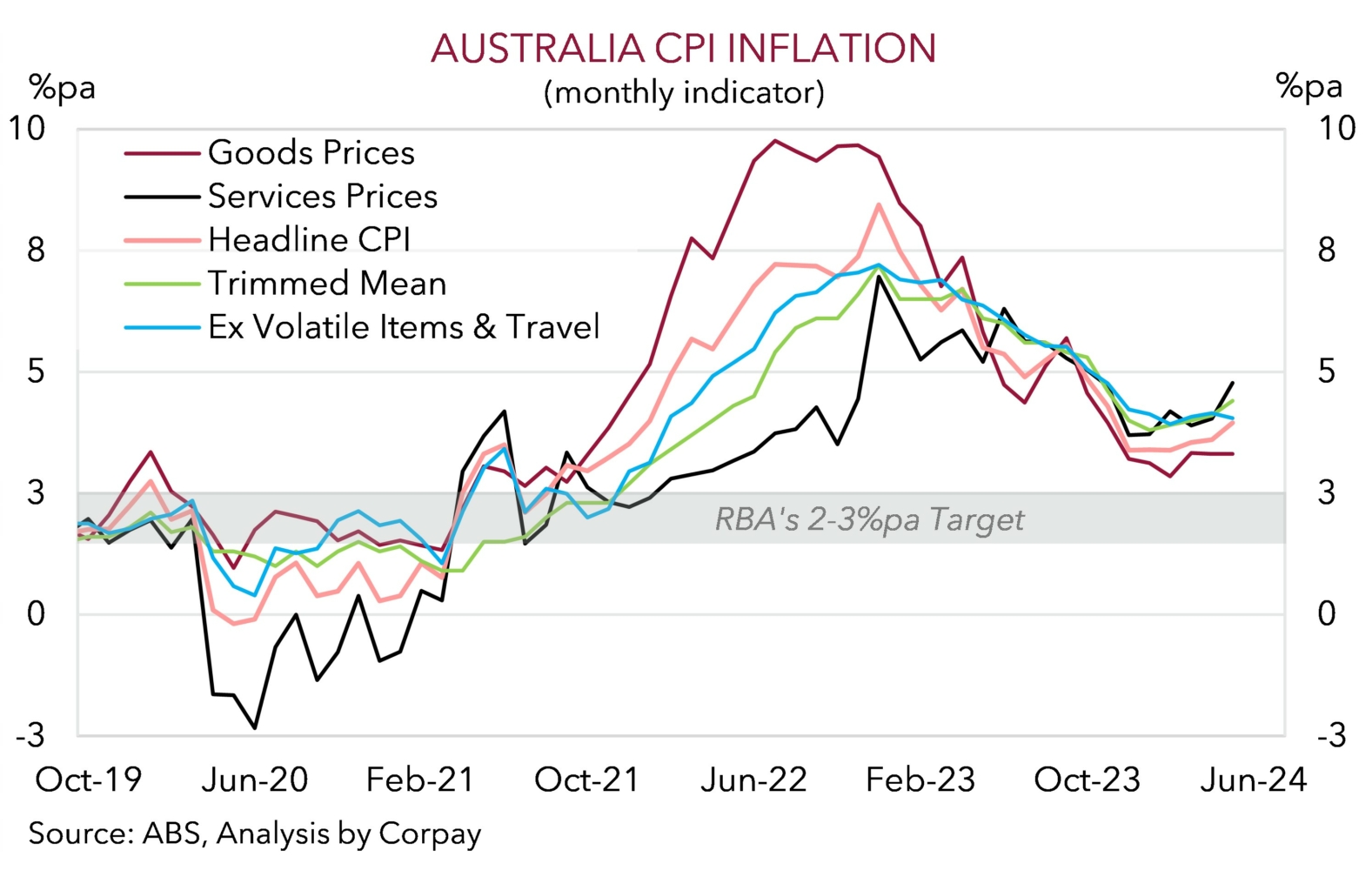

Australia’s inflation genie is struggling to be put back in the bottle. The monthly CPI indicator for May was hotter than predicted. Headline inflation re-accelerated to 4%pa (from 3.6%pa in April), its fastest pace in 7-months with the 3-month and 6-month annualized run-rates also ticking higher. Positive base-effects were a factor but the detail under the hood would also be on the RBA’s radar given it has indicated limited tolerance for upside surprises. Notably, the disinflation across ‘goods’ prices looks to be stalling (‘goods’ inflation has held steady at 3.3%pa over the past few months, above its pre-COVID average). And ‘services’ price pressures, the parts of the inflation basket that the RBA is lasering in on given they are tethered to domestic economic and labour market conditions, remain robust. Aggregate services inflation quickened to 4.8%pa, the fastest since last October. As a result, underlying/core inflation remains well north of the RBA’s target band. The trimmed mean measure stepped up to 4.4%pa, and the other focused on gauge (i.e. CPI ex volatile items and travel) continues to hover around 4%pa (chart 1).

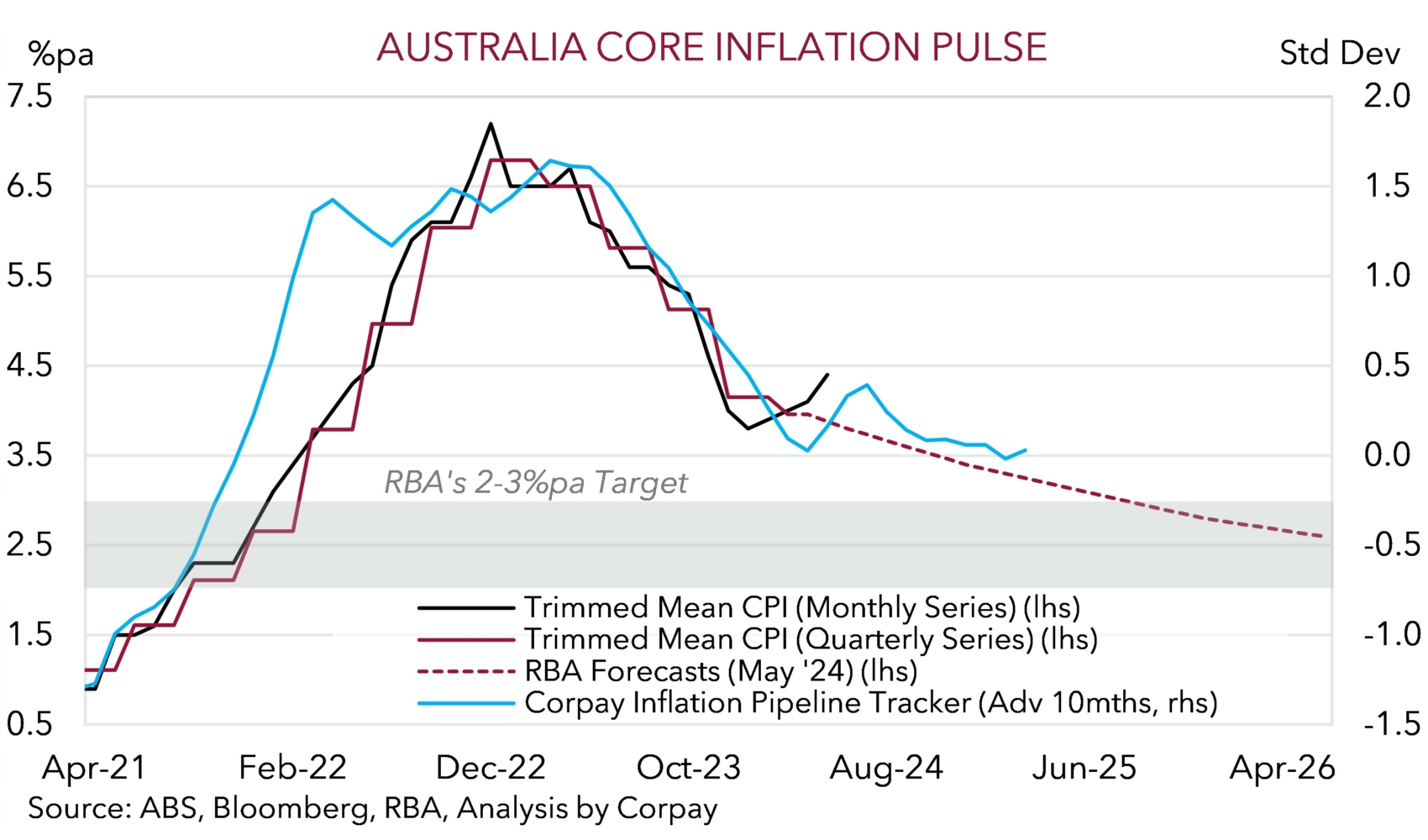

The monthly CPI indicator doesn’t have all the bits and pieces included in the full inflation dataset. The next quarterly CPI print (for Q2) will be released on 31 July. Nevertheless, the May data shows Australia’s inflation pulse remains quite strong with it tracking above the RBA’s projections (chart 2). The data supports our previously outlined thoughts that the last leg of the inflation fight could be a hard nut to crack given the cautious RBA doesn’t look to have raised interest rates far enough this cycle. As flagged before, our modelling suggests the RBA cash rate (now 4.35%) is ~50bps below where Taylor Rule estimates imply it ought to be (see Market Musings: AUD outperformance to continue?). We would also note that in comparable debt laden economies like Canada, the UK, and NZ, their respective central banks increased rates to 5-5.5% during the tightening phase.

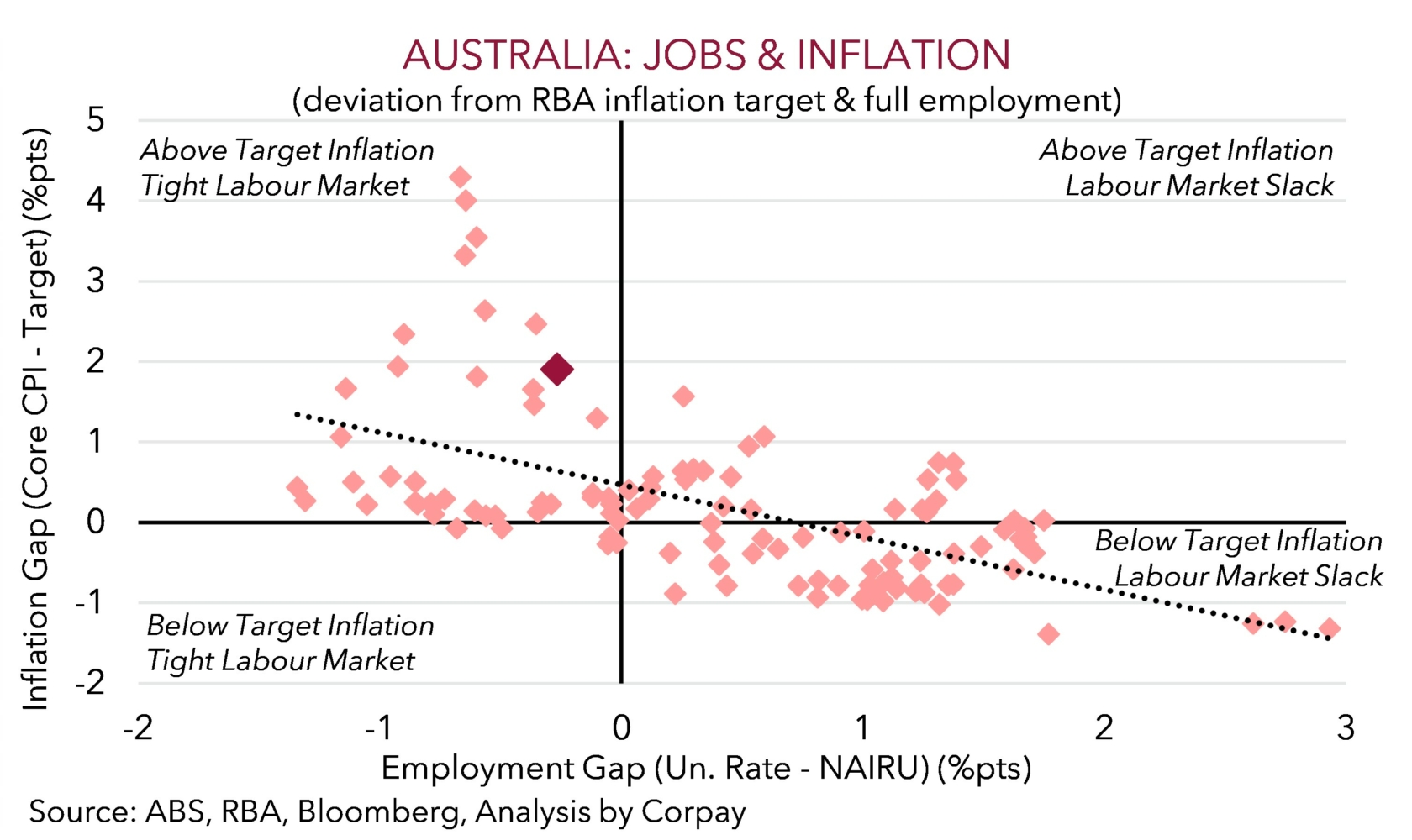

Locally, while growth rates and momentum have slowed, particularly on a per capita basis and across interest rate sensitive and ‘goods producing sectors’ on the back of the cost-of-living squeeze and higher mortgage costs, the level of activity across the private sector (and services providing industries) is still above of its pre-COVID trend. This is keeping labour market conditions rather tight, wages elevated, and in turn, as today’s data illustrates domestic/core inflation sticky (chart 3). Recall, it is the level of demand compared to supply which drives inflation. As our pipeline tracker shows (chart 2), based on current RBA settings which have been calibrated to try and limit labour market damage, the moderation in core inflation could be drawn out.

From our perspective, the pressure on the RBA to tighten its policy settings a little more over the near-term is growing with another rate hike at the 6 August meeting a real possibility unless quarterly CPI downwardly surprises and/or large cracks in the labour market appear. Failure to deliver further tightening would likely just mean that the current level of interest rates will need to be maintained for some time yet to deliver the required economic effects to drag down inflation.

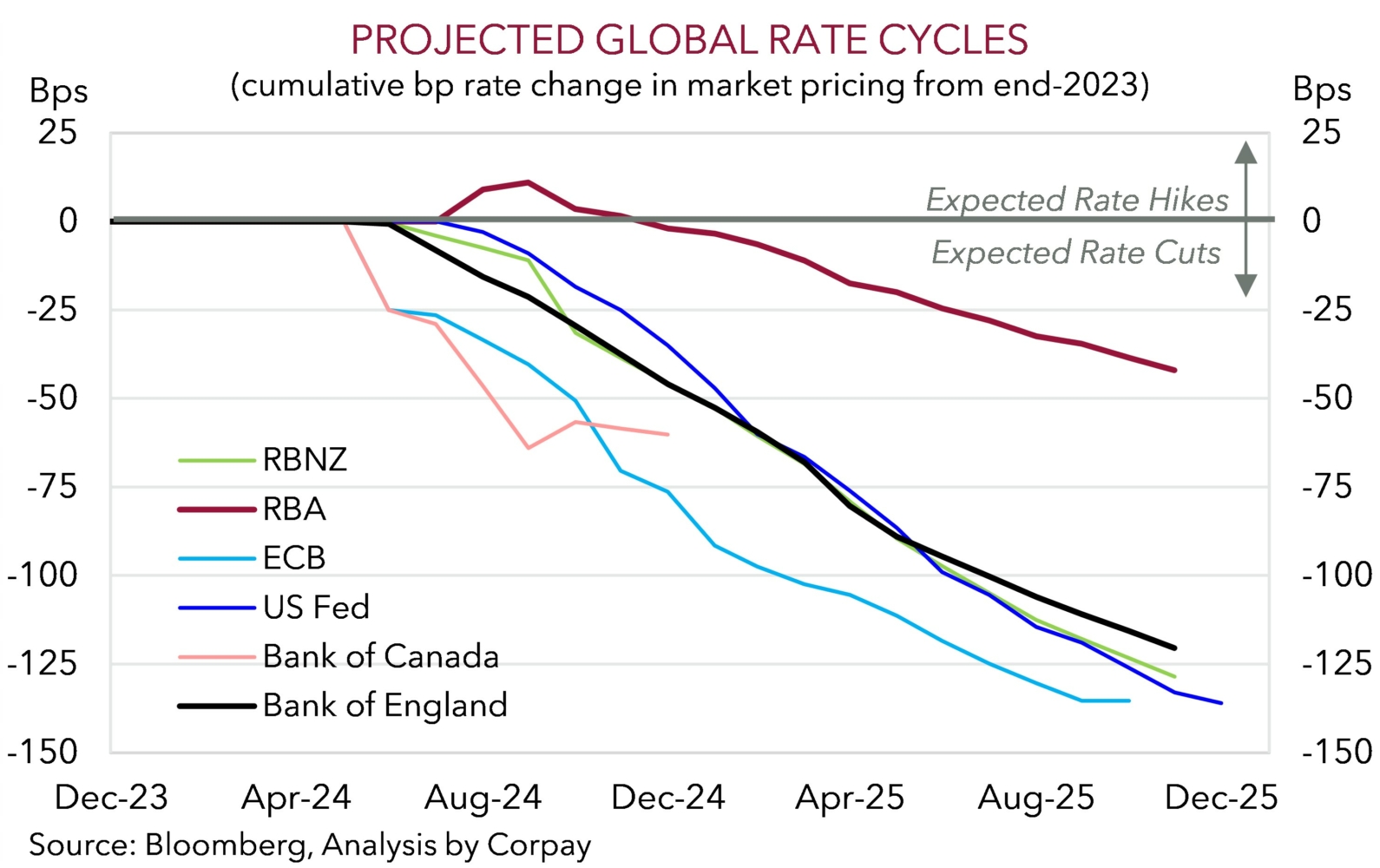

Overall, the latest monthly CPI reading supports our prior assessment that the diverging economic and monetary policy trends between Australia and others (chart 4), the swing in yield differentials, and a reduction of still bearish ‘net short’ positioning (as measured by CFTC futures) should be AUD supportive over the period ahead, particularly on crosses like AUD/EUR, AUD/CAD, AUD/GBP and AUD/NZD (see Market Musings: RBA: No retreat, No surrender).