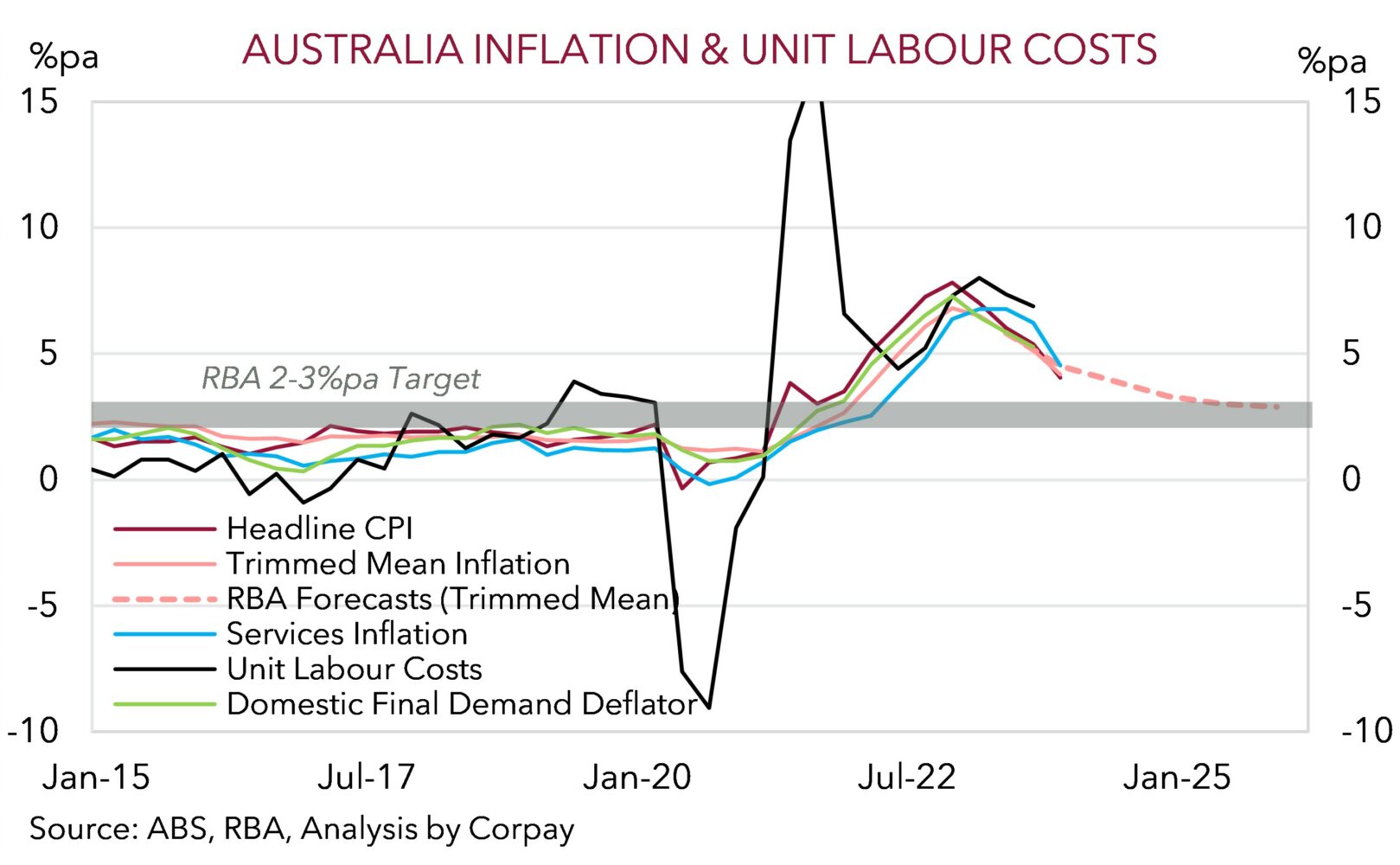

The Q4 Australian CPI report negatively surprised. A welcomed development for indebted mortgage holders with the data further cementing the case for the RBA to keep rates steady for a while, and opening the door slightly more to the start of a gradual easing cycle later this year. Positive base-effects in things like food and petrol as last year’s larger increases rolled out of calculations, coupled with disinflation across ‘goods’ prices (thanks to weaker global demand and repaired supply chains), and government subsidies designed to artificially hold back rents and take the heat out of electricity costs pushed annual CPI lower. Headline inflation decelerated to 4.1%pa, its slowest pace since late-2021, and trimmed mean (the RBA’s preferred core inflation gauge) slowed to 4.2%pa. The RBA was penciling in headline and core inflation to come in at ~4.5%pa in Q4.

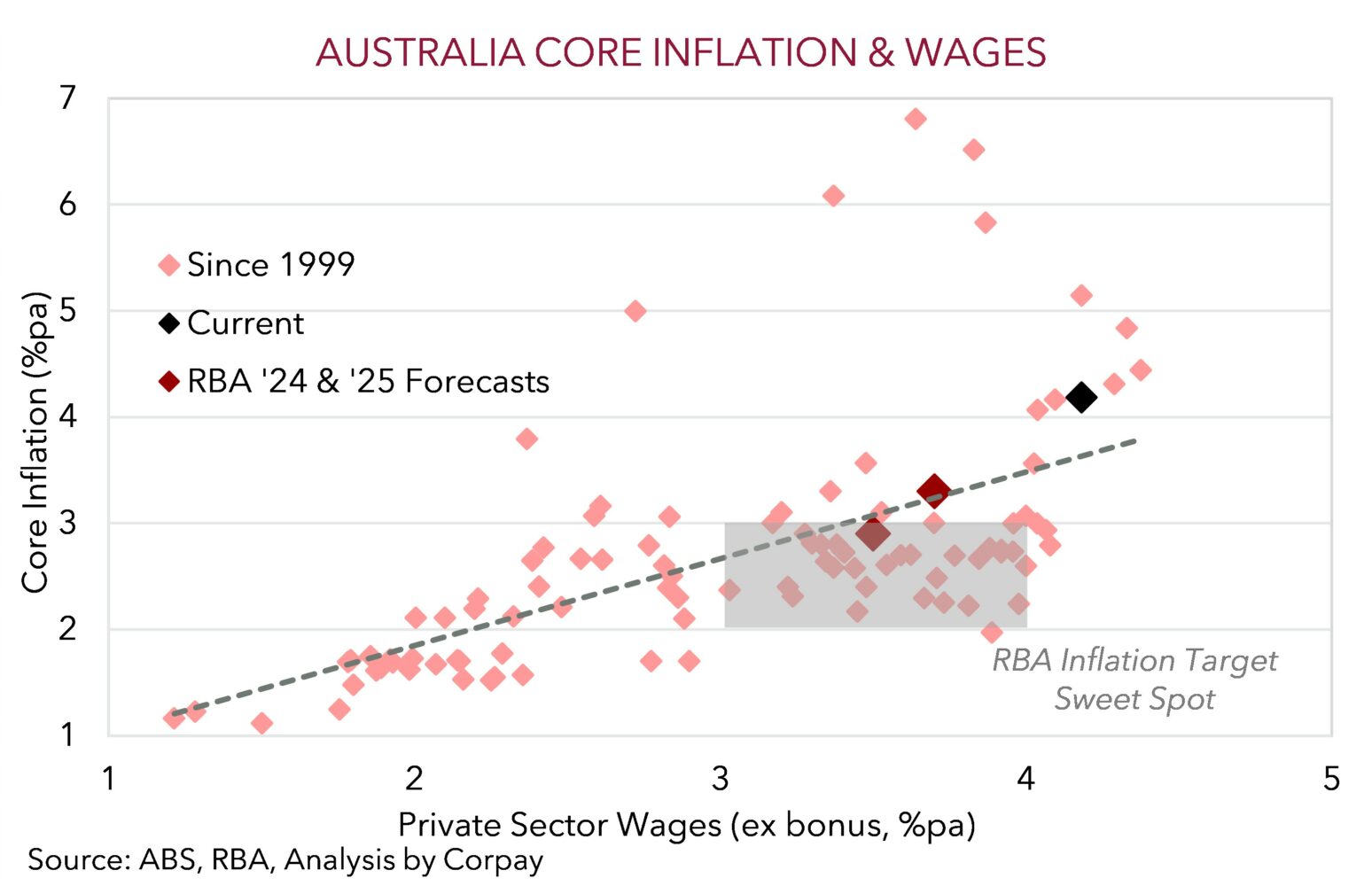

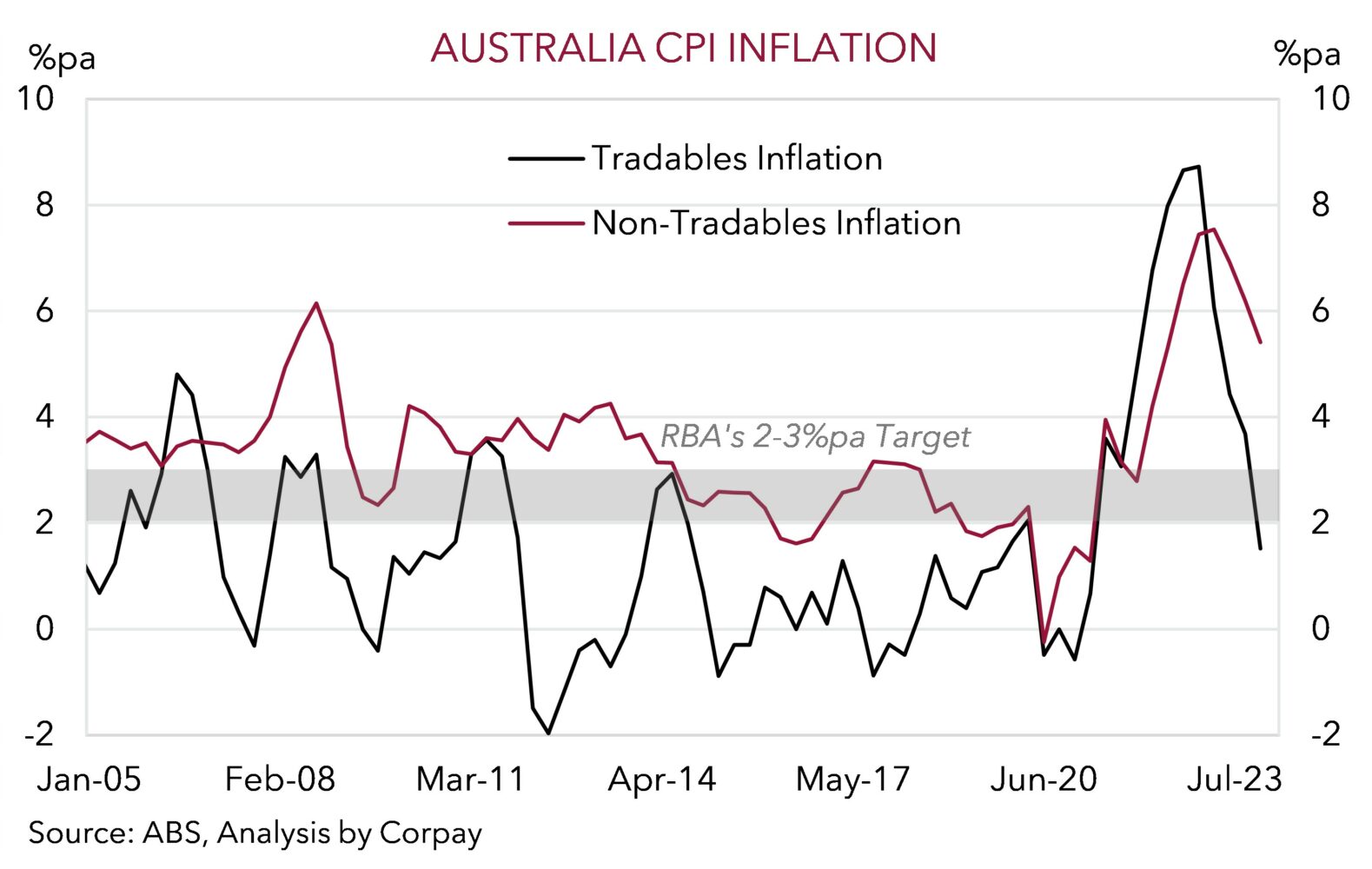

Things are heading in the right direction, as illustrated by the improvement in ‘breadth measures’ (the proportion of the CPI basket growing by more than 3%pa has fallen to ~60%, a multi-quarter low); however services inflation is still a decent way from where it needs to be. And we think these lingering domestic pressures point to the RBA remaining cautious when it comes to the timing and size of future rate cuts. Services inflation, which is tethered to the labour market and wages, is running at 4.6%pa. While below its peak this is still almost 1.5%pts higher than its pre-COVID average. These dynamics can also be seen in the tradables versus non-tradables split. The former (which reflects global conditions) has tumbled to just 1.5%pa, but the latter (which is linked to domestic trends) is tracking north of 5%pa. With the jobs market still rather tight, and given the slow-moving wage dynamics in Australia due to the high prevalence of multi-year Enterprise Bargaining Agreements, the last leg of the fight to get inflation to the mid-point of the RBA’s target could take time.

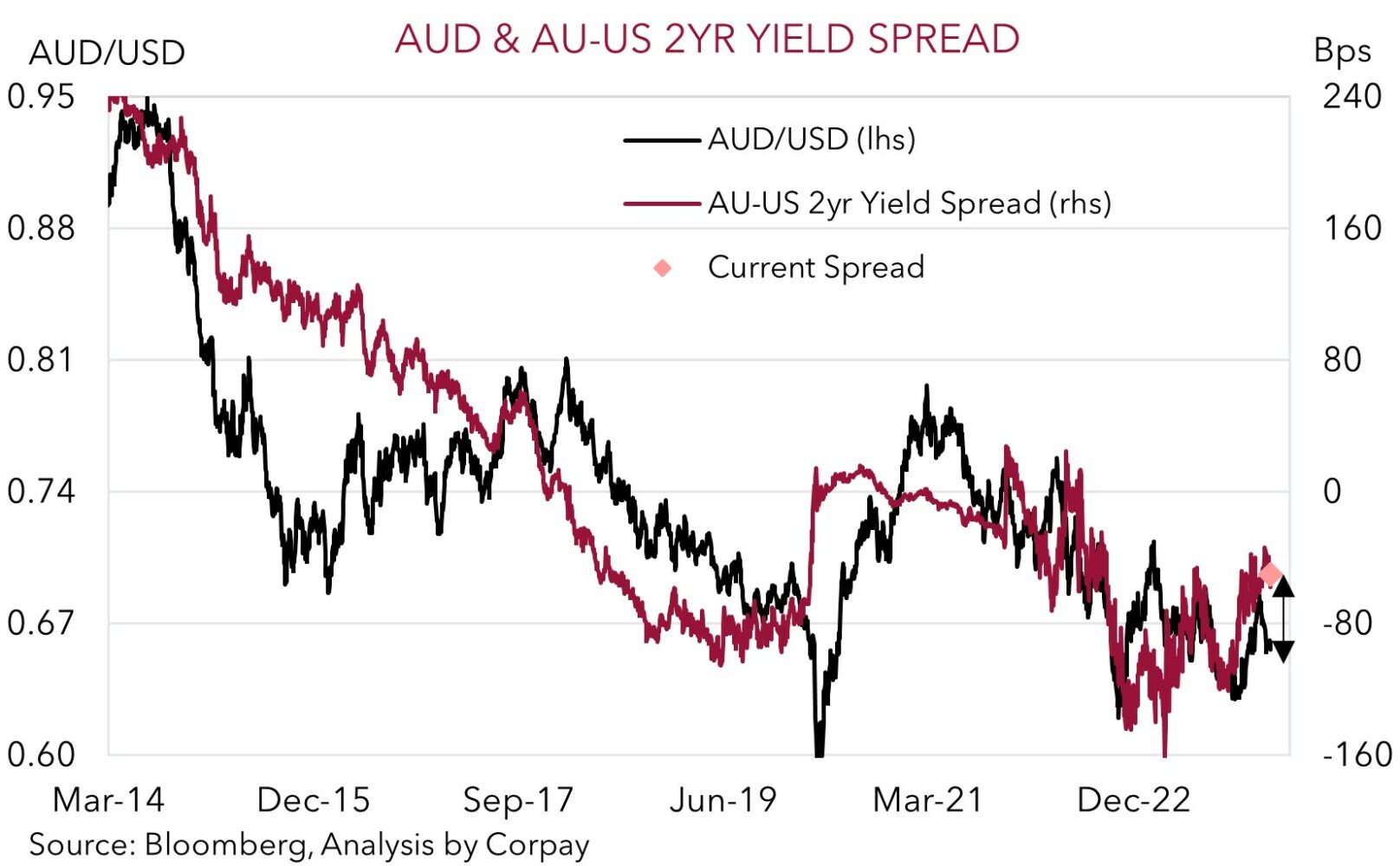

The AUD has dipped (now ~$0.6560) on the back of the of the CPI undershoot with Australian bond yields losing ground as markets discount a bit more interest rate relief by the RBA down the track. In our view, the AUD faces further near-term downside risks with tomorrow’s US Fed decision (6am AEDT) and press conference (6:30am AEDT) a potential catalyst for the USD to lift if, as we anticipate, policymakers push back on near-term rate cut pricing (markets are discounting a ~40% chance the US Fed lowers interest rates at the March meeting. By contrast, we feel the first move might occur mid-year, see Market Musings: US Fed pivot has further to run). As discussed recently, the burst of AUD volatility observed over January could be an example of what is in store over the next few months with macro turning points normally associated with market gyrations given visibility of how things are travelling is often murkier at this part of the cycle (see Market Musings: AUD volatility: a taste of things to come?).

But beyond the short-term headwinds, on balance, we continue to hold a positive medium-term bias for the AUD with: (a) narrower Australia-US short-dated yield differentials (as the RBA lags the US Fed and other major central banks during the easing phase); (b) a sturdier Chinese economy (as policy stimulus measures gain traction); (c) support to domestic activity from the incoming tax cuts and a larger population; (d) a paring back of ‘net short’ AUD positioning (as measured by the CFTC futures); and (e) a softer USD (as US Fed rate cuts actually start) projected to give the AUD a helping hand over the year. Our long-held baseline view is for the AUD to average a slightly higher level over 2024 compared to last year (i.e. ~$0.69 vs $0.66 in 2023). Although within that it looks set to be a tale of two halves. The AUD is seen meandering around ~$0.67 (on average) over H1 as cross-currents wax and wane before kicking on into the low ~$0.70s in H2.