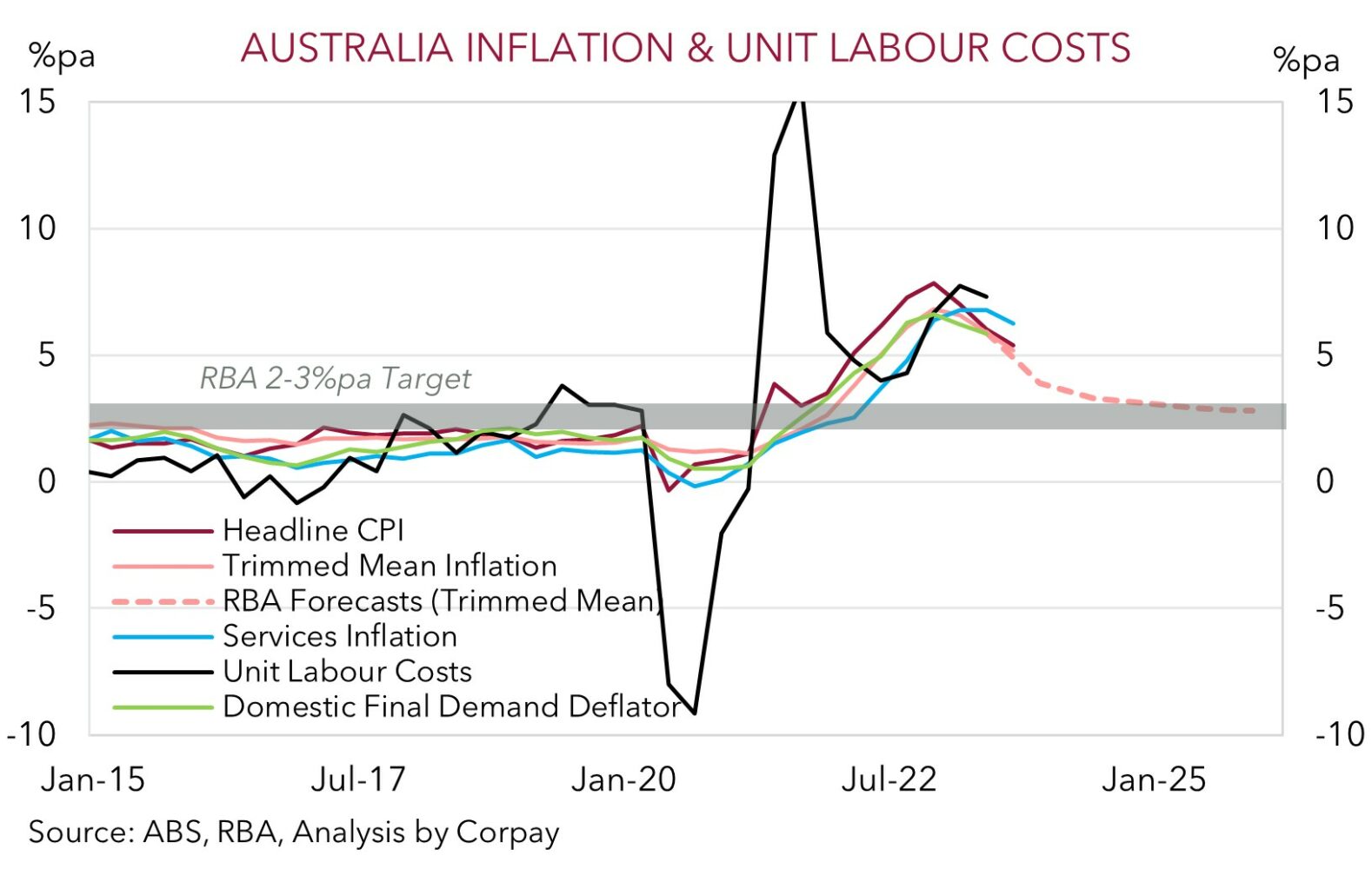

The Q3 Australian CPI report positively surprised, further opening the door to another 25bp rate rise by the RBA as soon as the 7 November meeting. While base-effects as last year’s larger price increases rolled out of calculation, pushed annual CPI lower (headline CPI decelerated to 5.4%pa and trimmed mean (the RBA’s preferred core inflation gauge) slowed to 5.2%pa), the underlying inflation pulse remains quite strong. The pull-back in annual inflation was less than anticipated, and quarterly growth stepped up with headline and core CPI both rising by 1.2%qoq. This was above the markets forecast and well north of the RBA’s projection. The RBA was penciling in core inflation to be ~4.9%pa in Q3.

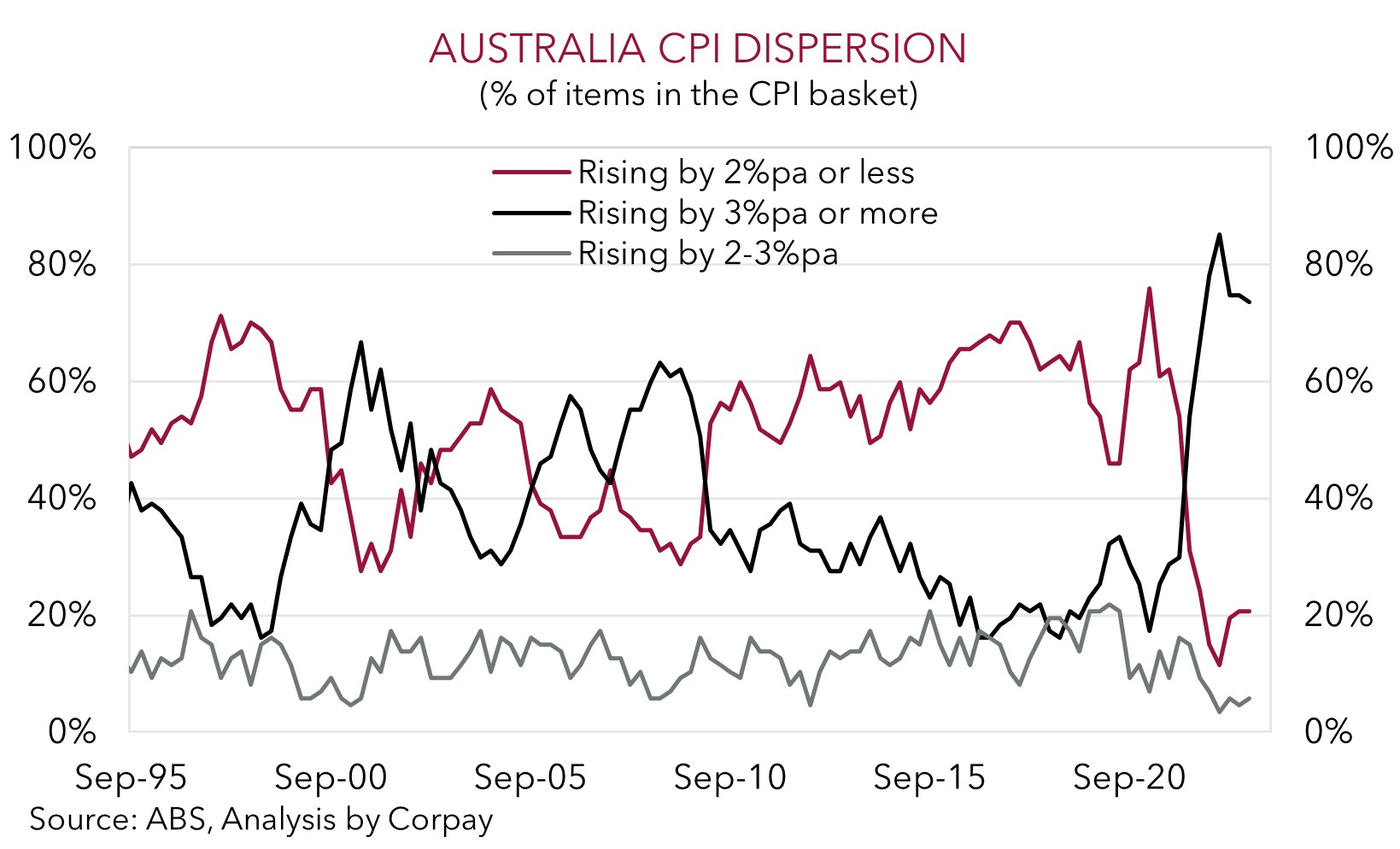

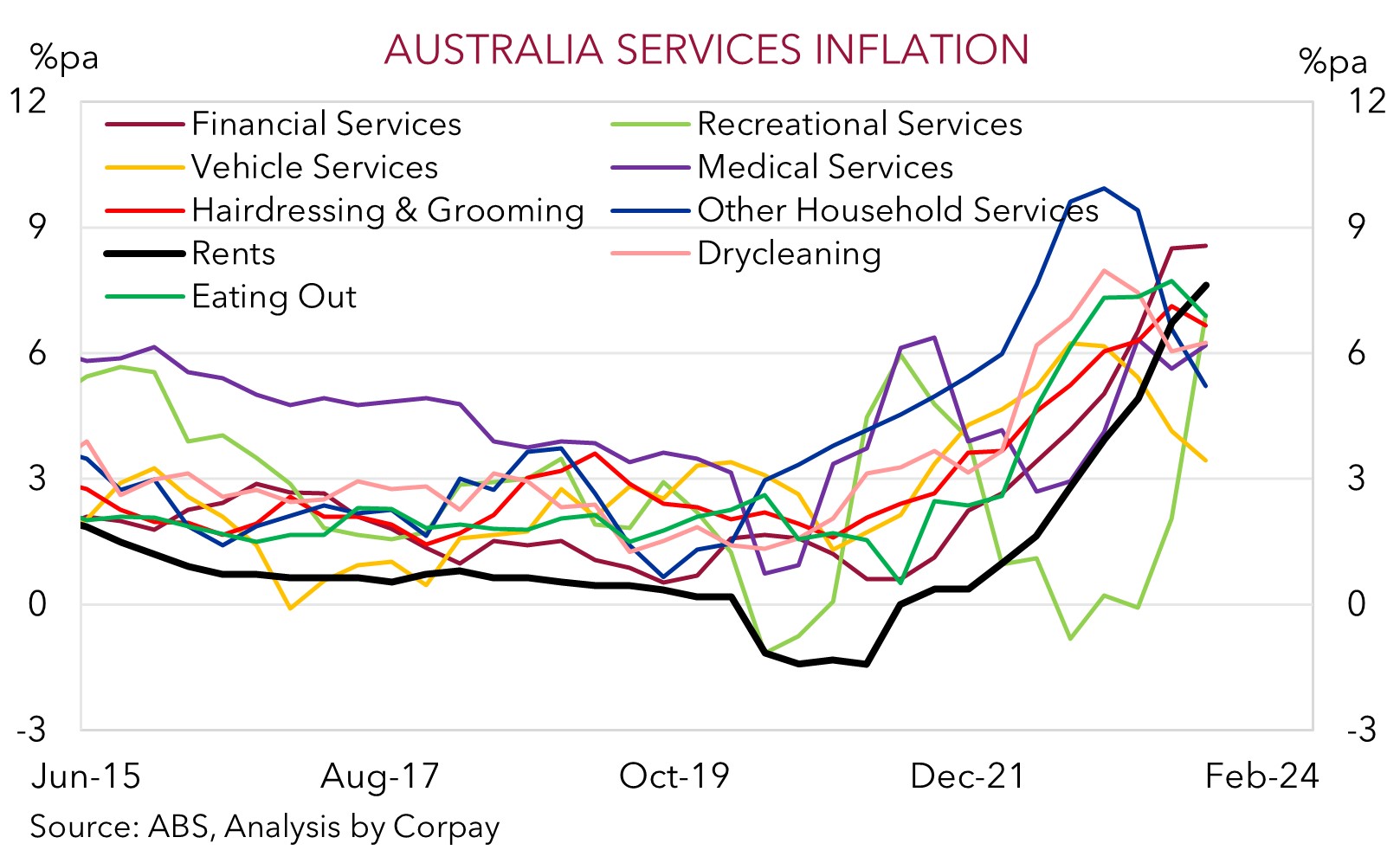

A look under the hood finds that while there has been improvement in areas such as ‘goods’ prices and ‘tradeables’ inflation thanks to softer demand and supply chain repairs, ‘services’ prices remain elevated and sticky. The still tight labour market and lagged upswing in wages given the use of multi-year enterprise bargaining agreements, and other things like accelerating rents due to very low vacancy rates are drivers here. As the chart shows price growth across many services categories like eating out/takeaway meals, hairdressing & grooming, drycleaning, recreation activities etc. are running well above where they need to be for overall inflation to be at the RBA’s 2-3%pa target. Rents continue to quicken, with the CPI measure now at its fastest annual pace since early-2009. The inflation genie is far from being put back in the bottle. On our figuring, ~3/4% of the CPI basket is still growing at 3%pa or more. This is historically high.

The RBA’s concerns about the upside risks to the inflation outlook have picked up recently with a few ‘hawkish’ shots across the bow fired at markets and the public in recent communications. Indeed, in her first speech new Governor Bullock stressed that the Board “will not hesitate” to lift rates again “if there is a material upward revision” to the inflation outlook. This followed other comments noting that there was “a low tolerance for a slower return of inflation to target than currently expected”. Policy changes work with a lag, and there is still quite of bit of tightening already put through by the RBA that hasn’t had its full effect. But based on the RBA’s rhetoric, today’s CPI data, still tight labour market conditions, and upgrades to near-term GDP forecasts we think the threshold for further action has likely been met. The pressures across services prices will take time to turn around, with (even) tighter policy settings needed to slow spending and investment in order to crimp labour demand to suppress wages and ensure inflation expectations remain anchored.

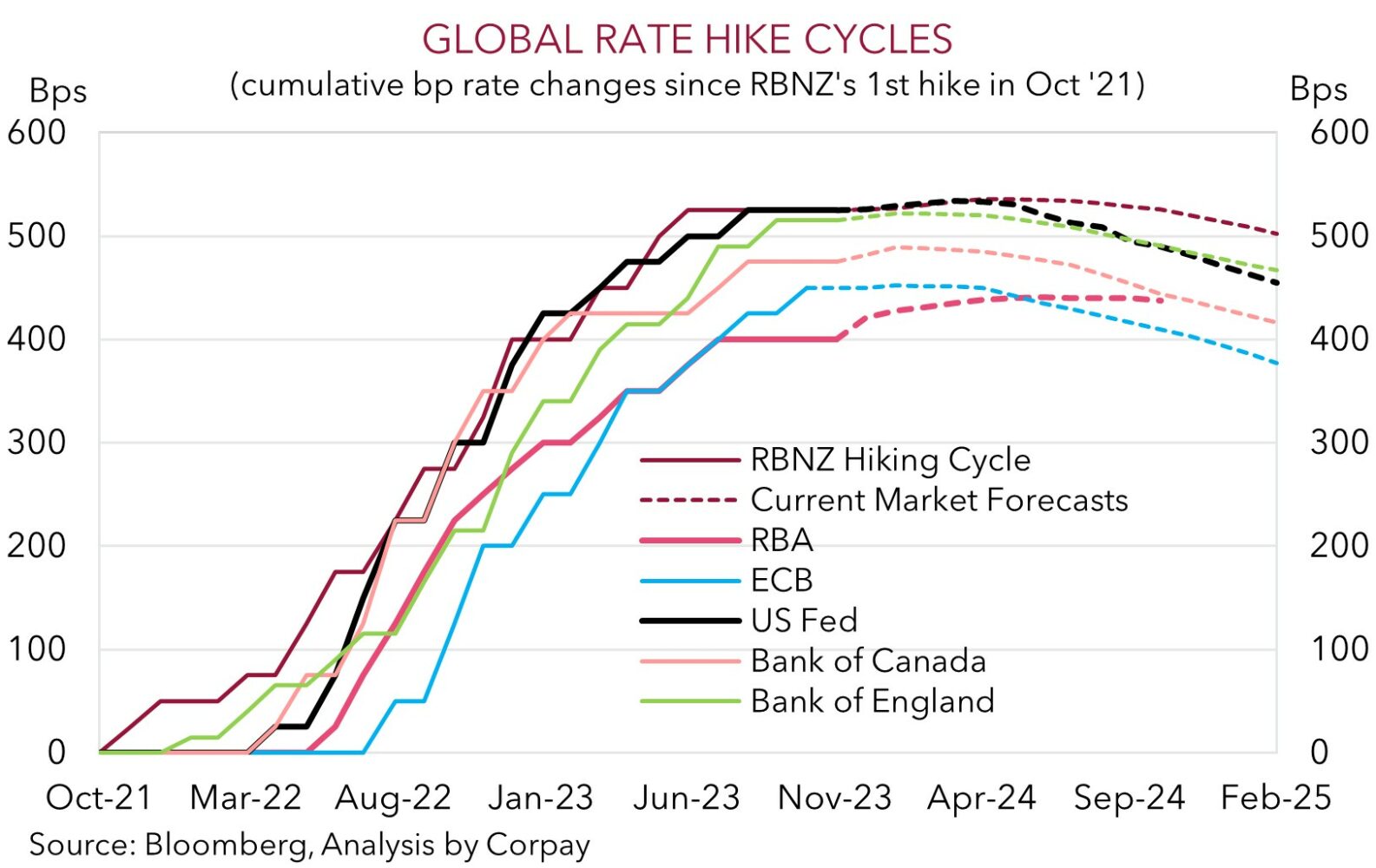

The bigger questions in our mind is whether one more 25bp hike will be enough to get inflation back on the desired path down to target, or will rates need to be raised even further? The RBA’s pragmatic approach so far this cycle, with an eye on preserving as many of the COVID-era job gains as possible and navigating a ‘soft’ economic landing suggests it may not be inclined to move that much further unless pushed. A lot will depend on the data flow; however, we think its tightening bias won’t disappear for a while given the lingering inflation risks, the boost to aggregate demand from Australia’s burgeoning population, and income supportive tax cuts coming in in mid-2024. From our perspective, the risks reside with more than one more RBA hike, and with markets factoring in the prospect of even more tightening, or at the very least an extended period of rates staying at high levels.

The unfolding shift in relative interest rate expectations as further RBA steps are discounted, coupled with: news authorities in China are pushing ahead with additional fiscal stimulus measures aimed at commodity-intensive infrastructure spending; still bearish AUD market positioning/sentiment (as measured by CFTC futures); the flow support from Australia’s current account surplus (~1.2% of GDP); and more favorable seasonality over the back end of the year reinforces our thoughts the beleaguered AUD should level off and grind higher over coming months (see Market Musings: AUD: Always darkest before the dawn, Market Musings: History doesn’t repeat, but…and Market Briefing: Australian inflation in focus). We are forecasting the AUD to edge back up to ~$0.66 in Q4, and onto ~$0.68 in Q1. Elsewhere, there will be bumps along the way but these forces, in conjunction with the slowdown in the Eurozone and UK economies and strong signs the ECB and Bank of England rate hiking cycles have peaked should, in our opinion, also see AUD/EUR and AUD/GBP move higher over time (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning).