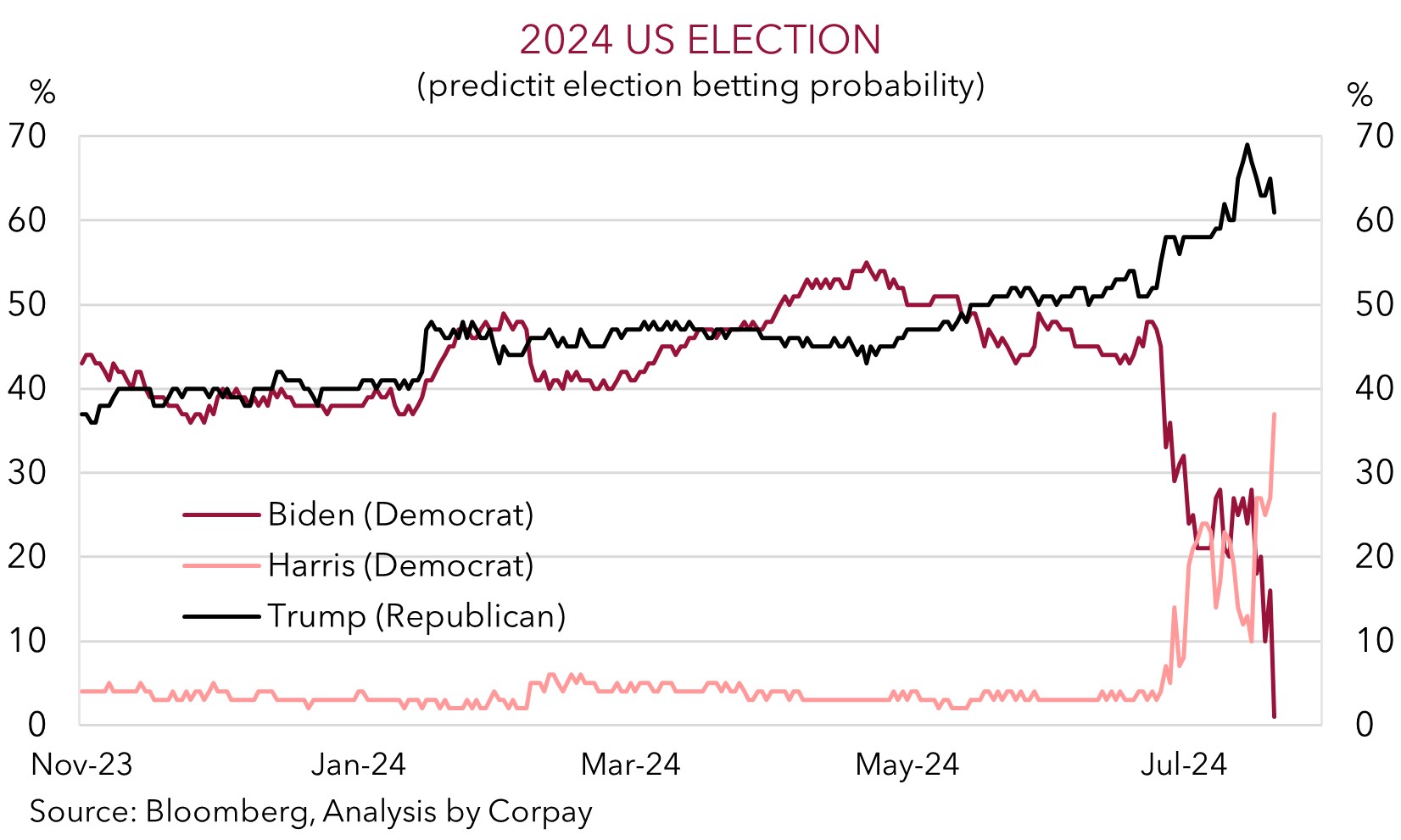

• US politics. Pres. Biden drops out of the race. Will the narrower gap between Harris & Trump in betting odds see traders unwind recent market moves?

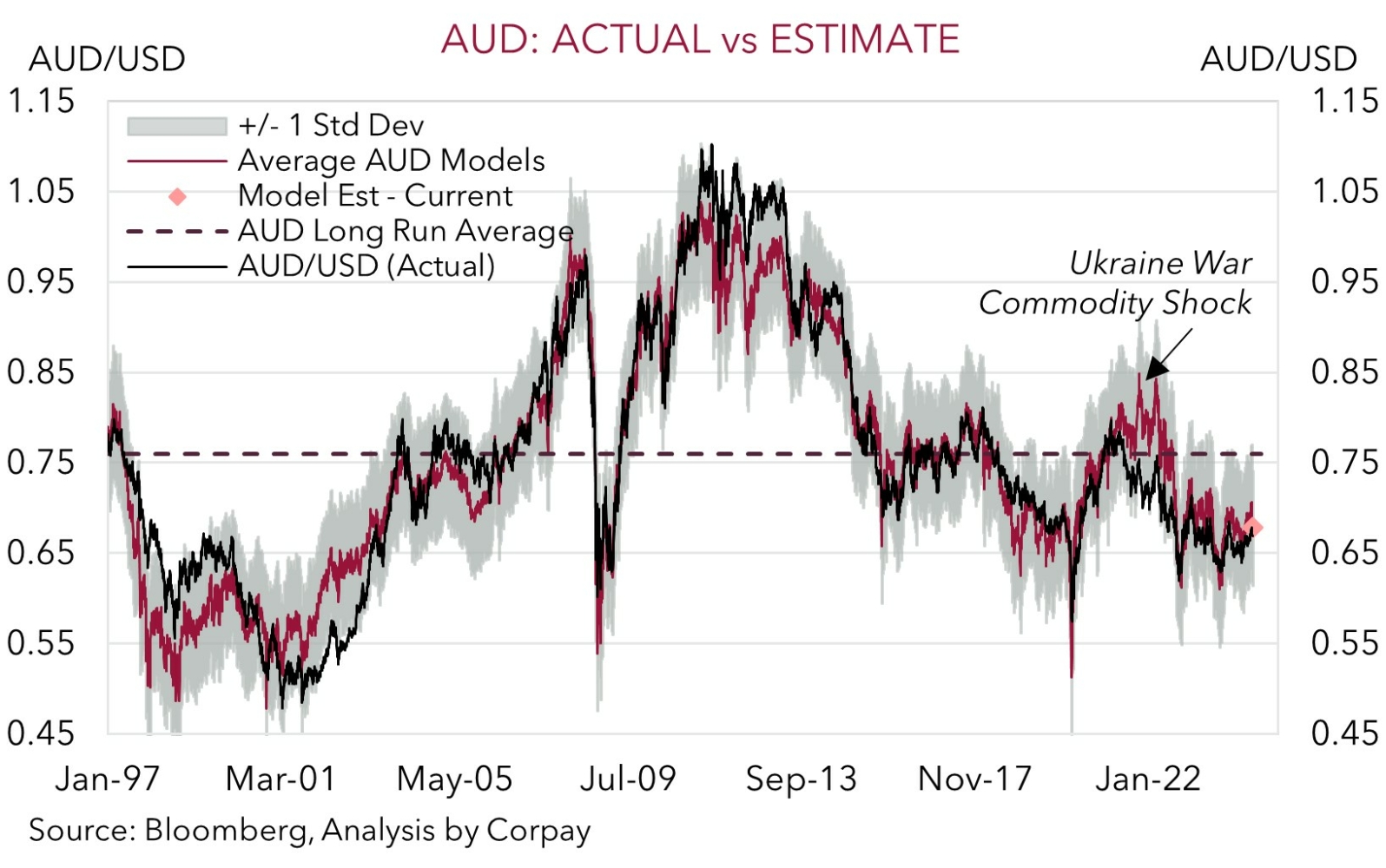

• AUD vol. AUD under pressure last week. But we think it is looking a bit undervalued given the relative macro & interest rate dynamics.

• Event radar. Global PMIs due (Weds). US GDP (Thurs) & PCE Deflator (Fri) are released. Bank of Canada meets (Weds), so does the MAS (Fri).

The pressure on cyclical assets continued at the end of last week with the pull-back in equities and industrial commodities extending. The US S&P500 declined 0.7%, its third straight daily fall (something which hasn’t happened since April), while copper (-1%) and WTI crude oil (-3.1%) also declined. By contrast, bond yields ticked up with the benchmark US 10yr rate clawing back ~4bps to be near where it was a week ago (now 4.24%). The negative risk sentiment generated a bit of USD support. EUR (now ~$1.0885) and GBP (now ~$1.2915) slipped back, USD/JPY consolidated (now ~157.45), and growth linked currencies like the NZD (now ~$0.6010) and AUD (now ~$0.6687) weakened.

Once again there wasn’t an obvious catalyst driving the moves. Factors such as investors looking to trim positions after a strong rally ahead of US earnings reports, and more focus on the looming US President Election continue to be pointed to. The latter is likely to remain front and center following the overnight announcement by US President Biden that he is dropping out of the race, with current Vice President Harris having his endorsement. Following the news odds of Harris winning have jumped up. But as the chart shows this only puts the Democrats probabilities back to where they were just after the late-June Biden/Trump debate. It will probably take a few weeks to see where things settle on the Harris side with a important events on the horizon (the Democrats hold their convention in late-August, and another debate with Trump is penciled in for early-September). For markets, there isn’t a lot of history to look back to on this. This is the first time a sitting President won’t seek a second term since Johnson in 1968. In our view, the political gyrations are likely to generate more intermittent bouts of volatility particularly as fresh polling data flows through.

Macro wise, this week the Bank of Canada is expected to cut rates again (Weds AEST). The latest global business PMIs are also due (Weds AEST). While in the US, Q2 GDP (Thurs AEST) and the PCE deflator (the Fed’s preferred inflation gauge) (Fri AEST) are released. We think the incoming data might compound any partial unwind of the ‘Trump trades’ that were being priced in such as the stronger USD. In our opinion, although there was likely to have been a re-acceleration in US activity growth should still be below last year’s pace and the US’ potential. This, and a moderation in the PCE deflator could give policymakers confidence things are on the right path, reinforcing expectations a Fed policy easing cycle may get underway in September which in turn drags on US yields and the USD.

AUD Corner

The shaky risk sentiment, as illustrated by another decline in global equities, base metals, and energy prices, has exerted a bit more downward pressure on the AUD. At ~$0.6687 the AUD is back where it was trading in early July, ~1.5% below its recent peak. The AUD has also remained on the backfoot on most crosses with falls of ~0.1-0.3% recorded against the EUR, JPY, GBP, CAD and CNH on Friday. The recent run has seen pairs like AUD/EUR, AUD/GBP, and AUD/JPY dip to the bottom of their respective 1-month ranges. By contrast, AUD/NZD remains supported with the diverging macro and policy outlooks helping keep the cross above ~1.11 (levels last traded in Q4 2022).

This week the local economic calendar is quiet. Hence, offshore trends should be the main AUD driver. As outlined above, the move by President Biden to withdraw from the US election may generate pockets of volatility. However, on net, we feel that the narrower gap between Vice President Harris and Former President Trump may see a partial retracement in some of the ‘Trump trades’ such as a stronger USD which were being discounted recently (see above). This, coupled with another sub-trend US GDP print (Thurs AEST), and step down in the US PCE deflator (the Fed’s preferred inflation measure) (Fri AEST) could see US bond yields and the USD slip back, in our view.

A softer USD would help lift the AUD which we believe is undervalued down near current levels. In contrast to the interest rate cuts factored in for other major central banks markets are assigning a ~33% chance the RBA hikes again by September, with the first RBA rate cut not fully priced in until mid-2025 because of the resilience in the Australian labour market and sticky core inflation. Based on this and other factors such as the still high level of equities and base metal prices, the average across our suite of models suggests AUD ‘fair value’ is now ~$0.68. On the crosses, we also think that a ‘dovish’ rate cut by the Bank of Canada (Weds night AEST), and signs in the latest PMIs (Weds AEST) that growth momentum in the UK and Eurozone remains sluggish might help the AUD recoup lost ground against the CAD, GBP, and EUR.