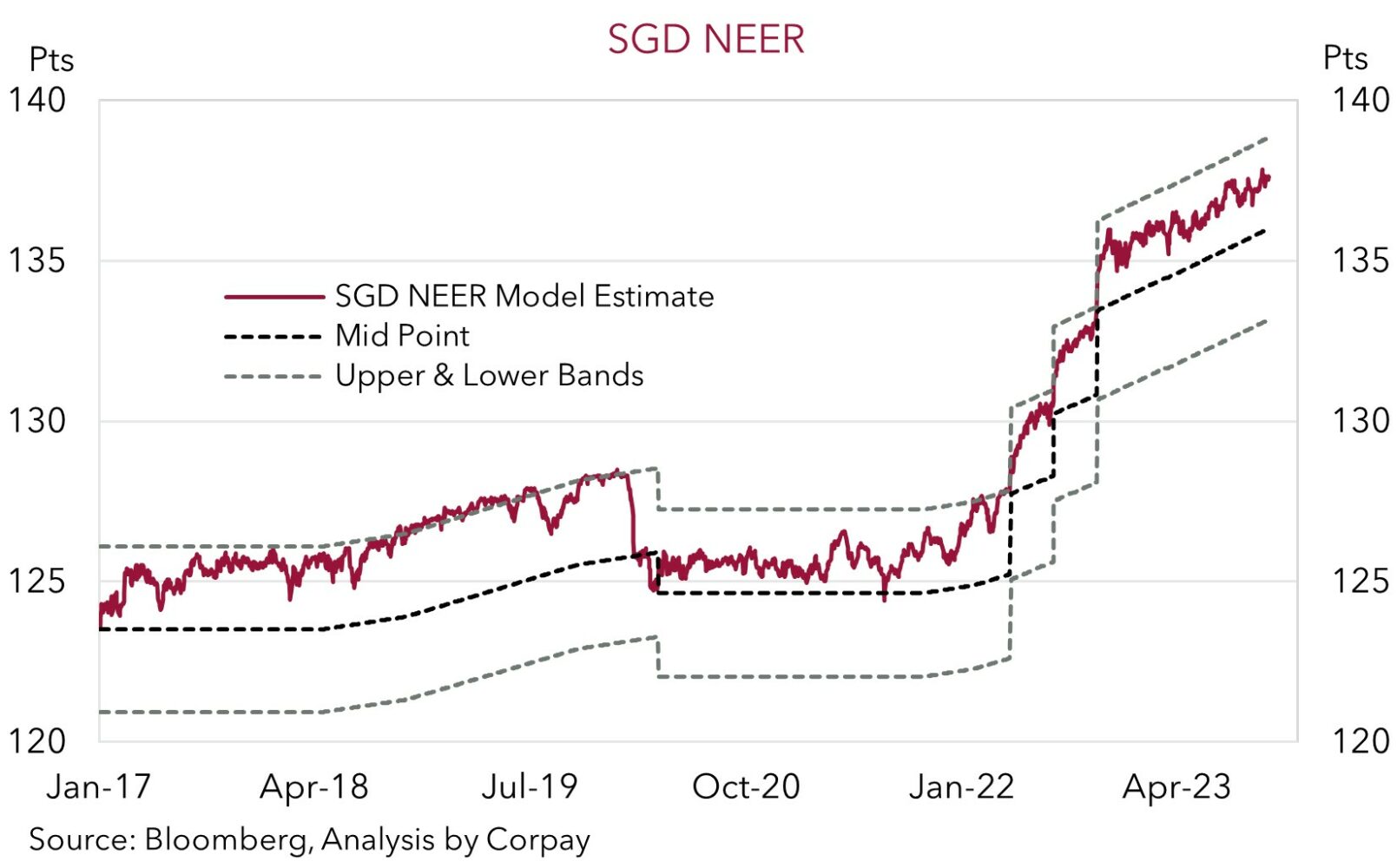

At its 13 October policy review, the Monetary Authority of Singapore didn’t rock the boat, and in line with expectations maintained “the prevailing rate of appreciation” of the SGD NEER (i.e. 1.5%pa). The MAS also held the width of the trading band and level at which it is centered steady. In our view, maintaining the width of the SGD NEER band at 2% from the midpoint gives the MAS scope to support activity should the downside global growth risks flagged materialise (see below). Going forward the MAS is shifting to quarterly, rather than semi-annual, policy reviews in 2024. The next statement will be released in late-January.

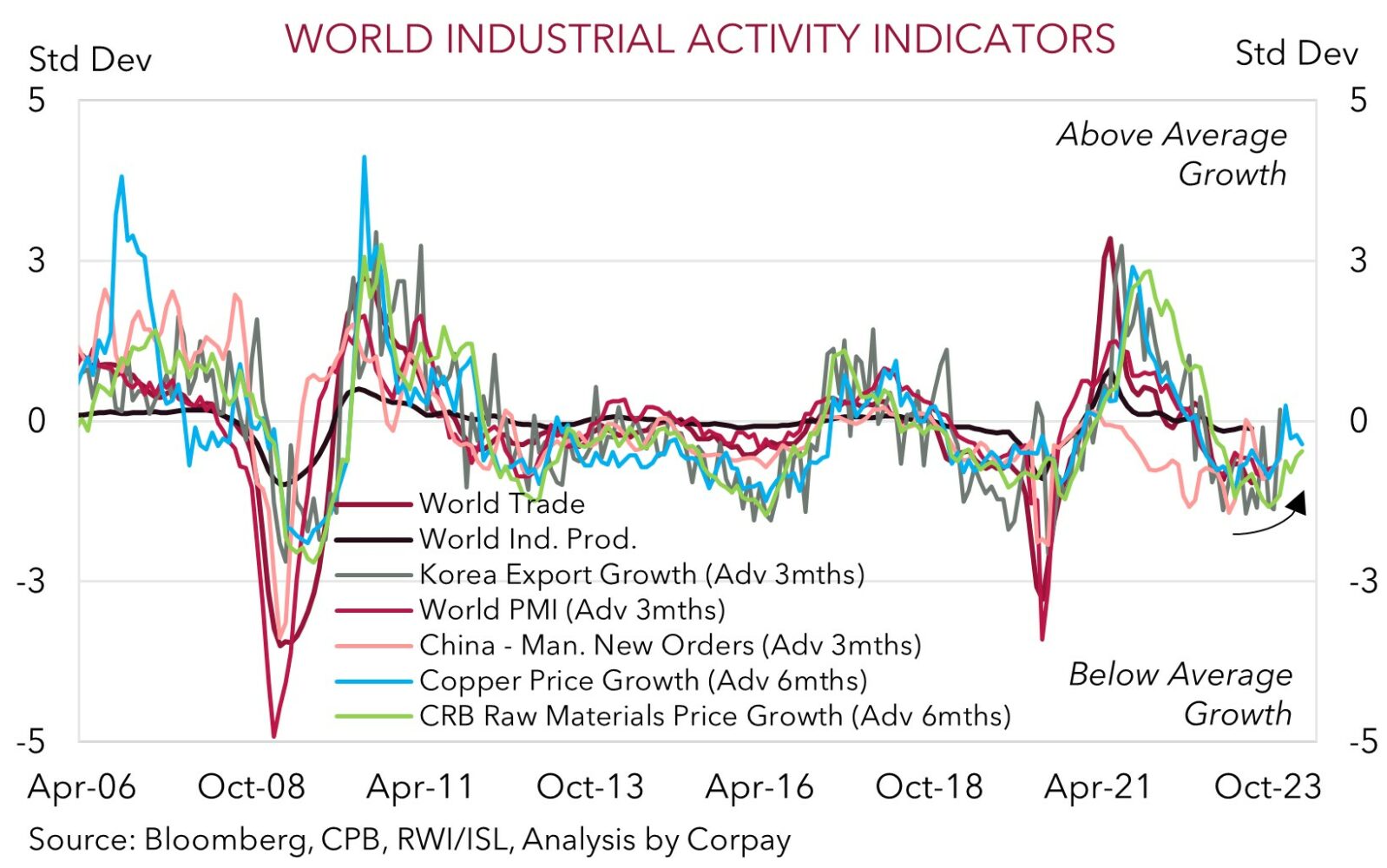

In terms of the growth outlook, according to the MAS, Singapore’s GDP is expected to “improve gradually over 2024”, but the global outlook “remains uncertain” and the domestic recovery “could be weaker” than anticipated. In its central case the MAS predicts Singapore’s GDP growth to come in at the lower half of the 0.5–1.5% forecast range in 2023, but in 2024 growth could edge up a little and come in closer to potential as momentum across Singapore’s major trading patterns slowly improves and the electronics cycle turns around. That said, the output gap could remain slightly negative, a necessary requirement to help cool inflation.

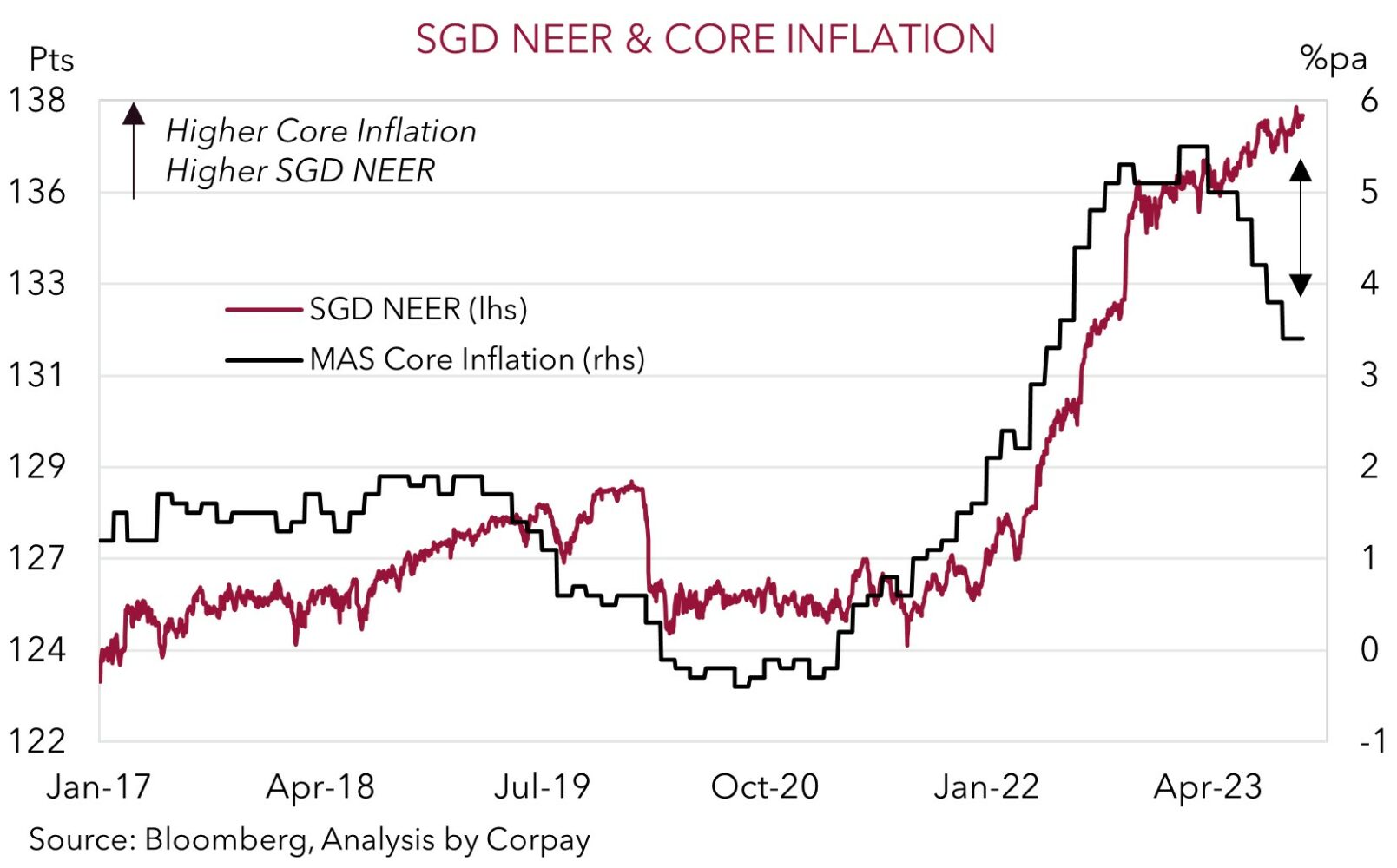

On this front, core CPI (now 3.4%pa) is projected to “decline over the course of 2024” back towards 1.5-2.5%pa. The MAS sees upside and downside risks to inflation from here. Global food and energy shocks are a potential positive impulse, while a sharper global downturn could be more of a drag. Overall, in its base case, the MAS believes the current SGD NEER appreciation path is “sufficiently tight” to help dampen imported prices and curb domestic cost pressures. As the chart below shows, a gap has opened between Singapore core inflation and the SGD NEER, suggesting current settings are proving effective in bringing down inflation.

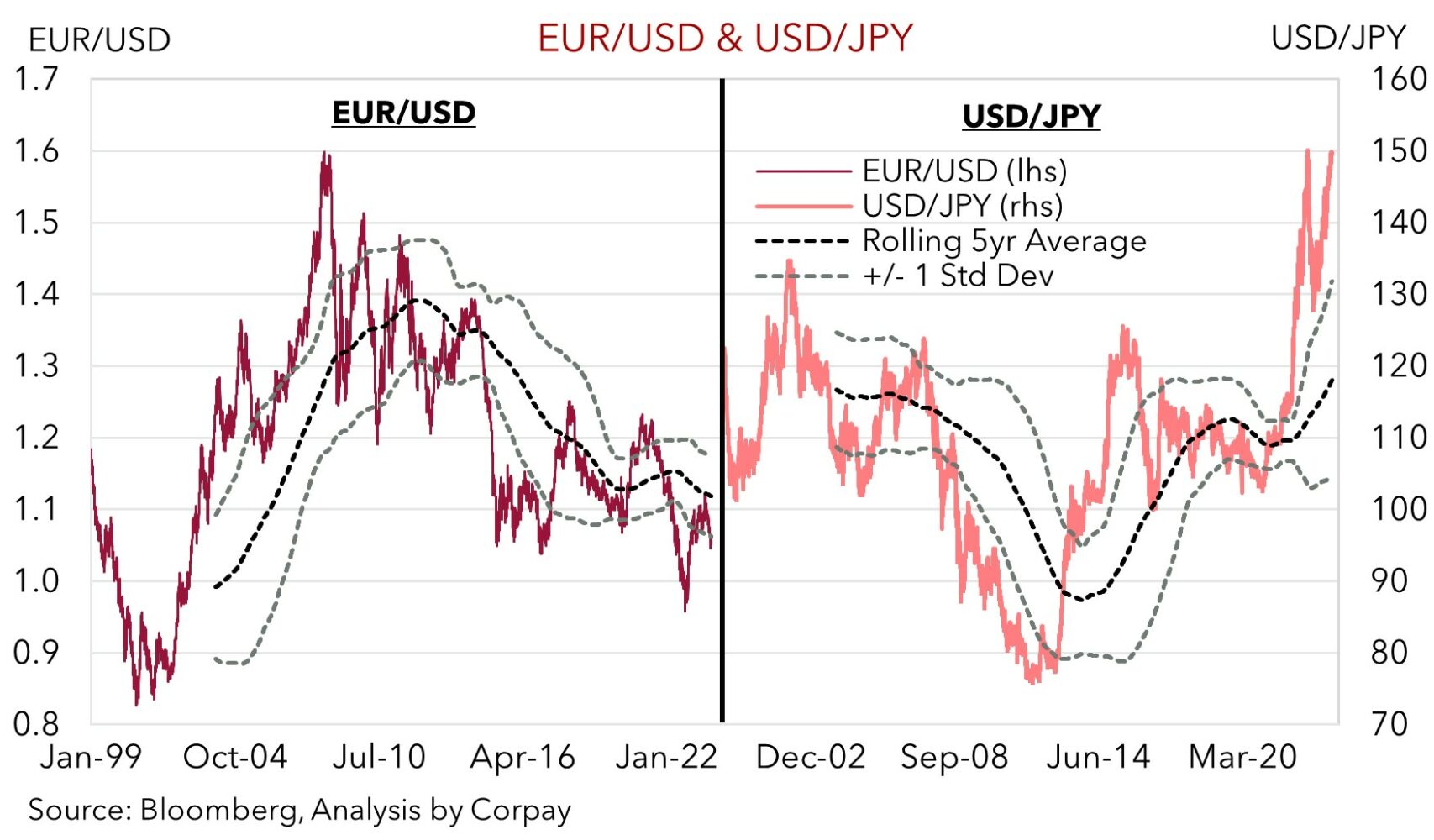

In our opinion, the MAS’s somewhat ‘hawkish hold’ may give the SGD some support against the firmer USD which has a renewed spring in its step following the latest US CPI inflation data. But over the medium-term, we still think USD/SGD should ease back into the low 1.30’s from current elevated levels as the USD cycle turns once there is confidence the US Fed has hit its interest rate peak, softening US data sees markets price in the next easing cycle, and/or as China’s recovery boosts regional growth prospects. However, an eventual dovish tilt by the MAS can offset some of this, and points to a bumpy glide path lower from current lofty heights.

On the crosses, we believe EUR/SGD can grind back up over coming months as the EUR is bolstered by signs China’s efforts to reinvigorate activity via additional policy stimulus is graining traction and as the elevated USD loses ground. By contrast, we think there is more downside than upside potential in SGD/JPY which is now historically high. In our judgement, markets may be underestimating the chances of a shift by the BoJ away from its ultra-accommodative stance. Core inflation in Japan is running at a multi-decade high, and the excessively weak JPY only adds to the inflation pressures.