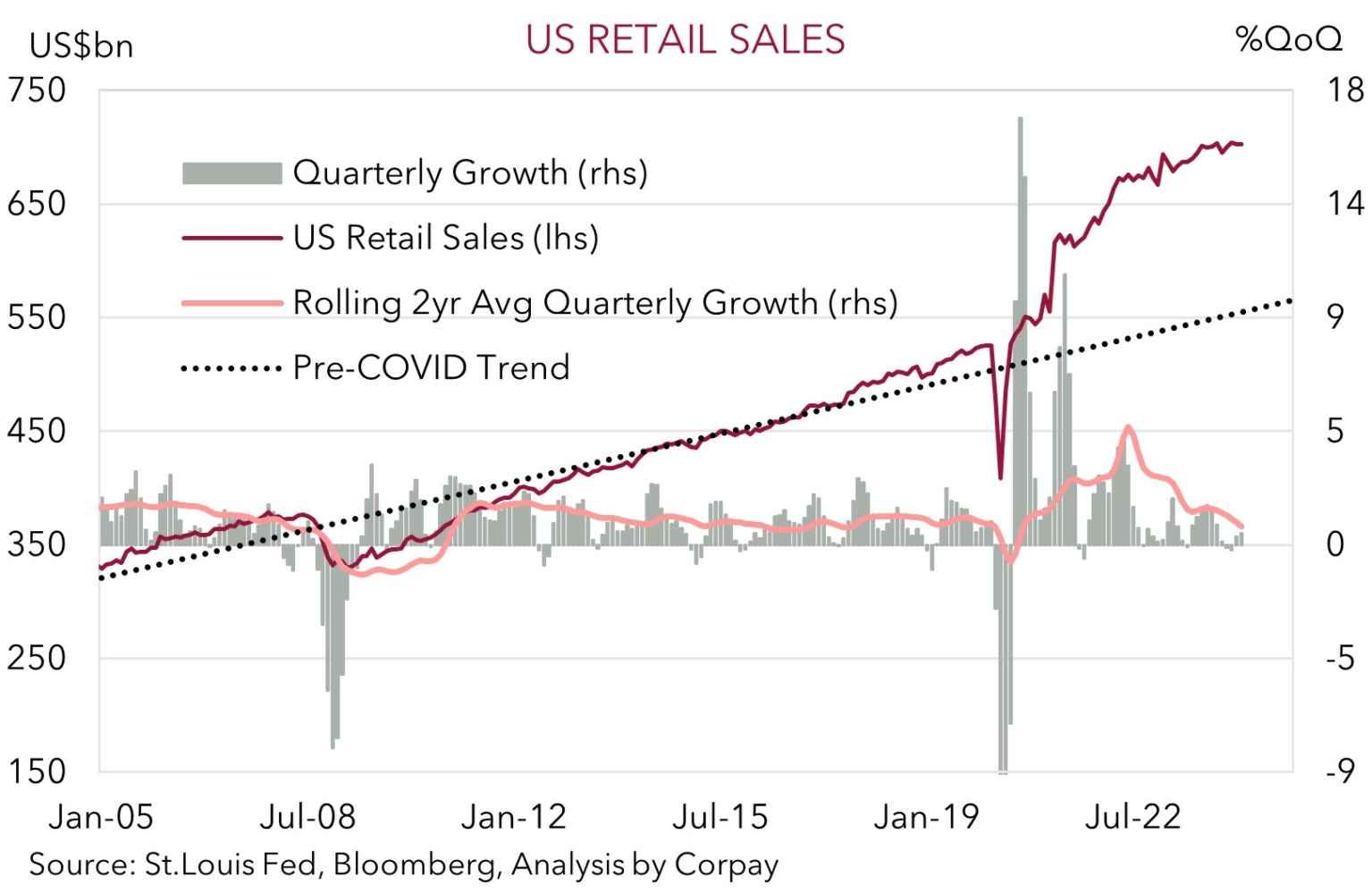

• Upbeat tone. Negative US economic news was good news for markets. Softer US retail sales weighed on bond yields which in turn boosted risk assets.

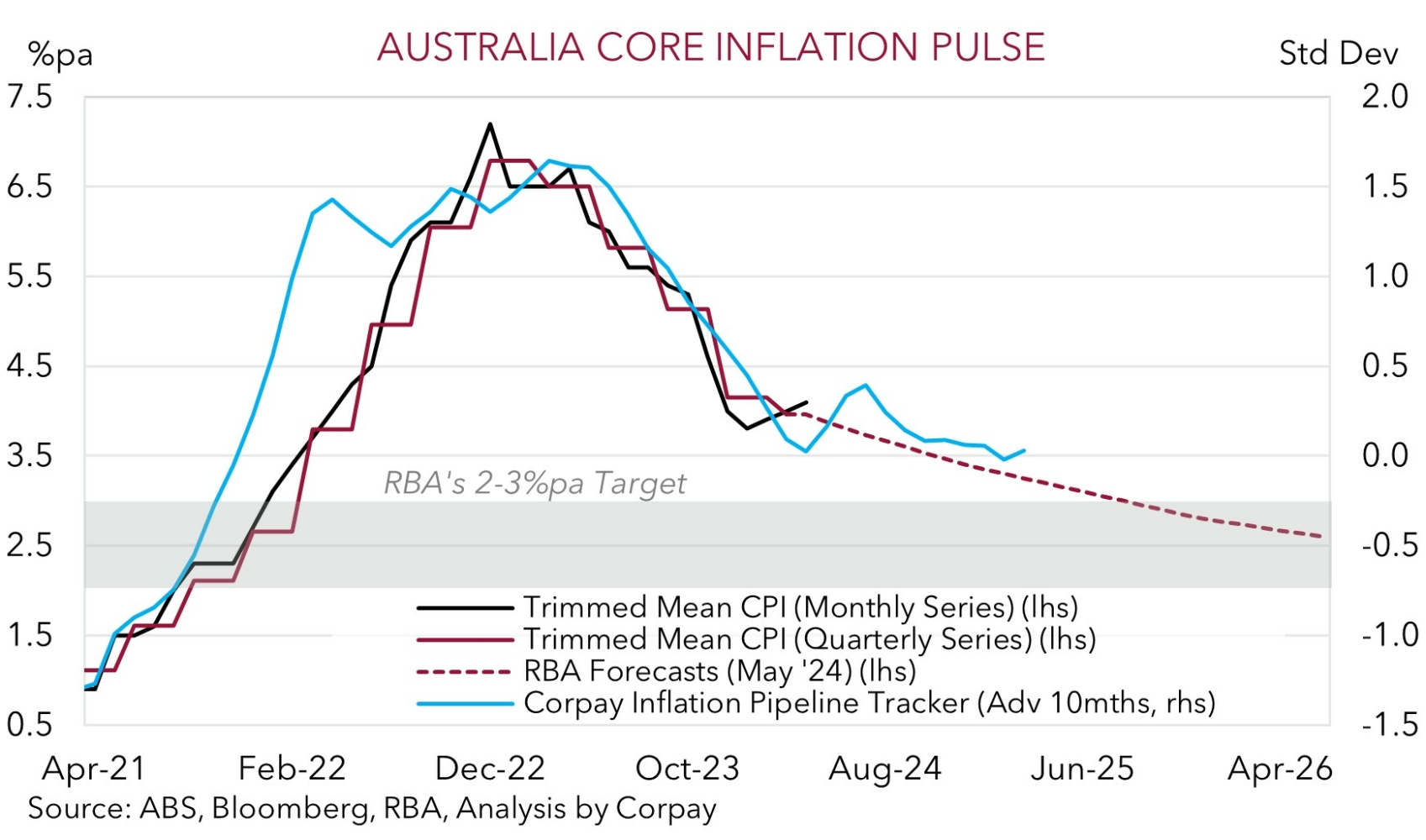

• RBA meeting. No change in rates but the RBA’s tone was more ‘hawkish’. Inflation risks remain. We think RBA cuts still look some time away.

• AUD outperformance. The backdrop has supported the AUD. AUD/EUR is at a multi-month high, while AUD/JPY is at levels last traded in 2013.

The positive vibes continued overnight. Easing concerns about the upcoming French parliamentary elections was compounded by softer US retail sales. The underwhelming US economic news was viewed favorably in risk markets as it raises the chances of rate cuts by the US Fed later this year. US retail sales rose by a tepid 0.1% in May, with downward revisions to prior months also meaning the recent lackluster growth was worse than first thought. On net, US retail turnover hasn’t grown since December with US consumers (the economic engine room) becoming more cautious. With COVID era ‘excess savings’ largely exhausted, credit conditions tighter, and the labour market starting to loosen, we think US consumption growth could remain sluggish near-term.

We believe this would be welcomed by the data-dependent US Fed as it means the economy is moving into better balance. This in turn points to the heat continuing to come out of the US jobs market and inflation pressures receding. In another sign of how important the data pulse will be the Fed members that spoke overnight had some vastly different views. On the ‘hawkish’ side, new St. Louis Fed President Musalem noted that it could take “quarters” for the data to support a cut and warned about the risk of additional hikes if inflation progress reverses. By contrast, Fed Governor Kugler indicated it will likely be appropriate for rate cuts “sometime later this year” if the economic backdrop unfolds like she anticipates.

All up, equities rose with European markets outperforming (EuroStoxx50 +0.7% vs US S&P500 +0.3%). Bond yields fell with US rates ~5-6bps lower across the curve. Markets are once again close to fully factoring in a second US Fed rate cut by year-end. Elsewhere, energy and base metal prices increased with WTI crude up ~1.5% and copper ~0.7% higher. In FX, the USD index slipped back a little with EUR ticking up to ~$1.0740, USD/JPY consolidating (now ~157.85) and GBP treading water (now ~$1.2710) ahead of today’s UK CPI report where a step down in the annual pace of inflation is predicted (4pm AEST). The backdrop, coupled with the ‘hawkish’ tilt in yesterday’s RBA meeting, helped the AUD outperform (now ~$0.6655).

The US is off tonight due to the Juneteenth public holiday. Hence, without an exogenous shock, markets should be quiet. Beyond that we do feel that without another flare up in European political risks the USD can continue to lose ground given the broadening signs of a slowdown in the US economy and with other major economies beginning to turn course. This dynamic could come through in the latest batch of global business PMIs released on Friday.

AUD Corner

The AUD has perked up over the past 24hrs. The upbeat risk sentiment (as illustrated by the lift in equities, energy, and base metal prices), a softer USD and lower US bond yields following the subpar US retail sales report, and ‘hawkish’ vibes at yesterday’s RBA meeting have pushed the AUD up to ~$0.6655. The environment also helped the AUD strengthen on the crosses. At ~0.6195 AUD/EUR is near its highest level since early-January. AUD/GBP (now ~0.5235) is at a ~1-month high, AUD/NZD is around ~1.0835, AUD/CAD is back above ~0.91, and AUD/JPY (now ~105.12) is up at levels last traded in April 2013.

Yesterday, as expected the RBA held the cash rate steady at 4.35%, where it has been since last November. However, the underlying tone did lean a little more ‘hawkish’. The Board reiterated it needs to “remain vigilant to upside risks to inflation” and that it “is not ruling anything in or out” when it comes to future moves. Notably, in something it hasn’t said since February the Board also stressed it “will do what is necessary” to achieve its aim of getting inflation back to target in a reasonable time. Indeed, when asked, Governor Bullock acknowledged another rate hike was ‘considered’ yesterday.

We are at a tricky point of the business cycle with several complex push-pull forces hitting the Australian economy. While growth rates have slowed, particularly on a per capita basis and across ‘goods producing sectors’ on the back of the cost-of-living squeeze and higher mortgage costs, the level of aggregate activity is north of its pre-COVID trend and labour market conditions remain tight. We think a further rebalancing across the economy may take time to unfold. And as our pipeline CPI tracker illustrates, based on current RBA policy settings (which are calibrated to try and limit possible labour market damage), improvement in core inflation might be drawn out. For more see Market Musings: RBA: No retreat, No surrender.

We continue to think that the potential start of a modest RBA rate cutting cycle looks to be a story for 2025. Interest rate markets agree with the first RBA rate cut not fully priced in until May 2025. Medium-term, we continue to believe that relative macro trends should be AUD supportive. Not just against the USD, but also on crosses like AUD/EUR, AUD/GBP, AUD/CAD, and AUD/NZD where other central banks have started or could soon begin to lower interest rates.