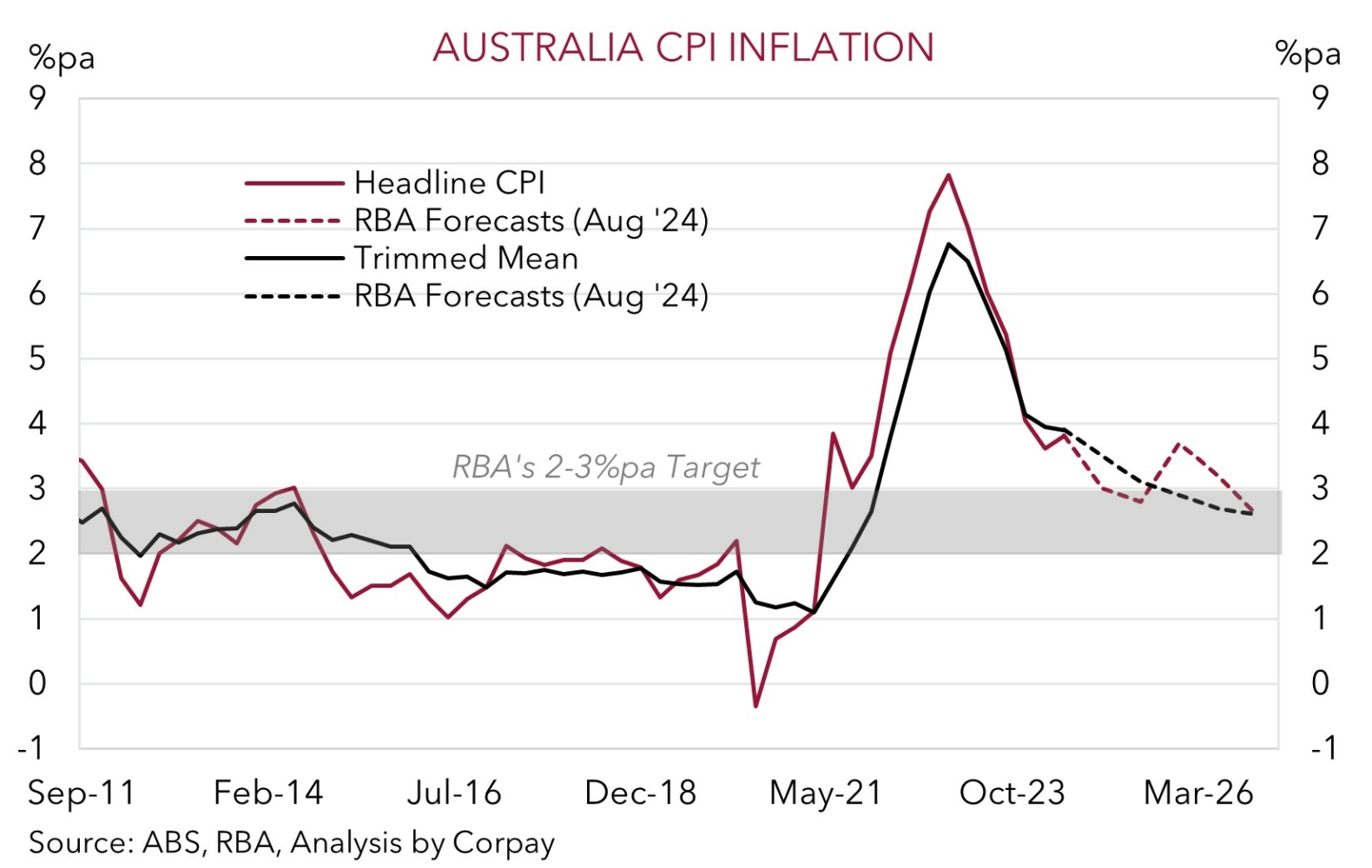

The RBA played a rather straight bat at today’s meeting with recent market gyrations not swaying the central bank to alter its mildly ‘hawkish’ vibes. Interest rates were kept steady at 4.35%, where they have been since last November, with inflation still front of mind. As outlined by the RBA, inflation has fallen from its 2022 peak but it is “some way” from the 2-3% target midpoint with the latest figures showing pressures are “proving persistent”. In its updated projections, while the RBA lowered its near-term headline CPI forecasts to take into account of the relief measures such as energy rebates put in place by Federal and State governments, core inflation (and headline readings further out) is only seen returning to where it needs to be in late-2026. This is a reflection of the still tight labour market conditions (unemployment remains below full-employment) and elevated activity levels across the aggregate economy.

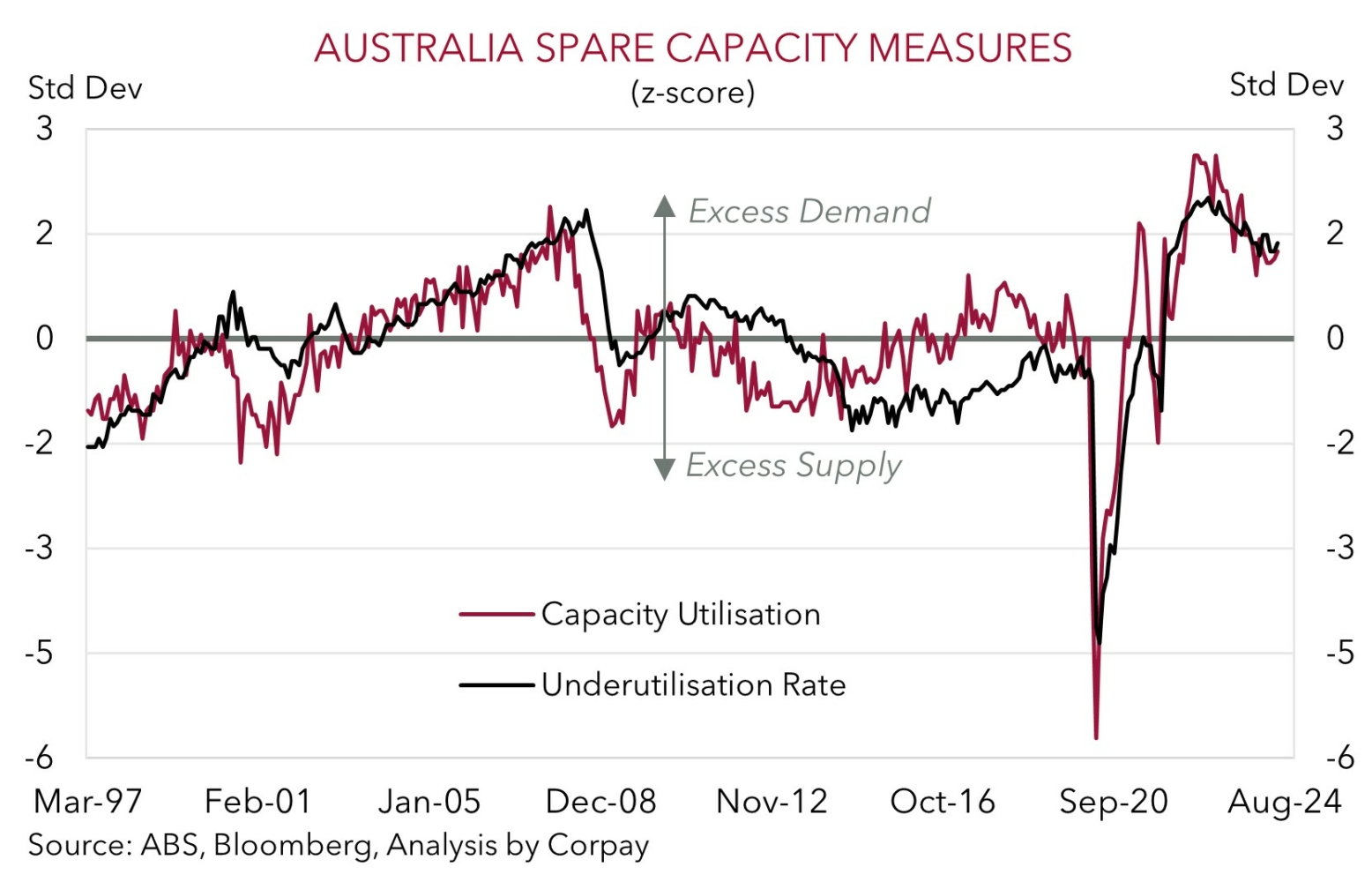

As we have pointed out previously, growth rates have stepped down, especially across interest rate sensitive ‘goods producing’ sectors, but the level of demand across labour intensive services sectors remains north of its pre-COVID trend. The mismatch between demand and supply is what drivers inflation and various ‘spare capacity’ measures show the broader economy is still in a state of ‘excess demand’. With this in mind the RBA reiterated it will “need to remain vigilant” to upside inflation risks and hence it is “not ruling anything in or out”.

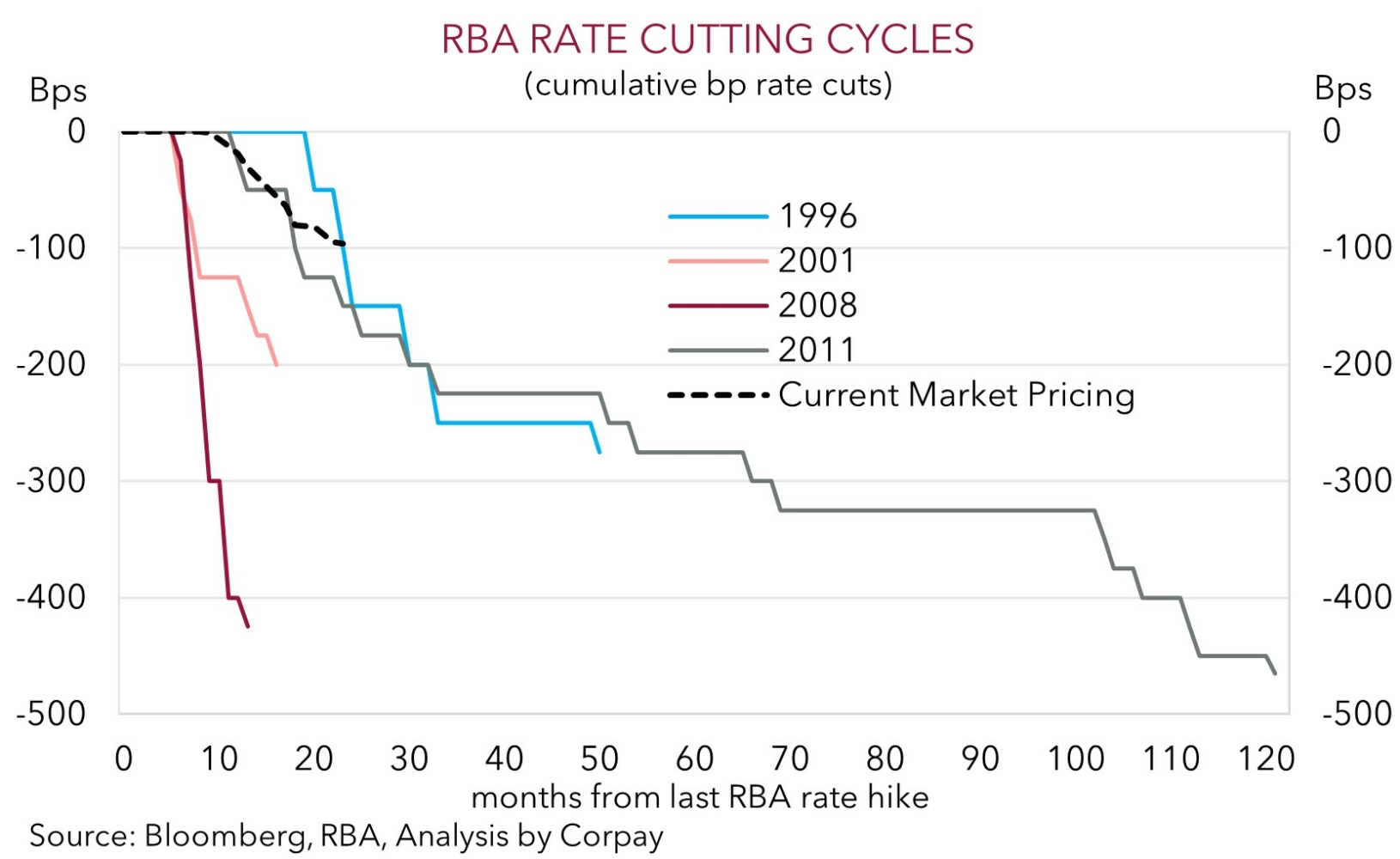

In our view, while another rate hike doesn’t look probable based on the RBA’s pragmatic approach, with momentum losing steam, unemployment beginning to drift higher, and other global central banks turning course, the chances aren’t zero. As RBA Governor Bullock stressed the Board “did consider” another rate rise at today’s meeting. At the same time, we continue to believe rate cuts might be some time away. In contrast to the swings in market pricing that have come through over recent days on the back of the abrupt moves in asset classes like equities we think the fundamentals across the real economy suggest the first RBA rate cut is a story for Q1 2025, at the earliest, without an exogenous shock manifesting. Indeed, in a shot across the bow of markets Governor Bullock proclaimed a near-term cut isn’t on the agenda with pricing for a December reduction “not aligned” with the RBA’s thinking.

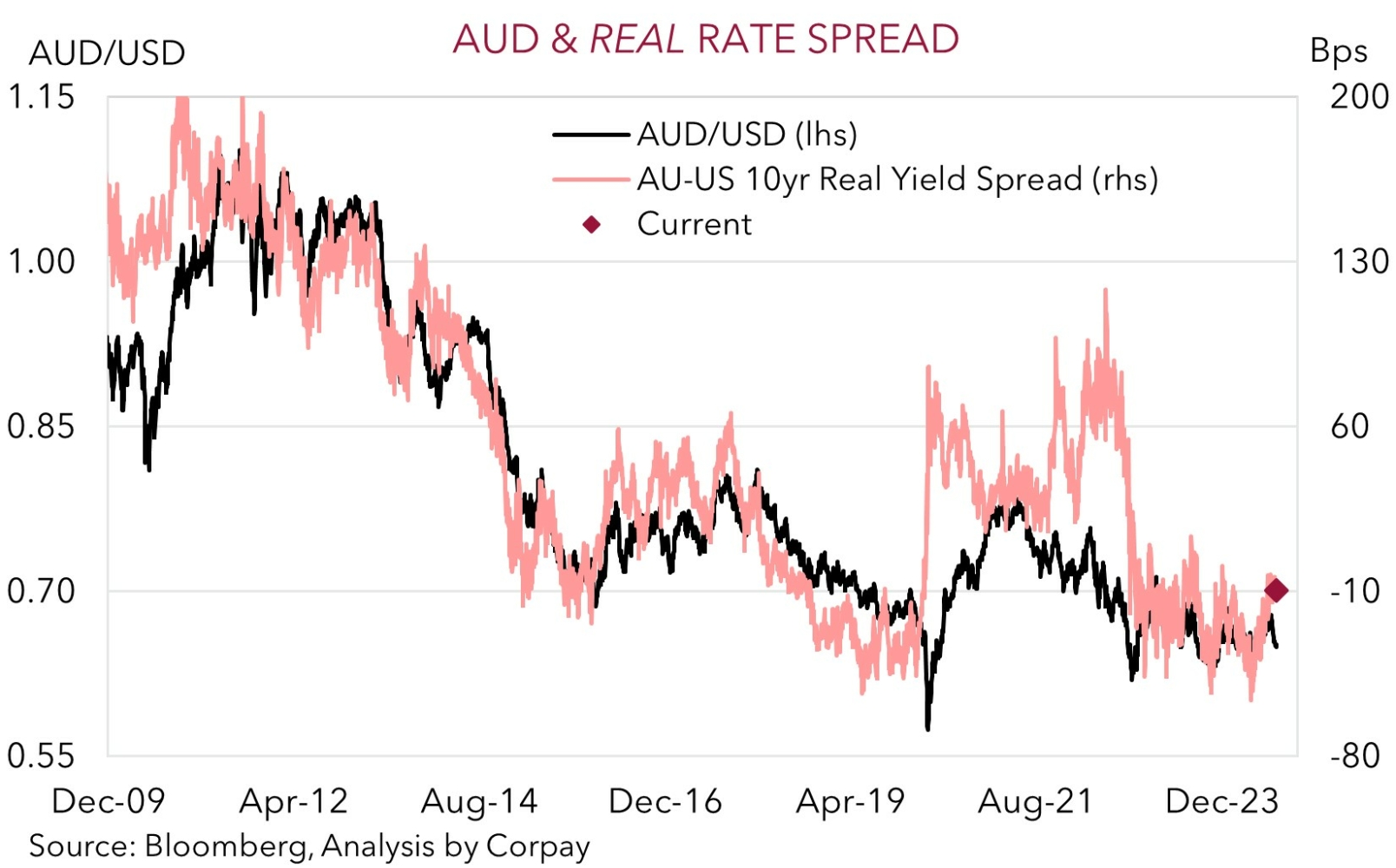

From our perspective, our long-held thesis that the RBA is set to lag its global counterparts in terms of when it starts and how far it goes during the next easing cycle remains intact. As risk sentiment stabilizes we expect the undervalued AUD to recover lost ground, in line with the signal from various indicators like real/nominal yield spreads which should turn progressively more in Australia’s favour over time if the RBA holds steady and other central banks act. We also feel participants shouldn’t be overly bearish the AUD down around current levels. A lot of ‘bad news’ may be baked in. Australia is running a broad basic balance of payments surplus with the terms of trade also above average. On our figuring, since these positive AUD flow and valuation dynamics swung into gear in 2015 the AUD has only traded sub $0.65 in ~6% of trading days.