Unsurprisingly the RBA held the cash rate steady at 4.1% for the 4th straight meeting. This was the first with new Governor Bullock at the helm. But her predecessor continues to cast a long shadow. The October post meeting statement appears very similar to the last one provided by former Governor Lowe. According to the RBA the policy tightening put through is “working to establish a more sustainable balance between supply and demand in the economy”, with the decision to hold firm again in October providing “further time to assess” the impacts of the jump up in interest rates. Given inflation is “still too high and will remain so for some time yet”, and despite “below trend growth expected to continue for a while” the door to further tightening remains ajar. The RBA retained its mild conditional tightening bias noting that “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe”, although the decision to act will be driven by incoming data and evolution of risks.

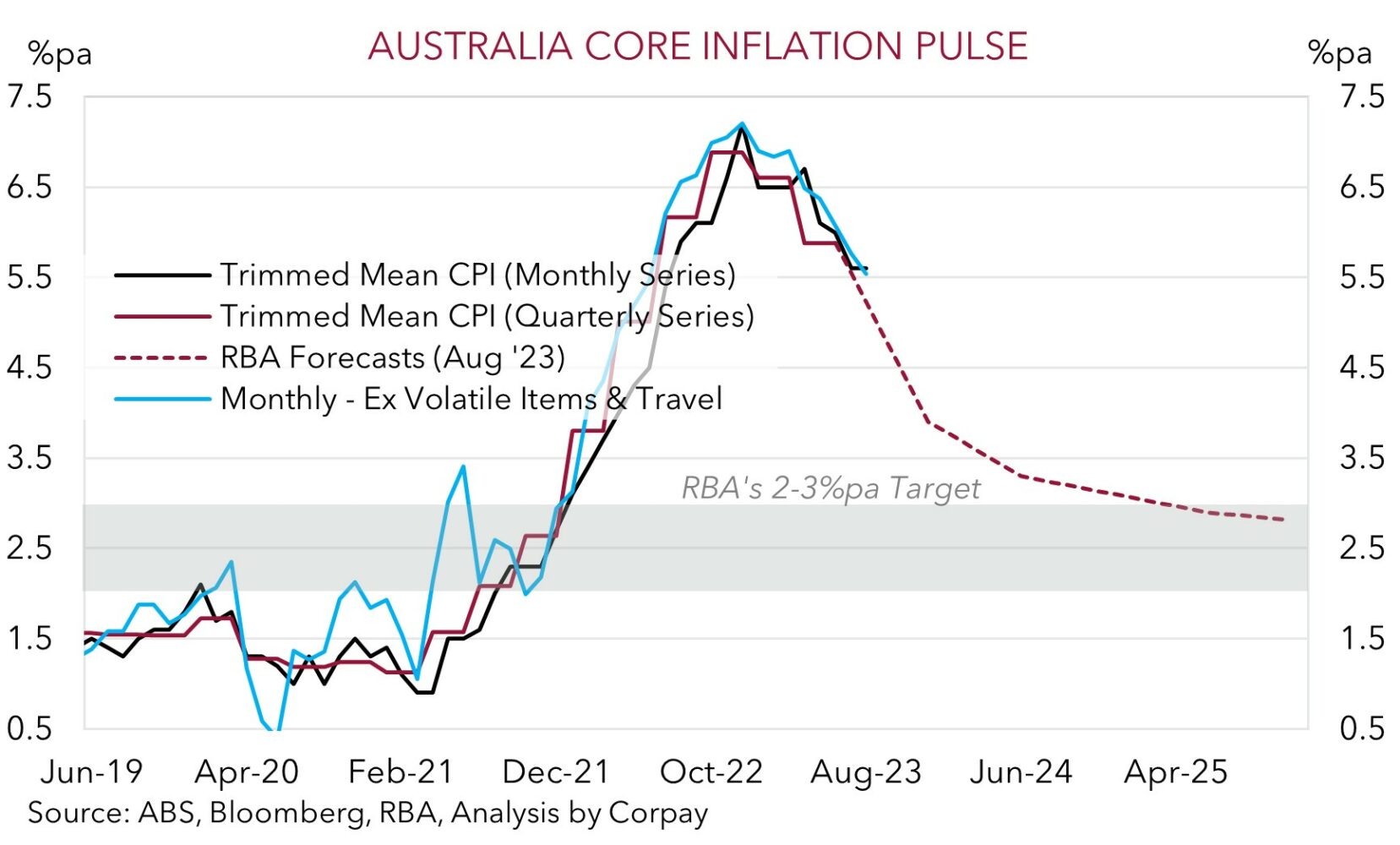

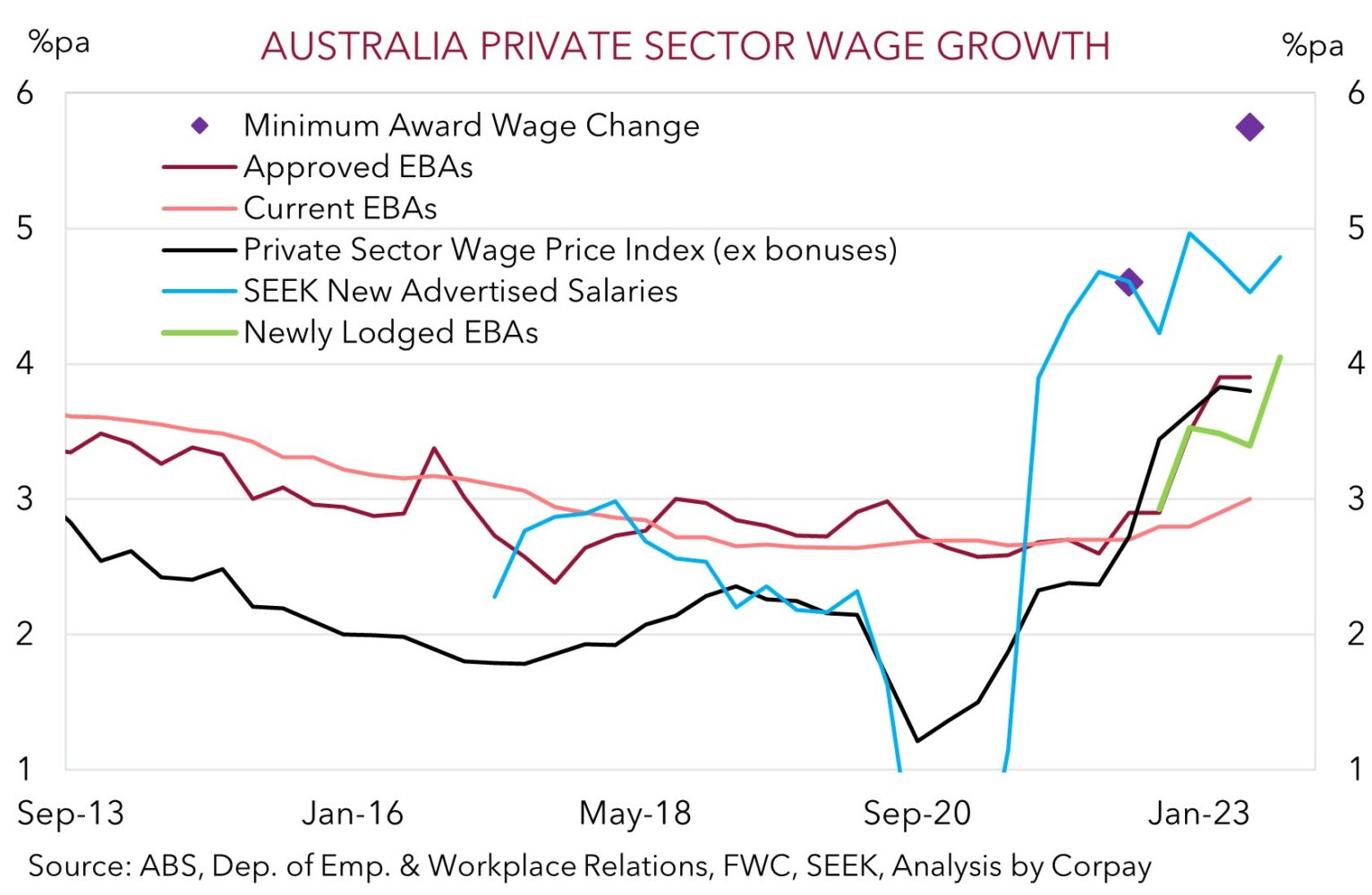

The late-October quarterly CPI report, the RBA staff’s new forecasts at the November meeting, spending trends, labour market conditions, and global macro developments will be crucial in the RBA’s decisions. From our perspective, the hurdle to move again appears quite high, but it is probably lower than many are now assuming. Another rate rise by the RBA this cycle still shouldn’t be completely ruled out. The stickiness in areas of services inflation like rents, income supportive tax cuts coming in mid-2024, Australia’s poor productivity growth, still tight labour market, and slow-moving wage dynamics due to multi-year enterprise bargaining agreements, suggest the pressure on the RBA to do a bit more will remain for some time. As the charts illustrate, Australia’s core inflation is improving only gradually, and timely reads on wage growth such as the Seek salary index and newly lodged EBA’s have ticked up. As the RBA opined, the “prices of many services are continuing to rise briskly”. At the very least, we think the undercurrents flagged mean the RBA may not have the capacity to move down as early or go as far as other central banks whenever the global policy easing cycle begins. Over the time, this points to relative yield differentials moving in an AUD supportive direction.

As discussed recently, the AUD is battered and bruised with a combination of factors on both sides of the equation pushing AUD/USD to fresh 2023 lows. That said, although the magnitude has been a surprise, the weakness in AUD/USD over August and September is not unusual. We flagged this repeatedly over the past few months following our deep dive into FX and market seasonal patterns (see Market Musings: History doesn’t repeat, but…). And in a sign of how USD-centric the moves have been, it hasn’t been one-way traffic. AUD/USD has slumped, but the AUD has held up better on the crosses as the more positive undercurrents such as signs China’s growth cycle is bottoming, and adjustment in longer-dated yield differentials in Australia’s favour have come through. AUD has appreciated against the EUR, GBP, and JPY over recent weeks.

Outcomes relative to expectations drive markets. While we think the AUD could remain heavy over the very near-term given the more negative risk backdrop on the back of the jump up in global bond yields, we continue to believe that down near current low levels a lot of ‘bad news’ is priced into the AUD and there are uneven medium-term risks from here (see Market Musings: AUD: Always darkest before the dawn). Indeed, since 2015, the AUD has traded sub ~$0.6350 less than ~2% of the time.

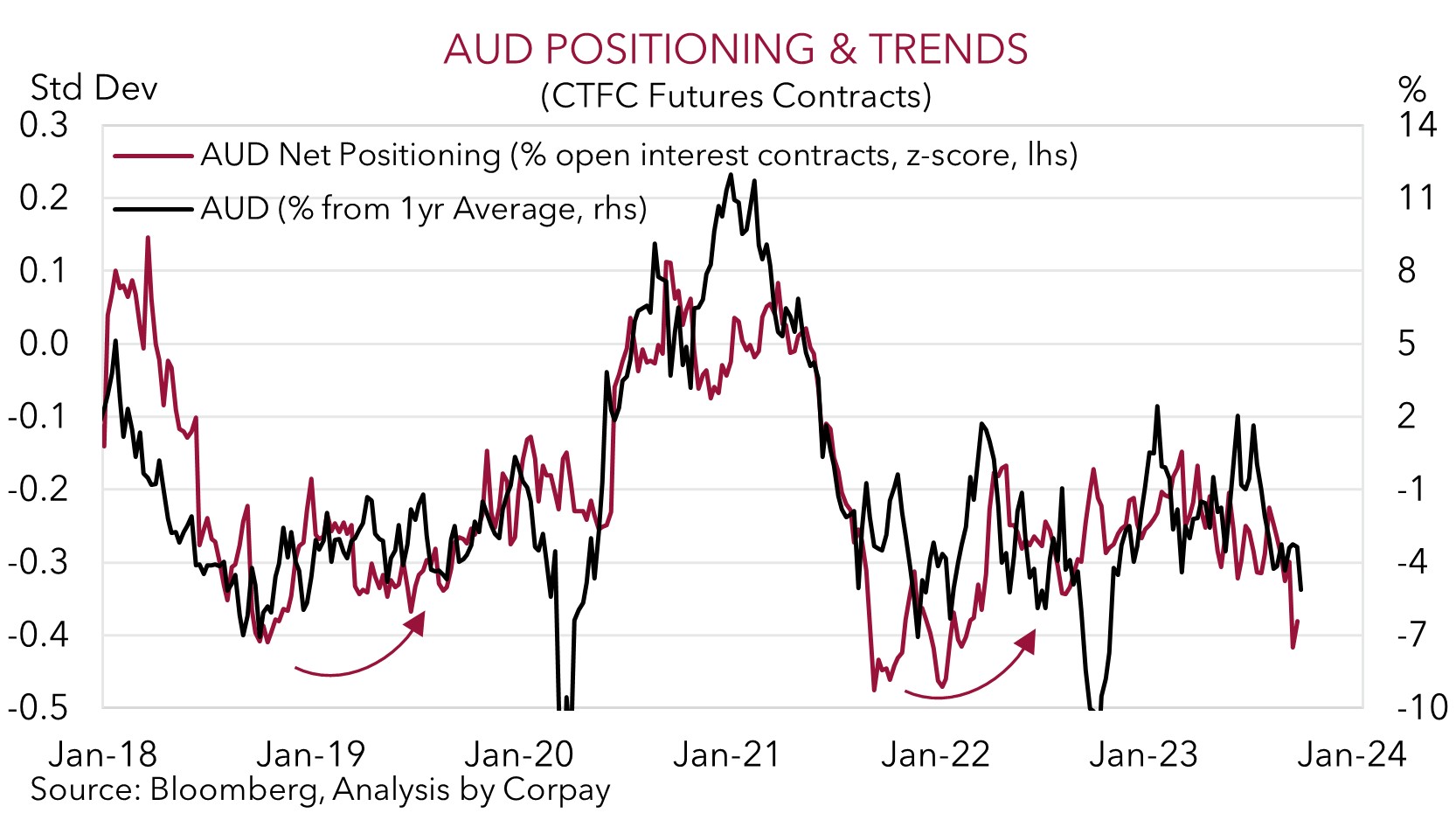

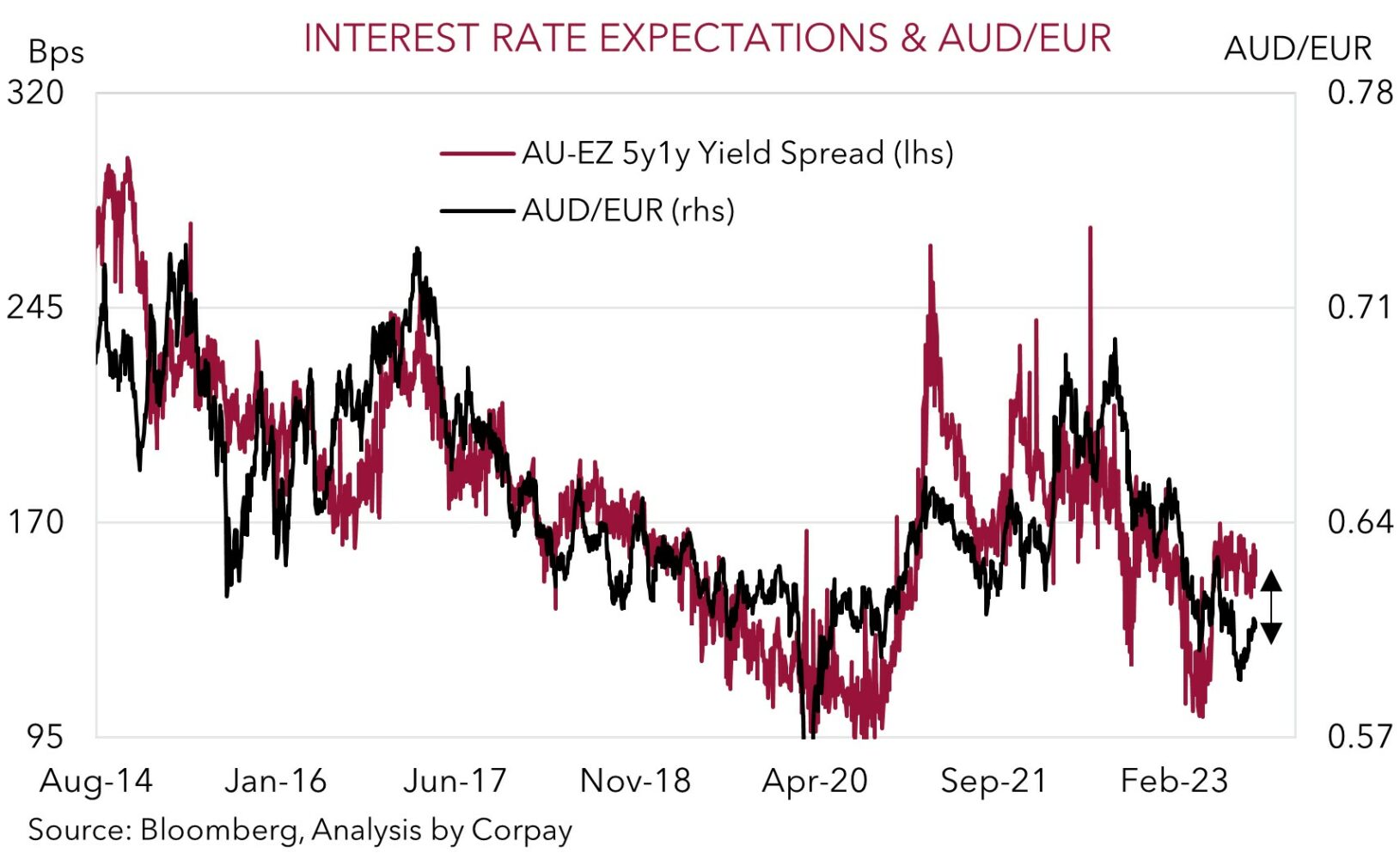

In our view, a lot of positives now appear factored into the USD with the ‘higher for longer’ US Fed interest rate view well discounted. As such, we believe the USD is becoming increasingly vulnerable to a run of softer US growth/inflation pulse and/or improvement in other major economies. On top of that, in our judgement AUD positioning and technical momentum indicators are starting to look stretched. History shows that when these forces are in place it may not take much of a shift in market sentiment to see the AUD snap back. Further signs China’s economy is turning the corner, an improvement in risk appetite, solid Australian data, a step down in US economic momentum (this is where we think the risks reside) and/or more supportive seasonal factors which typically kick in around this time of the year could give the beleaguered AUD some support, particularly on some of the crosses. Even after the recent rebound AUD/EUR and AUD/GBP still appear too low compared to our gauge of relative terminal interest rate expectations.