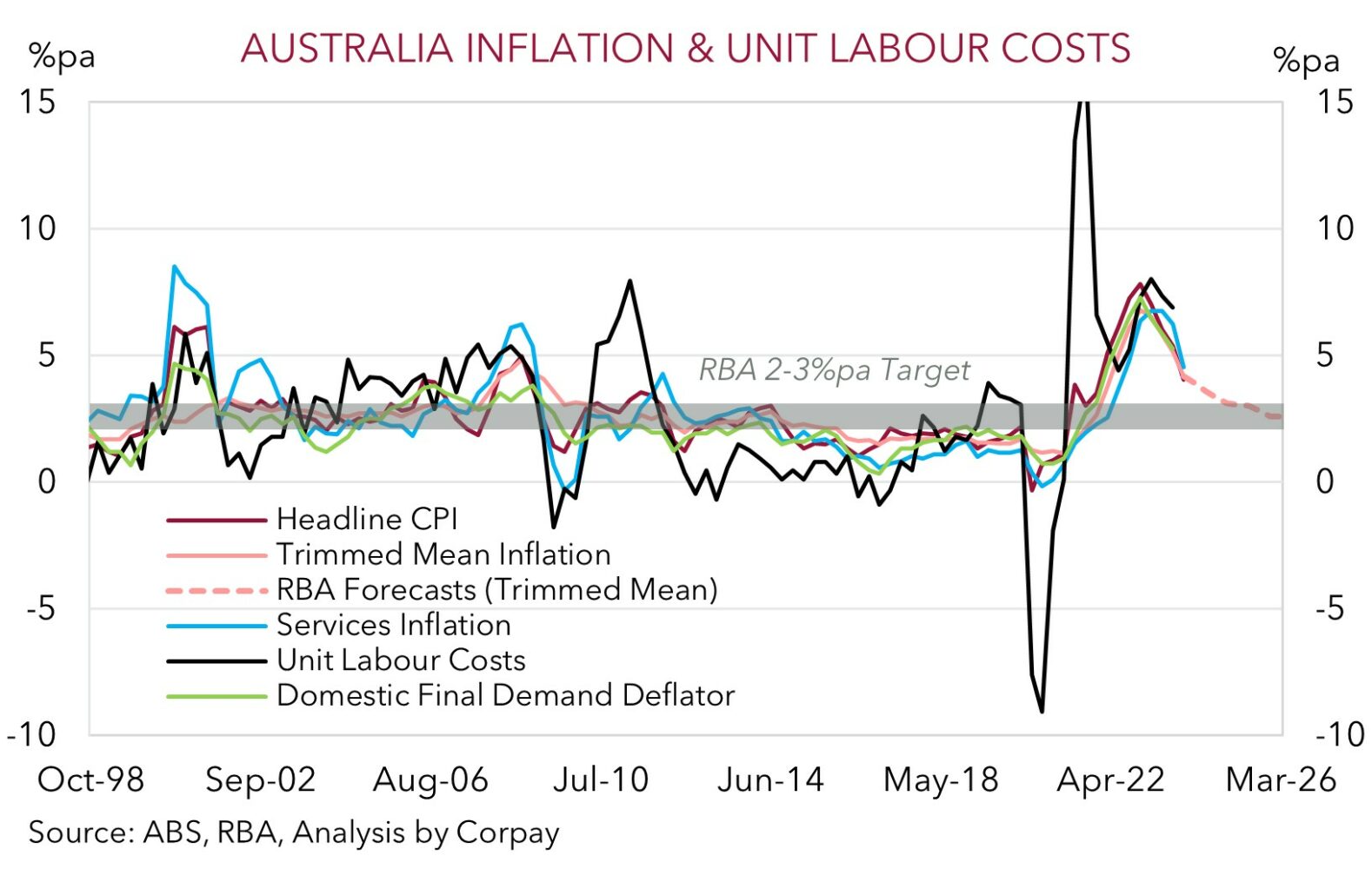

At its first meeting of 2024, and the first under the new ~6-weekly structure which also saw the bank release its latest economic projections, the RBA kept the cash rate steady at 4.35%. This was expected with more attention on the RBA’s updated reading of the macro landscape and its policy guidance. In the end the RBA played a rather straight bat by continuing to stress that “returning inflation to target within a reasonable timeframe remains the Board’s highest priority” and noting that “while recent data indicate that inflation is easing, it remains high”. With that in mind, in the RBA’s view the “path of interest rates that will best ensure inflation returns to target in a reasonable timeframe” will depend on how things unfolds and “a further increase in interest rates cannot be ruled out”. Indeed, as Governor Bullock put it, the RBA is “not ruling anything in or out” with the Board alert to the downside and upside risks and needing to “be vigilant”.

That said, although the RBA is continuing to keep the door ajar to further tightening we don’t think it will walk through it. Its already mild tightening bias has been further diluted, with a downshift to ‘neutral’ undertaken. In our opinion the RBA hit its interest rate peak last November, and the next move should be a rate cut. Though we continue to think the start of a modest and gradual easing cycle remains a story for the latter part of this year rather than anytime sooner (see Market Wire: Inflation moving in the right direction).

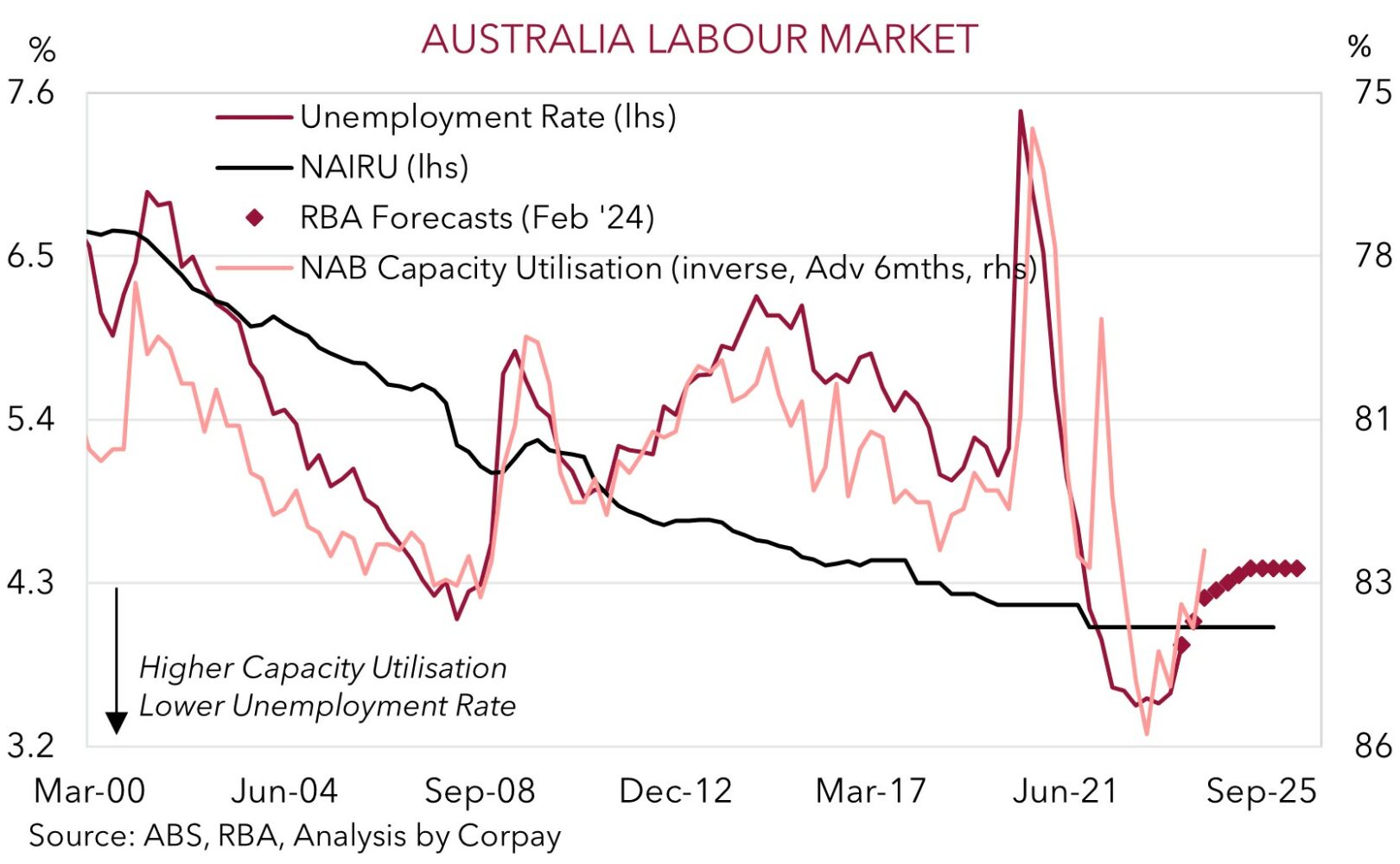

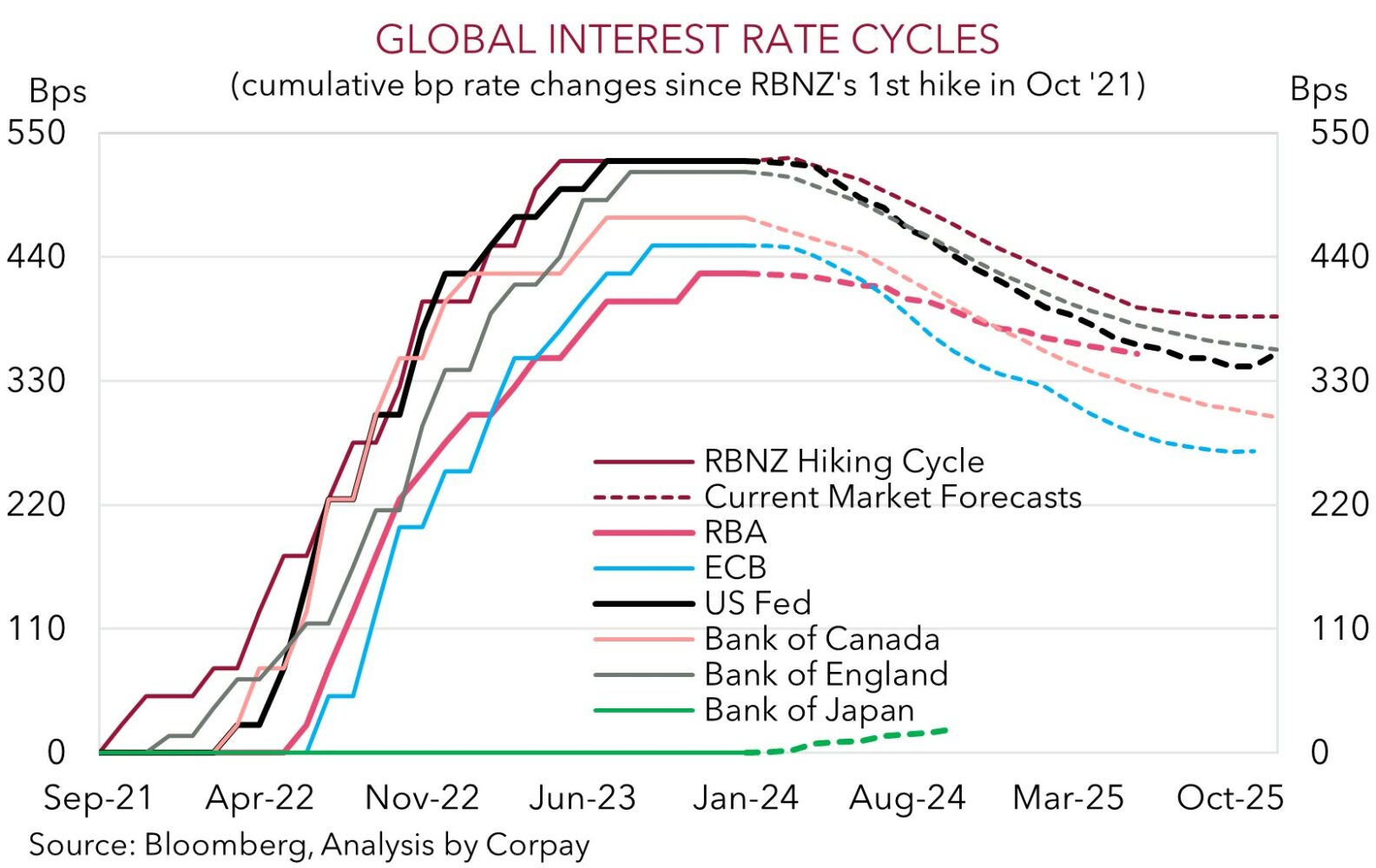

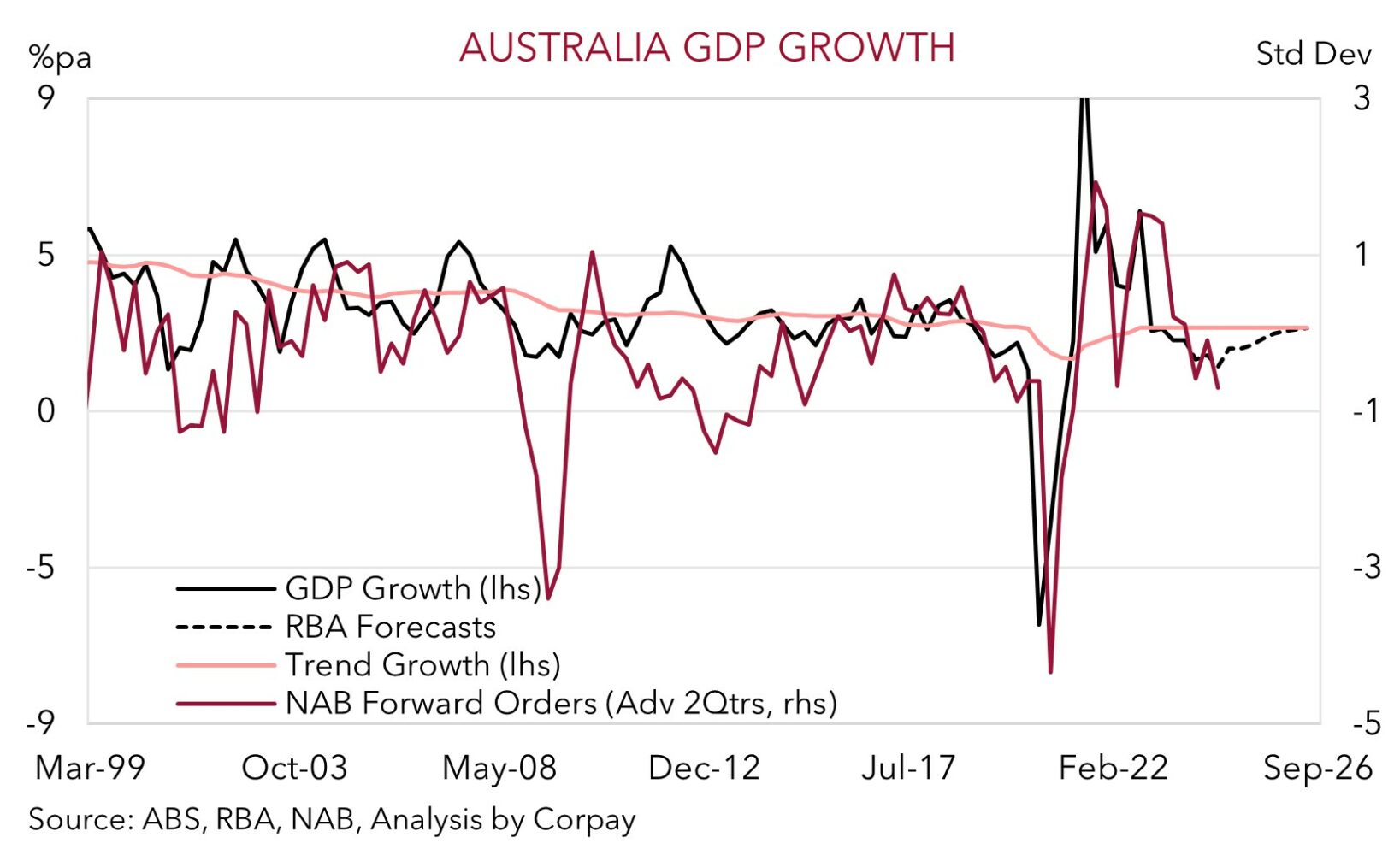

This is also the signal from a full read of the RBA’s forecasts which show Australian GDP growth has been revised a bit lower with the economy expected to expand at a well below trend pace over H1 2024 before momentum starts to improve. This sluggish backdrop feeds through to a slightly bigger uptick in unemployment (it is now forecast to peak at ~4.4%), and in time this should see inflation moderate a touch faster and return to the mid-point of the RBA’s target band by mid-2026. Notably, as per the usual practice, the RBA’s forecasts were based on a technical assumption (a blend of market interest rate pricing and economist surveys) that has the cash rate gradually easing from its current ‘restrictive’ stance towards a more ‘neutral’ level over time (i.e. from 4.35% to ~3.2% by June 2026). Compared to history this is a slower and more limited RBA easing cycle than past ones, and it would be akin to interest rate relief rather than a pivot to an accommodative setting.

The RBA’s leaning against near-term rate cut expectations, much like the Bank of England and US Fed last week, has provided the beleaguered AUD which has been weighed down by the upswing in US bond yields and the USD some modest intra-day support (now ~$0.6515). As pointed out in our recent research, ongoing pockets of AUD volatility, similar to what we have observed over early 2024, should be anticipated over the period ahead as geopolitical risks wax and wane, growth/inflation data deviates from expectations, and interest rate pricing continues to adjusts (see Market Musings: AUD volatility: a taste of things to come?). This is not unusual as turning points in economic cycles are tricky to navigate.

However, by and large, we think that a lot of negativities appear discounted in the AUD down around current levels (note, since 2015 the AUD has only traded below where it is currently ~6% of the time), and we feel that the USD’s resurgence might soon begin to lose steam. Importantly, the gap between the markets interest rate views and the US Fed’s central case has tightened considerably over recent weeks, and given data released next week appears set to show US inflation is continuing to slow and retail sales moderated after a late-2023 flurry a refocus by markets on the medium-term outlook for US interest rates to move lower could return. This in turn may see the USD give back ground, a support for the AUD and other major currencies.

More broadly, we remain of the view that over the course of 2024 the AUD should gradually tick up as: (a) a sturdier Chinese economy (as policy stimulus measures gain traction) underpins commodity demand and capital flows into Emerging Market assets; (b) the USD softens as US Fed rate cuts actually start (we are penciling in a US easing cycle from mid-year); and (c) short-dated yield differentials narrow in the AUD’s favour given we see the RBA lagging its global peers during the next global rate cutting cycle because of the support to demand from the expanding population, incoming Stage 3 tax cuts, tightish labour market conditions, and stickiness across ‘services’ inflation due to Australia’s slower moving wage dynamics and other things like rents.