• Shaky sentiment. US equities dip for the second day. Base metals lower. USD a little firmer. AUD/USD slips back but AUD holding up on the crosses.

• Global macro. ECB holds steady. September meeting is ‘wide open’. Incoming data will be key. UK wages cool. EUR & GBP lose a bit of ground.

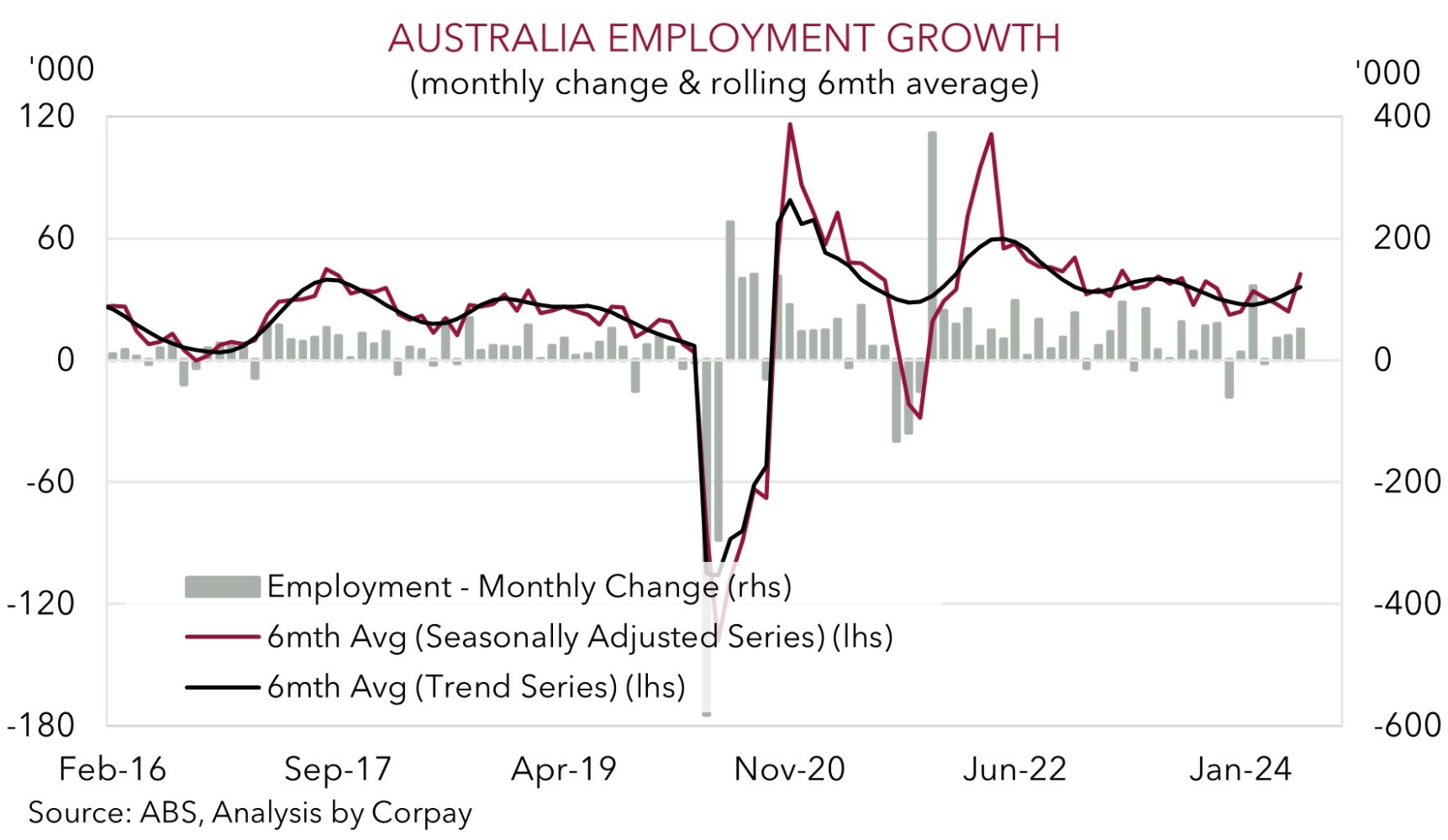

• AU jobs. Solid jobs report. Labour demand remains positive. Unemployment still low. RBA expectations diverging from other central banks.

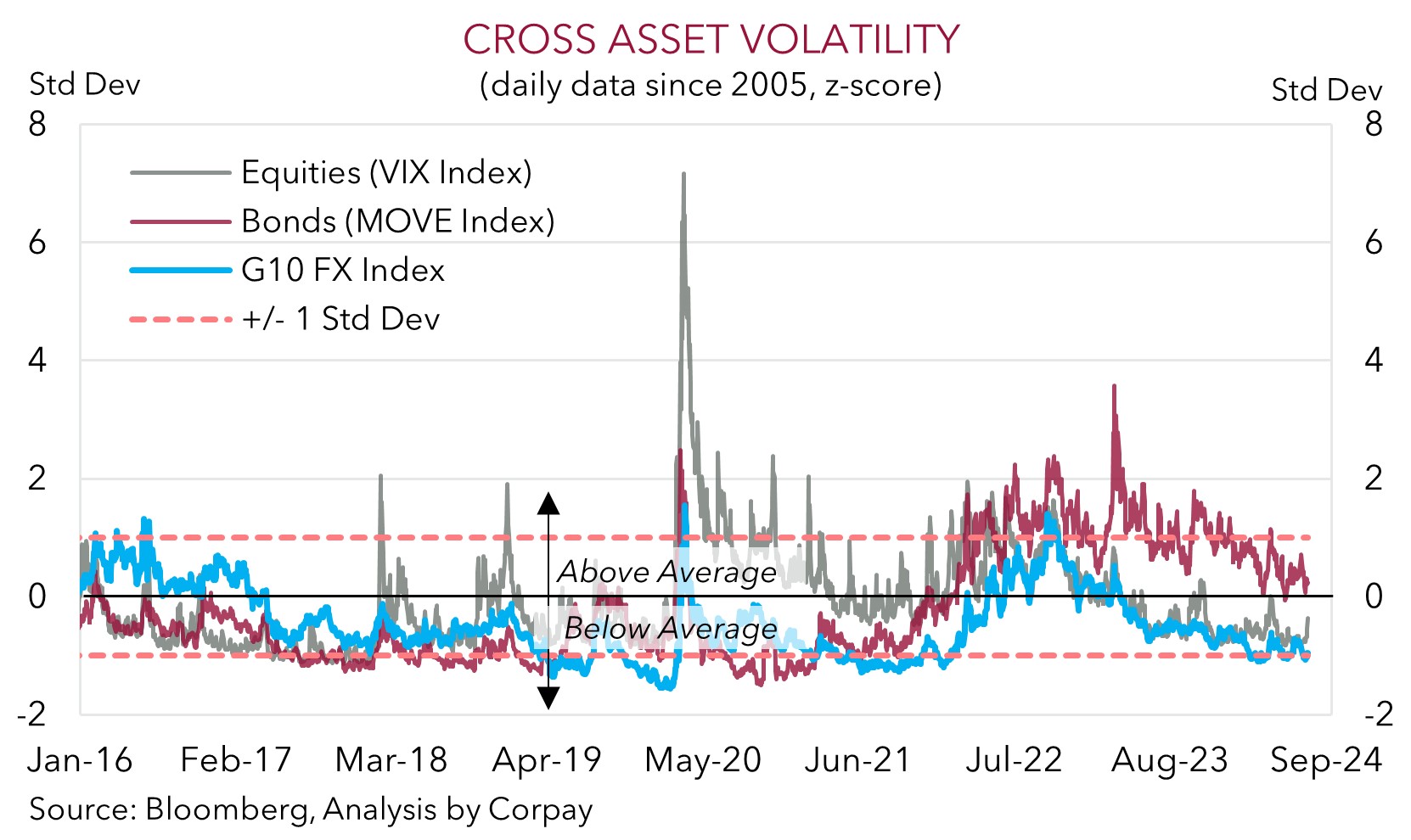

A few wobbles in risk sentiment over the past couple of sessions. US equities fell for the second straight day (S&P500 -0.8%), base metal prices declined (copper -3.3%), and the USD edged higher in line with the modest uptick in US bond yields. The US 10yr rate rose ~4bps to be at 4.2%, around where it was at the end of last week. There wasn’t a clear single catalyst driving the moves. Some have suggested markets may be starting to price in greater political risk premium given the looming US Presidential Election and with pressure mounting on President Biden from within the Democratic Party to bow out of the race. That said, perspective is also needed. Even after its recent dip the S&P500 is still ~2% from record levels, US bond yields and the USD are tracking near the bottom end of their multi-month ranges, and as our chart shows volatility across the major asset classes is at or below average.

The second tier US data was mixed. Initial jobless claims (a weekly gauge of how many people are filing for unemployment benefits) rose to a 5-week high, while the Philly Fed manufacturing gauge rebounded, pointing to a pick up in activity. Markets continue to factor in the first US Fed rate cut in September, with three moves fully priced in by January. In the UK, increased labour market slack has seen wages cool to 5.7%pa, its slowest pace since Q3 2022. This is a positive sign for future UK inflation, and the greater odds assigned to a near-term Bank of England rate cut (now a ~45% chance it happens in August) exerted pressure on GBP (now ~$1.2945).

In the Eurozone, as widely expected the ECB kept rates steady after kicking off its easing cycle in June. The ECB’s guidance was rather neutral with ‘hawkish’ tweaks regarding inflation offset by ‘dovish’ growth rhetoric. President Lagarde indicated that the mid-September meeting is ‘wide open’ with the incoming data and updated forecasts going to influence the ECB’s decision. Markets think there is a ~80% probability the ECB cuts rates again in September. The slight narrowing in German-US yield differentials weighed a bit on the EUR (now ~$1.0897). Elsewhere, USD/SGD nudged up (now ~1.3435), with the shaky risk environment also dragging on NZD (now ~$0.6045) and AUD (now ~$0.6710). Although another solid Australian jobs report helped the AUD on most of the major crosses over the past 24hrs.

Today, there are a few bits and pieces of economic news scheduled. Japanese CPI is due (9:30am AEST). Firming inflation pressures could support calls for another BoJ rate rise at the end of July. In the UK (4pm AEST) and Canada (10:30pm AEST) retail sales are released. Both are predicted to show a drop in spending. And in the US, the Fed’s Bowman (9:45am AEST) and Williams (12:40am AEST) are speaking.

AUD Corner

The AUD has lost a bit more ground against the firmer USD with the negative risk sentiment, as illustrated by the dip in US equities and base metal prices, a driving force (see above). That said, at ~$0.6710 the AUD is only back where it was trading ~2-weeks ago and ~1.3% from its recently touched multi-month highs. By contrast, the AUD has held up on most of the major crosses with gains of ~0.1-0.3% recorded against the EUR, GBP, and NZD over the past 24hrs. AUD/JPY has also partially retraced some of its recent slide with the pair rising by ~0.5% to be back above its 50-day moving average (~105.40).

Helping the AUD hold its ground on the crosses was another solid Australian jobs report which helped reinforce expectations the RBA is on a different trajectory to many of its central bank peers. 50,200 jobs were added in June, with the bulk (43,300) full-time. A slight uptick in labour supply (the participation rate rose to 66.9%) saw the unemployment rate nudge up slightly. The unemployment rate ticked up from 4% to 4.051% (which rounded up to 4.1%). Bottom line, the details of the labour force release were robust with jobs growth still running at above average pace and the unemployment rate below estimates of ‘full-employment’. in our opinion, positive labour market trends can help support household spending which is also receiving an added tailwind from the stage 3 tax cuts, other relief measures, and turn in real wages.

From our perspective the ongoing resilience in the labour market is another sign the RBA’s settings may not be ‘restrictive’ enough to bring inflation down to target in a timely manner. The upcoming Q2 CPI data (released 31 July) is likely to make or break the case for another rate hike by the RBA at the 6 August meeting. In contrast to the rate cuts factored in around the world markets are assigning a ~25% chance the RBA hikes again in August (up from ~15% earlier in the week) with the first RBA rate cut not fully priced in until July 2025. If the RBA holds fire it will mean that the current level of interest rates might need to be kept in place for some time to generate the economic impacts required to break the back of sticky services/core inflation. In our judgement, the economic and policy divergence between Australia and others should be AUD supportive over the medium-term, particularly on crosses like AUD/EUR, AUD/GBP, AUD/CAD, and AUD/NZD.