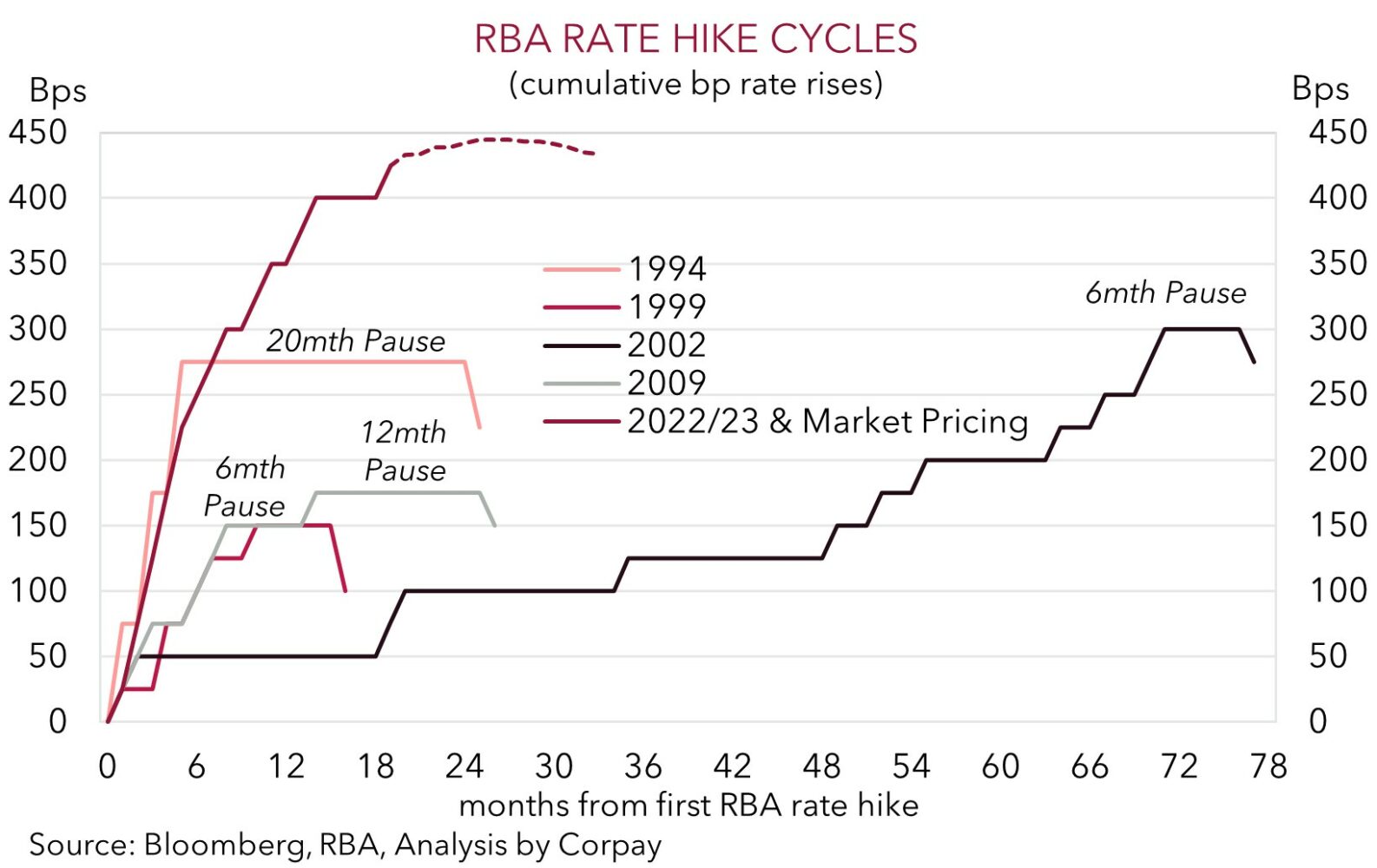

After sitting on its hands since delivering a rate rise in early-June, the RBA has seen enough to think that its policy settings weren’t ‘restrictive’ enough to get inflation back down to the 2-3% target band in the desired time. At today’s meeting the RBA Board, under the stewardship of new Governor Bullock, raised interest rates by another 25bps. This has taken the cash rate up to 4.35%, its highest level since November 2011. Today’s move has taken the cumulative tightening delivered to 425bps, by far the most abrupt RBA hiking cycle in several decades.

According to the RBA, inflation has passed its peak, but it is still too high and is “proving more persistent than expected”. Given the weight of information such as stronger than anticipated economic activity over H1 2023, ongoing tightness in the labour market, rising house prices, the slower than anticipated decline in inflation, and revised economic projections had suggested the risk of inflation remaining higher for longer had “increased”, another hike “was warranted” to be “more assured that inflation would return to target in a reasonable timeframe”. The RBA only sees inflation returning to the top of the 2-3%pa target band by end 2025.

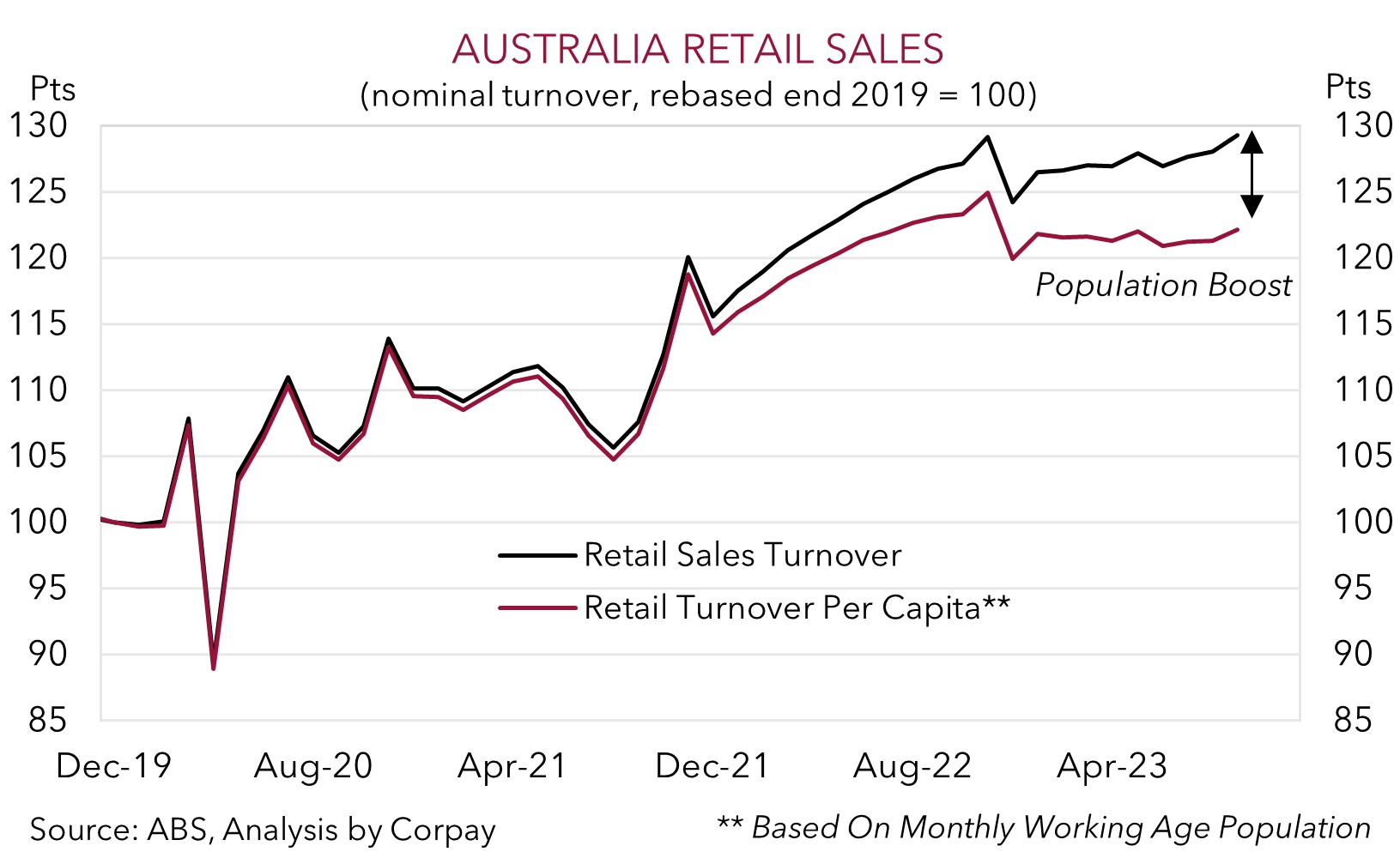

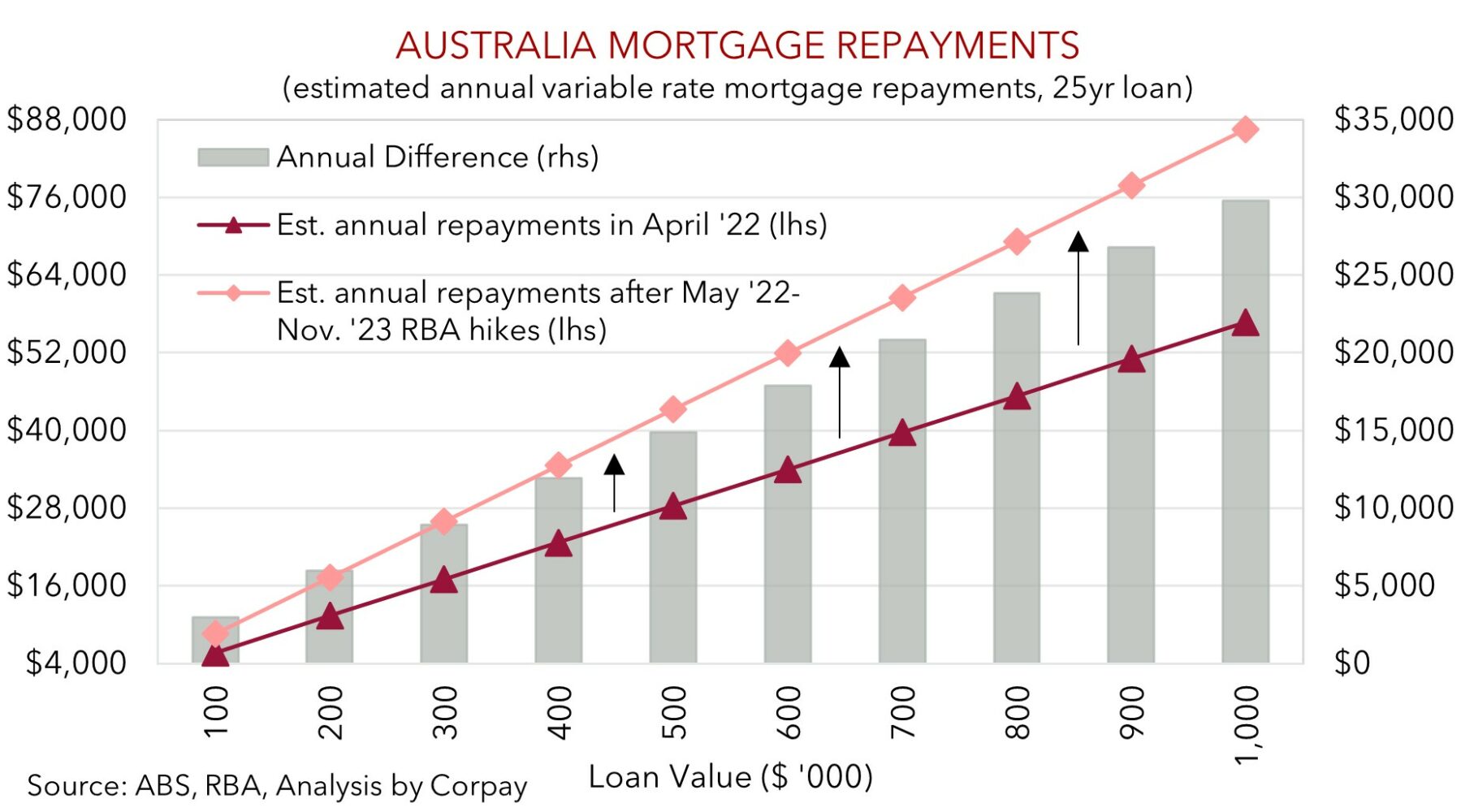

How the economy and balance of risks evolves will drive the RBA’s next move. In its words, “whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks”. This more diluted guidance suggests the RBA could be an even more reluctant rate hiker from here given the economic impacts of the large jump up in mortgage rates should gain more traction over the period ahead. On our figuring, following today’s change, a household with a ~$600,000 mortgage will be paying an extra ~$18,000 per year in repayments compared to before the RBA kicked things off in May 2022. The cashflow hit on indebted households should crimp consumer spending, particularly across discretionary areas, while higher interest rates may also work to constrain new lending and residential construction, which over time should see unemployment lift.

That said, it isn’t all one way. Net savers will benefit from the lift in interest rates, the pool of excess savings remains quite large (now ~$250bn on our estimates), and the surging population should help support aggregate demand. Many indebted households and businesses will be doing it tough as higher interest rates bite down harder, but more people floating around the economy is an offsetting force for spending and investment. And when combined with the income tax cuts coming in in mid-2024, and lingering services inflation pressures due to Australia’s slower moving wage dynamics given the prevalence of multi-year enterprise wage agreements there remains a chance the RBA still hasn’t done enough, in our view. At the very least, we believe these factors point to the RBA lagging its peers when the global interest rate cutting cycle (eventually) unfolds.

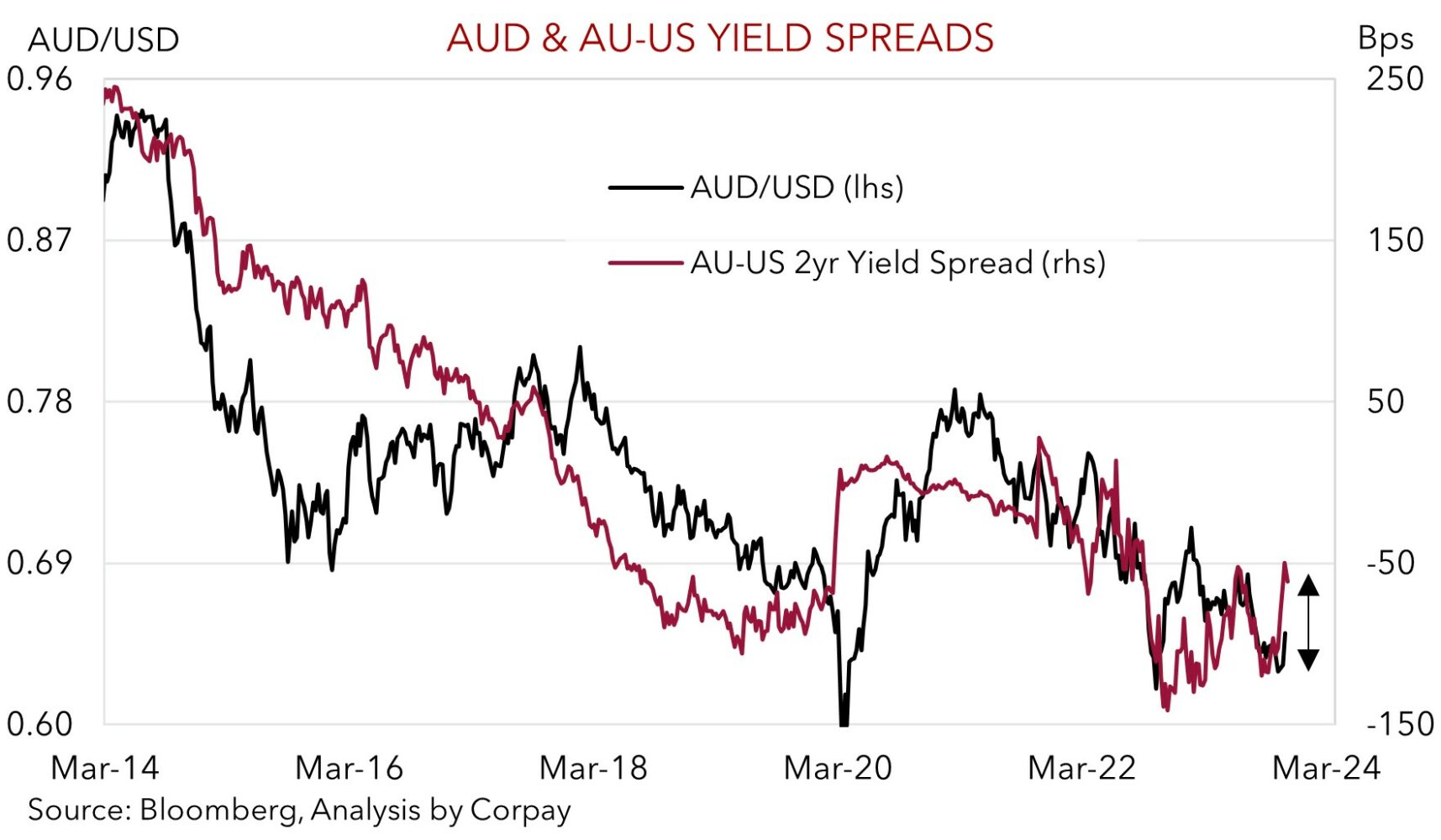

The AUD (now ~$0.6458) has dipped back a little post the RBA outcome, a reflection of the elevated level of rate hike expectations factored in ahead of the event, and the vaguer forward guidance provided in the meeting statement. Running into today’s meeting 29 of 32 analysts surveyed were looking for another rate rise, with interest rate markets assigning a ~65% chance of a move.

Following its recent 4% rebound, it wouldn’t be a surprise to see the AUD give back a little more ground in the near-term as markets question whether the RBA will deliver another rate rise this cycle. However, we continue to think that beyond these short-term gyrations the underlying and global drivers for the AUD to edge up further over coming months remain in place. The mix of narrower Australia-US yield differentials; still very bearish AUD positioning (as measured by CFTC futures); flow support stemming from Australia’s current account surplus (now ~1.2% of GDP); more stimulus injections in China aimed at commodity-intensive infrastructure spending; and an anticipated slowing in the US economy as tighter conditions crimp activity should be AUD supportive. We continue to forecast the AUD to tick up to ~$0.66 by year-end and onto ~$0.68 in Q1.